Monday,

September 28, 2020

Market recap

Dow Jones

27173.96

358.52 (1.34%)

S&P 500

3298.46

51.87 (1.60%)

Nasdaq

10913.56

241.30 (2.26%)

Amid evolving news + uncertainty surrounding COVID-19, your financial needs are our top priority. For more information on COVID-19 and your finances click here.

Top Story

The Week Ahead on Wall Street

Economic Data

There are no economic data reports scheduled today.

Tomorrow, look out for the advance trade in goods report for August, the Case-Shiller National Home Price Index for July, and the September Consumer Confidence Index. Last month, consumer confidence, which measures how Americans feel about economic and business conditions, fell to its lowest level in six years. Analysts will be eager to see if September consumer confidence shows improvement.

On Wednesday, look out for Chicago PMI, the August Pending Home Sales Index, a Q2 GDP revision, and the September ADP employment report. This monthly economic data release shows private employment levels in the US. Last month, private payrolls rose by 428,000 with leisure and hospitality and then education and health care leading the way. Though this was an improvement, it was still below estimates of 1.17 million from economists surveyed by Dow Jones.

On Thursday, August reports for personal income, core inflation, construction spending, and consumer spending are due. Consumer spending ticked up by 1.9% in July and analysts will be eager to see if this upward trend continues. Also look for September motor vehicle sales, the September IMS Manufacturing Index, and initial jobless claims. So far in September, weekly jobless claims have hovered just below 900,000 per week, increasing slightly last week from 866,000 to 870,000.

To round out the week on Friday, look for August factory orders and the September Consumer Sentiment Index. September Nonfarm payrolls, September average hourly earnings, and the September unemployment rate are all released. These three data points are linked, and together give an important picture of the country’s labor market. In August, the unemployment rate dropped by 1.8 percentage points to hit 8.4%, showing a small degree of recovery.

Earnings Reports

This week, a number of important companies in the food and beverage industry and the technology industry will report earnings. Analysts will be watching to see how these companies have been responding to unique consumer needs as the pandemic continues.

Cal-Maine Foods (CALM), the nation’s largest egg producer, will report its earnings today. Cal-Maine Foods specializes in the production, grading, and packaging of fresh shell eggs. During the company's earnings call in July, it said sales jumped over 60% in the prior quarter as people stocked up on eggs while they were cooking at home. Investors will be curious to see if this increase continued into the summer months.

Tomorrow, Micron Technology (MU), a computer memory and computer data storage company based in Boise, Idaho, reports its earnings. Micron depends heavily on trade with China, and as tensions rise between Beijing and Washington, trade restrictions have caused challenges for the company. However, the work-from-home boom has led to an increase in demand for cloud storage and PCs, which has given Micron a boost.

On Thursday, look for a report from Conagra Brands (CAG). The Chicago-based packaged food company owns brands like Duncan Hines, Reddi-wip, and others. It’s likely that the company has gotten a sales boost from more people eating food from grocery stores instead of going to restaurants. Additionally, Conagra Brands is responding to changing consumer demands by offering healthier snack options and more environmentally friendly packaging.

Bed, Bath, & Beyond (BBBY) will also report on Thursday. The home goods retailer is working on a restructuring plan and announced that it will close about 200 of its locations over the next two years. The store is often a popular destination for college students outfitting their dorm rooms, so this arm of the company’s business is suffering this fall as many students study remotely. However, the company may have gotten a boost from students and workers buying materials for home offices.

Constellation Brands (STZ) will also hand in its report card on Thursday. The company’s portfolio includes Corona Extra beer, SVEDKA Vodka, Casa Noble Tequila, and other alcohol brands. Though bars and restaurants have been buying far less alcohol, consumers have been flocking to purchase alcohol at grocery stores and online during the pandemic. Analysts will be curious to see how Constellation Brands has adapted its supply chain to cater to customers under different circumstances.

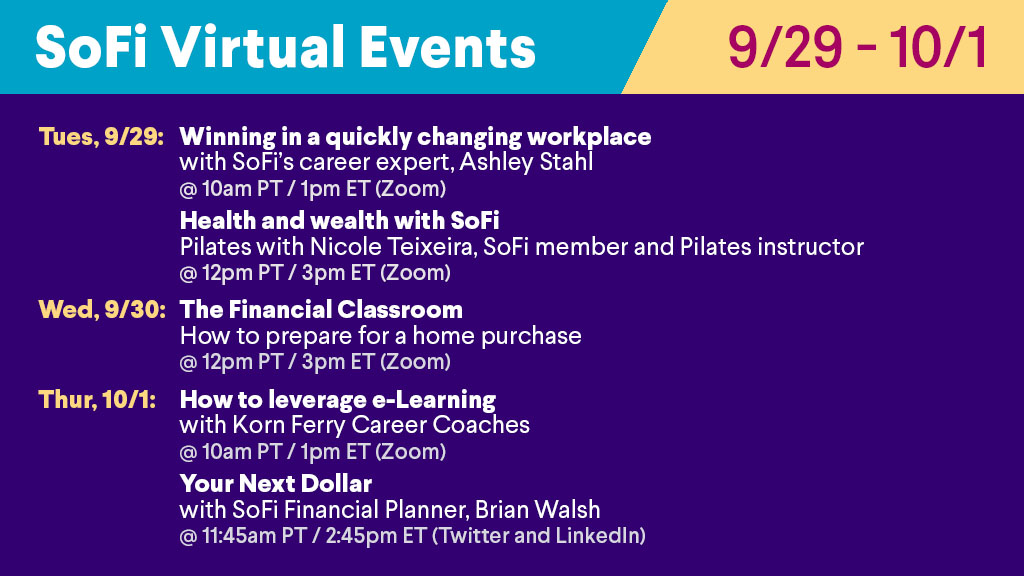

The Week Ahead at SoFi

This week’s lineup of virtual events will help you get centered while you continue to make progress on your career and your financial independence. Reserve your spot today in the SoFi app!

Big Tech in Hot Water Both At Home and Abroad

Apple’s EU Tax Battle Continues

In both Europe and the US, large tech companies are butting heads with lawmakers. Apple’s (AAPL) legal disputes with the EU over a $15.2 billion tax bill may continue for months or even years. On Friday, EU lawmakers ruled to stand by a decision from 2016 saying that Ireland had given Apple illegal tax breaks between 2003 and 2014.

This appeal followed an unexpected ruling in July when EU judges sided with Apple saying there was not enough evidence that tax laws had been broken. Apple is now reviewing the court’s latest decision and emphasized that “facts have not changed” since the ruling in July.

The Threat of an EU Digital Tax

The decision from the appeal comes at an important time for global discussions about digital taxation. A number of European countries, including France, introduced national taxes on tech companies.

The European Union said it may impose a bloc-wide digital tax on companies like Google (GOOGL) and Facebook (FB). The US threatened tariffs on European goods if the bloc implements this type of tax.

US Lawmakers Vote on Subpoena

Stateside, tech companies are also facing scrutiny from lawmakers. Republicans on the Senate Commerce Committee scheduled a vote to subpoena testimony from big tech company CEOs on October 1. These subpoenas would impact Facebook’s Mark Zuckerberg, Twitter’s Jack Dorsey, and Google’s Sundar Pichai.

Democrats on the committee criticized the calls for subpoenas, saying they will hurt tech companies’ efforts to curb hate speech on their platforms. It’s a fraught time for relations between tech companies and governments around the world. Investors will be anxious to see how negotiations both at home and abroad unfold for big tech companies.

A New Way to Invest in Diamonds

Diamond Standard Makes a Plan

Diamond Standard is a new startup looking to open up the diamond market to a wider range of investors. The company created standardized sets of the precious stones, called coins. It plans to sell $25 million worth of the coins starting today.

The idea of these coins is to make a benchmark similar to a standard gold bar. If these coins become popular, the diamond industry could see big changes.

Changes for the Diamond Industry

The COVID-19 pandemic has battered the diamond industry. Prices have fallen as consumers purchase less jewelry. Investors hope that this new way of trading diamonds will stabilize diamond prices.

Leaders in the diamond industry also see this as a way to modernize diamond trading. The new initiative could create more supply-chain traceability and make diamond pricing clearer.

Diamond Standard Co. plans to begin by selling 5,000 coins each worth $5,000. It will then increase its offerings by bidding for diamonds around the world.

New Technology Allows for More Precise Diamond Valuation

This is not the first attempt at creating investment vehicles tied to diamonds. However, professionals in the industry say that even five years ago this type of benchmark would not have been possible. New diamond testing technology developed recently allows for more precise readings of stones’ color, clarity, and other factors that impact their value.

Investors will be eager to see how this change in the diamond industry impacts diamond retailers like Tiffany &Co. (TIF), as well as diamond miners like De Beers Group and Alrosa Group (ALRS).

Not-So-Breaking News

- Palantir Technologies Inc, a data-mining-software specialist, is expected to forgo a traditional IPO in favor of a direct listing next Wednesday, September 30. Shares could start trading around $10, giving the company a valuation of roughly $22 billion. We'll be tracking Palantir's debut and have more next week.

- Zhong Shanshan, founder of Nongfu Spring, a Chinese bottled water company, has become the wealthiest person in China, surpassing Alibaba (BABA) founder Jack Ma. Nongfu Spring had a very successful IPO in Hong Hong earlier this month and its shares continue to rise. As of last Wednesday, Shanshan’s net worth is roughly $58.7 billion.

- Impresa Aerospace, which makes parts for airplane manufacturer Boeing (BA) filed for bankruptcy protection. The company’s parts were involved in Boeing’s 737 MAX jets which were grounded after two fatal crashes. This, combined with a reduced demand for travel as a result of the COVID-19 pandemic, hurt both Impresa Aerospace and Boeing.

- As millions of people continue to work from home, technology companies are finding creative ways to meet their needs. For example, Adobe (ADBE) is working to incorporate Adobe Sensei, the company’s AI technology, into its PDF reader. The technology will identify headings and other important parts of a document using machine learning. It will then make them larger so people can read pdfs easily on small screens without having to zoom in.

- Daniel Ek, the CEO of Spotify (SPOT) announced last week that he will invest $1.2 billion of his personal money to fund European startups. Ek said his goal is to achieve a “new European dream,” similar to the American dream over the next decade.

- Though many married couples have traditionally merged their finances, this is not the automatic course of action for all couples. Read more about who should pay the bills in a marriage at SoFi Learn.

Financial Planner Tip of the Day

"Before you begin building an investment portfolio—and choosing the tools and strategies you’ll use—it’s important to know what you’re trying to achieve. Ask yourself what you really want and how you can make those things happen."

Brian Walsh, CFP® at SoFi