Cost of Living in South Dakota

(Last Updated – November 4, 2024)

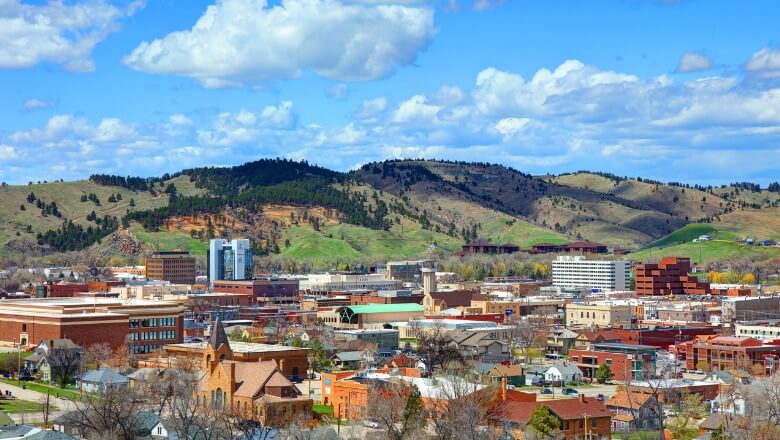

South Dakota is known for expansive landscapes, iconic Mount Rushmore, and small towns with a strong sense of community. Before relocating to the Great Plains, it’s worth asking “what’s the cost of living in South Dakota?” Read on for an in-depth look at the average cost of living in South Dakota to help determine if it’s the right move for you.

What’s the Average Cost of Living in South Dakota?

Average Cost of Living in South Dakota: $48,997 per year

Before you move to the Mount Rushmore State, consider how the cost of living will impact your monthly budget and personal finances.

According to MERIC’s 2024 Cost of Living Index , South Dakota has the 13th lowest cost of living in the country, with a cost of living index of 91.2 (on this scale 100 is the average U.S. cost of living). The cost of living in South Dakota is lower than that of five out of six of its neighboring states. If you need your budget to stretch a bit further, you can consider a move to Iowa, which borders South Dakota and is the 8th most affordable state in the U.S. But don’t be surprised to see South Dakota on any list of the best affordable places to live in the U.S.

So, what is the cost of living in South Dakota on average? According to 2022 data from the Bureau of Economic Analysis (BEA), the average total personal consumption cost in South Dakota is $48,997 annually. Put another way, the average monthly expense for one person is $4,083 in South Dakota. Here’s a closer look at how that spending breaks down by category:

|

Category |

Average Annual Per-Capita Cost in South Dakota |

|

Housing and Utilities |

$7,095 |

|

Health Care |

$10,881 |

|

Food and Beverages (non-restaurant) |

$3,592 |

|

Gas and Energy Goods |

$1,340 |

|

All Other Personal Expenditures |

$26,090 |

Housing Costs in South Dakota

Average Housing Costs in South Dakota: $507 to $1,557 per month

Housing costs in South Dakota are more affordable than the national average — good news if getting a home loan is on the horizon. South Dakota has just 417,220 housing units, according to the latest Census data, so the housing inventory isn’t the most extensive.

Buying your first home in South Dakota? Keep in mind that the typical home value in South Dakota is about $307,799, according to Zillow, so there are many properties you could choose that won’t require a jumbo loan. This is what you can expect to spend monthly if owning or renting:

• Median monthly mortgage cost: $1,557

• Median studio rent: $507

• Median one-bedroom rent: $716

• Median two-bedroom rent: $899

• Median three-bedroom rent: $1,063

• Median four-bedroom rent: $1,317

• Median five-bedroom (or more) rent: $1,110

• Median gross rent: $866

Where you live in South Dakota can impact how much you’ll pay for housing costs and the type of mortgage loan that will best suit your needs. Let’s take a look at the average home values for some of South Dakota’s largest cities, according to Zillow data from June 2024. (Remember there are down payment assistance programs to help homebuyers who have difficulty coming up with funds to put money down on a property.)

|

South Dakota City |

Typical Home Price |

|

Sioux Falls |

$332,970 |

|

Rapid City |

$356,994 |

|

Aberdeen |

$223,262 |

|

Watertown |

$332,672 |

|

Brookings |

$288,908 |

Utility Costs in South Dakota

Average Utility Costs in South Dakota: $300 per month

What do you need to budget for utilities each month if you plan to live in South Dakota? Here’s a breakdown of the average monthly utility costs for South Dakotans.

|

Utility |

Average South Dakota Bill |

|

Electricity |

$128 |

|

Gas |

$50 |

|

Cable & Internet |

$95 |

|

Water |

$27 |

Sources: U.S. Energy Information Administration, Electric Sales, Revenue, and Average Price, 2021; Inspirecleanenergy.com; DoxoInsights, U.S. Cable & Internet Market Size and Household Spending Report 2022; and Rentcafe.com, What Is the Average Water Bill?

Groceries & Food

Average Grocery & Food Costs in South Dakota: $299 per month

How much you spend on food each month can depend on your dietary preferences, as well as where you live. According to data from the Bureau of Economic Analysis, the average cost of food per person is $3,592 per year. This comes out to about $299 per person, per month.

The Council for Community and Economic Research ranked the grocery costs in South Dakota’s main population centers from the first quarter of 2023 through the first quarter of 2024. Below are the grocery costs per location, ranked from lowest to highest.

|

South Dakota City |

Grocery Items Index |

|

Pierre |

94.7 |

|

Sioux Falls |

96.8 |

|

Rapid City |

100.0 |

Transportation

Average Transportation Costs in South Dakota: $10,920 for one adult

Between commuting to work, running errands, and trips to South Dakota’s beautiful national parks, transportation costs are something you’ll need to budget for.

How much you’ll spend on transportation will depend on where you live, your habits, and what your household looks like. To get a clearer picture of what you might spend on transportation costs in South Dakota, here are some estimates from MIT’s Living Wage Calculator , which uses data from the first quarter of 2024.

|

Family Makeup |

Average Annual Transportation Cost |

|

One adult, no children |

$10,920 |

|

Two working adults, no children |

$12,638 |

|

Two working adults, three children |

$18,296 |

Recommended: 7 Ways to Save Money on Commuting to Work

Health Care

Average Health Care Costs in South Dakota: $10,881 per person, per year

According to the BEA, South Dakotans spend an average of $10,881 per year on health care. What you actually spend will depend on your personal care needs and health coverage.

Average health care costs in South Dakota are on par with North Dakota, but higher than other neighboring states, including Iowa, Minnesota, Montana, Nebraska, and Wyoming.

Child Care

Average Child Care Costs in South Dakota: $810to $1,042 or more per child, per month

For families with kids, child care can be a significant expense. South Dakota residents who need support with child care costs can apply for state child care assistance programs .

For a better idea of how much you’ll pay for child care costs, use these average costs from CostofChildCare.org .

|

Type of Child Care |

Average Cost Per Month, Per Child |

|

Infant Classroom |

$810 |

|

Toddler Classroom |

$810 |

|

Preschooler Classroom |

$810 |

|

Home-based Family Child Care |

$1,042 |

Taxes

Highest Marginal Tax Rate in South Dakota: None

South Dakota residents do not pay any state income taxes, reports the Tax Foundation .

Miscellaneous Costs

Now that your essential expenses are covered, let’s have a look at what you can expect to budget for discretionary spending. According to the BEA, average personal expenditures amount to $26,090 per person, per year.

Here are some examples of what you might spend money on in South Dakota for fun and leisure.

• Visit Mount Rushmore: $0-10 per vehicle, depending on age and military service

• Enjoy family-friendly fun at the Reptile Gardens in Rapid City: $14-25 per person, depending on age and seasonality

• Marvel at the unique works at Porter Sculpture Park: $0-10 per person, depending on age

How Much Money Do You Need to Live Comfortably in South Dakota?

Whether you can enjoy a comfortable style of living in South Dakota will vary depending on your family’s needs and your chosen lifestyle, as well as where you live.

If you plan on living in South Dakota, you might be relieved to know it is more affordable than the average cost of livig in the U.S. In fact, South Dakota ranks 5th in the U.S. News & World Reports Affordability Rankings, which assesses the average cost of living against the average household wealth in each state.

As a reminder, MERIC ranked South Dakota 13th on its list of state’s average cost of living. Between both lists, South Dakota emerges as one of the more affordable places to live in the country.

What Major City Has the Lowest Cost of Living in South Dakota?

Although South Dakota is one of the most affordable states to live in, some cities offer a lower cost of living than others.

These are three of the least expensive cities in South Dakota according to the Council for Community and Economic Research’s Cost of Living Index for quarter 1 of 2023 through quarter 1 of 2024.

Sioux Falls

Among the most affordable cities in South Dakota is Sioux Falls, which has a cost-of-living index score of 90.6. Sioux Falls has a population of 202,078, making it the most populous city in South Dakota. Situated on the Big Sioux River, the city has plenty of dining, shopping, and entertainment options. In terms of housing costs, Sioux Falls scored 86.9 on the housing cost index, so it’s a more competitive market for first-time home buyers. (Going through the mortgage preapproval process will help you figure out what your home buying budget should be.)

Pierre

With a cost-of-living index of 93.7, Pierre is another of South Dakota’s most affordable cities. Though it’s South Dakota’s capital city, Pierre has a population of just 14,091, making it the second-least populous capital in the U.S. Nestled on the Missouri River, Pierre offers a small town atmosphere and access to outdoor activities like fishing, camping, and boating.

Rapid City

Rapid City tied Pierre for second place with a matching cost-of-living index of 93.7. According to council data, housing costs measured out to 82.5 on the cost-of-living index, meaning that homeownership and renting here is more budget-friendly. Rapid City is home to a population of 79,404, making it South Dakota’s second largest city.

Recommended: Best Afforable Places to Live in South Dakota

Helpful Resources for Future South Dakota Residents

SoFi Home Loans

Perhaps better known for famous tourist attractions like Badlands National Park, South Dakota also offers one of the lowest costs of living in the country. If proximity to natural beauty and the relaxed pace of the Mount Rushmore State sound like a good fit, you may need to secure a mortgage to relocate and put down roots.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

Is South Dakota expensive to live in?

The cost of living in South Dakota is less than the national average. Residents of South Dakota can expect to pay less for housing, plus there’s no state income tax.

What are the pros and cons of living in South Dakota?

Affordability is a major pro of living in South Dakota, alongside access to outdoor recreation, less congestion, and charming small towns. On the flip side, parts of the state get very cold in winter. It also lacks public transportation, and its rural setting could be a drawback for some.

How much does a house cost in South Dakota?

Housing prices vary by location, but the average statewide home value is $307,799 based on June 2024 data from Zillow.

Photo credit: iStock/RiverNorthPhotography

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q324-112