The Week Ahead on Wall Street

Economic News

On Wednesday, be on the lookout for the Bureau of Labor Statistics to release job opening numbers for July. In June the US had 10.1 million job openings as businesses struggled to find workers. Investors will be paying close attention to July’s release to see if the worker shortages are beginning to abate.

On Thursday, initial and existing unemployment claims for the week prior are released. The unemployment picture has been steadily improving in recent weeks despite rising COVID-19 cases. Any uptick in unemployment numbers could raise concerns that the Delta variant is starting to impact the recovery.

On Friday, the Producer Price Index for August is released. This data point tracks the change in prices that domestic producers get for their goods. In July, the Producer Price Index lodged its biggest year-over-year gain in over 10 years. If this number is even higher for August, it could raise more inflation concerns. Also Friday, the revised number for wholesale inventories in July is released.

Earnings Reports

There are no major earnings reports slated to be released today.

On Wednesday, GameStop (GME) will report quarterly earnings. The meme stock skyrocketed earlier this year when retail investors joined forces to counter short sellers, betting on GameStop’s turnaround plans. Since then GameStop’s stock has fallen as investors have heard few details about its transformation under its new chairman, Ryan Cohen. The retailer’s last earnings conference call was brief.

Also Wednesday, Lululemon (LULU) reports quarterly earnings. One of the big winners of the pandemic, the stock has languished since setting new highs earlier in the year. That could reverse if the retailer meets Wall Street expectations for same-store sales to increase 36% in the quarter. Athleta, the workout brand owned by Gap (GPS), reported that net sales jumped 35% year-over-year in the second quarter, driven by demand for comfortable clothes.

On Thursday, Affirm (AFRM), the buy-now, pay-later startup, reported quarterly earnings. The company just announced a partnership with Amazon (AMZN), which sent its stock soaring. The ecommerce giant will allow customers to pay for items with interest-free installments through Affirm on purchases of $50 or more. Investors will undoubtedly want to hear more about the deal when Affirm reports earnings.

Also Thursday, teen-focused retailer Zumiez (ZUMZ) reports quarterly earnings. Zumiez is expected to be a big beneficiary of a strong back-to-school shopping season, driven by pent-up demand after last year’s shutdowns. However, that growth may have been hurt by the Delta variant of COVID-19. Investors will be paying close attention to Zumiez’s sales data.

To round out the week, Kroger (KR) reports quarterly earnings on Friday. The grocery-store chain has been a big beneficiary of the cook-at-home trend born out of the pandemic. But there are signs that pandemic growth is beginning to slow, even with the Delta variant spreading across the country. Investors will be paying close attention to what Kroger has to say about demand and COVID-19 when it reports earnings Friday.

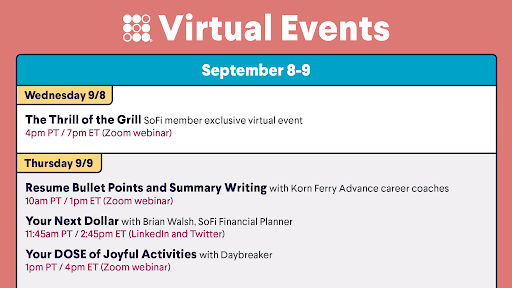

The Week Ahead at SoFi

Join us for SoFi’s End of Summer Chill with energetic activities and a virtual BBQ. Also, tune in for valuable resume tips, plus check out Your Next Dollar. Save your seat!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Advisor

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21090701