Millennials Find Apps More Helpful for Personal Finance Than Dating—But Still Aren’t Reaching Financial Goals.

Earlier this month, we shared results from our 2017 Millennials and Financial Resolutions survey. We discovered several trends and recent events that impact how millennials are thinking about forward-thinking financial topics. This week, we review the results of a second survey we conducted to learn why these young professionals aren’t reaching their financial goals, and how they compare to other generations.

Personal finance can be frustrating. And your financial future can suffer without the right strategy.

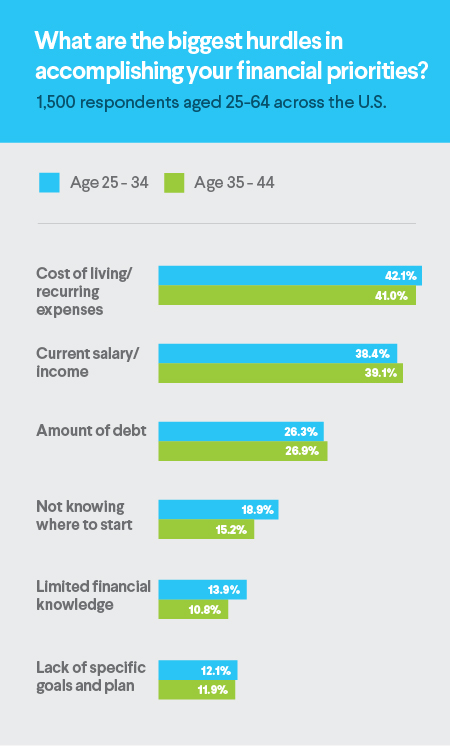

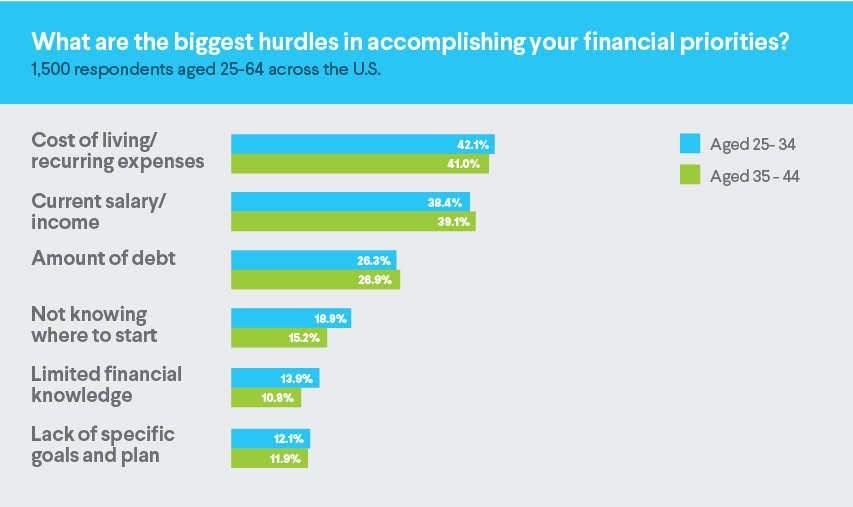

That’s true for everyone, but it’s especially for millennial professionals ages 25 to 34 and Gen Xers ages 35 to 44. On top of having student loan debt and dealing with an ever-increasing cost of living, both groups have a tough time figuring out who to trust and what advice to take. And that’s not just a guess; it’s what 1,500 Americans ages 25 to 64 told us in a recent survey we conducted near the end of 2016. From them, we learned a lot of other things, too. Here’s how our findings break down.

Millennials and Gen Xers struggle to break through the barriers to a solid financial future

Cost of living and recurring expenses prove to be big hurdles for all of our survey respondents—greater obstacles than even salary and debt. And a lack of financial knowledge and goal planning do not help. But those stumbling blocks are surmountable. By planning wisely, sticking to a budget, and making smart decisions about where to live and work, professionals of all ages can overcome these big challenges.

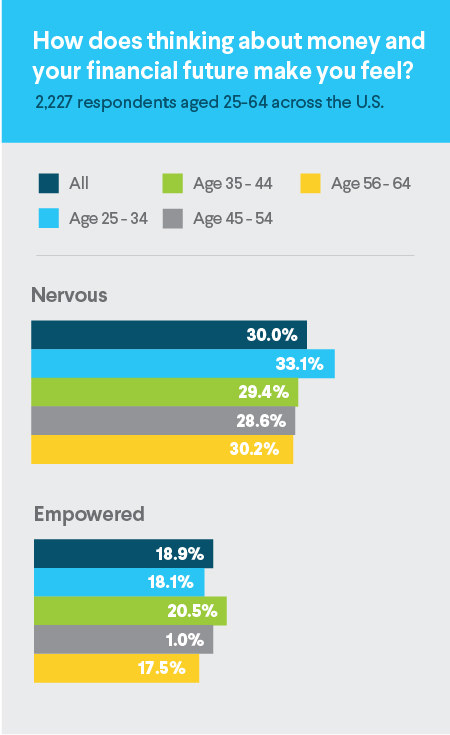

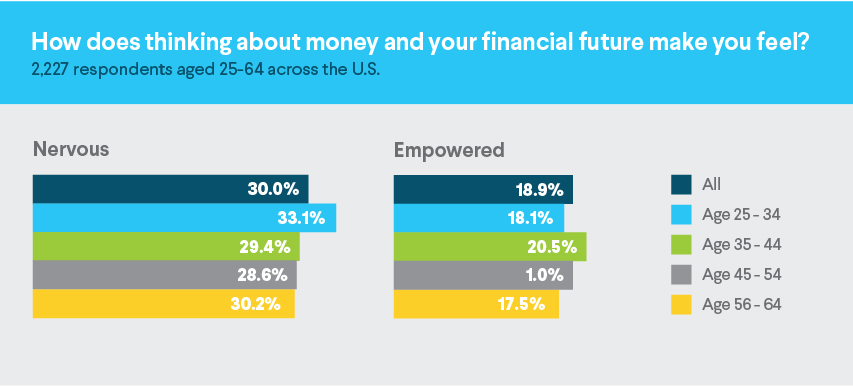

Gen Xers feel more empowered by money than other age groups

While only 18% of respondents say that thinking about their financial future makes them feel empowered, those ages 35 to 44 feel the most empowered. Perhaps that’s because as professionals rising in their careers, they’re thinking about what money will enable them to do.

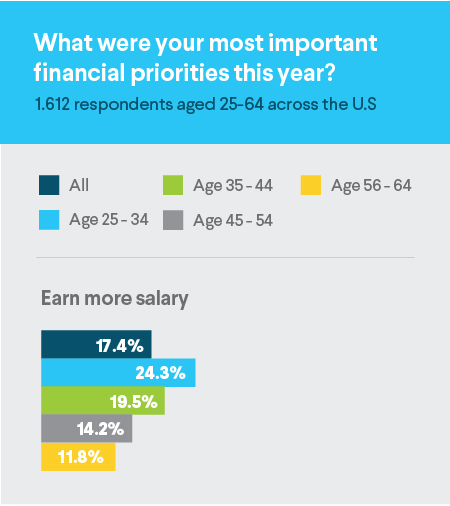

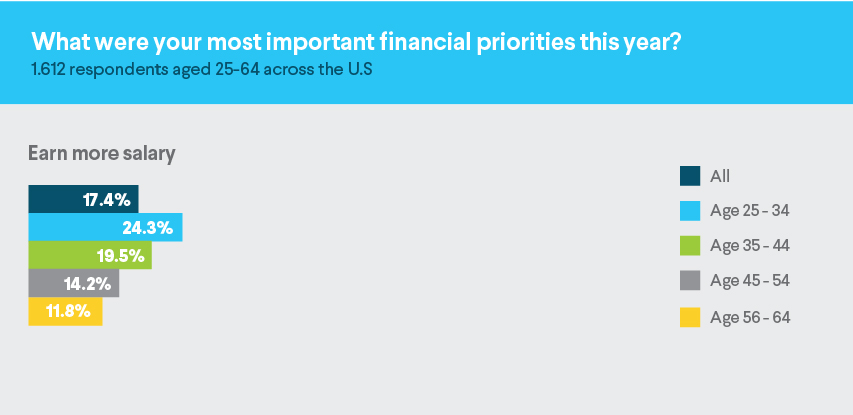

For millennials, earning a higher salary is a financial priority

It’s been reported that millennials, on average, are willing to take a $7,600 pay cut in exchange for an improved quality of life/work. But our findings show something different: For these ambitious professionals, earning a higher salary is, indeed, a financial priority. While it’s true that millennials experience wage stagnation, there are a number of ways to change that.

Millennials find it challenging to meet long-term goals

Young professionals admit they’re lost on how to meet long-term financial goals, perhaps in part because they’re focused on more immediate issues, such as paying monthly bills and loan payments. But savvy money management and setting serious financial goals is new to them, and they don’t yet know how to go about it. Learning how to invest can help.

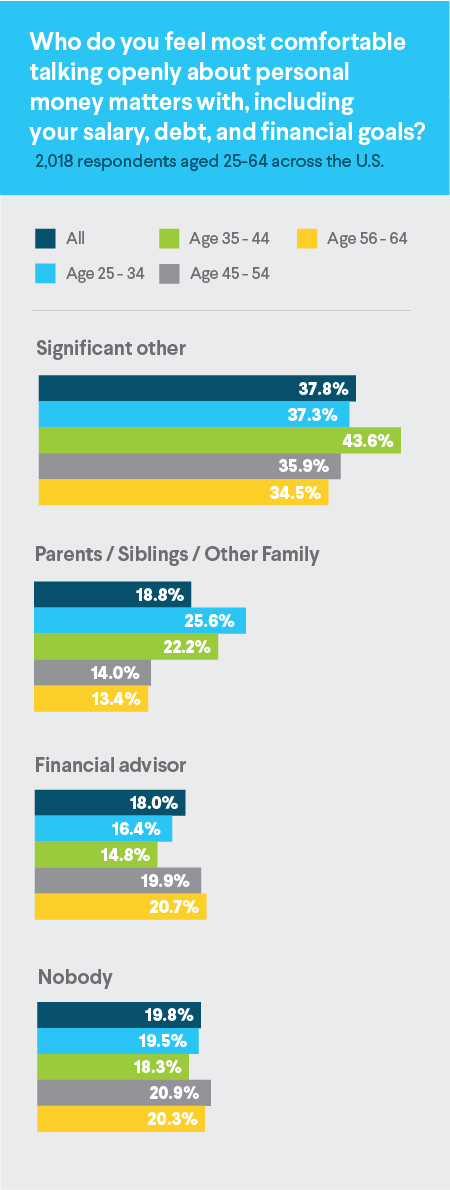

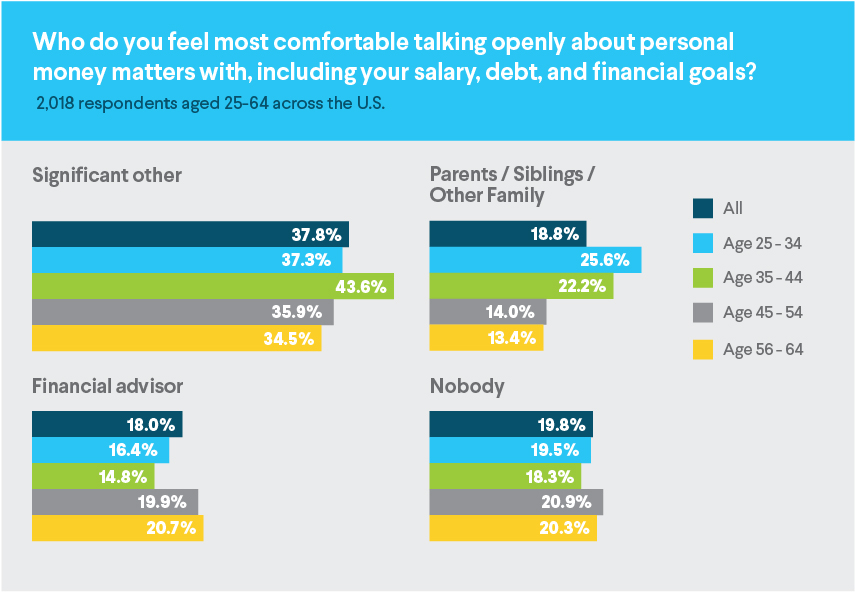

Young professionals are least likely to look to financial professionals for financial advice

Our survey respondents just don’t like talking about money. But when they do, they tend to talk to their life partners and family members rather than finance professionals. In fact, while “significant other” ranked highest among all groups for the people to talk to about money, the much less helpful “nobody” ranked second highest overall.

25-34 year olds talk to parents and/or siblings more than any other group, and reach out to financial advisors only slightly more than 35-44 year olds. But talking about finances with a professional advisor can actually be easier than talking to family members, because there’s less emotion involved. It’s not as hard as you might think to become financially fit.

We all need to get a little bit better at long-term planning

Overall, planning for the big picture (more than five years ahead) is something all respondents do to varying degrees. But in comparison to other groups, 35-44 year old professionals do the least when it comes to structuring their long-term goals. Among all groups, those making more than $100,000 were the most likely to look at the big picture. And that makes sense, because those earning less don’t yet feel they can afford the luxury of long-term planning.

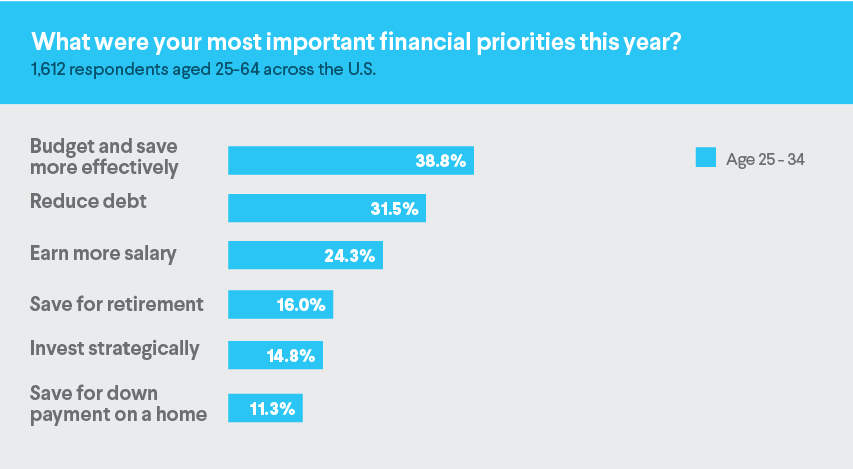

Millennials are more interested in saving than in paying off debt

Every age group ranked reducing debt as their top financial priority—except millennials. For them, budgeting and saving is of greater importance. On one hand, it’s admirable to stick to a budget and save for the future, but on the other, debt reduction, especially student loans, is key to achieving long-term financial goals. The good new is, with smart planning, saving for a first home while paying down student debt is also possible.

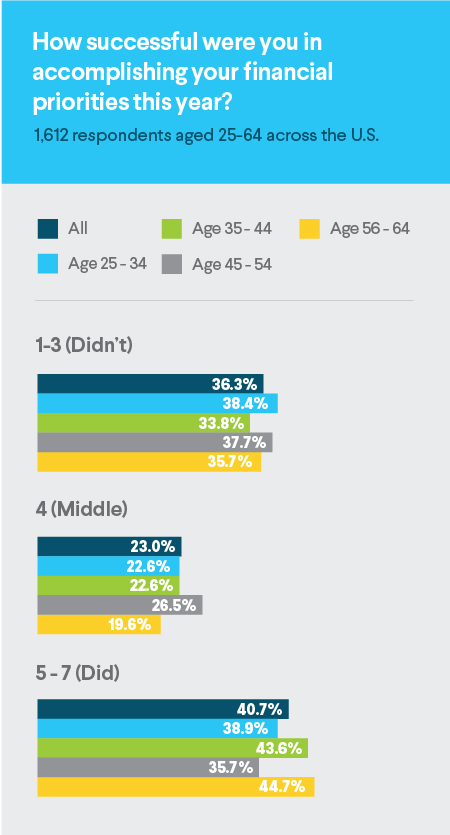

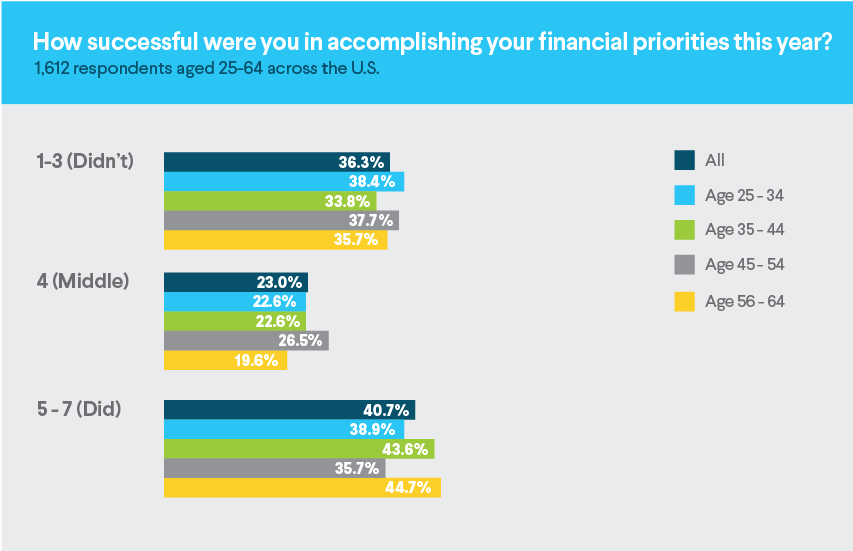

Millennials ages 25-34 reported the least success in achieving their financial goals

Experiencing difficulty in planning for the big picture, and spending less time focused on reducing debt, may explain why millennials didn’t have a lot of success in meeting their goals in 2016. But no group did great when it came to meeting objectives.

On a scale of 1 to 7, with 1 being “not close” to achieving financial goals and 7 being “achieved them,” the average response among all groups was a 4—smack in the middle. Overall, only 9.7% of respondents said they achieved their goals, while 14.2% said they didn’t come close. Once again, unsurprisingly, those with higher incomes indicated they came closer to reaching their goals than others.

But with 38.4% of 25-34-year-olds indicating they were less than successful in accomplishing their priorities, that’s sure sign they could use more help in setting investment goals and creating good financial habits for reaching them.

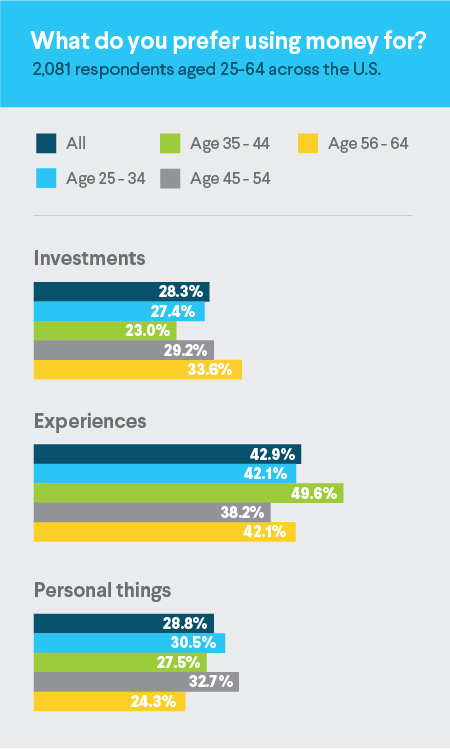

Millennials are investing their money

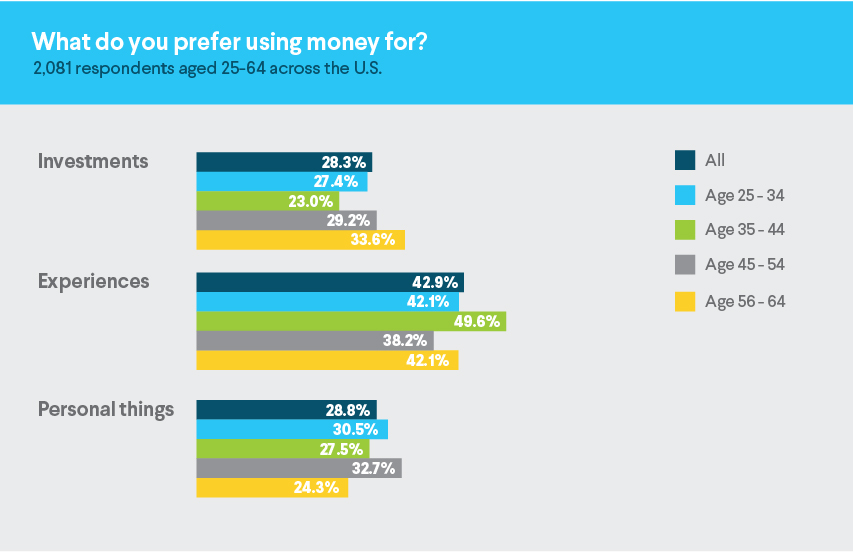

When asked what they prefer to use their money for, every respondent group ranked experiences, such as travel and entertainment, well above personal items, such as fashion or electronics. But millennials put more emphasis than 35-44-year-olds on using money for investments. That just might speak to an appetite for risk, which demands a savvy approach to building a diversified portfolio.

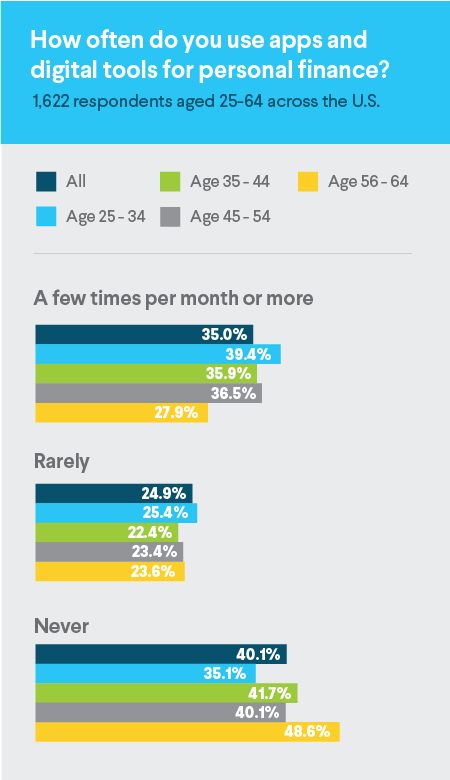

Millennials seek financial help through digital tools and mobile apps

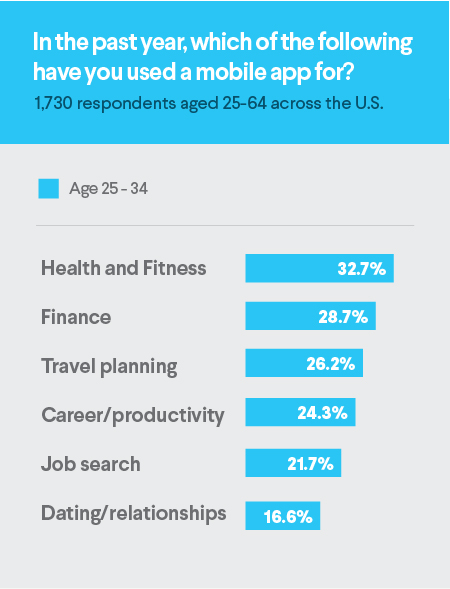

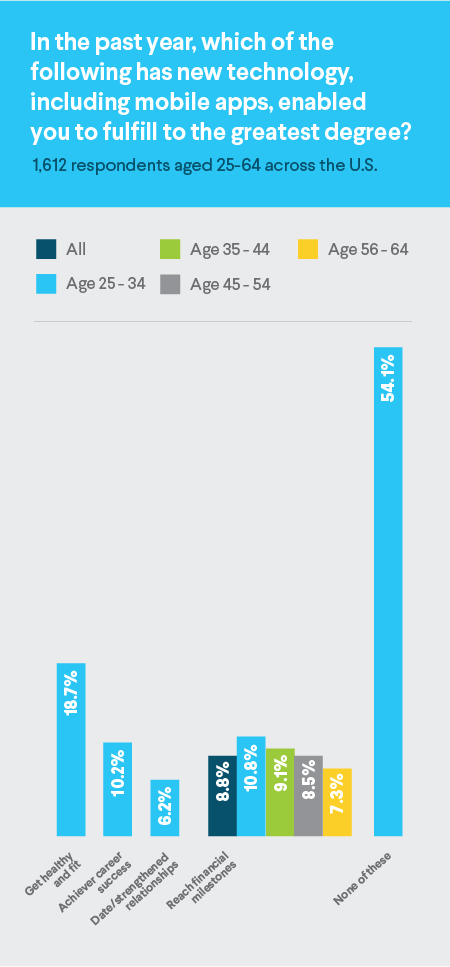

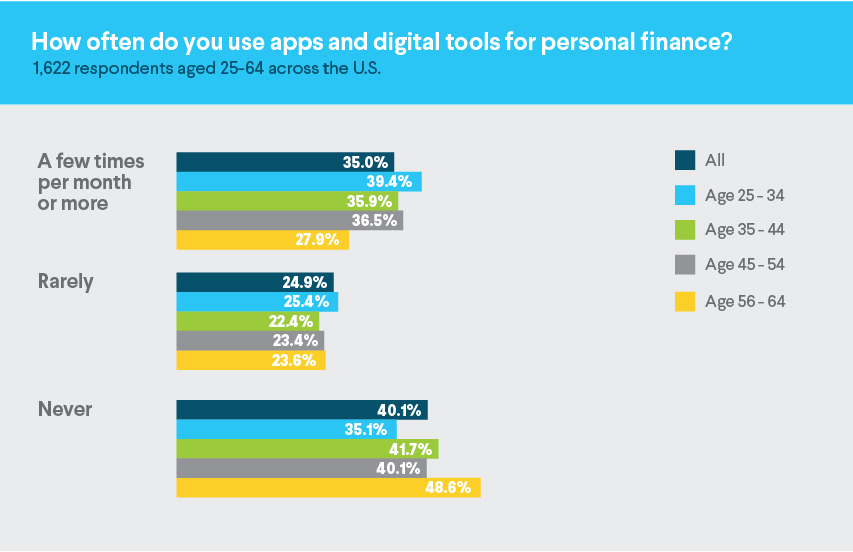

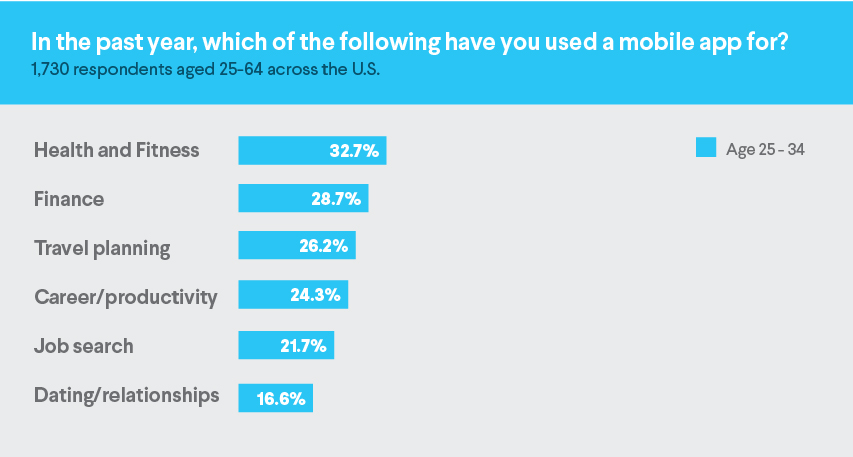

Compared to older generations, millennials—especially those with a higher income—report a greater use of mobile apps for finance. In fact, 39.4 percent of millennials said they use tools and apps a few times per month, or more. They use apps for finance less than they use apps for health and fitness, but more than they use apps for travel, career, job hunting, or even dating!

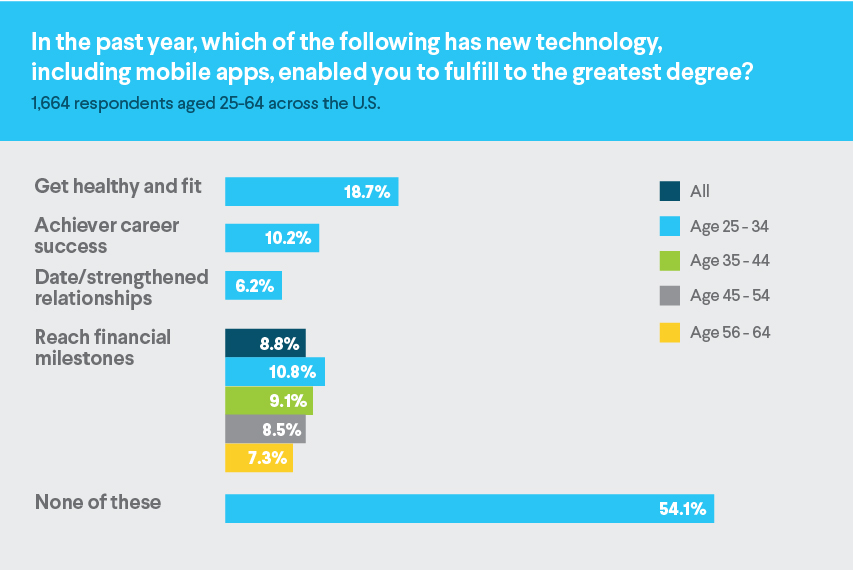

While only 10.8% of 25-34-year-olds have used digital tools to actually achieve financial milestones, that’s still more than any other group. But by and large, those apps aren’t doing much to help them lead more successful financial lives — or other areas of their personal or professional lives. When asked how new technologies have helped them to succeed in various areas, over half of respondents across all age groups said new tech hasn’t helped them succeed in any of the listed areas. Not working towards specific goals, forming habits to achieve those goals, and/or communicating with others about goals, could be a common factor for lack of success in each area.

What it all means

Young professionals are ready to take charge of their finances. They want to earn more, they’re using personal finance apps, and they’re investing. But they aren’t achieving their financial goals – yet – because they don’t know where to start and they’re not discussing money matters with experts who can help them and win their trust.

To get a better grip on a manageable cost of living, while chopping away at debt and saving for the future, think smarter about the big picture. Using the latest apps to help reach those goals are great tools in the process. But setting specific goals and timelines upfront, while partnering with a trusted expert, is often the best place to start.

Very informative study!