Why SoFi is Betting on a Bankless World

We recently hit the streets to ask people how they feel about their banks. The responses weren’t surprising:

“I don’t think my bank cares much about me.”

“I’ve never recommended my bank to anyone.”

“I don’t really trust banking institutions in general.”

Beating up on banks has become a national pastime. Yet what’s crazy is how long we’ve put up with it – the nickel-and-dime fees, the bad customer service, the being treated like a number. Most of us don’t even switch banks when we get fed up —it’s too much hassle, and aren’t they all the same anyway?

In pretty much every other industry, competition drives innovation to the benefit of the customer. Banks, on the other hand, have remained smug in their “too big to be challenged” attitude. But consider this: Blockbuster probably never saw Netflix coming, and look where that got them.

Clearly, banking is ripe for disruption. Fortunately, judging by the spate of fintech challengers that have recently launched, the revolution has already begun.

“I think it’s time for an alternative to banks, that’s for sure.”

When we launched SoFi in 2011, we set out to prove that consumers wanted much more than what traditional banks can provide.

We first tackled student loan debt. In the student loan world, borrowers are often given a one-size-fits-all loan from the federal government or a private lender. As grad students ourselves, my co-founders and I saw a disconnect between our ambitious peers and their high interest rate loans. These were hard workers who were responsible with their finances – and yet the system told them they didn’t deserve a better deal than anyone else.

Soon after, we found the same disconnect between product fit and financially responsible people who wanted to buy their first home or pay down high interest credit card debt.

Why? Traditional lenders use antiquated, backward-focused methods of evaluating a person’s financial wherewithal, but we look at factors that speak to a borrower’s future potential. A perfect example: SoFi doesn’t use FICO credit scores to assess our loan applicants. We firmly believe that a FICO score doesn’t tell an applicant’s whole story.

For us, it’s simple. If you make more money than you spend, have a promising career and a track record of paying your bills on time, chances are we want to invest in you. And our customers – whom we call members – love our approach. They ask us for “Future SoFi Member” onesies for their newborns and send us unsolicited poems. As SoFi advisor and former SEC chairman Arthur Levitt puts it, “I think what makes (SoFi) different is the establishment of a relationship between lender and borrower. The notion of trying to make that connection between a lender and borrower more personal is unheard of. It’s unthinkable.”

As we’ve grown, identifying the ‘greatness’ in people has remained a core SoFit tenet. In our new ad campaign, including our Super Bowl 50 ad, we cleverly point out ‘great’ vs. ‘not great’ people. Each ad includes a ‘great’ person who’s a real SoFi member. The fact is, it’s likely that many of our members would be considered ‘not great’ by traditional banks. Banks just use a different method — high interest rates, bad products and loan rejections — to tell them so.

We know there are millions out there just like our existing members – ambitious, responsible people who don’t want to bank, but would love to SoFi instead.

“I can’t remember the last time my bank made me smile.”

Investing in our members’ potential has allowed us to expand in ways that further benefit our members. We’re particularly excited about our upcoming wealth management services and a significant expansion of our career strategy and entrepreneurship programs. We want to help more people create great businesses and get great jobs.

The biggest measure of success – our members’ happiness – continues to tell us we’re onto something good.

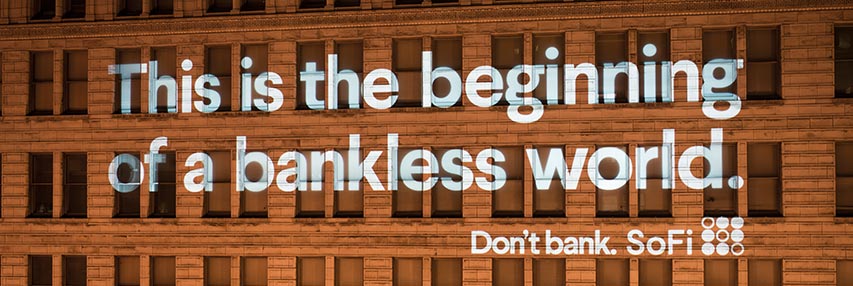

When people envision the coming exodus from traditional financial institutions — the beginning of a “bankless world” — they tend to focus on small things like lower costs and more online tools. Increased competition will certainly drive product innovation, bring down those annoying fees (SoFi, for example, charges no lender fees on most products), and make life easier.

But from our perspective, that’s simply table stakes. To truly win the hearts and minds of modern consumers, we must set the bar much higher. We must turn banking on its head. We must anticipate consumers’ needs today and recognize how they vastly differ from previous generations. We must be on their side.

I think that’s what our 120,000 members would say we do – we not only anticipate their needs, but we actually want them to succeed.

“I think (banks) are set up for the banks, not for the consumer.”

A bankless world is provocative for some and a foregone conclusion for others. But no matter where you fall on the spectrum, you probably agree that there has to be a better way. Progress is surely being made, and the consumer will reap the benefits. But in the end, some of us will not rest until more Americans feel they’ve truly been propelled to financial greatness…on their terms.