Liz Looks at: The Fed’s June Statement

Tick, Tick, Boom

These are historic times. We got another piece of data yesterday, but the puzzle is still not solved.

The Federal Reserve raised its benchmark policy rate by 75 basis points to an upper bound of 1.75%. We haven’t seen a hike of this size since 1994. Just one week ago, markets were still expecting only a 50 basis point move, but that was quickly abandoned for more aggressive action after a hotter-than-expected inflation print last Friday.

Additionally, Fed officials raised their forecast for the Fed Funds Rate at the end of 2022 from 1.9% to 3.4% and for 2023 from 2.8% to 3.8%. Adjustments that large in just three months’ time reinforce the growing sentiment that the Fed was far behind the curve. We’ve now seen three hikes in this cycle, each one bigger than the last…tick, tick, boom.

Dynamite or Kryptonite?

Sometimes you have to break it down in order to build it back up. That’s a phrase used often by business leaders who are trying to “fix” a problem in their company. In a perfect world, we can light the dynamite carefully enough to blow up the problem spots without taking the whole thing down.

If we ask the market, it’s still sending a message that averting a deep recession is possible (judging by the S&P’s max drawdown of 22% so far this cycle). Earlier this week, however, the S&P officially entered bear market territory for the first time since 2020 and the 2s/10s yield curve inverted more than once. Those indicators would say the market is still hanging on to some “no recession” optimism, but the likelihood of averting one has fallen. Typically, drawdowns coupled with recessions are deeper than 30%, which would suggest the market has not yet priced in a recessionary environment.

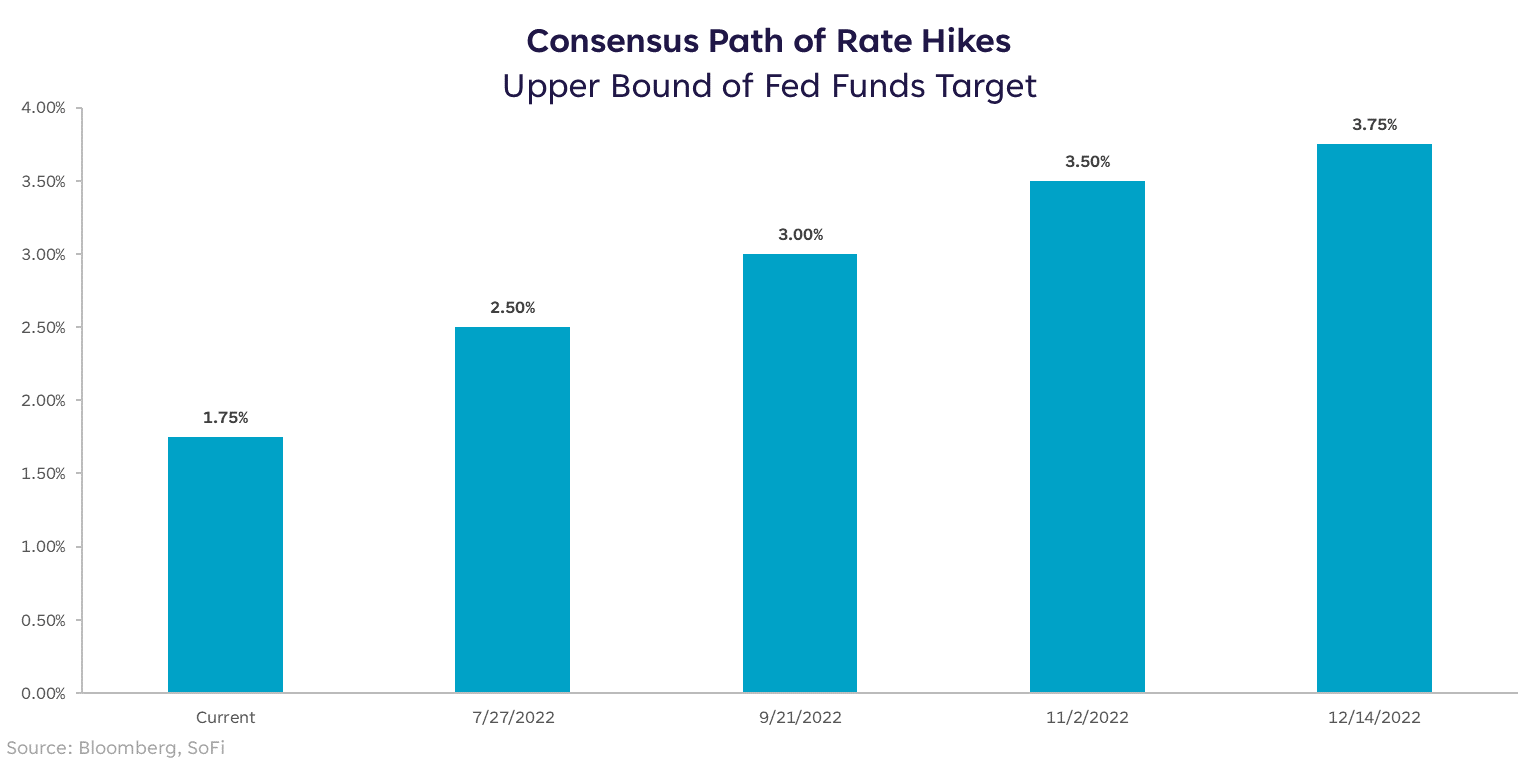

And here’s where rate hike expectations fall for the remainder of the year. Expectations are for another 75 bps hike in July, and roughly 125 bps more before the end of the year. That would bring the Fed Funds Rate to an upper bound around 3.75%.

The market has predicted hikes with surprising accuracy so far, and the acceleration of hikes has given the market comfort for now. That said, inflation is kryptonite for markets and rate hikes are the best tool we have to work with. There really is no choice but to be aggressive about attacking the problem…regardless of recession risk.

Trimming the Wick

The Fed’s previous projections for growth, unemployment, the Fed Funds Rate, and inflation were pretty far off base, in my opinion. This meeting brought those projections to a more appropriate place – 2022 growth expectations came down from 2.8% to 1.7% and inflation expectations moved up from 4.3% to 5.2%.

Despite volatility immediately after the Fed announcement, markets reacted positively. I think the two biggest positives from the meeting were, 1) the Fed showed they were willing to be nimble and react quickly to the data, 2) they also proved that they were watching more “real world” indicators to make policy decisions. In particular, headline inflation instead of core, and consumer sentiment and consumer activity.

The best we can do as investors is wait for some of the immediate uncertainty to abate, and stay ready to re-evaluate our allocations in the case of any unexpectedly good or bad news. I continue to believe volatility stays elevated through June and likely July. It’s more important as investors to prevent full participation in drawdowns than to ensure full participation in upside. As such, I’m comfortable keeping a larger-than-normal cash position until later in summer.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22061604