Liz Looks at: Spreads

A Tale of Three Spreads

I’m not talking about a mezze platter. In this macro-obsessed environment, I want to take a moment to focus on some less headline-worthy market indicators that can be important guideposts. We talk about the spread between 2-year and 10-year Treasuries so often that I’m purposely leaving it out in favor of other measures that I think investors should also pay attention to.

The Great Flatsby

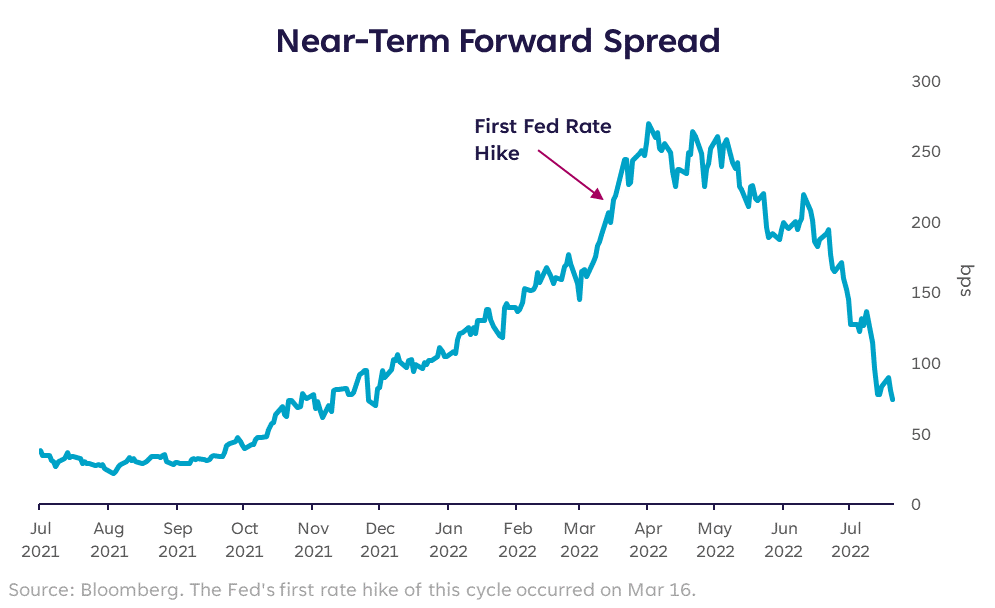

The term “flat is the new up” has been thrown around recently in reference to the stock market, but in the case of yield curve spreads, flat is not usually a good thing. A less widely covered Treasury spread is one called the “near-term forward spread”. It represents the spread between the current yield on a 3-month Treasury bill, and the market’s expectation of the 3-month yield 18 months from now (the implied forward rate).

In other words, it reflects the 3-month rate today vs. the expected 3-month rate in a year and a half.

Why does it matter? Because it serves as an indicator of when the market thinks the Fed may have to cut interest rates — likely due to economic stress or recession. Specifically, if markets expect in 18 months the 3-month yield will be lower than it is today (i.e., inverted), that implies the Fed is likely to cut rates at some point in the next 18 months.

This spread is not inverted currently, but it’s narrowing fast and has come down by almost 200 basis points since early April. At the time of this writing, the current 3-mo rate is 2.48% and the forward rate is 3.28%, making the spread a measly 80 basis points.

The other big reason this spread matters is because it’s one the Federal Reserve watches closely. If this inverts, it’s one of the signals to slow down or halt hikes. At present, this spread isn’t screaming “recession,” but keep a watchful eye.

To Kill a Stock-ingbird

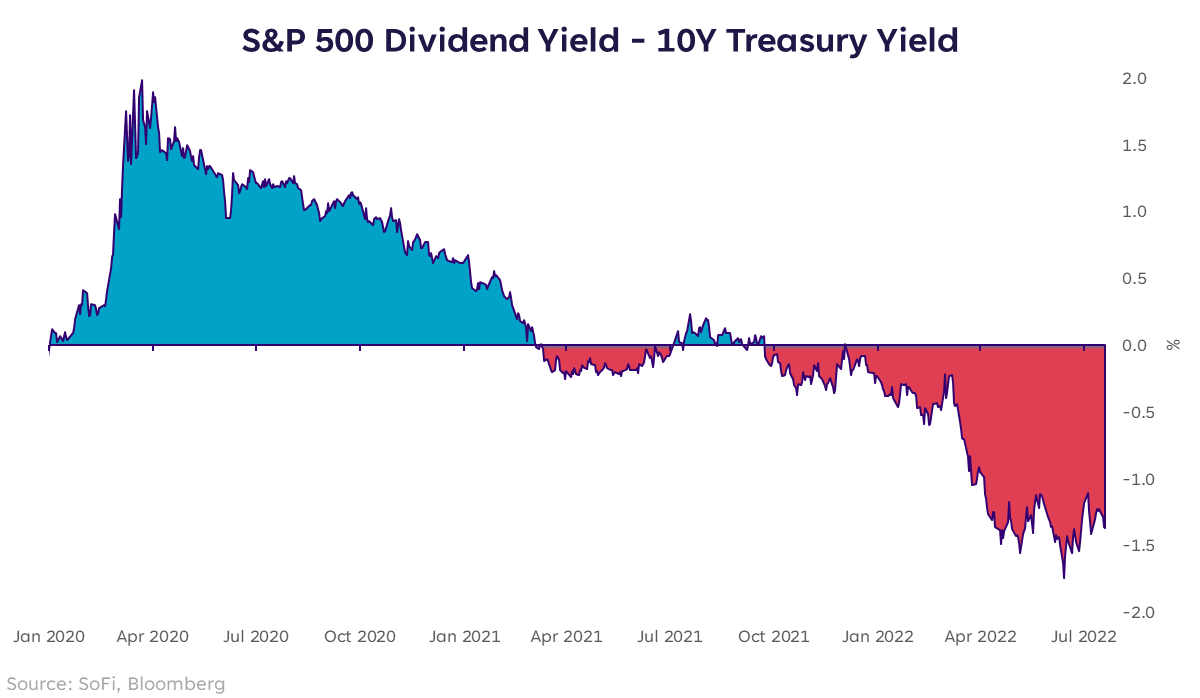

Another spread measure of note is one that brings stocks into the conversation. Namely, the spread between the dividend yield on the S&P 500 and the 10-year Treasury yield. This is interesting to look at because it attempts to isolate “income” as a driving decision factor.

There are multiple forces behind both of these yield measures, which are beyond the scope of this piece, but the main takeaway is that after many, many years of bonds not offering much yield at all, they now offer a more attractive yield than dividend paying stocks, and by a pretty wide margin.

Obviously, investors buy stocks for more reasons than dividend yield (such as price potential), but this metric can be used as a gauge of relative attractiveness of stocks vs. bonds. Moreover, it indicates that the classic 60/40 portfolio may again offer some benefits. Meaning, the bond portion of an investor’s allocation may now offer more upside than it has in recent years.

Moby Debt

Last, but certainly not least, there are credit spreads. This one shows the stress present in corporate credit markets, which is a critical indicator of risk appetite (the larger the spread, the lower the risk appetite) and fear (larger spread = more fear).

Using the high yield bond yield (risk asset) vs. the 10-year Treasury yield (lower risk asset), we find that the current spread between the two is 5.21%. That compares to 2.70% at the beginning of the year, which means this has almost doubled since January.

Luckily, it’s still nowhere near levels of spring 2020 when the spread hit 10.9%, but the increase this year is notable and worth keeping an eye on. If it widens considerably more, it’s likely to happen in concert with a drawdown in equities, and on the heels of some sort of “bad news” catalyst.

Pride and Prudence

Despite many investors’ wishes that we are near the bottom, and the idea that the market falls first, but also bounces back first, it’s important to heed the messages that the market itself is sending. On balance, the three spreads covered here are not sending an “all clear” message. In fact, they’re suggesting that we still practice prudence. I still believe investors can start to wade back into the market this summer, but I also believe we have some work to do before finding durable upside.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young Thomas is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22072103