SoFi’s 2019 Year in Review

As 2019 comes to a close, we are eager to look back on the year and see how our members fared financially. From paying off student loans to getting started with investing, we found that members really focused on building their financial health this year—and they achieved a number of milestones along the way.

To really dig into the specifics, we surveyed over 1,000 SoFi members and 1,000 general consumers (ages 24-73)1 across the U.S. to get their insights on how they did financially in 2019, the key financial trends of the year, and the financial goals they hope to achieve in 2020.

SoFi Member Milestones in 2019

We were curious to find out how our members and general consumers felt about their finances overall in 2019, so we asked them to rank their financial year as either: Great, Good, Fair, or Terrible. The good news? Over 50% of SoFi members and general consumers surveyed had either a “Good” or “Great” financial year, and over 35% had a “Fair” financial year.

SoFi members checked off some pretty major financial milestones this year:

• 35% negotiated a raise

• 22% started investing

• 18% paid off their debt

• 17% maxed out their retirement accounts (401k, IRA, Roth IRA)

• 13% saved for their child’s 529 plan.

Top milestones were achieved by general consumers, too:

• 26% started investing

• 25% negotiated a raise

• 19% paid off their debt

• 18% maxed out their retirement accounts

• 15% saved for their child’s 529 plan

Overall, we found that SoFi members were pretty much on track with general consumers when it comes to checking off big milestones on financial to-do lists.

SoFi Member Product Trends

In 2019, SoFi members saved, invested, and took advantage of new SoFi product features in SoFi Checking and Savings® and SoFi Invest®. This year, the top 5 most popular stocks, ETFs, and assets SoFi Invest members bought or sold were: Amazon (AMZN), Bitcoin (BTC), SoFi Select 500 ETF (SFY), Apple (APPL), and Disney (DIS).

In September, we launched crypto trading with SoFi Invest. Since that launch, Bitcoin is the second most popularly bought or traded asset among SoFi members! We dug into the stats a little bit more and found that 7.3% of millennial SoFi members invested in crypto vs. 6.3% of Gen X members and 5.38% of Boomer members.

We also launched vaults in SoFi Checking and Savings earlier this year that allow members to create individual “envelopes” within SoFi Checking and Savings under different umbrellas—so you can easily save and spend from one account, while simultaneously working toward different financial goals. Since launch, the top 5 most popular vault categories for SoFi members are:

• Emergency Fund

• House

• Other

• Taxes

• Travel

IPOs, Recessions, and More Headlines from 2019

Throughout 2019, company IPOs, talk of recession, and rising student debt numbers dominated the headlines. When it came to company IPOs, 27% of SoFi members said they paid attention to news around IPOs whereas 66% of general consumers said they did.

When it came to talk of a recession, over 60% of both SoFi members and general consumers said the thought of a recession was concerning—but only 43% of SoFi members took steps to recession-proof their finances, while 50% of the general public did.

For those who are interested in taking steps now to recession-proof their finances, SoFi’s Lauren Anastasio, CFP® shared her expertise earlier this year to help keep you financially fit.

Get Your Money Right®. What Exactly Does That Mean?

At SoFi, we’re all about helping you figure out your finances, whether it’s paying off your student loan debt, investing in your future, saving for retirement, or buying a home. But we wanted to know exactly what it means to you.

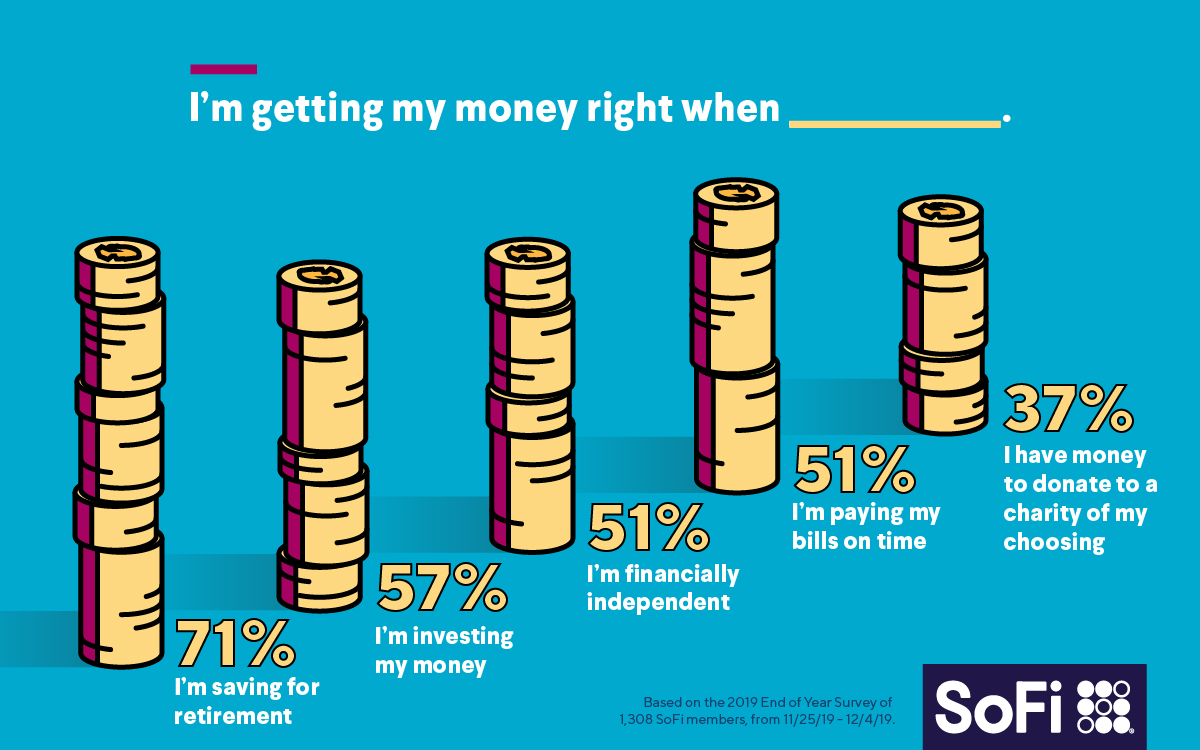

So, we asked those members surveyed and found that most people feel they are getting their money right when they save for retirement (71%), invest their money (57%), pay their bills on time (51%), when they’re financially independent (51%), they have money to donate to a charity of their choosing (37%), and when they’re saving for their child’s college education (28%).

To us, getting your money right means achieving all of those financial milestones and instilling those habits. We want to equip our members with the resources and products to help you get there and make your financial lives easier and better —so you can reach financial independence to realize your ambitions.

SoFi Membership Has Its Perks

As part of helping our members get their money right, we pride ourselves on our membership benefits and the community we’ve built together. This year, we hosted 163 member events in 21 states, where over 13,900 members attended.

Members set career goals with Goal Getters, celebrated paying off student loan debt at Summer of Funds, and were equipped with the tools, resources, and confidence to ask for a raise with Get That Raise. For members who couldn’t attend in-person, the livestream events on Twitter and LinkedIn received over 1,089,000 views collectively.

We also saw many members celebrate paying off their debt or dreaming about how they planned to celebrate the big moment during the Ditch the Debt Life contest and in our exclusive Facebook community. This year, over 92,000 SoFi members joined the “Paid-in-Full” club by paying off their student loan, personal loan, or home loans. Of those, 55.25% were millennials, 30.56% were Gen X, and 10.58% were Boomers.

Not surprisingly, members said that in-person member experiences were their favorite member benefit, followed by access to the exclusive Facebook member group, and then 1:1 sessions with financial planners and career services powered by Korn Ferry.

How does being a SoFi member enable people to feel about their finances? We asked our member community and got some pretty awesome answers that made us, frankly, blush. Many members said:

New Year, Who Dis?

With a New Year and a new decade on the horizon, we were curious to find out how many people are setting financial resolutions. It turns out that 60% of general consumers and SoFi members are planning on setting them while 40% said they were not planning to.

And what is everyone hoping to accomplish in 2020? The top goal both SoFi members and general consumers hope to accomplish is paying off debt (61%), followed by maxing out retirement accounts (31%). Third important to SoFi members was negotiating for a raise (22%), while the third important goal for non-members was to get started with investing (23%).

Cheers to 2020

As we close out 2019, we want to thank you for another amazing year. We’re excited to continue to help you celebrate new financial milestones with you in 2020. There’s a lot of exciting moments to come in the year ahead!

1Based on two SurveyMonkey surveys with both SoFi members and non-members with a total of 2,321 respondents from 11/25/19 to 12/4/19.

The individuals surveyed for this article were not compensated for their participation. This information is educational in nature, is not individualized, and it may not be applicable to your unique situation. It is not intended to serve as the primary or sole basis for your financial decisions.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SoFi isn’t recommending any of the stocks or brands shown here.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Checking and Savings

SoFi Money is a cash management account, which is a brokerage product, offered by SoFi Securities LLC, member FINRA / SIPC .

SoFi Bank Debit Card issued by The Bancorp Bank.

SoFi has partnered with Allpoint to provide consumers with ATM access at any of the 55,000+ ATMs within the Allpoint network. Consumers will not be charged a fee when using an in-network ATM, however, third party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time.

SoFi Invest®

The information provided is not meant to provide investment or financial advice. Investment decisions should be based on an individual’s specific financial needs, goals and risk profile. SoFi can’t guarantee future financial performance. Advisory services offered through SoFi Wealth, LLC. SoFi Securities, LLC, member FINRA / SIPC .

SoFi Student Loan Refinance

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®