Home Keep-O

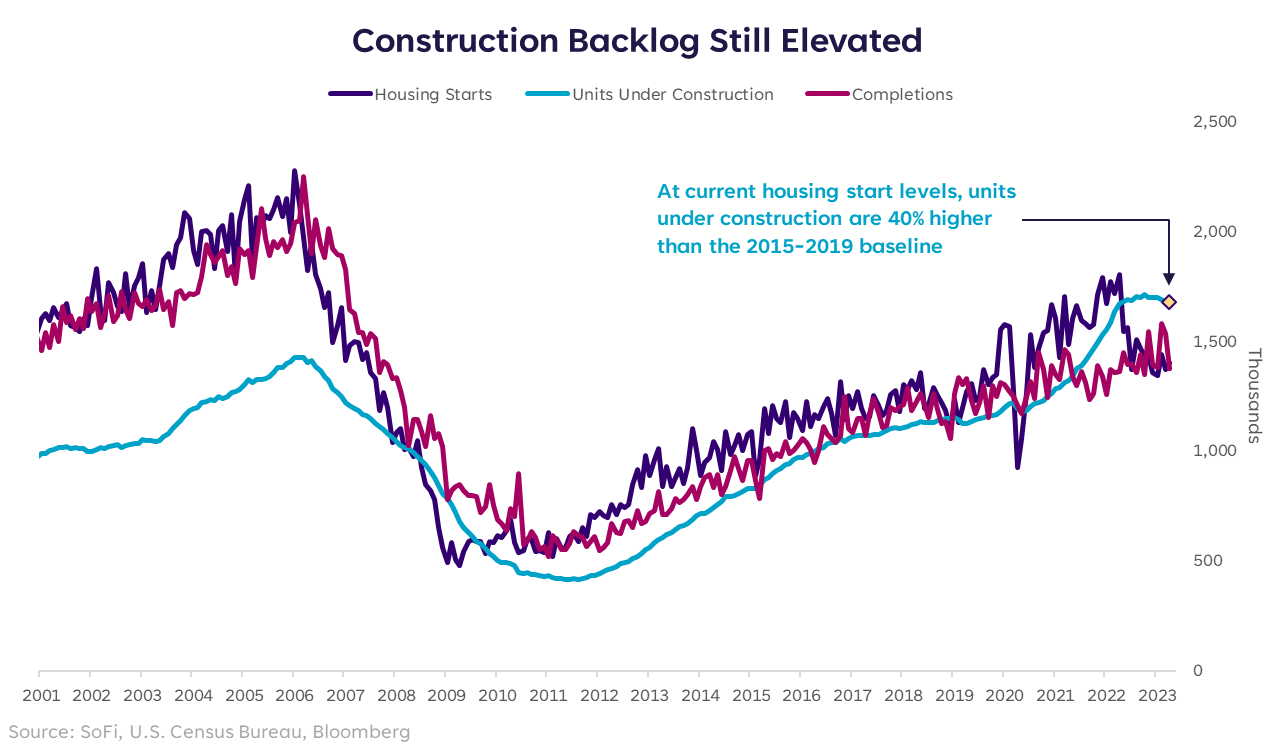

Despite the pun, this week’s note isn’t about the company alluded to in the title, but the housing market in general, and its seemingly bulletproof demand and persistent lack of supply. It’s a data set that can tempt even the most bearish investors to ask whether this time really is different. From a top-down perspective, housing is viewed as a cyclical indicator of economic strength and activity. One could argue that if housing is strong, the economy must be strong, because why would people still be willing to buy homes at elevated prices after mortgage rates have risen to levels not seen in decades? Beats me, but it’s happening. Sure, there has been some softening in home prices, and data points such as existing home sales suggest that activity has come to a screeching halt compared to what we saw in the second half of 2020. Yet, metrics that track new homes, such as housing starts, continue to paint a picture of healthy demand. Additionally, the backlog of homes under construction that occurred due to supply chain and labor constraints remains a big force in the market. With new home completions not taking a big enough bite out of the backlog, the shortage of home supply is still a major factor at play. As with other industries driven by supply and demand, this set-up explains at least some of the resilience in home prices, despite measures of housing affordability plummeting over the last 12 months.Builders Hotline Keeps Ringing

Given the fears over slowing economic growth and the closely watched labor market, this topic begs the question: Can a resilient housing market keep job numbers strong? In the residential construction sector, yes…for now. If there are enough projects still underway, the industry still needs workers to complete them, hence the situation depicted in the chart below. There is also a relationship between construction employment and the broad labor market that bears mentioning. In general, if construction employment were to fall meaningfully, we’d expect softening in the broad labor market to show up in the data shortly thereafter. Despite a big drop in construction job openings earlier this year, actual construction employment hasn’t really budged. Either it’s too early to see it in the real data, or the demand/supply dynamic is strong enough to keep weakness at bay. Time will tell.Cracks in the Foundation

But perhaps this cycle of the housing market is not quite as straightforward as we think. There’s reason to believe that home prices have stayed elevated simply because the market is frozen. With so many low-rate mortgages outstanding, no one wants to take out a new mortgage at today’s high levels. Therefore, it’s impossible to get a current read on home prices unless they change hands. After all, houses are only worth as much as someone is willing to pay for them — so if there are no transactions, there is no actual movement in price. Rather than looking at the data as “strong,” maybe we should look at it as “stuck.” In addition, the lumber market is sending a curiously divergent message vs. homebuilder stocks. The lumber index has fallen back to 2020 levels after two big spikes in 2021 and 2022. Lumber is generally a leading indicator to the housing market, yet homebuilding stocks have moved in the opposite direction for the last six months. This is one of those undeniable signals that we can’t easily explain away. If lumber leads, the implication is that housing should fall. Last, but certainly not least, although there continues to be a backlog in homes under construction, the number of building permits has fallen meaningfully. Naturally, if permits are falling, new homes starting to be built should eventually follow suit. Even if the supply shortage has kept things supported for now, maybe it’s only a matter of time before that support crumbles. It will come as a surprise to no one that I’m not convinced housing can remain resilient. But I do recognize that this cycle is a fighter, and housing is one of the spots that hasn’t quit. Regardless, I’m finding it more and more plausible that this environment is more about timing than signals. Just because it’s taking longer doesn’t mean it’s getting stronger.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Advisor SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS23051803