Post-college Millennials and 2017 Financial Goals: A World in Flux

For many Americans, the beginning of a new year is a time for self-reflection and personal goal-setting — losing those holiday pounds, learning a new language, or maybe getting to a better place with their finances.

As a personal finance company devoted to helping a new generation achieve prosperity, we decided we’d dive into the financial aspect of these resolutions, especially among younger Americans. We also wanted to see how recent events might have shaped those resolutions. So we surveyed more than 500 college-educated Americans ages 25-34 — the older cohort of U.S. Millennials — to find out their attitudes on a variety of forward-looking finance topics.

In the process, we found some really interesting trends that may shape Millennial mindsets in 2017.

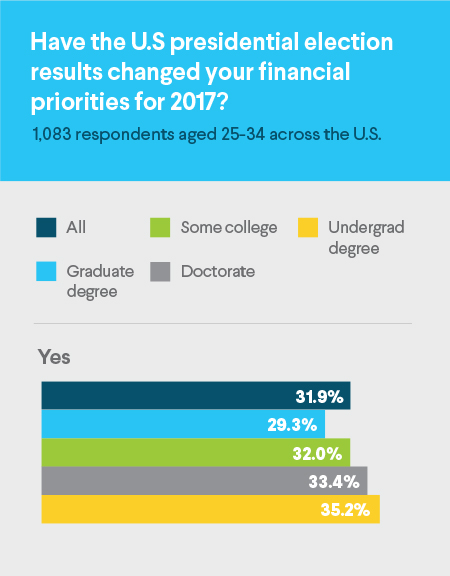

The presidential election had a meaningful impact on financial priorities of young people

With a new presidential administration set to take power, 32 percent of post-college Millennials said the election has changed their financial resolutions and priorities for 2017. We hadn’t expected this high a “Yes” response, and it made us wish we’d asked a follow-up of how it had been impacted, and why.

Interestingly, the higher the degree respondents had attained, the more likely they were to say that the presidential election changed their financial priorities this year. Looking at the results through that lens:

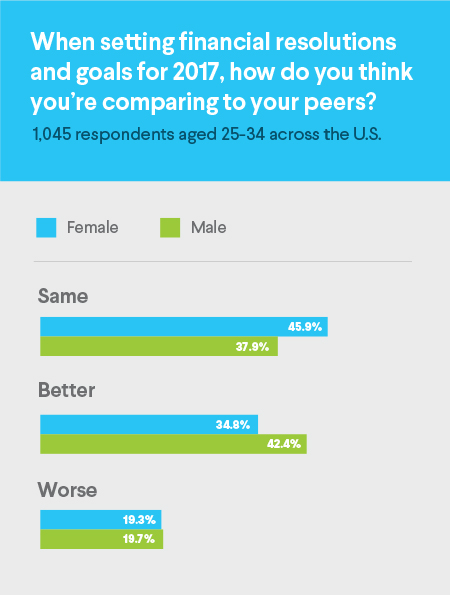

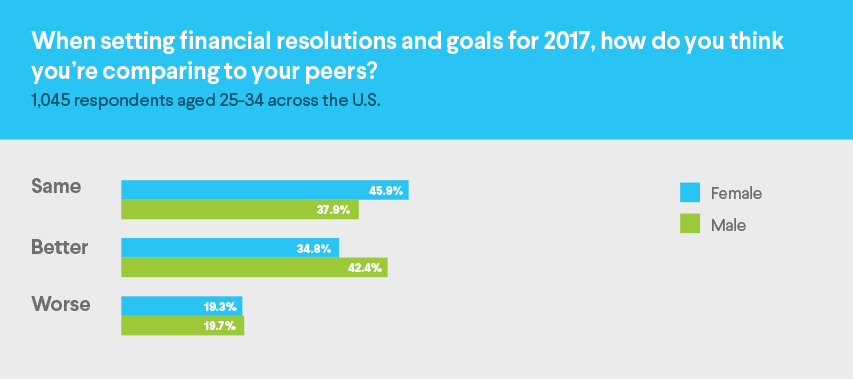

Men are more confident than women they’ll hit their goals this year

As young professionals make new financial plans for the new year, men and women have different takes on how well they’re doing relative to their peers—in a way that would seem to reinforce some gender stereotypes around financial confidence, though not actual acumen.

Most female respondents said that they’re doing as the same as their peers, while most male respondents say they’re doing better than their peers.

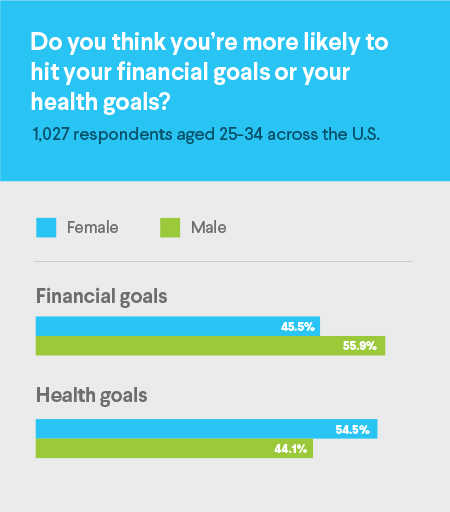

Women are more optimistic about their health goals than their finance goals

At the same time, men think they’re more likely to hit their financial goals than their health goals, while women think the opposite.

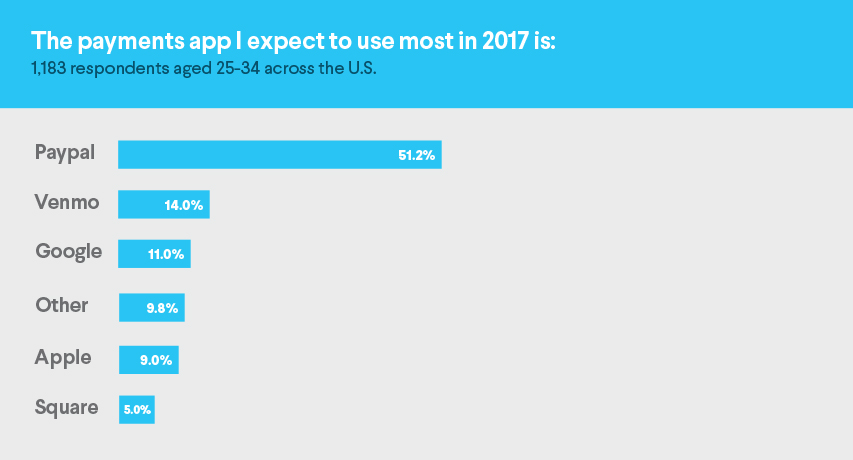

PayPal dominates payments, but Venmo coming on strong

Use of payments apps are on the rise, both for commercial transactions and person-to-person exchanges, and Millennials are leading the way. PayPal dominates this space among our survey respondents, with PayPal-owned Venmo coming in second.

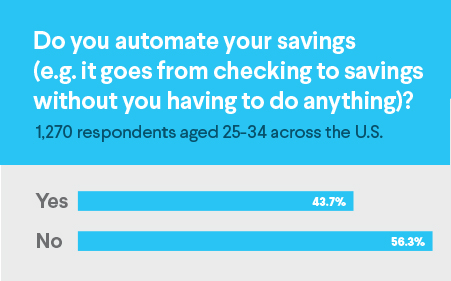

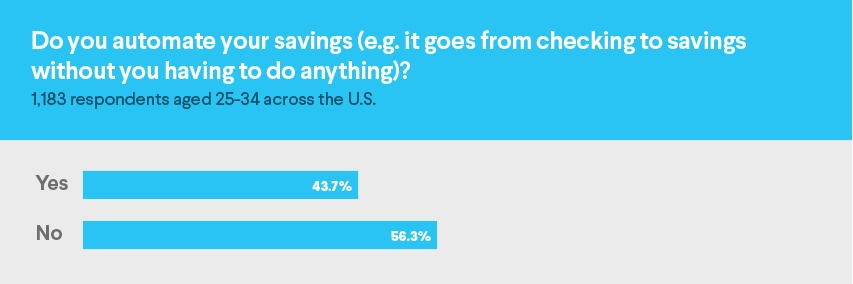

Millennials still aren’t paying themselves first

One of the best strategies for increasing personal savings is to automate it by setting up your checking account to automatically move a fixed amount of money to savings every month. “Paying yourself first” makes sure you don’t neglect savings.

In our survey, we found older Millennials aren’t automating their savings, and could be missing out on bolstering their cash reserves as a result:

The bottom line

Millennials are coming of age, and coming into money through their careers, into a world in flux, and that includes the financial world. New developments in the global economy, developments in technology and banking, and changing expectations mean that Millennials are having to find answers for how to handle their money in new ways.

Of course look who is president I hope all men don’t turn into complete buttholes and treat women better nowadays

Your hysterical rantings don’t make any sense.

Bernie Sanders got more millennial votes (voters age 30 & under) than President Obama did in 2008! Alot of that had to do with, among other things, his stances on free public colleges/universities & student loan reform. One of the biggest reasons why Hillary was able to get 80-90% of Bernie supporters age 30 & under to come over to her after the primaries (other than dislike &/or fear of Donald Trump), was due to the fact that she updated her “New College Compact” plan to include free public college/university to American families earning $125,000 or less & some kind of student loan reform (I can’t remember exactly). Once Donald Trump won, all of that hope disappeared. Trump has said a lot of things & given hints as to what he believes on certain issues, but college affordability & student loan debt is not one of them. That leaves millennials with a lot of worry & uncertainty.

Pingback: 4 Key Steps on How to Plan Out Your Financial Goals This Year