The Week Ahead on Wall Street

Economic Data

Today, the Empire State manufacturing index for August is released. This data point tracks general business conditions in the state of New York. For July the reading climbed 26 points to 43. This was the highest reading on record, and well above expectations.

Tomorrow, retail sales for July are released. Retail sales in June increased 0.6% from May and were up 18% year-over-year. Investors will be watching to see how the Delta variant of COVID-19 is impacting sales at the nation’s retailers. Also Tuesday, business inventories for June and industrial production for July are released.

On Wednesday, be on the lookout for housing starts for July. This tracks the number of new houses that began construction during the month. New construction has been under pressure in recent months as builders deal with labor shortages, high material costs, and a lack of property to build on. Investors will be paying close attention to July housing starts to see if those pressures are abating. In June housing starts came in at 1.64 million.

On Thursday, initial and existing unemployment claims for last week are released by the Labor Department. Unemployment numbers have been declining for a few weeks now as businesses reopen. Last week claims fell from 387,000 to 375,000, which was close to setting a new pandemic low. Investors will be paying close attention to this number as the Delta variant spreads.

There are no economic reports scheduled for Friday.

Earnings

Today, Tencent Music Entertainment (TME) reports quarterly earnings. The Chinese internet giant’s WeChat messaging-app unit got sued by Chinese prosecutors last week. They contend that WeChat’s youth mode violates laws protecting minors. Investors will want to know what impact this regulatory pressure is having on Tencent’s bottom line.

Tomorrow, be on the lookout for earnings from Walmart (WMT). The nation’s biggest retailer is offering the majority of its warehouse workers bonuses to stay throughout the holidays. In some instances it is also dolling out pay raises. The moves are part of Walmart’s strategies to recruit and retain workers in a tight labor market. It also comes as the Delta variant of COVID-19 is rapidly spreading. Investors will undoubtedly be focused on the impact of both labor shortages and rising costs for Walmart.

On Wednesday, be on the lookout for Target’s (TGT) quarterly earnings. Aiming to capitalize on the growth it saw during the pandemic, the retailer just launched its own brand of pet food, Kindfull, which went on sale over the weekend. In addition to hearing more about the new brand, investors will be paying close attention to what Target has to say about back-to-school shopping. With the Delta variant spreading throughout the country, consumers are reining back spending, putting the back-to-school shopping season at risk.

Be on the lookout for Estée Lauder’s (EL) earnings Thursday. The makeup company has been benefiting from increased spending on the part of consumers after months of shutdowns. It is also gaining traction in China. Investors will be parsing through Estée Lauder’s report and forecast for any signs the economic recovery is slowing. Supply-chain issues and costs of goods could impact the beauty products company’s bottom line.

Also Thursday, Deere (DE) reports quarterly earnings. The farm equipment company just spent $250 million to purchase Bear Flag Robotics, which makes autonomous technology for farm equipment. The company has been testing its technology on a variety of crops. The move is part of Deere’s efforts to counter labor shortages by using technology. It also comes as Deere looks to embrace new technologies like drones and robotics. Investors will be paying attention to what Deere has to say about the acquisition and others coming down the pike.

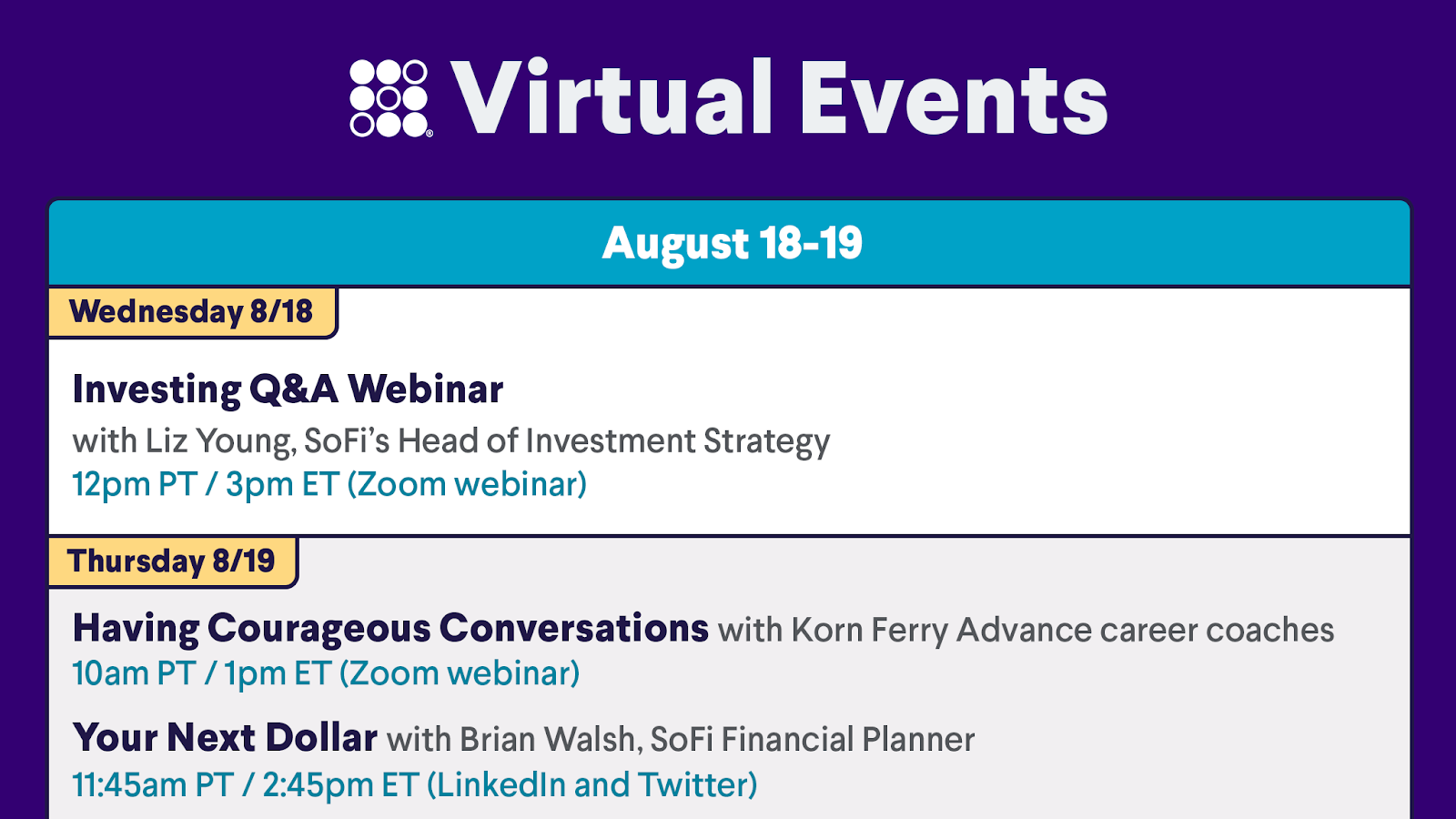

The Week Ahead at SoFi

Tune in for an investing Q&A session, then learn about having courageous conversations at work. Plus, check out this week’s Your New Dollar with SoFi’s Brian Walsh. RSVP to save your seat!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21081601