Liz Looks at: the Market Shakedown

Wash, Rinse, Repeat

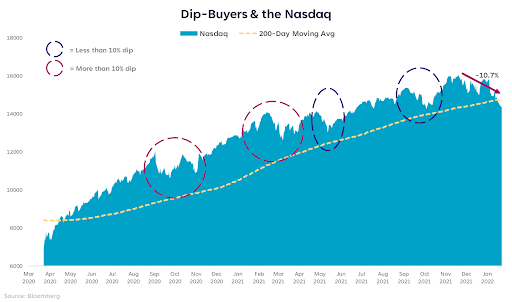

On Tuesday, the Nasdaq broke below its 200-day moving average for the first time since April 2020. That marked an important level as it indicated to many that the support we’ve seen, and the dependable dip buyer, may have relinquished their power.

Since the market bottom on March 23, 2020, Nasdaq dip buyers have swept in well above the 200-day moving average level (chart below) and succeeded in making the index look invincibly buoyant. This year is different. Dip buyers still came in, but they didn’t stay long enough to keep it lifted. To the newer investors out there, not all pullbacks, even ones that seem persistent, are signals of an imminent bear. Sometimes, they’re shakeouts, shakedowns, removals of excess, and narrowing of gaps. That’s what I think this one is.

I called this note Wash, Rinse, Repeat though because I think we’re going to do this a few more times before the shakedown is over.

You Call it Mean Reversion, I Call it Right-Sizing

Some may say this is the reversion to valuation averages that happens in every cycle. My issue with calling it that is the averages are always moving and can be distorted — particularly in environments of unprecedented policy stimulus. I see right-sizing as a more appropriate term and think its about time we narrowed the illogical gaps, such as:

• Negative real Treasury yields vs. double digit stock returns

• The sizeable Fed balance sheet vs. a strong consumer and labor market

In other words, it’s about time. Although watching 70 new all-time highs in the S&P 500 was fun last year, it wasn’t logical. It also priced many investors out of buying stocks or adding to positions because they were just too expensive. Now is the time when we’ll start seeing buy signals that hit on both valuations and fundamentals, which is much more logical.

The Gap Between Wants and Needs

Sure, we all want the market to only go up. We all want the removal of risks and a guaranteed safety net in case something goes wrong. But what our economy needs right now is a tightening of the purse strings, and a rebuilding of a buffer so we’re prepared to fight the next crisis. No, I don’t see a new crisis on the horizon, but eventually it will happen again and we need to make sure we have the policy resources to support the economy when it does. We have a lot to unwind and it won’t happen overnight. The hard part is that even if the economy can handle it, the stock market will put up a fight as we break our “easy money” habits. Get comfortable being uncomfortable.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22012002