Splitsville

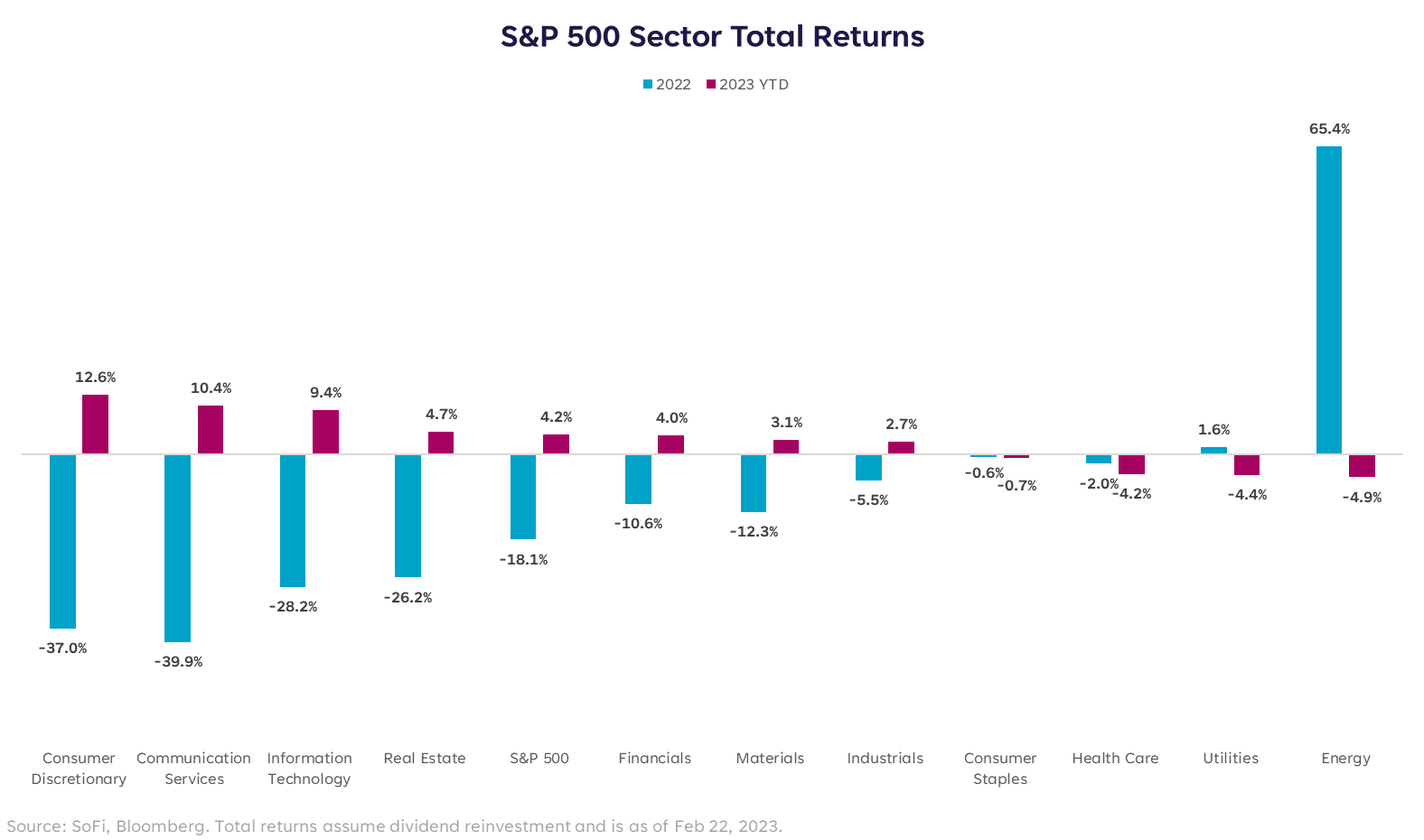

This may be one of the more short-term oriented posts I’ll write, but we’re in an era of short attention spans and a market walk that is measured in weeks, not quarters. Gotta give the people what they want. The rip-your-face-off rally that started in January was one that saw high beta and high growth stocks (in other words, everything that didn’t work in 2022) bounce back in spectacular fashion. The chart below shows the dispersion in returns among sectors YTD vs. their 2022 performance. The trends split apart quite starkly with last year’s biggest losers becoming this year’s biggest winners. There are a number of different ways this move has been explained. Some say it’s the beginning of a new bull market and the drawdown of 2022 was the repricing we needed to digest higher rates and tighter financial conditions. Some say this is a rotation back into parts of the market that were hit disproportionately hard by economic growth fears and are rebounding because things aren’t as bad as expected. Lastly, some say this rally was due to Treasury yields falling and financial conditions easing, which allowed investors to pile back into risky assets. My thoughts align with the last group, and I’ll add that although our economy is much more dependent on technology and services today, cyclical indicators still matter and the rally didn’t quiet those warning bells.Up, Up and…No Way

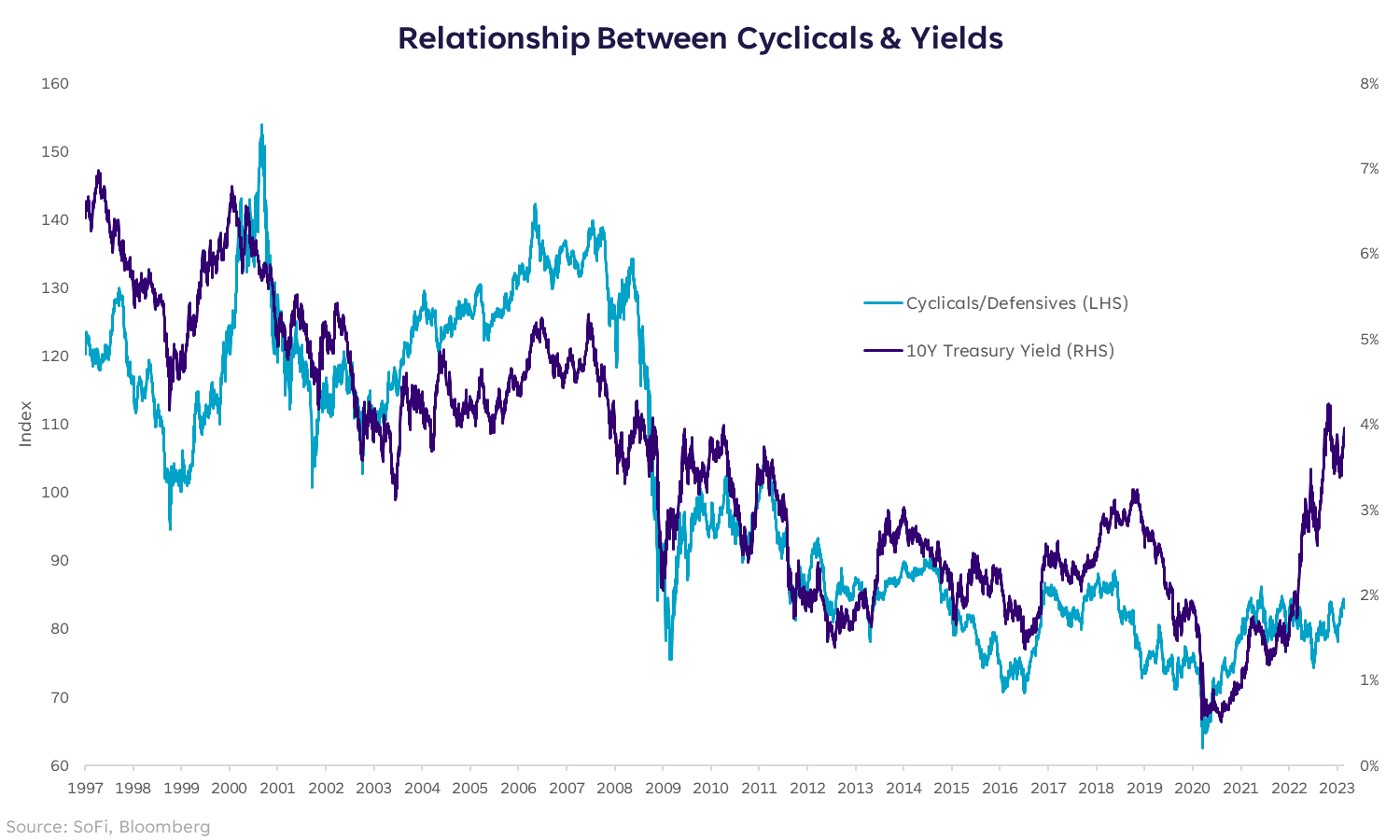

I’m not one to disagree with the market all the time. We’ve heard the argument “don’t fight the tape” a lot lately, and I recognize that it’s a thing. However, it can be very instructive to slice and dice market action into pieces and study the behaviors among certain asset classes. One relationship we look at is that between cyclical stocks and the 10-year Treasury yield. We used the Goldman Sachs cyclicals vs. defensives index, which splits the S&P 500 into stocks that are more sensitive to GDP growth (cyclical) or less sensitive (defensive) to gauge market direction. As the line moves up, cyclicals are performing better. As it moves down, defensives are performing better. The other line on this chart is the 10-year Treasury yield. Oftentimes, if the 10-year Treasury yield is rising, it indicates less fear in the market and an expectation for stronger GDP growth in quarters to come. On the contrary, if it’s falling it generally means investors are worried about growth and are buying protection in the form of long-term Treasuries. This relationship has tracked pretty tightly for decades. In periods where yields fell, growth was underwhelming, and cyclicals trended downward. The most interesting part of the chart is what’s happened since the end of 2021: the relationship completely decoupled. The two entered splitsville as if to say, “it’s not you, it’s me,” “I think we should see other lines,” “you’ve changed.” But why, and what does it mean? To me, it means despite a meteoric rise in 10-year yields, the cyclical parts of the market know that rates aren’t up because growth prospects are up. They’re up because inflation is up, the Fed is in fight not flight, and that at some point this may not end well. Here is where I won’t fight the market at all. I think that blue line is right as rain and sniffing out that a short-term rally does not change the fact that economic growth could have a tough road ahead.We Are on a Break

The key to any successful relationship is compromise, some form of meeting in the middle. These indicators that have entered splitsville likely need to find some common ground in the months ahead. What I think we’ve just witnessed was the high-beta parts of the market on a bender, out in life and wildin’ to exercise their freedom. The difficult part is knowing which side needs to give more back. And that’s where we sit right now, on the precipice of some retracement — either in yields, or in stock multiples — because while this relationship is likely on a break, it’s not breaking up for good.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Advisor SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS23022303