November Reading Roundup

Ready for the holiday season? Yeah, neither are we! The most wonderful time of the year may be just around the corner, but there’s still plenty to get done before you can enjoy the season of comfort and joy. To help you prepare for the holidays (like getting some fall home projects done before winter), we’ll discuss getting your finances in order before the end of the year, prepping for Thanksgiving, staying productive , and more!

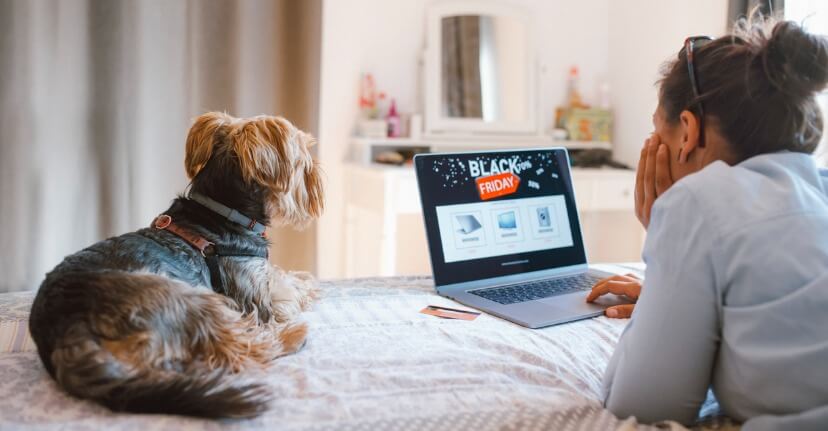

Black Friday & Cyber Monday

While it’s true that you can score some great deals on Black Friday and Cyber Monday, this time of year can also bring out scammers looking to take advantage of both online and in-person Black Friday shoppers . Before you start scouring stores and sites for deals, you may want to check out some common Black Friday & Cyber Monday scams to protect yourself from losing money. (And if you’re planning to shop in person, you may want to double-check if the stores on your list accept cash amid the ongoing coin shortage.)

But hackers and scammers aren’t the only threats to your money on Black Friday and Cyber Monday. Overspending can make the holiday season even more stressful. To avoid this, you may want to create a budget for the holidays, including how much you’re willing to spend on Black Friday and Cyber Monday.

Last-minute Thanksgiving Prep

While working from home has made holiday prep a bit easier for some folks, there are still plenty of Thanksgiving dinner party plan details that can get overlooked. If you still need to plan a light breakfast or lunch before your family’s Thanksgiving feast begins, you could use common pantry items to make a cheap, healthy, and easy meal that won’t spoil their appetite.

Trying to figure out what wine to buy for Thanksgiving? You could save time and money by buying a well-made, affordable wine at your local grocery store or by using a service like Shipt or Amazon Fresh to have it delivered. Need some more help in the kitchen this Thanksgiving? You could check out these cheap, last-minute Thanksgiving dinner tips to help you keep your sanity!

When Is (and What Is) Giving Tuesday?

Giving Tuesday is Nov. 30 this year. For those unfamiliar with it, Giving Tuesday is a global event aimed to help people raise funds for their local organizations and charities. It also aims to encourage others to spread generosity, such as volunteering, donating time or money, or even simply being kind to others. You can find out if there are any local Giving Tuesday campaigns near you by searching Giving Tuesday’s official website .

Participating in Giving Tuesday can be a great way to show gratitude to your community during the holiday season. Additionally, it can be an equally great way to make an end-of-the-year donation. Doing so can mean that you help out a charity you care about while also getting a tax deduction before the end of the year. And if you need help deciding which charities to donate to, check out this list of charities!

Taxes & Finances

While you may have sugar plums and pumpkin spice on the brain, your future self may thank you if you spend some time now getting your taxes in order. If you’re a small business owner or used cash apps for a side hustle, you may also want to familiarize yourself with tax laws that affect how you report income you received over apps like Venmo or Cash App. And if you need a notary for any of your tax forms, you can find a notary for free (or close to it!) quickly and easily!

Low on cash this holiday season? It may be time to finally ask your boss for a raise before salaries are set for 2022. Looking for easier ways to get some cash? You could also save money for the holidays by learning when is the best time of year to buy or replace some common household items, including when to buy new furniture. If you’re feeling overwhelmed focusing on growing your wealth during the holidays, you could take a look at these tips on improving your financial situation .

Staying Motivated … and Calm!

The start of the holiday season can be a stressful time of year, especially if you’re going through another stressful life event , such as planning a wedding . But you can help keep your stress levels down by taking a few minutes to do something fun, like looking at memes on social media or dusting off some of your favorite video games .

You could also start preparing for Christmas and other end-of-the-year holidays before they start compounding your leftover stress from Thanksgiving. Developing a morning routine could help set your day up for success. So could learning about some of the biggest time wasters and how to avoid falling for them. (Still stressed? You may want to take a moment to yourself to enjoy some funny life quotes! )

More From Around the Web

Online scams, holiday stress, and cold and flu season — oh my! We found even more articles from the web to help you navigate getting it all done before the end of the year (without losing your mind!):

• Stress, depression and the holidays: Tips for coping

• Five Ways to Prepare For The Holiday E-Commerce Rush

• 10 ways to protect yourself against scams during Black Friday and Cyber Monday

• Is it COVID-19, the flu, or RSV? Doctor offers tips

Looking for a place to park your hard-earned cash? SoFi Checking and Savings® is a checking and savings account with no account fees—and where you can spend, save, and earn all in one place.

Also, SoFi members gain access to SoFi Relay®, where they can track their inflows, set up goals, and keep tabs on their spending.

SoFi Checking and Savings

SoFi Money is a cash management account, which is a brokerage product, offered by SoFi Securities LLC, member FINRA / SIPC .

SoFi Bank Debit Card issued by The Bancorp Bank.

SoFi has partnered with Allpoint to provide consumers with ATM access at any of the 55,000+ ATMs within the Allpoint network. Consumers will not be charged a fee when using an in-network ATM, however, third party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time.

SoFi Relay offers users the ability to connect both SoFi accounts and external accounts using Plaid, Inc.’s service. When you use the service to connect an account, you authorize SoFi to obtain account information from any external accounts as set forth in SoFi’s Terms of Use. Based on your consent SoFi will also automatically provide some financial data received from the credit bureau for your visibility, without the need of you connecting additional accounts. SoFi assumes no responsibility for the timeliness, accuracy, deletion, non-delivery or failure to store any user data, loss of user data, communications, or personalization settings. You shall confirm the accuracy of Plaid data through sources independent of SoFi. The credit score is a VantageScore® based on TransUnion® (the “Processing Agent”) data.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOCO1021006