The Week Ahead on Wall Street

Economic Data

Today, September construction spending is released. A pair of manufacturing figures including the October ISM Manufacturing Index and October markit manufacturing PMI are also published. Last month, economic activity in the manufacturing space expanded, with markit manufacturing PMI in the US ticking up to 53.2 in September from 53.1 in August.

Tomorrow, September factory orders and October motor vehicle sales are due. September marked the best month for car sales since before the pandemic. This was likely because more people are traveling or commuting, but still feel wary of public transportation. Of course, tomorrow is also the election for the president of the United States. While results may not be announced for several days after November 3, investors will be carefully following developments as people across the country cast their ballots.

On Wednesday, September trade deficit data, October markit services PMI, and the October ISM Services Index are released. The October ADP Employment Report, which tracks private employment in the US, will also be published. In September, this figure climbed by 749,000 on a seasonally adjusted basis, beating economist expectations of 600,000.

On Thursday, look for Q3 productivity and Q3 unit labor costs. Initial jobless claims will also be released. During the week ending October 24, jobless claims declined for a second straight week, reaching 751,000. This was the lowest level since the beginning of the pandemic. The Federal Open Market Committee is also scheduled to meet today and Jerome Powell, Chair of the Federal Reserve, will hold a press conference. Investors will be curious to see if he provides information about the Fed’s economic outlook and any color surrounding the interest rate environment.

To round out the week, on Friday, September wholesale inventories and September consumer credit will be released. Also look for October nonfarm payrolls, the October unemployment rate, and October average hourly earnings. Together, these three metrics will give a picture of the US labor market. In September, the unemployment rate was 7.9%—down from 8.4% in August.

Earnings Reports

Today, PayPal (PYPL) reports its earnings. The online payments giant recently announced that it will allow users to store, buy, and sell various cryptocurrencies on the platform and on Venmo, which is owned by PayPal. Bitcoin, Ethereum, Bitcoin Cash, and Litecoin will be supported on PayPal.

Tomorrow, look for a report from Wayfair (W). The online furniture retailer’s shares fell 76% following a mid-March selloff, but have made a strong comeback since then. Many of the brand’s physical storerooms remain closed, but online sales have been strong with people spending more time at home.

On Wednesday, Qualcomm (QCOM) hands in its report card. Shares of the San Diego-based software and semiconductor maker have climbed by roughly 40% so far this year. Qualcomm’s technology has been an important part of the 5G rollout. Additionally, the company signed a licensing deal with China-based Huawei which involves Huawei paying Qualcomm $1.8 billion for previously using patented Qualcomm technology. Huawei also agreed to pay Qualcomm royalties for using its technology in the future.

On Thursday, Uber (UBER) reports its earnings. The company’s core rideshare business is still suffering as a result of the pandemic, but it is investing in its restaurant delivery business and recently began delivering groceries in select locations. The last quarter was also marked by legal battles concerning whether or not Uber should be legally required to classify its drivers as employees. Investors will be curious to see how these difficulties impacted the company’s bottom line.

To round out the week, CVS (CVS) will report earnings. The pharmacy chain is currently in the process of hiring 15,000 new workers to help give flu vaccines, perform COVID-19 tests, and administer a COVID-19 vaccine if and when it becomes available. Distributing hundreds of millions of COVID-19 vaccine doses could put a strain on the healthcare system, and drugstores like CVS could be integral to successfully immunizing the population.

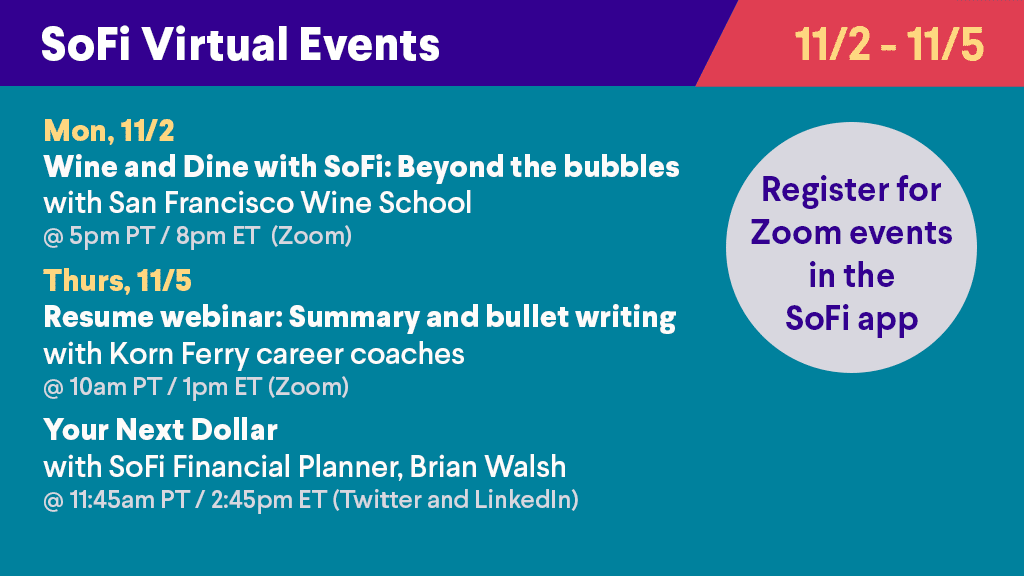

The Week Ahead at SoFi

Kick off November in financial style with our virtual events—where you’ll learn how to write the perfect resume and talk about your next dollar with Brian Walsh. It’s all happening this week on Zoom, Twitter, and LinkedIn. Register today in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS110201