The bullish harami pattern consists of two candlesticks and is a sign of a potential bullish turn on a stock. When a downtrend has been in place, a harami can offer traders clues that an upward trend is forming.

Other technical analysis tools should be used alongside observation of the bullish harami pattern for better confirmation. The pattern is useful when analyzing assets other than stocks, for example, the bullish harami pattern is also applicable to cryptocurrency charts.

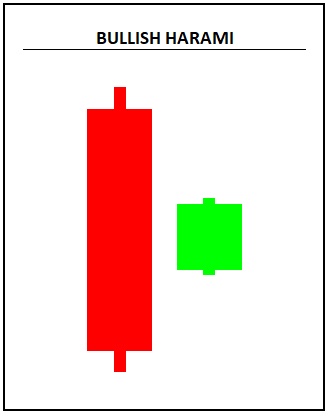

Period 1 of a bullish harami is a long bearish candle, often after a series of down days. Period 2’s candlestick has a smaller body, sometimes even a doji (a candle with little to no body due to opening and closing prices being very close.

What Is a Bullish Harami Pattern?

A bullish harami candlestick pattern indicates a bottom may be forming. This two-day candlestick pattern is a signal that a bullish reversal might be taking shape.

You can learn more about candlestick charts on SoFi Invest.

Period 1’s candle is a large red body (or black depending on your candlestick chart settings) which is bearish. It might be a bearish marubozu, a candle with no wicks — that means the opening price is the high of the day and the closing price is the low of the day. Period 1’s candle could also have small wicks.

An upper wick is price action above the opening price and closing price. A lower wick is trading activity below the opening and closing price.

Period 2 features a small green (or white) body. This candle is contained within period 1’s candle. This is also known as an inside day pattern. Period 2’s trading action includes a gap higher at the open and a closing price that is slightly higher than the opening price. The upper and lower wicks should be within the body of the first day’s candle.

Day 2 is often a minor increase in price that might seem unimportant, but the pause in the prior downtrend is taken as a signal of bearish exhaustion. Some traders further limit the size of period 2’s candle such that the candle body is no larger than 25% of period 1’s candle.

As with most candlestick patterns, it is important to know the context of the larger trend. With a bullish harami candlestick pattern, the existing trend is bearish.

A bullish harami is just one of many bullish technical indicators.

On the flip side, a bearish harami candlestick pattern happens after a bullish trend, and can indicate the start of a new bearish trend.

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

What Does a Bullish Harami Pattern Tell Traders?

A bullish harami pattern tells traders to be on guard against a quick change in trend. For bears, that means it might be prudent to cover short positions. For bulls, this type of harami candlestick pattern can be a signal to get long.

Before putting on big positions, the wise trader reviews other technical indicators for confirmation of a change in trend. Momentum tools such as oscillators, moving average crossovers, and subsequent bullish candlestick patterns can help confirm the predicted bullish reversal.

The crucial aspect of a bullish harami pattern is period 2’s gap up in price and higher close. A small body, sometimes a doji, shows indecision on a price chart. It indicates that bearish momentum could be slowing and perhaps the bulls are ready to take charge.

If period 2’s candle is a doji, traders refer to the pattern as a bullish harami cross. The “cross” refers to the doji candlestick.

Example of a Bullish Harami Pattern

It can be helpful to use an example of a stock’s price action to show how a bullish harami pattern works.

While the harami candlestick formation is frequently used and offers a favorable reward/risk ratio, it does not guarantee profits. It’s important to know the existing price trend and use other trading tools for better results.

Initially, you want to identify that a downtrend was in place before the harami pattern appeared. Let’s say a stock was trading at $100 one year ago, and it closed at $30 on the most recent trading day. You can use other technical tools like moving averages to help confirm the bearish price trend.

Next, look for clues that the bears are losing their stranglehold on the security — that could be seen with a bullish hammer or other candlestick patterns. This is not a requirement, but it can be a telltale signal that a reversal is not far off. What’s important is that a bearish trend is in place before day 1’s candle.

In our example, let’s say day 1’s candle opens with a small gap down to $29. Intraday price action is bearish. The stock closes at $26, near the low of the day. Bears are excited as a downward price trend seems to be continuing. The stock’s sentiment is likely very bearish.

Day 2 opens with a minor gap higher to $27. The low of the day and high of the day are tight — between $26.50 and $27.50. The stock settles up on the day at $27.20. That is also slightly above the opening price.

The entire session’s trading activity is within day 1’s range.

While other candlestick patterns require a third day to help confirm a reversal in trend, a bullish harami pattern does not. Traders use the two-day candlestick pattern to identify a bullish price reversal.

Other technical indicators, like the relative strength index, can be used to show that the market is in an oversold condition.

💡 Quick Tip: Did you know that opening a brokerage account online typically doesn’t come with any setup costs? Often, the only requirement to open a brokerage account — aside from providing personal details — is making an initial deposit.

Does the Bullish Harami Pattern Work?

When researching stocks, technical analysis is used to help traders improve their chances of making profits over time. One indicator is never a sure thing, though.

It is helpful to analyze price action around the harami and to use other tools to spot key areas of support and resistance.

A bullish harami pattern has advantages and disadvantages. Let’s describe those.

Benefits of the Bullish Harami Pattern

An upshot to the bullish harami is that it can offer early long entry points when a bullish trend begins. That means the risk to reward ratio can be very favorable.

Moreover, it is an easy pattern to identify on a price chart.

Drawbacks of the Bullish Harami Pattern

There are some limitations, however.

You should not use the harami in isolation. You also must know the prevailing price trend when looking for a bullish harami pattern.

Finally, you should have a grasp of momentum indicators to help support the case for a bullish reversal.

How to Trade a Bullish Harami Pattern

You trade the bullish harami pattern by spotting a small bullish candlestick after a long bearish candle within an existing downtrend. You can use momentum oscillators and other technical indicators to help confirm a bullish reversal is taking shape.

A buy order can be executed after period 2’s candlestick. A trader might place a stop loss order below the low price over the 2-day harami pattern.

Since a new bullish trend pattern may be developing, look for multiple upside price targets to take profits based on prior support and resistance levels.

Bullish Harami Pattern in Crypto

Bullish harami candlestick patterns can be found on several timeframes and across many assets. It is a popular indicator among cryptocurrency traders. The tight risk range can lead to attractive risk-to-reward ratios.

A downside with crypto markets, since they trade 24/7, is that it is rare to see a price gap, so that is a limiting factor, but it can make the pattern even more important when it does appear on a crypto chart. Some traders also make allowances for no gap in price between periods, with all other factors in place.

The Takeaway

The bullish harami is a two-day candlestick pattern indicating a prior bearish trend could be reversing. A bullish harami candlestick pattern could signal that a bottom may be close, and that a bullish trend might be taking shape.

Period 1 of the pattern features a large bearish session with downward price action.

Period 2’s candle has a small body often with minor upper and lower wicks. The bullish harami candlestick pattern is used to spot signs of bearish exhaustion.

An upshot to the bullish harami is that it can offer early long entry points when a bullish trend begins. That means the risk to reward ratio can be very favorable, but this does have its limitations, and is best used by experienced investors when considering their goals.

Ready to invest in your goals? It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here).

SoFi Invest®

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

1) Automated Investing and advisory services are provided by SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi Wealth“). Brokerage services are provided to SoFi Wealth LLC by SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi Securities LLC, Member FINRA (www.finra.org)/SIPC(www.sipc.org). Clearing and custody of all securities are provided by APEX Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms described above please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any product or service sold through any SoFi Invest platform.

For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Claw Promotion: Customer must fund their Active Invest account with at least $50 within 30 days of opening the account. Probability of customer receiving $1,000 is 0.028%. See full terms and conditions.

SOIN1021469