The Great Divide: Sector Performance Divergence

September has brought volatility back to the stock market, led by the retreat of the technology sector and some of the most popular names with retail and institutional investors alike. Many investors question whether this is just a healthy consolidation after a strong market rebound unmatched by the economic rebound, or a start of another round of major market corrections. There is also the possibility of revaluation within certain sectors, where valuations have become too lofty too quickly.

Sector Performance Divergence

The year of the pandemic has brought not only extreme market volatility, but also a great divide among different economic sectors. Stock markets have experienced tremendous volatility in 2020. As the global pandemic halted business activities, the US stock market, as measured by the S&P 500 index, lost over 1/3 of its value within one month early in the year. It has since staged a strong rebound from the market trough on March 23. As of September 4, the S&P 500 is up 6.5% year-to-date.

However, this number masks the great divide between sector performances this year. Certain sectors have better withstood the economic standstill, or even thrived during the pandemic, while others have suffered severe setbacks. Technology, consumer discretionary, and communication services sectors have greatly benefited from the new work from home, shop from home, and entertain from home culture. On the other hand, the energy financial services sectors lagged significantly. The chart below shows the disparity among SPDR sector ETF returns year to date.

Data source: Purview Investments, Bloomberg, Monthly series as of 9/4/2020

The spread between the best and worst sector has widened to an astounding 70% so far this year. The tech sector turned out to be most resilient to the global pandemic, up nearly 30%. Fossil fuel energy is down over 40%, due to both drastic pandemic-induced demand and a long-term structural industry decline well before the pandemic started.

Historical Context

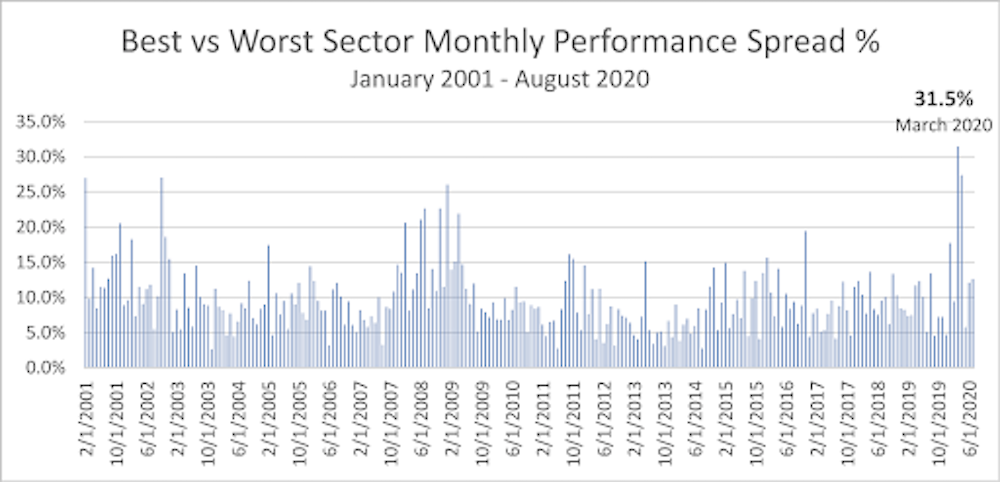

Looking back in history, sector performance differentiation is a normal part of the capital market movements. On average, the best and worst sector spread per month is just over 9% on average.

Data source: Purview Investments, Bloomberg, Monthly series as of 8/31/2020

What is unusual this year is the size of that divergence. In March, the best vs worst sector monthly spread reached over 31%. This is a record high monthly sector divergence in the past two decades. Sector divergence tends to spike during periods of great financial and economic duress. We have seen the spikes during the burst of the dot com bubble in early 2001 and during the financial crisis of 2008 and 2009.

Sector Leadership Takeaways

Sector leadership changes tend to coincide with the period of economic and capital market turmoil. However, the exact timing of sector rotation is hard to pin down. It is very hard to predict when the sector leadership will change, but here are a few points to consider:

Sector leadership may persist, sometimes far longer than many investors might anticipate. However, sector leadership changes are often accompanied by a catalyst of some kind, such as a shift in economic fundamentals.

Even while one sector leader remains in place, there often can be second tier leadership changes emerging. In June 2020, and again in August, certain cyclical sectors are trying to make a comeback, such as consumer discretionary and industrials, as economic recovery is underway in Asia and Europe, and even in parts of the U.S.

After each great financial and economic duress, there is often permanent damage to certain sectors and industries. For example, the financial sector after 2008 never regained its sector leadership in terms of index weight in the S&P 500, with some of the key players and key functions disappeared permanently. Some depressed sectors will eventually bounce back.

Investors will want to distinguish “value opportunities” from “value traps.” Some industries might be hurt temporarily by the pandemic, which could imply a relatively good time to buy. However, other sectors may appear to be cheap on a historical basis, but may be suffering permanent damage as a result of structural changes in those industries, regardless of the pandemic.

Investors are better off developing a macro view before investing in individual securities. When you have a long-term view and investment horizon, one is less likely to be perturbed by near-term market volatility, and might even be able to take advantage of market consolidations to get into positions that fit your long-term investment thesis. For those with limited capital, thematic ETFs can allow you to express your investment views with the exposure to a basket of securities.

SoFi Invest® External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement. Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

The information provided is not meant to provide investment or financial advice. Investment decisions should be based on an individual’s specific financial needs, goals and risk profile. SoFi can’t guarantee future financial performance. Advisory services offered through SoFi Wealth, LLC. SoFi Securities, LLC, member FINRA / SIPC .

Fund Fees

If you invest in Exchange Traded Funds (ETFs) through SoFi Invest (either by buying them yourself or via investing in SoFi Invest’s automated investments, formerly SoFi Wealth), these funds will have their own management fees. These fees are not paid directly by you, but rather by the fund itself. these fees do reduce the fund’s returns.. Check out each fund’s prospectus for details. SoFi Invest does not receive sales commissions, 12b-1 fees, or other fees from ETFs for investing such funds on behalf of advisory clients, though if SoFi Invest creates its own funds, it could earn management fees there.

SOIN20159