Week Ahead on Wall Street

Economic Data

Today the Chicago Fed will release last month’s National Activity Index, after the reading edged downward in February, indicating a slight decrease in economic growth. The Dallas Fed will also publish that region’s Manufacturing Index for April.

Tomorrow, several data points related to the housing market will be published, including March’s new home sales. The number came in 2% lower in February, falling short of earlier estimates. Analysts say elevated home values and rising mortgage rates have forced a significant number of would-be buyers to continue renting. March’s durable goods orders are also due, as well as this month’s consumer confidence index.

Wednesday, when MBA mortgage applications are released, the market will look to gain further insight on how increased mortgage rates have affected the housing market, as well as the average rate for a 30-year fixed loan. Also, watch for the first-quarter’s home ownership rate and last month’s pending home sales.

Thursday, jobless claims are due, after the most recent report indicated 184,000 Americans filed for unemployment benefits, which slightly exceeded estimates. Still, it marks the lowest such number in 52 years, as the tight labor market continues.

Friday, be on the lookout for March’s personal consumption expenditures index or PCE, which is the Fed’s preferred inflation gauge. In February it showed prices increasing by 6.4% on an annual basis. March’s personal income and spending are also set for release.

Earnings

Today, video game giant Activision Blizzard (ATVI) will hand in its latest report card. Reports indicate the company’s popular World of Warcraft, Hearthstone, and Call of Duty franchises have expanded their user bases, and helped boost in-game spending.

Tomorrow, JetBlue (JBLU) will publish earnings, during what’s been a busy earnings season for the airline industry as a whole. While the consensus is that this summer will be positive for the sector, Deutsche Bank (DB) recently downgraded JetBlue and said the stock could lag behind its competitors.

Wednesday, Ford (F) is set to share its latest quarterly data, providing the market with a look at how one of the nation’s largest automakers is navigating inflationary pressures and the ongoing chip shortage. Last week the company announced it was recalling 650,000 trucks and SUVs for faulty windshield-wiper arms.

Thursday, fast food industry leader McDonald’s (MCD) is scheduled to release earnings for its most recent quarter. The company recently rolled out some new menu items, including the return of spicy chicken nuggets to roughly half of its US locations, and the Samurai Big Mac in Japan.

Friday, Chevron (CVX) will share its first-quarter results after posting a mixed earnings report for Q4 2021 during which the oil giant missed on earnings but beat on revenue. Analysts are expecting Chevron to report earnings per share of $3.23.

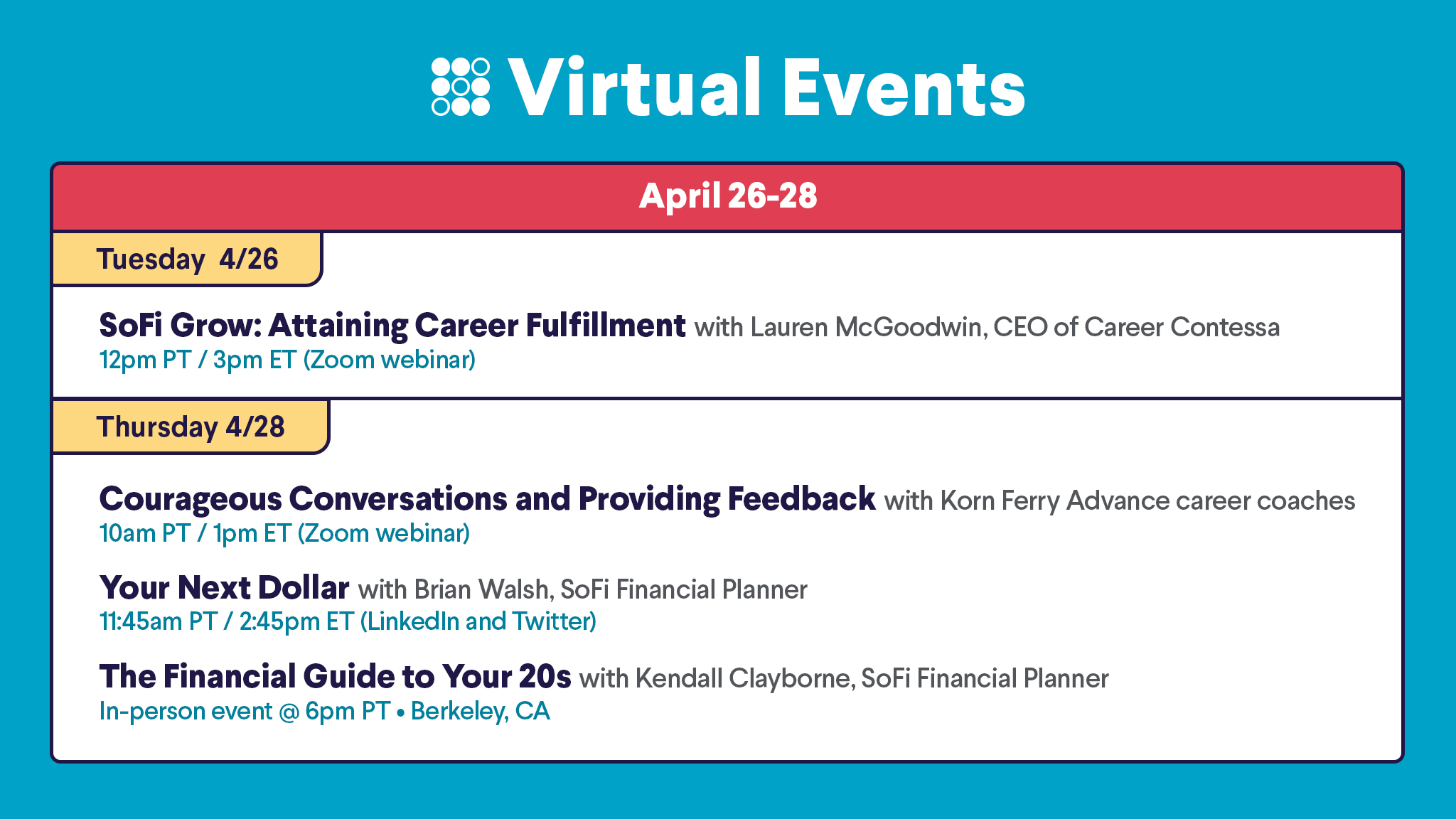

The Week Ahead at SoFi

This week’s events include talks on attaining career fulfillment and having courageous workplace conversations, plus an in-person event in Berkeley, CA. Also, check out our Your Next Dollar livestream.Save your seat!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22042501