The Week Ahead on Wall Street

Economic Data

Today no major economic data is scheduled for release.

Tomorrow, be on the lookout for April’s new home sales. The number fell 8.6% in March year-over-year. Meanwhile, the median price of a new home rose 21.4% from a year ago, which analysts attribute to extremely tight supply. S&P Global’s US manufacturing and services PMI is also due for May.

Wednesday, the Federal Open Market Committee will release the minutes from its most recent meeting, during which the central bank enacted its second rate hike in just months. It was also the sharpest rate increase since 2000 as the Fed is attempting to rein in record inflation. Durable goods and capital equipment orders are also set to be published for April as well.

Thursday, weekly jobless claims are due, which have been on an uptick recently. Last week the number of initial claims was at its highest level since January, while existing unemployment claims hit a 53-year low.

Friday, the Fed’s preferred method of measuring inflation will be released as the April PCE is set to be published. The Personal Consumption Expenditures index is a broad measure of changing prices and how consumer behavior is responding. In March the index rose by 5.2% year-over-year, further diminishing Americans’ spending power. It also represented a 40-year high.

Earnings

Today, Advance Auto Parts (AAP) reports its most recent quarterly results. With inflation soaring and new cars hard to come by due to supply-chain and chip-shortage problems, auto aftermarket companies are in a position to succeed. Broadly speaking, analysts say consumers are more willing to keep driving older cars for now.

Tomorrow, clothing retailer Nordstrom (JWN) hands in its report card. The broader retail sector was a major talking point on Wall Street last week, as some market observers worry inflation is starting to catch up to Americans’ spending habits. During its most recent earnings call Nordstrom beat expectations on the top and bottom lines.

Wednesday, chipmaker NVIDIA (NVDA) will publish its latest results, during a highly publicized period of difficulty for the industry as a whole. The worldwide chip shortage has put limits on production and made a significant impact on the bottom lines of companies like NVIDIA. One of the latest setbacks involves decreased semiconductors orders for smartphones in China, resulting from COVID-19 lockdowns.

Thursday, Costco (COST) is set to report earnings after rivals Walmart (WMT) and Target (TGT) shared that higher fuel and labor costs were eating into their bottom lines. A false rumor also circulated last week that Costco had raised the price of a hot dog and soda combo in its food court, as a result of inflation.

Friday, another retailer will be in focus as Big Lots (BIG) will publish its latest earnings data. It’s been a struggle for the stock over the last year, as its share price is down over 50%. Investors will be looking to gain further insight into the retail sector and US spending habits with this report.

The Week Ahead at SoFi

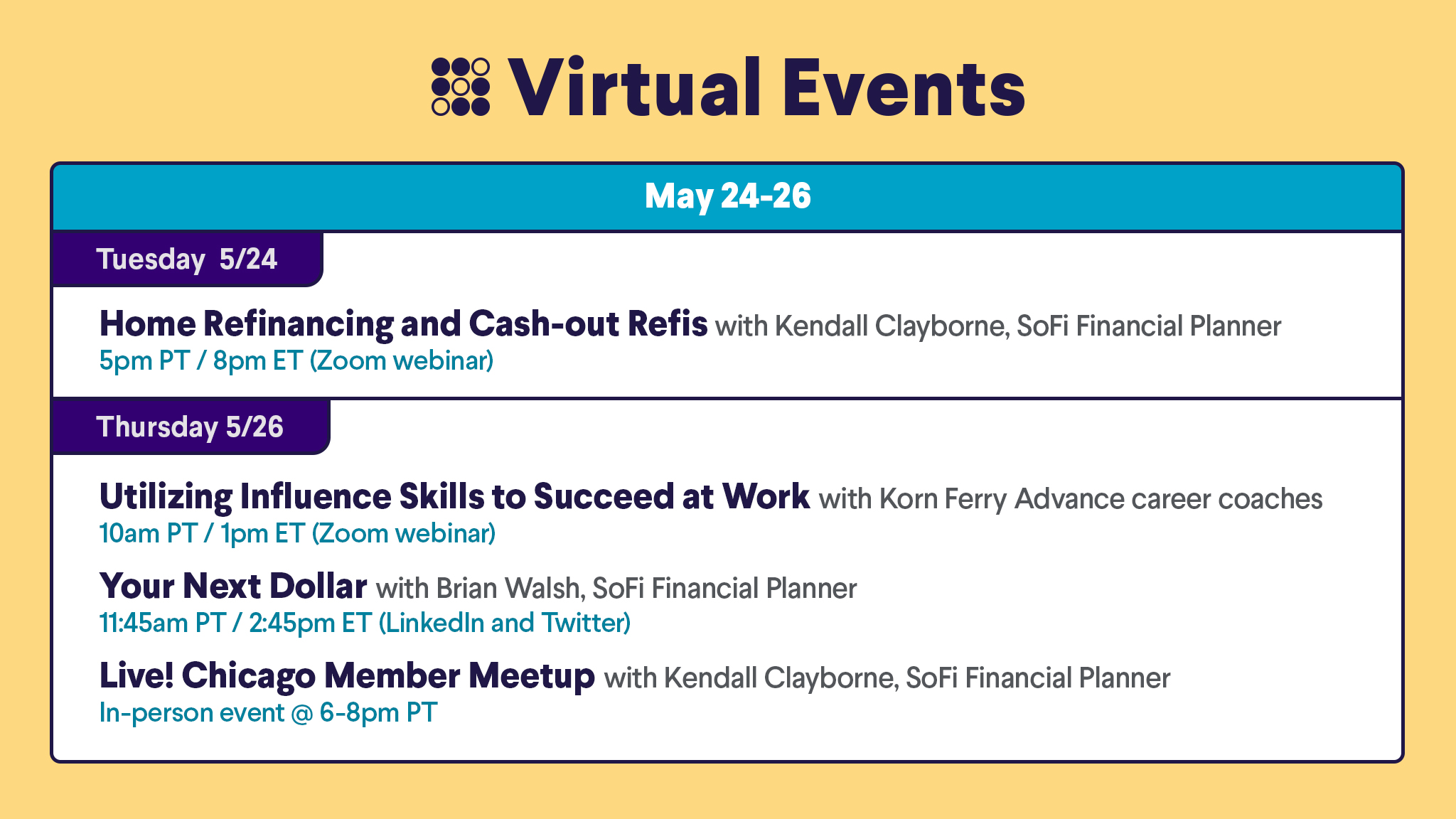

Lots happening this week, including talks on home mortgage options, how to use your mad influence skills at work, plus an in-person event in Chicago. Also, check out the Your Next Dollar livestream. Save your seat!

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS22052301