Should You Rent or Buy a Home in the Bay Area?

These days, it seems the only thing more expensive than San Francisco rent is a San Francisco mortgage payment. Or is it the other way around? It’s getting hard to keep track.

According to Zumper, the City by the Bay maintained its title as the most expensive rental market in the U.S. this past month, with median one-bedroom rentals currently estimated at $3,500. What’s more, rents across San Francisco are uniformly high, as opposed to New York City where bargains can still be found in select areas.

Paying big bucks for a shoebox space has some SF renters fast-tracking their plans to buy a home, reasoning that it’s better to build equity than “throw money away” on rent. But with median Bay Area home prices also hovering near all-time highs, the decision to buy isn’t always clear.

Renting vs. Buying in the Bay Area

So how do you know whether to rent or buy in the Bay Area? That’s the question we posed to Trulia Housing Economist Ralph McLaughlin during a recent member event held at SoFi’s San Francisco headquarters.

McLaughlin’s answer? “It’s a tough decision with a complex set of factors to weigh.” He began by outlining five great reasons to buy a home, including:

1. Your budget is big enough to keep up with the associated costs of homeownership (it’s not just about the mortgage payment).

2. You plan on staying put for at least seven years, giving you a chance to build equity in your home.

3. You itemize your tax deductions and therefore can benefit from writing off mortgage interest.

4. You have good credit, which can help you get a lower interest rate.

5. Rents in your area are high relative to home prices.

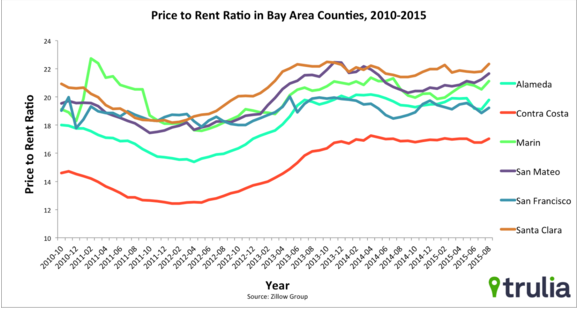

When deciding whether to rent vs. buy, McLaughlin stressed that the two most important factors are 1) how long you plan to stay in your home and 2) the ratio of prices to rents. “In the Bay Area, home prices have risen relative to rents since the bottom of the recession, but appear to have stabilized over the past couple of years,” he says, adding that this is good news for homebuyers, because it means we’re likely out of bubble territory.

Source: Trulia

Source: Trulia

Breaking Down the Cost of Bay Area Living Options

So now that we’ve covered the macro elements, let’s take a look at a micro example. Let’s say you’re a San Francisco renter paying $4,500/month on a 2-bedroom apartment, and you’re considering upgrading to a $1,000,000 3-bedroom home in Oakland and staying for at least seven years. At a 25% income tax rate and a 3.7% mortgage rate, Trulia’s rent-vs-buy calculator estimates that buying would be 30% cheaper than renting.

Bay Area Home Down Payments

Of course, there’s another big factor to consider in this equation: the down payment, which many cite as their biggest obstacle to homeownership (and 20% of a million bucks isn’t exactly spare change). Recent analysis by McLaughlin and his team showed that in expensive markets like San Francisco, it can actually take more than twice as long to save for a 20% vs. a 10% down payment – which may be why more people are considering low down payment mortgage loans when possible.

Should you rent or buy in the Bay Area? The answer is a resounding “it depends,” but having the framework McLaughlin outlined is a helpful way to begin your journey.

I’ve been living in the bay area for 7 years , this is a big topic of debate in my friends circle. The real kicker in the bay area isn’t the sales price. More often then not, you are buying a property that is not new construction.

In addition to the current cost of mortgage/taxes/insurance, upkeep is a big cost. Also, when you take the 20% plunge, there also is an opportunity cost with purchasing.

In the end it will come down to personal situation, but personally, having a home to share with my family will be the number one reason we eventually buy.

My wife and I have been trying to decide if we should rent or buy a new place. Our lease is going to expire in a month or so, and we need to decide as soon as possible. I didn’t realize that people who itemize their deductions are capable of utilizing mortgage interest to write off in their taxes. I’ll definitely remember that moving forward.