Skinny Love

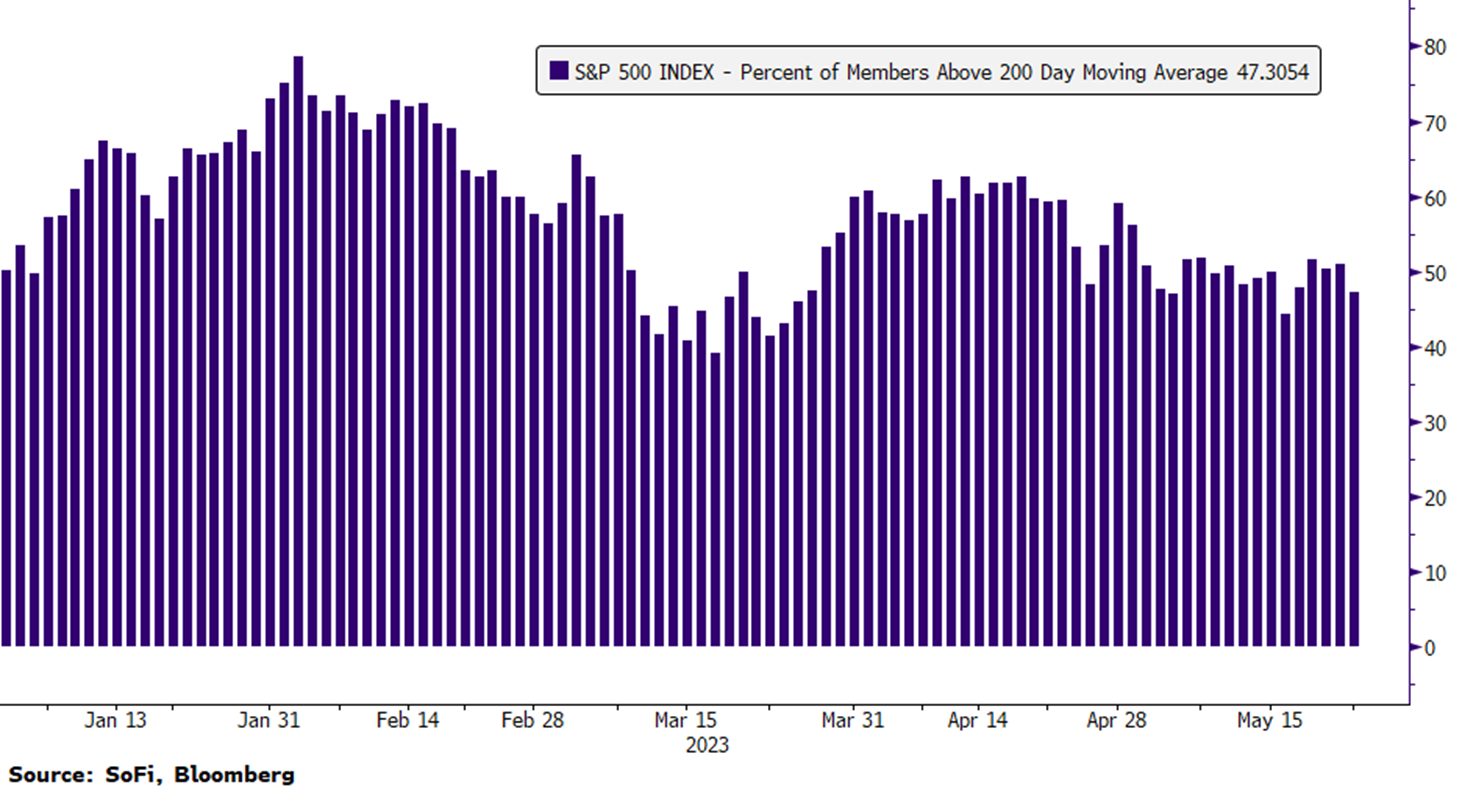

For anyone not familiar with the band Bon Iver, let this be your introduction. The lead singer, Justin Vernon, was born in a small town in Wisconsin called Eau Claire. (Coincidentally, my dad went to college at the University of Wisconsin-Eau Claire, but I digress.) One of Bon Iver’s biggest hits is a song called Skinny Love, which was not written about the stock market, but markets can be a lot like love songs (heartbreak songs?) so let’s roll with it. The skinny in this context refers to the small number of stocks in the S&P 500 that are doing well, despite the index’s 7% YTD return. In fact, the number of stocks trading above their 200-day moving average has been decreasing since mid-April. Those that remain above their 200-dma exhibit some similarities, which I’ll get to in a minute, but the important takeaway is that despite the market’s upside over the last month and change, the strength under the surface has actually deteriorated. This is also evident when we compare the equal-weighted S&P with the market-cap weighted S&P, where the market-cap weighted index has outperformed the equal-weighted version by more than 700 basis points YTD. Message being, the “average” stock hasn’t kept up with its mega-cap cousins.Eau de Performance

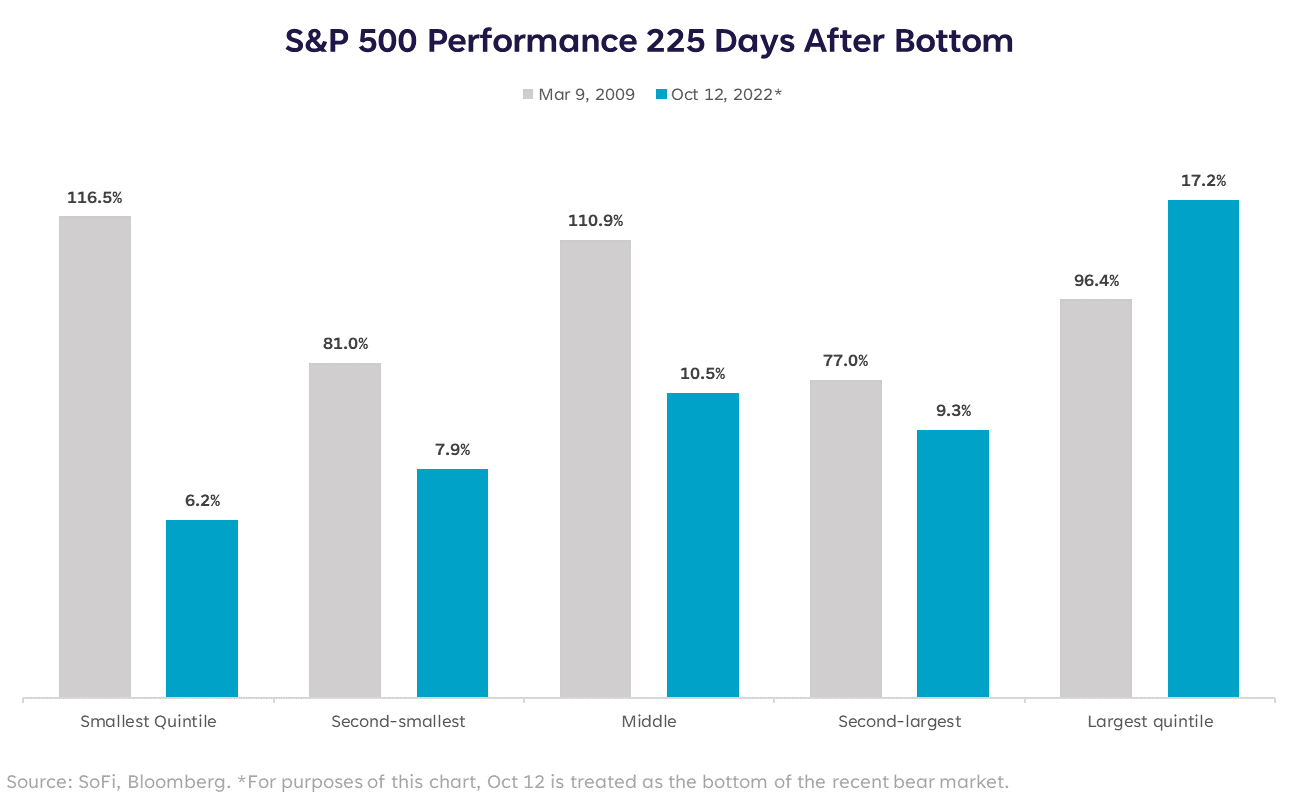

But does it matter? In my opinion, yes. The mark of a durable bull market is one with broader participation in the upside. In other words, we want to see more stocks than not pushing the index higher. Especially if we’re trying to explain a rally with proof points around economic strength — smaller-cap stocks, typically thought of as very economically sensitive, should be climbing. That’s not the case right now, with the top quintile by market cap outperforming the bottom quintile by 11% since the October 2022 low. Comparatively, in a period of the same length following the 2009 market bottom, the performance pattern of market cap quintiles looks quite different — with the bottom quintile (smallest stocks) besting the top by a meaningful margin, and including strong participation from the middle quintiles. That’s good breadth; this is not. Point being, although historical periods can serve only as a guide, we know with certainty that spring 2009 was the beginning of a durable bull market in the S&P…and it didn’t start like this.Cyclical Exile

Many of you may not have heard of Bon Iver until they recorded some compilation songs with Taylor Swift, one of which was called Exile. Hence this section’s title of Cyclical “Exile.” Seemingly in exile right now are some of the classic cyclical sectors such as Financials and Energy, which is another indicator that’s not exactly firing off “strong economy” signals. On the contrary, it’s sending more “late cycle” signals than anything else. In January of this year, the weight of the largest five stocks in the S&P (Apple, Microsoft, Amazon, Alphabet, NVIDIA) surpassed the weight of the Financials and Industrials sectors combined (148 stocks in total). And the weights have diverged even further over recent weeks. That’s wild to me. Investors are playing favorites in a big way, and they could continue to play favorites unless something changes. Nevertheless, this set-up makes me uncomfortable, which becomes even more confusing because oftentimes it’s when we are uncomfortable that we should buy. But in this period when most signs point to “late cycle,” what could we buy? Treasuries, gold, defensives, cash…same old tune. Perhaps a tired narrative, but it’s worth noting that late cycle phases can last a long time, and I think that’s what we’re seeing right now. So rather than feel like my discomfort is a buy signal, I’m viewing my limited patience as a sign that we should wait a little longer — because the other common experience is just when our stamina is running out, the finish line comes into view.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision. The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content. Communication of SoFi Wealth LLC an SEC Registered Investment Advisor SoFi isn't recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners. Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv. SOSS23052503