Finding Unclaimed Money From the Government

Table of Contents

About one in seven Americans has unclaimed funds lurking somewhere. In fact, there’s an estimated $70 billion in unclaimed assets in the United States. Typically, the amounts people receive when retrieving this money can be small (say, $20) or, in rare cases, it can be a significant amount of six figures or higher.

States typically manage these funds, which can come from forgotten bank accounts, pensions, insurance benefits, wages, savings bonds, and other sources.

If you’re wondering whether there’s any money out there that belongs to you, read on. This guide will walk you through where unclaimed money may be hiding and how to claim it.

Key Points

• About 1 in 7 Americans have unclaimed funds, totaling approximately $70 billion in assets.

• Searching state databases for unclaimed property is one route to find funds.

• Check for unpaid wages and pensions, and look for unclaimed tax refunds.

• Research can also help identify insurance funds which may be due you.

• Unclaimed funds may also be found by investigating closed bank accounts.

How to Find Unclaimed Money 5 Ways

Money usually remains unclaimed because owners have no idea it exists. That’s why it may be worth searching for unclaimed funds in your name just in case. You might be due some cash that you could sock away in your savings or checking account. So how do you go about it? Unfortunately, there’s no single place you can look for all potential unclaimed cash. It may take some work, but here are some steps you can take to help make sure you’re claiming everything that’s yours.

1. Searching State Databases

A good first step may be to hunt for unclaimed funds at the state level. Each state has an office that oversees unclaimed property, typically housed in the state treasurer’s, controller’s, or comptroller’s office. You can link to your state by visiting the website unclaimed.org, which is run by the National Association of Unclaimed Property Administrators.

Don’t forget to search your name in the database of each state where you have lived, not just the one where you live now. Make sure that you are searching the official state site (it should have .gov in the URL) to avoid scams. If you are married and changed your name, you may want to consider searching under your maiden name too.

You can continue your search by checking MissingMoney.com, which offers a multi-state database endorsed by the National Association of Unclaimed Property Administrators.

All of these searches are free to complete. If someone asks you for money to complete a search, that’s a red flag. There’s no reason to pay to access money that’s yours, unless there is a small processing fee.

If you happen to find unclaimed property, each state has its own process for proving that you’re the true owner and getting your hands on the cash. Many states allow you to file a claim electronically.

Usually you need to provide some kind of official documents to prove that you’re the person named as the owner. Luckily, there is typically no time limit for claiming the money. If the owner has died, you can often claim funds from a deceased relative. You can typically file a claim if you’re an heir, trustee, or executor of the estate.

2. Looking for Unpaid Wages and Pensions

Here’s another possibility in terms of how to find unclaimed funds: Hunt for back pay. If your employer owes you back wages, you can search the Department of Labor’s database. Start by inputting the name of the employer. You typically have to move quickly in this case, since the agency only keeps unpaid wages for three years.

You can also look for pensions from a former employer. Pension funds may be unclaimed if a company closed its doors or ended a particular pension plan. You can look for funds through the website of the Pension Benefit Guaranty Corporation, which is a government agency.

3. Checking for Unclaimed Tax Refunds

If you think you may have failed to receive a tax refund at some point, you can track that down through the Internal Revenue Service’s website. Keep in mind that you will need to know the exact refund amount in order to conduct the search.

4. Searching for Insurance Funds

Many insurance companies transfer unclaimed funds to states, but a couple of federal government agencies maintain their own unclaimed funds databases. The U.S. Department of Veterans Affairs holds onto unclaimed VA life insurance funds for most policyholders and, if they’re deceased, their beneficiaries.

People who had mortgages insured by the Federal Housing Administration can check for potential unclaimed refunds on the website of the U.S. Department of Housing and Urban Development.

5. Finding Closed Bank Accounts

You may also want to see if you have any money that is in a lost bank account or one that was held at a now-closed bank. It’s a very rare occurrence, but bank failures do occasionally happen. If you believe you had funds in one that you never received, you can contact the FDIC Claims Depositor Services at 877-275-3342.

Increase your savings

with a limited-time APY boost.*

Being Aware of Scams

Where there’s unclaimed money, there are bound to be con artists trying to take advantage of it. Some companies may offer to help you find unclaimed funds and recover the money for a percentage of the amount owed you. Be cautious: These can be scams. Paying these fees is pointless, since you can search for unclaimed property and reclaim it for free (or perhaps for a small processing fee to the state).

The IRS recently warned of another kind of unclaimed money scam, in which a letter arrives, claiming to be from the government, alerting you to a refund you have not yet accessed. This fraudulent communication then says that your banking details are needed to receive the money. If you send that sensitive information, you could end up losing money and having your accounts compromised.

Using Your Unclaimed Money

If you happen to be one of the lucky people who finds cash waiting for them, what should you do with it? You may be tempted to blow the surprise windfall on those new shoes you’ve been eyeing or on a dream vacation.

But depending on the sum you receive and your financial situation, there may be smarter ways to put the unexpected money to use. Consider these possibilities.

Paying Off Debt

If you have high-interest debt, many people suggest putting much of your extra cash toward knocking it out. That’s because interest rates can cause a balance to balloon significantly over time, meaning the longer you wait to pay off your high-interest debt, the more you’ll likely pay overall.

Credit cards and payday loans tend to have high interest rates, but you may also want to check the rate you’re paying on your student loans, car loan, personal loan, or mortgage. One method for potentially paying off your debt faster is to tackle your highest-interest debt first, while staying on top of minimum payments for your other liabilities.

Building an Emergency Fund

Once you’re on top of your debt or at least the highest-interest liabilities, it may be a good idea to establish or pump up an emergency fund.

Financial experts suggest having enough saved to cover three to six months’ worth of living expenses.

It may be a good idea to keep this money in a safe place, like a high-interest savings account, for unexpected emergencies such as car repairs, medical bills, or a layoff. Having an emergency fund may help you avoid getting into high-interest debt in the future since you have that cash cushion to see you through challenging times. And an emergency fund calculator can help you do the math to figure out how much money to save each.

Saving for a Goal

Once you have a basic emergency fund, you may want to start setting aside money to get closer to a big financial goal. Maybe you want to have a wedding, travel, start a business, or buy a home.

Saving in advance means you may need to take out less in loans or pay less in credit card charges. Or you might be able to avoid them altogether, keeping more of your money in your pocket.

Investing for the Future

Another option is to invest your money in an individual retirement account, college savings plan, brokerage account, or another financial vehicle.

Investing your money for the long-term could allow you to take advantage of the power of compounding returns and potentially increase your chances of reaping solid growth over time. It can be tempting to spend your lucky find on short-term fun, but investing may set you up for financial freedom in the future.

Recommended: Weird Ways to Make Money

The Takeaway

How do you find unclaimed funds? Typically, it involves searching on websites to see what pops up. These are usually specific to the kind of money that is sitting unclaimed, whether that means going searching for tax refunds, the contents of closed bank accounts, back wages, or insurance payments.

Whether it’s deciding what to do with reclaimed cash, if you’re owed any, or figuring out how to afford a big goal, life poses plenty of personal finance challenges. Finding the right financial partner can be an important step in making your money work harder for you.

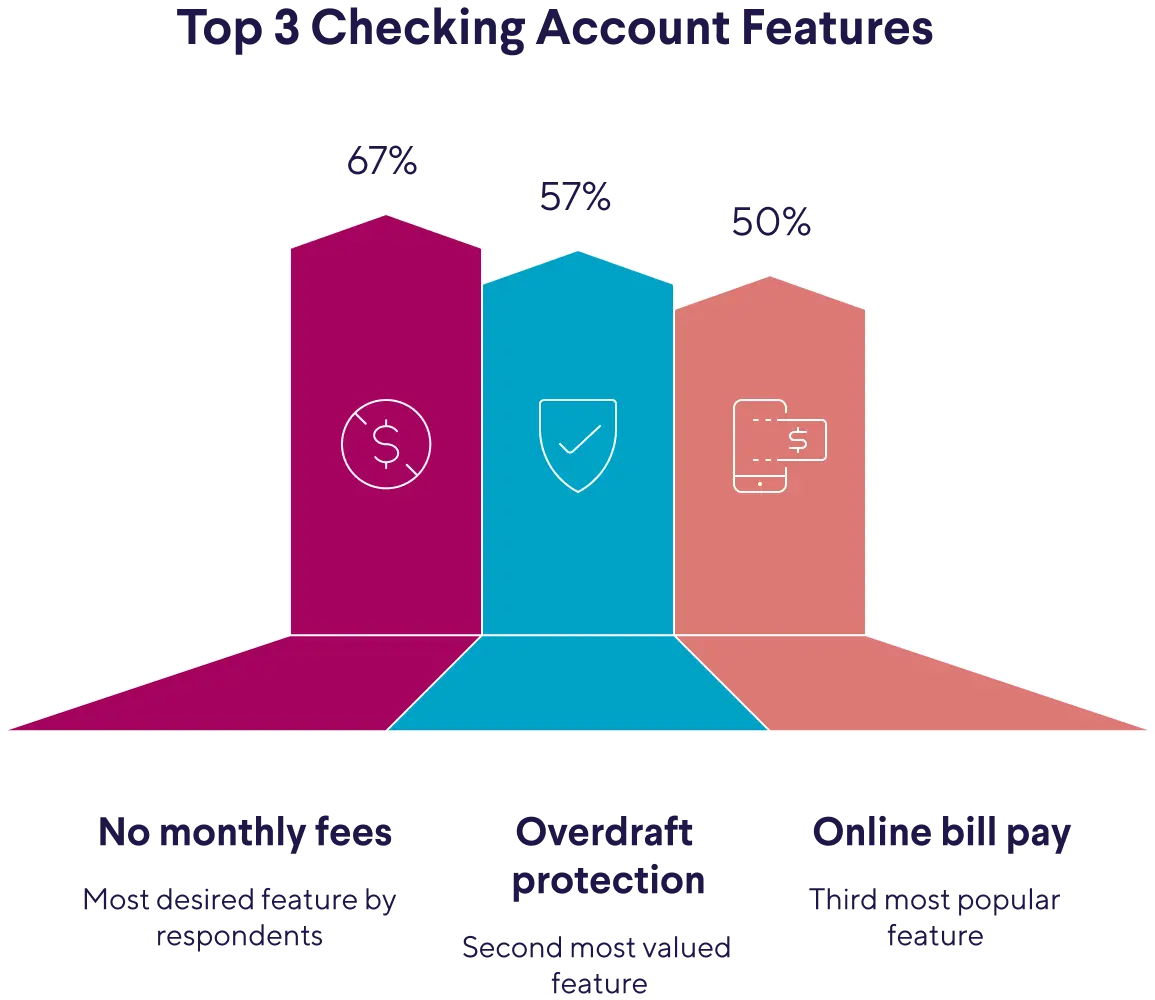

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

What is the best website to find unclaimed money?

Using a website to find unclaimed money will depend somewhat on the source of the unclaimed funds, such as whether it’s from an insurance claim, a forgotten safety deposit box, or other source. One good place to start can be unclaimed.org, which is run by the National Association of Unclaimed Property Administrators.

What happens if money is unclaimed?

When money is unclaimed, it often goes through a dormancy period (perhaps five years), after which the state takes control of the funds.

How do you claim unclaimed money from the IRS?

If you were expecting a federal tax refund and didn’t receive it, visit the IRS’ Where’s My Refund page and/or call their helpline at 800-829-1040. For state taxes, contact your local Department of Revenue.

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

^Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOBNK-Q425-001

Read more