Making Smart Money Moves During COVID-19

This article contains breaking news and events related to the current state of politics and the economy. While we try our best to keep our articles as up-to-date as possible, the ongoing effects of COVID-19 are happening in real time and information is subject to change.

Even in the best of times, crafting a financial plan can be a challenge. There are plenty of moving parts and competing financial goals and priorities that can make streamlining your finances challenging.

Financial planning can be even more complicated in times of uncertainty. For many, the COVID-19 pandemic has already impacted their financial situation.

At SoFi, we’re working with members to help them recalibrate their finances during this unprecedented time. While everyone’s financial situation is unique, there are certain high level strategies that could be useful for members to use as they evaluate their finances.

Through this blog series, I’ll review some financial tools that could help people navigate the somewhat unpredictable terrain ahead. This starts with establishing a framework to assess your financial situation, understanding the options available to you, and then, developing a plan to get you through the next 30, 60, or 90 days.

It’s important to note that, while the goal of this series is to provide information to our members, it shouldn’t be taken as financial advice. In order to properly advise you, I’d need a comprehensive understanding of your personal financial situation.

This blog series is designed to leverage the lessons we’ve learned through consulting with thousands of our members. Consider consulting with a financial professional for personalized advice.

Assessing Your Financial Situation

Part of making financial decisions is the ability to effectively assess your current situation. When evaluating your individual circumstances, ask yourself: What was your situation before COVID-19? Once you’ve determined that, you can then evaluate how COVID-19 has impacted your finances.

Understanding this information can help you effectively respond to the changes in your financial circumstances. And, I want to note the importance of responding vs. reacting. Reacting is often informed by emotion—and when it comes to finances, it is rarely effective.

Responding, on the other hand, is informed by logic and reason. In this case, responding can help you create a careful plan that can help you weather the financial changes that may be occurring as a result of COVID-19.

Financial Situations Before COVID-19

To get a better idea of financial situations pre-COVID, consider asking yourself the below questions:

• Do I have an emergency fund with enough cash to cover three to six months of expenses?

• Do I have any high-interest debt?

• Was I saving enough for long-term financial goals, such as retirement?

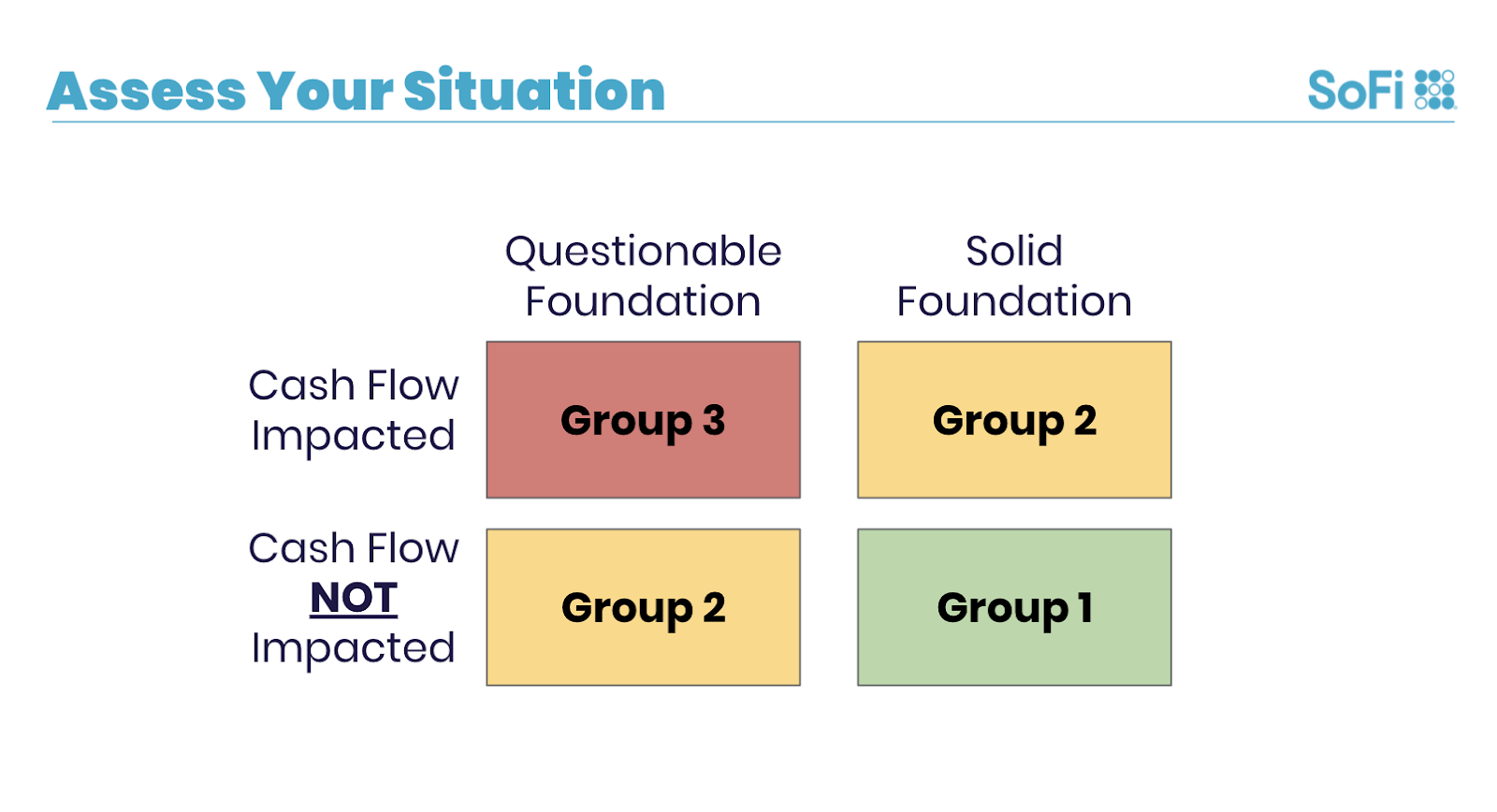

For the purposes of this informative series, those with enough cash, no high interest debt, and who were saving enough already would be considered in a good financial position.

Those who weren’t able to check those boxes would be in a questionable financial position.

Understanding the Financial Impact of COVID-19

Now that you have established the state of your finances before COVID-19, take the time to understand how COVID-19 has directly impacted your personal finances. In this case, one of the key focusses is cash flow.

Has your income been reduced or eliminated? Many households have already experienced a direct impact, while other households haven’t yet experienced any changes in their income.

In this series, I’ll review three different groups that people may be experiencing, as we navigate the changing circumstances of the COVID-19 crisis.

Group 1: Those who were in solid financial situations before the crisis and who have not experienced a direct impact on their income.

Group 2: Those who were in a solid financial position and have experienced a direct impact on their finances; or those who were in a questionable financial situation who have not experienced a direct impact on their income.

Group 3: Those who were in a questionable financial position and have experienced a direct impact on their income.

In each scenario, different options and considerations may need to be made. I’ll review information that may be helpful in understanding the available options related to a person’s income, expenses, debt, and investments for each in a dedicated blog post as part of this series.

Have more questions?

While the impact of COVID-19 continues to evolve, all of us at SoFi continue to work diligently to help our members manage their financial needs.

If you have questions about your finances, consider making an appointment with one of SoFi’s Financial Planners. And you can check out the COVID-19 Financial Guide for more articles and resources.

Learn more about managing your finances through COVID-19. Schedule a complimentary call with a SoFi financial advisor.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Advice—Advisory services are offered through SoFi Wealth, LLC an SEC-registered Investment adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov.

SOCO20022