SoFi’s 2021 Year In Review

It’s that time of year again where we look back at the last twelve months and take a moment to celebrate the wins, both big and small, and see how far we all have come since 2020 and even 2019. Last year, we were all eager to ring in 2021 and say goodbye and good riddance to 2020. While the challenges and pandemic continued, it’s been another interesting year to process and reflect on.

To do this, we analyzed internal data, surveyed over 2,000 SoFi members and surveyed 2,000 general consumers ages 18 to 73 across the U.S1. Here’s what we found:

Making Money Moves

We’re so inspired by our members making money moves as they work to achieve financial independence. When it came to making money moves this year, we were curious to uncover things like spending habits, what the top money concerns people are facing, what they would change about their financial situations and the money moves they want to make in the New Year.

The top money concerns SoFi members and consumers have in 2021 are (in order of importance):

• Saving for retirement

• Credit card debt

• How to invest

• Needing an emergency fund

One thing SoFi members and consumers would change about their financial life if they could:

• Making more money (28%)

• Saving more money (25%)

• Investing more money (18%)

• Being more organized (10%)

• Learning more about managing finances/the market (10%).

The top money moves SoFi members and consumers want to make in 2022 are:

• Save as much as possible

• Stay out of debt

• Invest in the market

• Finally get out of debt

• Get a raise

We also wanted to see how our members were spending their money and how that compared to last year. Some of this year’s most popular categories were:

• Retail

• Restaurant

• Grocery

The top Savings vault categories were:

• Emergency Savings

• Saving for a Home

• Taxes Owed

• Travel Fund

• Car Payments

For us, this year was all about moving your money to SoFi. In fact, we even had a campaign dedicated to it. We worked with renowned choreographer Matt Steffanina to choreograph our Money Moves dance which took off on TikTok with over 8.5 billion views and had Dude Perfect, Noah Beck, Maiko, Shawn Johnson and others dancing.

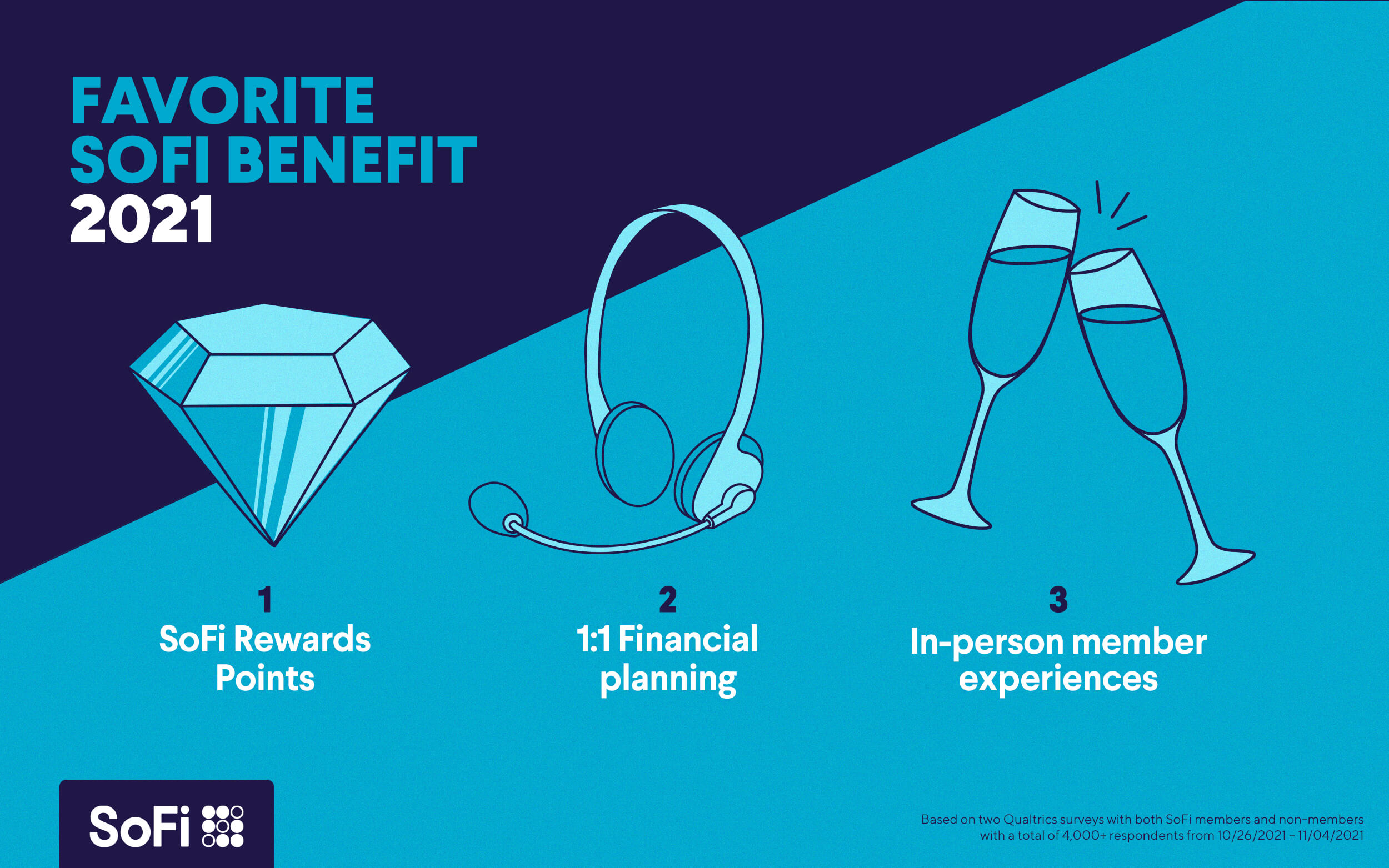

Moving your money to SoFi means we get to fulfill our mission of helping our members get their money right through our products and member benefits. When we asked SoFi members what their favorite benefits are, they said they loved redeeming SoFi rewards points the most, followed by complimentary financial planning sessions with our team of financial planners, our exclusive member experiences events, and career coaching.

The Rise of Retail Investors and Crypto

In January 2021, retail investors chatting on social media created a new phenomenon and began to shake up the market. GameStop (GME) stock soared more than 140%, resulting in a frenzy that would come to be known as GameStop saga, and would coin a new term: “meme-stocks”. Curiosity piqued? Ours did!

Between the retail investing and Crypto craze, 50% of our survey respondents felt that the surge of retail investing news coverage increased their curiosity in investing. It only makes sense that this year’s top trades on the SoFi Invest platform were: AMC Theaters (AMC), Bitcoin (BTC), Ethereum (ETH), Tesla (TSLA) and GameStop (GME) – (top 5 traded stocks: AMC, TSLA, GME, SOFI, RIVN), top 5 traded coins (BTC, ETH, ETC, ADA, LTC).

On the heels of investing, cryptocurrency also took the spotlight. Ethereum, Bitcoin, Dogecoin, or Tether ring a bell? Though many people use the words crypto, coins, and tokens interchangeably, it’s important to understand how they differ from one another in order to gain a basic understanding of cryptocurrency. We found that over 42% of SoFi members purchased crypto for the first time this year, with 23% of non-members admitting to having bought it for the first time. Interested in learning more about crypto? Check out our Crypto 101 guide.

While there’s still a lot to unpack and learn when it comes to Investing and crypto, we’re always curious when it comes to who’s currently investing. Our survey uncovered that over 74% of respondents do actively invest and for those who do not, 38% say that it’s because they don’t know where to start, while 47% don’t have the disposable income.

Surprisingly between the headlines and chatter on social, 60% of respondents shared that they did not think social media (i.e. TikTok, Instagram) serves as an informative platform for financial information. Interestingly, when looking for financial advice, SoFi members trust YouTube (29%), followed by Facebook (20%) whereas non SoFi members turn to Facebook (30%) followed by YouTube (28%).

Student Loan, Personal Loans, Oh My!

This past year the Biden administration extended the student loan moratorium through January 31, 2022, giving them the opportunity to pause payments on federal student loans. On December 22, they extended it once more to May 1, 2022. Our survey found that of SoFi members and non-members who had student loan debt, over half of respondents (58%) did not take advantage of the student loan moratorium while over one-third (36%) did, and a small number (6%) had federal student loans but continued to make payments. Data from SoFi uncovered SoFi members on average refinanced $72,431 in student loans in 2021.

Student loans weren’t the only form of debt that people had this year. A home renovation, wedding planning and car buying, all of which can be covered by a personal loan, are many financial ambitions that our members have. It’s clear that they, too, are becoming a part of the financial journey for many people.

The top three use cases for SoFi personal loans this year were:

1. Home improvement

2. Credit card debt consolidation

3. A major purchase

The Great Resignation

Another headline that gained momentum throughout 2021 was “The Great Resignation”. The pandemic upended an already shifting workplace, paving the way for employees to work from the comfort of their own homes for almost a year. While many may have seen this as comfort, it also made separating home life and office life more difficult – weaving the two together with hardly any boundaries. Some consumers felt it was the right time to hit reset on their careers paths and explore new options.

Nearly half (48% of those surveyed ages 24-42) left their jobs this year, and the top three reason were to start their own business (51%), having another job lined up (28%), and, despite the headlines, only a small group (13%) admitted to leaving due to burnout.

A BIG Touchdown Year at SoFi

2021 was also a big year for SoFi and it wasn’t possible without all of you, our wonderful members. We started out the new year announcing our plans to become a publicly traded company via a merger with Social Capital Hedosophia. On June 1, 2021, we reached a major milestone in our history and became a publicly traded company on Nasdaq under the ticker symbol $SOFI. This day was many years in the making and it gets us one step closer in helping everyone get their money right. We can’t wait for 2022 as our first full year as a public company.

Some other fun facts about SoFi this year:

• We increased members by over 68%

• We saved members over $888,000 in ATM fees*

• We awarded nearly 2 billion SoFi Rewards Points and the top categories our members redeemed points in were:

◦ Cashback

◦ Personal Loan

◦ Student Loan

◦ Credit Card

◦ Crypto

While social distancing was still encouraged this year, we continued to connect with our members digitally. We sought out to reach more members in 2021 and successfully hosted over 158 events (including webinars, social livestreams and in-person events) across financial, career, and member appreciation topics. As a result, over 16,000 people attended a SoFi event and nearly 43,000 SoFi members watched recordings of our events. Toward the end of 2021, we hosted a few in-person events to bring members together again – a first since the start of the pandemic in March 2020. We plan to resume in-person events nationwide in 2022 and look forward to coming together!

Talk about major milestone moments. This year, SoFi Stadium was able to welcome fans for NFL games and concerts for the very first time.

Since then, we’ve had so many moments to celebrate. As the official home of the Los Angeles Chargers and Los Angeles Rams, both teams have been clearing the field, scoring touchdowns, and entertaining thousands of fans at each game. Here’s a few fun facts:

• There’s been a total of 45 touchdowns scored at SoFi Stadium between the Rams and Chargers

• The Rams and Chargers have won 6 home games total, 3 each.*

*As of Nov 28, 2021

Our members are always at the forefront of what we do (all nearly 3M of you make SoFi what we are today!). From the Rolling Stones to BTS (the first concert to sell out four shows in a row), it’s only the beginning for what’s in store at SoFi Stadium in the months (and years) to come. Looking ahead, the stadium will welcome Coldplay, Kenny Chesney, the Red Hot Chili Peppers, WrestleMania and more.

We can’t forget to remind you that in a few short months, Los Angeles will welcome the Super Bowl to the region for the first time in nearly three decades, and Super Bowl LVI will take place at SoFi Stadium.

2021, It’s Been Real .. But Onward!

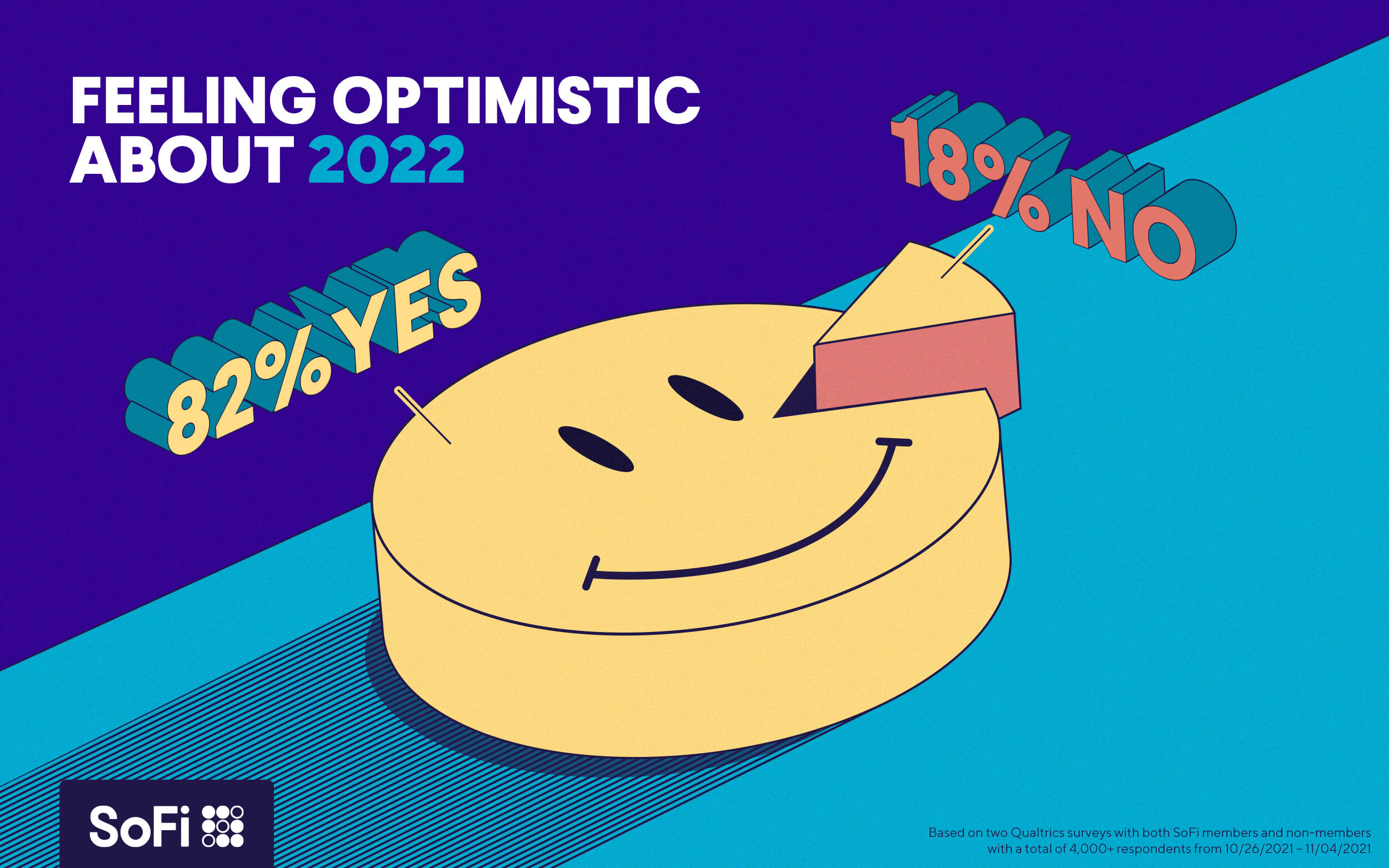

We can’t believe we’re closing out another year together. We stand with you when you say it’s been another wild year, but we’re so thankful to be on this journey with you on your quest for financial independence. We were so inspired to hear that 60% of SoFi members felt that their financial situation improved over 2020. Let’s continue to radiate positivity because 82% of our survey respondents, both SoFi members and consumers, are feeling optimistic about 2022 when it comes to their finances. Join us in raising a glass as we continue to help you Get Your Money Right in 2022. Cheers to another SoFi-tastic year!

1Based on two Qualtrics surveys with both SoFi members and non-members with a total of 4,000+ respondents from 10/26/2021 – 11/04/2021

The individuals surveyed for this article were not compensated for their participation. This information is educational in nature, is not individualized, and it may not be applicable to your unique situation. It is not intended to serve as the primary or sole basis for your financial decisions.

*SoFi Checking and Savings accounts opened prior to June 8, 2020 receive reimbursement for ATM fees incurred. Accounts opened after this date receive free ATM access via the Allpoint network. These accounts will not be reimbursed for fees incurred outside the network.

SoFi Student Loan Refinance INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

SoFi Invest is a trade name used by SoFi Wealth LLC and SoFi Securities LLC offering investment products and services. Robo investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser. Brokerage and self-directed investing products offered through SoFi Securities LLC, Member FINRA/SIPC.

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

CRYPTOCURRENCY AND OTHER DIGITAL ASSETS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE SoFi Loan Products

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi Checking and Savings

SoFi Money is a cash management account, which is a brokerage product, offered by SoFi Securities LLC, member FINRA / SIPC .

SoFi Bank Debit Card issued by The Bancorp Bank.

SoFi has partnered with Allpoint to provide consumers with ATM access at any of the 55,000+ ATMs within the Allpoint network. Consumers will not be charged a fee when using an in-network ATM, however, third party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

Cryptocurrency and other digital assets are highly speculative, involve significant risk, and may result in the complete loss of value. Cryptocurrency and other digital assets are not deposits, are not insured by the FDIC or SIPC, are not bank guaranteed, and may lose value.

All cryptocurrency transactions, once submitted to the blockchain, are final and irreversible. SoFi is not responsible for any failure or delay in processing a transaction resulting from factors beyond its reasonable control, including blockchain network congestion, protocol or network operations, or incorrect address information. Availability of specific digital assets, features, and services is subject to change and may be limited by applicable law and regulation.

SoFi Crypto products and services are offered by SoFi Bank, N.A., a national bank regulated by the Office of the Comptroller of the Currency. SoFi Bank does not provide investment, tax, or legal advice. Please refer to the SoFi Crypto account agreement for additional terms and conditions.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.