World’s Largest Semiconductor Maker Plans Price Increases

Taiwan Semiconductor Manufacturing Co.’s Pricing Power

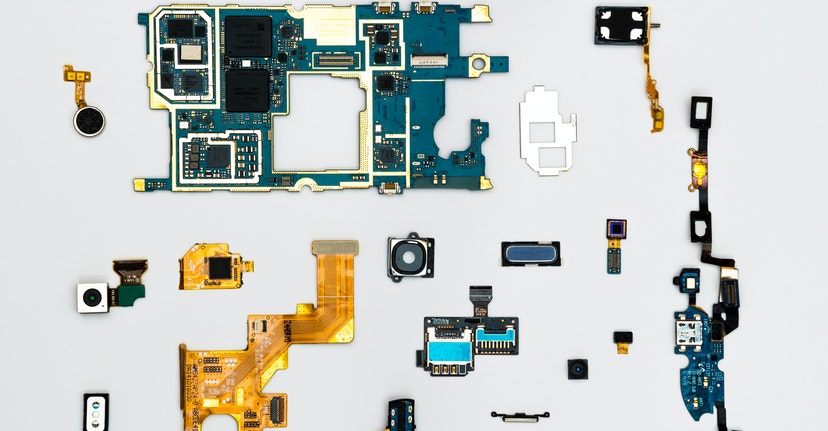

Taiwan Semiconductor Manufacturing Co. (TSM), the world’s largest contract chip maker, is increasing its prices by as much as 20%. This could result in higher price tags for consumers buying electronics.

The company is known for supplying chips to Apple (AAPL) and other tech giants. TSMC supplies over 90% of the world’s most advanced chips, so it has significant pricing power. The company will bump the prices of its most advanced chips by about 10% while the cost of its less advanced chips will be 20% higher. The change in prices is expected to take place late this year or early next year.

The Chip Shortage’s Impact Across Industries

TSMC’s announcement comes as a variety of industries continue to deal with a global semiconductor shortage. The shortage has impacted electronics companies as well as carmakers.

This month, General Motors (GM) idled three of its North American factories specializing in pickup trucks, its most profitable vehicle. Last week, Toyota (TM) also announced plans to scale back production by 40% in September.

Looking Ahead

TSMC’s motivations for the price increase are twofold. The company hopes that higher prices will drive down demand and alleviate the shortage. The company also plans to invest revenue from the increased prices into expanding manufacturing capacity.

Over the next three years, TSMC plans to invest $100 billion in new factories and equipment. It is increasing production capacity in Nanjing, China, and has started building a $12 billion production facility in Arizona. These moves will likely help alleviate the chip shortage in the long term. But in the short term, TSMC’s higher prices may trickle down to consumers.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

SOSS21082701