The Week Ahead on Wall Street

Economic Data

There are no economic data reports scheduled today.

Tomorrow, look out for the advance trade in goods report for August, the Case-Shiller National Home Price Index for July, and the September Consumer Confidence Index. Last month, consumer confidence, which measures how Americans feel about economic and business conditions, fell to its lowest level in six years. Analysts will be eager to see if September consumer confidence shows improvement.

On Wednesday, look out for Chicago PMI, the August Pending Home Sales Index, a Q2 GDP revision, and the September ADP employment report. This monthly economic data release shows private employment levels in the US. Last month, private payrolls rose by 428,000 with leisure and hospitality and then education and health care leading the way. Though this was an improvement, it was still below estimates of 1.17 million from economists surveyed by Dow Jones.

On Thursday, August reports for personal income, core inflation, construction spending, and consumer spending are due. Consumer spending ticked up by 1.9% in July and analysts will be eager to see if this upward trend continues. Also look for September motor vehicle sales, the September IMS Manufacturing Index, and initial jobless claims. So far in September, weekly jobless claims have hovered just below 900,000 per week, increasing slightly last week from 866,000 to 870,000.

To round out the week on Friday, look for August factory orders and the September Consumer Sentiment Index. September Nonfarm payrolls, September average hourly earnings, and the September unemployment rate are all released. These three data points are linked, and together give an important picture of the country’s labor market. In August, the unemployment rate dropped by 1.8 percentage points to hit 8.4%, showing a small degree of recovery.

Earnings Reports

This week, a number of important companies in the food and beverage industry and the technology industry will report earnings. Analysts will be watching to see how these companies have been responding to unique consumer needs as the pandemic continues.

Cal-Maine Foods (CALM), the nation’s largest egg producer, will report its earnings today. Cal-Maine Foods specializes in the production, grading, and packaging of fresh shell eggs. During the company’s earnings call in July, it said sales jumped over 60% in the prior quarter as people stocked up on eggs while they were cooking at home. Investors will be curious to see if this increase continued into the summer months.

Tomorrow, Micron Technology (MU), a computer memory and computer data storage company based in Boise, Idaho, reports its earnings. Micron depends heavily on trade with China, and as tensions rise between Beijing and Washington, trade restrictions have caused challenges for the company. However, the work-from-home boom has led to an increase in demand for cloud storage and PCs, which has given Micron a boost.

On Thursday, look for a report from Conagra Brands (CAG). The Chicago-based packaged food company owns brands like Duncan Hines, Reddi-wip, and others. It’s likely that the company has gotten a sales boost from more people eating food from grocery stores instead of going to restaurants. Additionally, Conagra Brands is responding to changing consumer demands by offering healthier snack options and more environmentally friendly packaging.

Bed, Bath, & Beyond (BBBY) will also report on Thursday. The home goods retailer is working on a restructuring plan and announced that it will close about 200 of its locations over the next two years. The store is often a popular destination for college students outfitting their dorm rooms, so this arm of the company’s business is suffering this fall as many students study remotely. However, the company may have gotten a boost from students and workers buying materials for home offices.

Constellation Brands (STZ) will also hand in its report card on Thursday. The company’s portfolio includes Corona Extra beer, SVEDKA Vodka, Casa Noble Tequila, and other alcohol brands. Though bars and restaurants have been buying far less alcohol, consumers have been flocking to purchase alcohol at grocery stores and online during the pandemic. Analysts will be curious to see how Constellation Brands has adapted its supply chain to cater to customers under different circumstances.

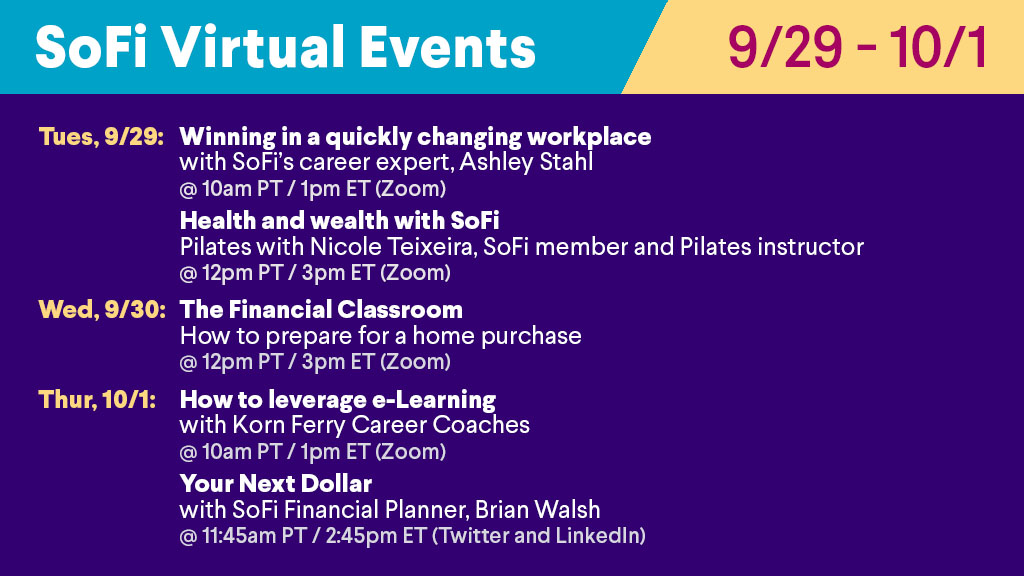

The Week Ahead at SoFi

This week’s lineup of virtual events will help you get centered while you continue to make progress on your career and your financial independence. Reserve your spot today in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS092801