The Week Ahead on Wall Street

Economic Data

Today, IHS Markit releases its purchasing manager’s index or PMI for manufacturing and services in the month of January. This provides a general sense of whether US purchasing managers see the market as expanding, contracting, or staying the same. December’s index report showed modest increases in manufacturing. Analysts said further growth was constrained by material shortages and supplier delays.

Tomorrow, S&P Case-Shiller reports its national home price index for November, which shows the year-over-year change in the average price of a single-family home. October’s index increased 19.1%. The FHFA also releases its national home price index and January’s consumer confidence index is due.

More housing data is on the way Wednesday in the form of December’s new home sales starts, after November’s figure rose by 12.4% from October. Also be on the lookout for Federal Reserve Chair Jerome Powell’s news conference and the Federal Open Market Committee’s statement, as the market closely watches for any insight regarding future rates hikes. December’s advance report on trade in goods also comes out Wednesday.

Initial jobless claims are released on Thursday as well as continuing jobless claims. Initial claims serve as an indicator of recent layoffs. The figure jumped last week by 55,000 to 286,000 — a three-month high — as the market enters the post-holiday period and Omicron’s impact continues. Also Thursday be on the lookout for the seasonally adjusted Q4 2021 gross domestic product, which tabulates the US economy’s output. December’s pending home sales index is also due.

Friday the University of Michigan publishes its final consumer sentiment index for January, as well as its final five-year inflation expectations.

Earnings

Today, IBM (IBM) reports quarterly earnings. Analysts expect earnings per share of $3.51, which would represent a 13.7% decline from the year-ago quarter. The company reported a 0.3% increase in revenue during Q3 2021 with executives crediting progress in its software and consulting business.

Fellow “old-school” tech company Microsoft (MSFT) will post quarterly earnings Tuesday, fresh off its acquisition of video game maker Activision Blizzard. Shares have fallen over 10% from recent highs. That said, Microsoft consistently beat Wall Street’s expectations in terms of both revenue and earnings per share.

Wednesday, tech remains the theme of the week on the earnings front with Tesla (TSLA) set to release its quarterly earnings for Q4 2021. CEO Elon Musk is expected to be on the call after previously indicating he’d only participate when there was “something important” to say. There have been reports the electric car maker faces delays in producing Cybertrucks amid supply-chain issues.

Fellow tech giant Apple (AAPL) reports quarterly earnings on Thursday. The company has seen its stock decline as tech investors sell shares ahead of expected Federal Reserve rate hikes. Still, some predict Apple will post a big increase to its top line with fourth-quarter revenue growth estimated to be around $118 billion.

Rounding out the week in earnings, heavy machinery company Caterpillar (CAT) will report its Q4 2021 results on Friday. Some analysts expect strong earnings boosted by robust activity in both residential and non-residential construction.

The Week Ahead at SoFi

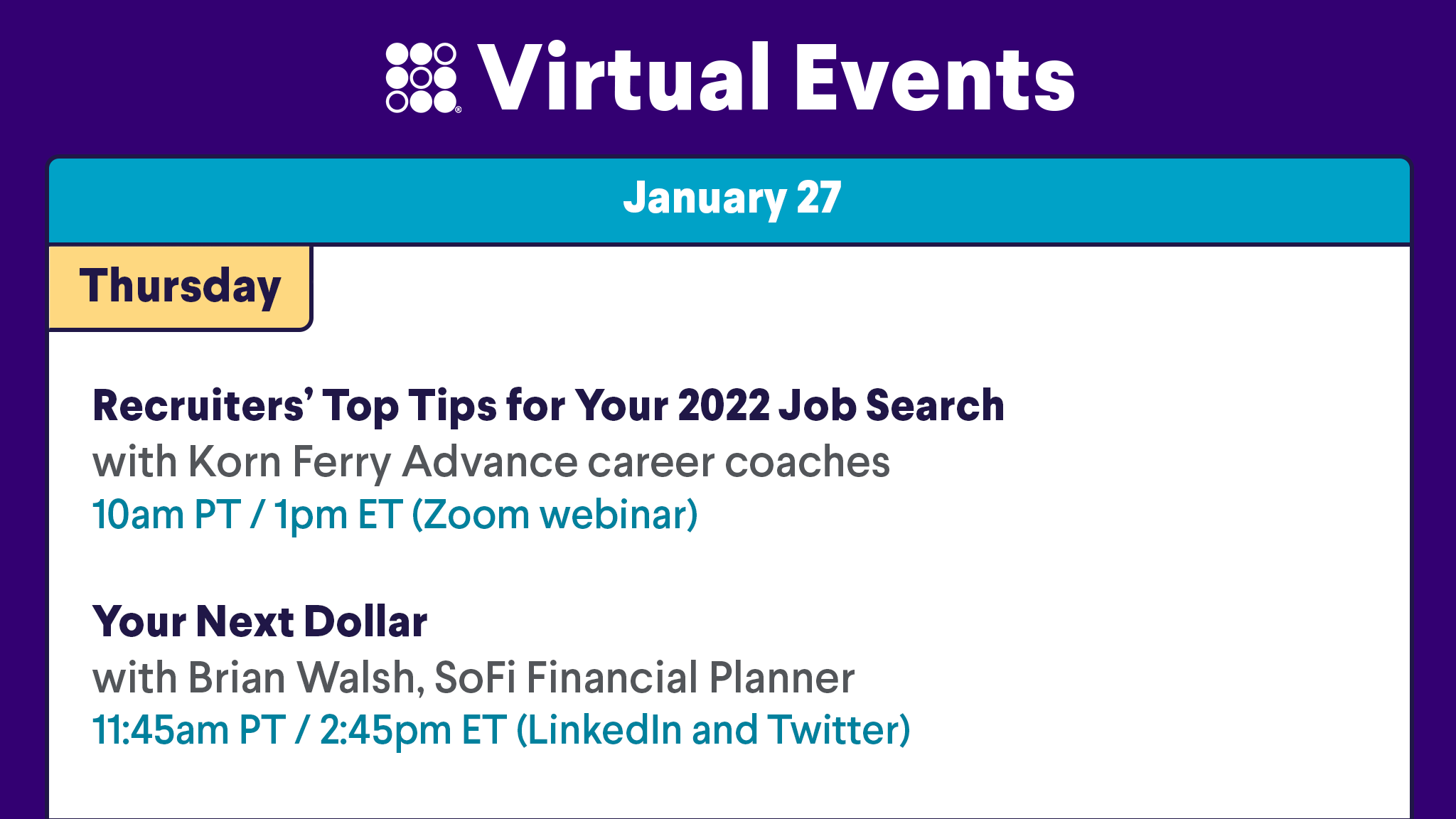

Join us for a panel discussion and get insights on what recruiters are looking for when conducting a job search. Plus, don’t miss out on this week’s Your Next Dollar. Sign up for these events and more in the SoFi app!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22012401