Semiconductor Stocks Struggle Amid Chip Shortage

The Rout May Persist

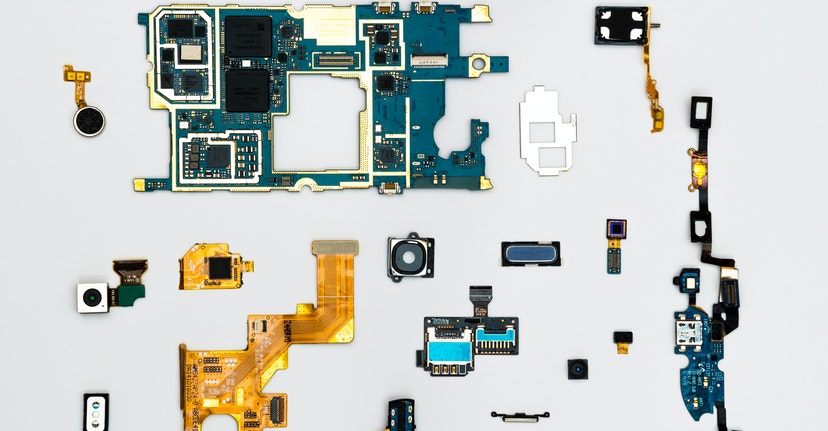

After a run-up in 2021, semiconductor stocks have struggled to keep their footing this year. Tech giants like Advanced Micro Devices (AMD), NVIDIA (NVDA), and Qualcomm (QCOM) have seen their valuations plummet as the shortage in chips has hit their bottom lines. Poor performance in the sector mirrors that of technology stocks in general this year.

Some market observers contend the worst is yet to come.

Strong Headwinds

Inflation-driven headwinds are showing up as waning consumer demand has started to cause inventory levels to increase. COVID lockdowns in China are further exacerbating the chip-shortage problem. The Russia-Ukraine war is also contributing to overall uncertainty as it disrupts the global supply chain and increases the potential for persistent inflationary pressures.

The current economic environment has left some industry analysts seeing a lot of risk in the category as they think back to the 2018 selloff of these stocks.

Seesaw Phenomenon?

The ongoing COVID-19 lockdowns are exacerbating supply-chain problems, all while chipping away at consumer confidence.

Newsmagazine Nikkei Asia reported that the primary smartphone makers in China ordered suppliers to cut production by 20%. In turn, Xiaomi (XIACF), the country’s largest smartphone maker will slash its shipment goals by as much as 20%. The chip shortage and weakening consumer confidence both factored into the revised plans. With so many issues affecting tech, some wonder if the chip shortage will end right around the time demand is starting to slip, leading to a no-win seesaw phenomenon.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22052002