The Week Ahead on Wall Street

Economic Data

Today, the Federal Reserve reports December’s consumer credit figure, which totals all loans Americans took on including credit card debt. The November figure increased by $40 billion, more than double expectations. Analysts say this shows US households are using debt more freely now that COVID-19 stimulus funds are largely spent.

Tomorrow, be on the lookout for the January NFIB Small Business Optimism Index. This monthly assessment aims to determine the near-term outlook for small businesses in the US. In December, the small-business index rose to 98.9, up 0.5 points from November. Of those surveyed, 22% cited inflation as their business’s top concern, which is the highest number since Q4 1981. December’s international trade data tracking imports and exports is also set for release, along with real household debt for Q4 2021.

Wednesday, watch for the revised number concerning December’s wholesale inventories. The original figure showed a 2.1% increase from November to December. That’s a year-over-year increase of 18.3%. Market observers say this shows sellers loaded up on supplies during the holiday shopping season.

On Thursday, investors will be paying close attention to inflation indicators when the January CPI and January Core CPI are released. December’s Consumer Price Index, which is determined by tracking the costs of dozens of items, rose 7% from the previous year. That’s the fastest pace for inflation since June 1982. Core CPI excludes food and energy. This metric rose 5.5% in December when compared to the same point in 2020. Traders will also be following initial jobless claims, which came in lower than anticipated for the week ended January 29 at 238,000. The federal budget deficit is set for release on Thursday as well.

Rounding out the week on Friday, the University of Michigan’s preliminary Consumer Sentiment Index is due for February. This number estimates future spending and saving rates. January’s index fell 4.8% from December, marking its lowest level since 2011. The university’s five-year inflation expectations on a preliminary basis for February will also be published.

Earnings

Today, toymaker Hasbro (HAS) reports its quarterly results. Its most recent earnings beat analyst expectations, while company management said supply-chain issues held back sales. Late last month, news broke that rival Mattel (MAT) had won back the rights to Disney (DIS) princess toys from Hasbro.

Tomorrow, drugmaker Pfizer (PFE) hands in its report card, with analysts looking for guidance as to how quickly its COVID-19 pill can sell. Some analysts predict the pill will bring in as much annual revenue as the company’s vaccines. Dating back to the earliest days of the pandemic, Pfizer’s share price has risen by over 54%—outpacing the market as a whole.

Wednesday, the Walt Disney Company (DIS) will post quarterly earnings. Investors will listen closely to what company executives have to say as shares of the blue-chip stock have sold off recently. Analysts say the growth of its streaming platform, Disney+, and the recovery of company theme parks are especially important moving forward.

Fellow Dow component Coca-Cola (KO) reports its most recent earnings on Thursday. The iconic US brand has been unable to generate much growth over the last five years, and shares have increased by just 1.4% over that time. Investors note the company must confront the fact that consumers are increasingly moving away from sugary sodas, which remain Coca-Cola’s core product. Still, analysts praise the beverage giant for acquiring healthier drinks such as Smartwater and BODYARMOR SportWater.

Friday, Dominion Energy (D) will post quarterly earnings. The Richmond-based power and energy company last reported earnings in early November, beating analyst expectations for earnings but missing on revenue. Some market observers say Dominion is benefiting from consistent capital investment, customer growth, and acquisitions.

The Week Ahead at SoFi

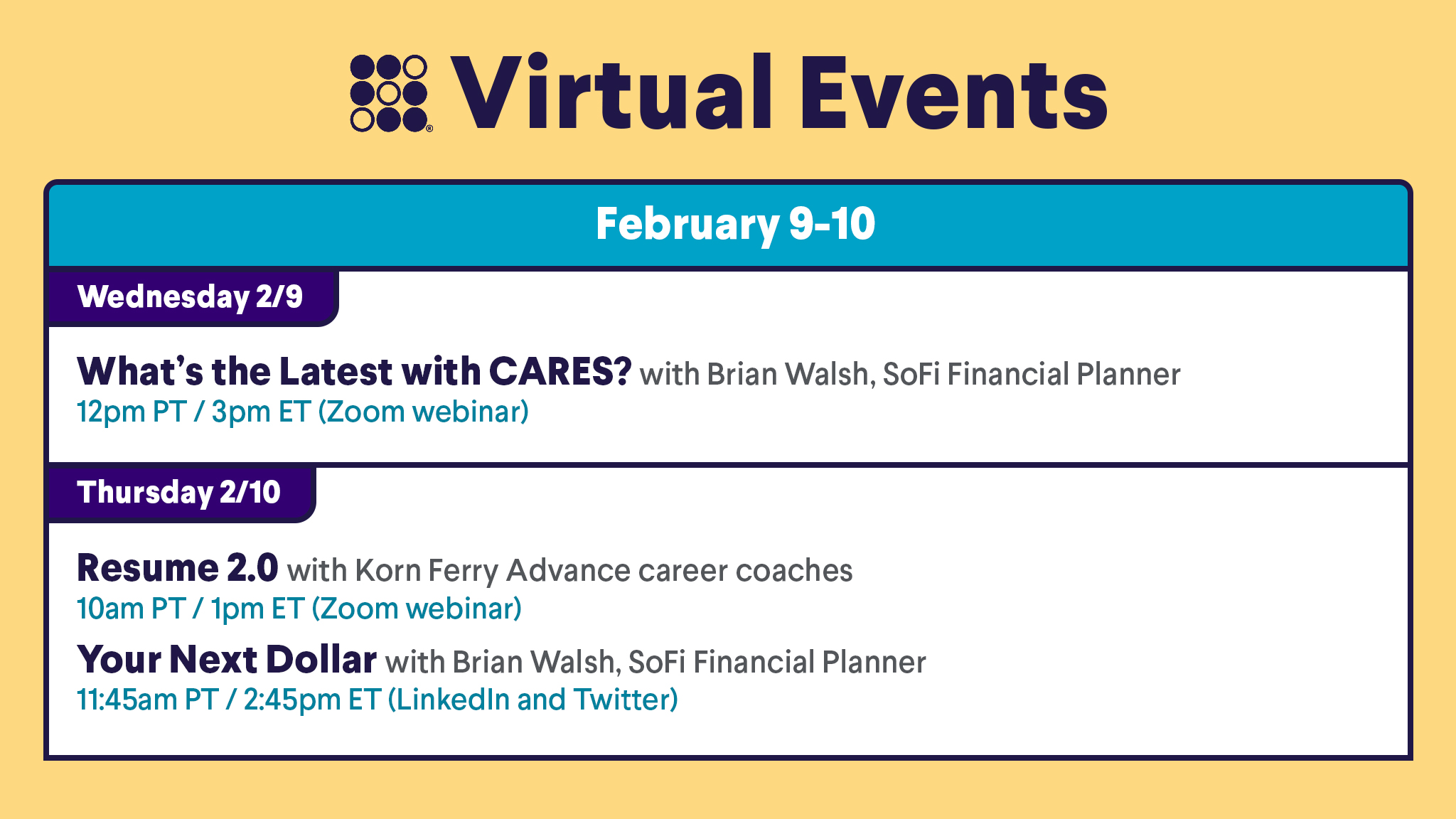

Join us this week for a discussion about the ever-changing CARES Act, plus get tips on how to craft a game-changing resume. Plus, join us for Your Next Dollar. Register for events in the SoFi app.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22020701