A Beginner’s Guide to Options Trading

Editor's Note: Options are not suitable for all investors. Options involve risks, including substantial risk of loss and the possibility an investor may lose the entire amount invested in a short period of time. Please see the Characteristics and Risks of Standardized Options.

Table of Contents

An option is a financial instrument whose value is tied to an underlying asset; this is known as a derivative. Instead of buying an asset, such as company stock, outright, an options contract allows the investor to try to benefit from price changes in the underlying asset without actually owning it.

Because options contracts typically cost much less than the option’s underlying asset, trading options can offer investors leverage that may result in potential gains or losses depending on how the market moves. But options are very risky, and also can result in steep losses. That’s why investors must meet certain criteria with their brokerage firm before being able to trade options.

Key Points

• Options trading involves buying or selling options contracts for the right — and for sellers the obligation — to trade assets at a fixed price by a set date.

• Options are derivatives, deriving value from underlying assets, allowing trades based on anticipated price movements.

• Call options offer buyers the right to buy underlying assets at a set price, while put options offer buyers the right to sell assets at a set price.

• Key terms like the put-call ratio and the Greeks are essential for evaluating market sentiment and options behavior.

• Options trading may offer high returns and additional income but also carry significant risks, including the possibility of experiencing rapid losses.

What Is Options Trading?

Knowing how options trading works requires understanding what an option is, as well as its potential advantages, disadvantages, and risks.

What Are Options?

Buying an option is simply purchasing a contract that represents the right, but not the obligation, to buy or sell a security at a fixed price by a specified date.

• The options buyer (or holder) has the right, though not the obligation, to buy or sell a certain asset, like shares of stock, at a certain price by a specific date (the expiration date of the contract). Buyers pay a premium for each options contract; this represents the market price of the option contract at the time of purchase.

• The options seller (or writer), who is on the opposite side of the trade, has the obligation to buy or sell the underlying asset at the agreed-upon price, aka the strike price, if the options holder chooses to exercise their contract.

Options buyers and sellers may use options to attempt to profit if they think an asset’s price will go up (or down), to offset risk elsewhere in their portfolio, or to potentially enhance returns on existing positions. There are many different options trading strategies.

Why Are Options Called Derivatives?

An option is considered a derivative instrument because it is based on the value of the underlying asset: an options holder doesn’t purchase the asset, just the options contract. That way, they can make trades based on anticipated price movements of the underlying asset, without directly owning the asset itself.

In stock options, one options contract typically represents 100 shares.

Other types of derivatives include futures, swaps, and forwards. Options on futures contracts, such as the S&P 500 index or oil futures, are also popular derivatives.

It’s also important to know the difference between trading using margin vs. options? Having a margin account does offer investors leverage for other trades (e.g., trading stocks). But while a brokerage may require you to have a margin account in order to trade options, you can’t purchase options contracts using margin. That said, an options seller (writer) might be able to use margin to sell options contracts.

Recommended: What Are Derivatives?

What Are Puts and Calls?

There are two main types of options: calls vs. puts.

Call Options 101

When purchased, call options give the options holder the right (though not, again, the obligation) to buy an asset at a certain price in the future, typically in anticipation of the asset’s price rising

Here’s how a call option might work. The options buyer purchases a call option tied to Stock A with a strike price of $40 and an expiration three months from now. Stock A is currently trading at $35 per share.

If Stock A appreciates to a value higher than $40 per share, the option holder may choose to exercise the contract to realize a profit, or sell their option for a premium that’s higher than what they initially paid. If the value of Stock A goes up, the value of the call option may, all else being equal, also go up.

The opposite may also occur. If shares of Stock A go down, the value of the call option may go down, and expire worthless.

Assuming the price goes up and the options holder wants to exercise their call option, they would, with an American-style option, have until the expiration date to do so. With European-style options, the option can only be exercised on the expiration date). When they exercise, they would typically buy 100 shares at the strike price.

Put Options 101

Meanwhile, put options give holders the right to sell an asset at a specified price by a certain date, typically with the anticipation that the asset price will fall.

Here’s how a put trade might work. A trader buys a put option tied to Stock B with a strike price of $45 and an expiration three months from now. Stock B is currently trading at $50 per share.

If the price of Stock B falls to $44, below the strike price, the options holder can exercise the put to profit from the price difference. Alternatively, the value of the option may also rise in this scenario, giving the option holder the choice of selling the option itself for a potential gain.

Should the price of the underlying asset rise instead of fall, however, the option may expire worthless.

What Is the Put-Call Ratio?

A stock’s put-call ratio is the number of put options traded in the market relative to calls. It is one measure that investors look at to help gauge sentiment toward the shares. A high put-call ratio may indicate bearish market sentiment, whereas a low one may reflect more bullish views.

Quick Tip: How do you decide if a certain online trading platform or app is right for you? Ideally, the online investment platform you choose offers the features that you need for your investment goals or strategy, e.g., an easy-to-use interface, data analysis, educational tools.

Options Trading Terminology

• The strike price is the price at which the option holder can exercise the contract. If the holder decides to exercise the option, the seller is obligated to fulfill the contract.

• With American-style options the expiration is the date by which the contract needs to be exercised (meaning it can be exercised up to and on the expiration date). The closer an option is to its expiration, the lower the time value.

• Premiums reflect the value of an option; it’s the current market price for that option contract.

• Call options are considered in the money when the shares of the underlying stock trade above the strike price. Put options are in the money when the underlying shares are trading below the strike price.

• Options are at the money when the strike price is equal to the price of the asset in the market. Contracts that are at the money tend to see more volume or trading activity, as holders may choose to trade or exercise the options.

• Options are out of the money when the underlying security’s price is below the strike price of a call option, or above the strike price of a put option. For example, if shares of Stock C are trading at $50 each and the call option’s strike price is $60, the contracts are out of the money. For an out-of-the-money put option, the shares of Stock C may be trading at $60, while the put’s strike price is $50, so it is not currently exercisable.

Recommended: Popular Options Trading Terminology to Know

“The Greeks” in Options Trading

Traders use a range of Greek letters to gauge the value of options. Here are some of the Greeks to know:

• Delta measures how much the option’s value is expected to change when the underlying asset’s price changes by $1.

• Gamma measures how much Delta is expected to change when the underlying asset’s price changes by $1.

• Theta is the sensitivity of the option to time.

• Vega is the sensitivity of the option to implied volatility.

• Rho is the sensitivity of the option to interest rates.

Finally, user-friendly options trading is here.*

Trade options with SoFi Invest on an easy-to-use, intuitively designed online platform.

*Check out the OCC Options Disclosure Document.

How to Trade Options

The market for stock options is typically open from 9:30am to 4pm ET, Monday through Friday, while futures options can usually be traded almost 24 hours.

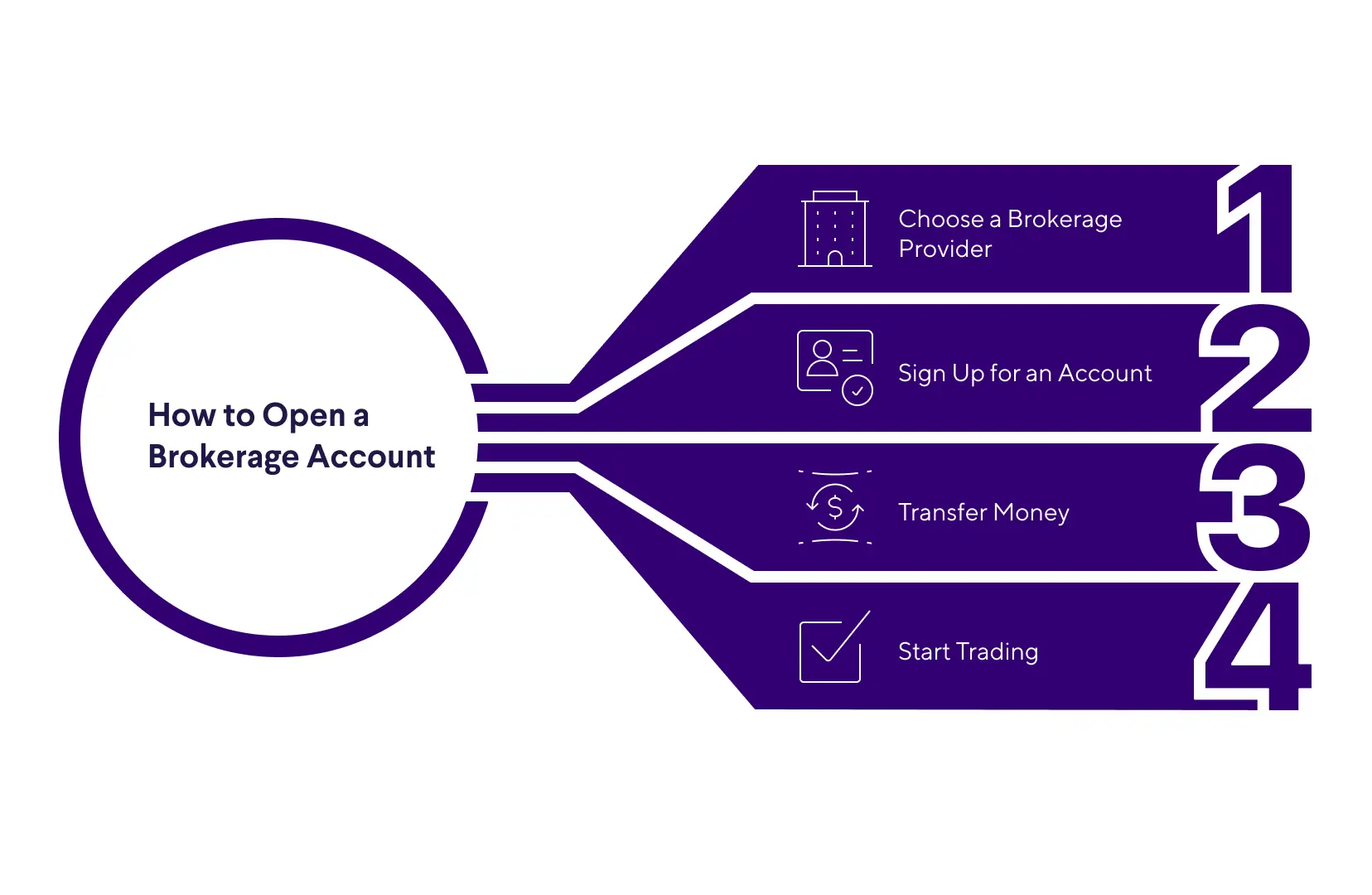

This is how you may get started trading options:

1. Pick a Platform

Log into your investment account with your chosen brokerage.

2. Get Approved

Your brokerage may base your approval on your trading experience. Trading options is riskier than trading stocks because some strategies can expose traders to losses that exceed their initial investment (or result in rapid capital loss). Options trading is for experienced investors who have a higher tolerance for risk.

3. Place Your Trade

Decide on an underlying asset and options strategy, being sure you have a risk management plan and exit strategy in place, should the price of the underlying asset move adversely. Then place your trade.

4. Manage Your Position

Monitor your position to know whether your options are in, at, or out of the money.

Basic Options Trading Strategies

Options offer a way for holders to express their views on the direction or volatility of an asset’s price through a trade. But traders may also use options to hedge or offset risk from other assets that they own. Here are some important options trading strategies to know:

Long Put, Long Call

In simple terms, if the buyer purchases an option — be it a put or a call — they are ‘long’. A long put or long call position means the holder owns a put or call option.

• A holder with a long call strategy may be able to purchase the asset at a lower price than market value if the asset rises above the strike price before expiration.

• A holder with a long put strategy may be able to sell the asset at a higher price than market value if the market price drops below the strike price before expiration.

Covered and Uncovered Calls

If an options writer sells call options on a stock or other underlying security they also own outright, the options are referred to as covered calls. The selling of options may allow the writer to generate an additional stream of income while committing to sell the shares they own for the predetermined price if the option is exercised.

Uncovered calls, or naked calls, also exist, when options writers sell call options without owning the underlying asset. However, this is a much riskier trade since the exercising of the option would oblige the options seller to buy the underlying asset in the open market, in order to sell the stock to the option buyer.

Note that the seller wants the option to stay out of the money so that they can keep the premium (which is how the seller may generate income).

Spreads

Option spread trades involve buying and selling a defined number of options for the same underlying asset but at different strikes or expirations.

A bull spread is a strategy in which a trader anticipates a potential increase in the price of an underlying asset..

A bearish spread is a strategy in which a trader anticipates a potential decline in the price of the underlying asset.

Horizontal spreads involve buying and selling options with the same strike prices but different expiration dates.

Vertical spreads are created through the simultaneous buying and selling of options with the same expiration dates but different strike prices.

Straddles and Strangles

Strangles and straddles in options trading allow traders to potentially benefit from a move in the price of the underlying asset, rather than the direction of the move.

In a straddle, a trader buys both calls and puts with the same strike prices and expiration dates to benefit from volatility rather than direction. The options buyer may see a gain if the asset price posts a big move, regardless of whether it rises or falls.

In a strangle, the holder also buys both calls and puts but with different strike prices.

Pros & Cons of Options Trading

Like any other type of investment, or investment strategy, trading options comes with certain advantages and disadvantages that investors should consider before going down this road.

Pros of Options Trading

• Options trading is complex and involves risks, but for experienced investors who understand the fundamentals of the contracts and how to trade them, options can be a useful tool to gain exposure to asset price movements while putting up a smaller amount of money upfront.

• The practice of selling options can also be a way for writers to attempt to earn income by collecting premiums. This was a popular strategy particularly in the years leading up to 2020 as the stock market tended to be quiet and interest rates were low.

• Options can also be a useful way to protect a portfolio. Some investors offset risk with options. For instance, buying a put option while also owning the underlying stock allows the options holder to offset their losses if the security declines in value before that option expires.

Cons of Options Trading

• A key risk in trading options is that losses can be outsized relative to the cost of the contract in some cases — especially for sellers, who may face losses that exceed the initial premium received if the market moves sharply against them. When an option is exercised, the seller of the option is obligated to buy or sell the underlying asset, even if the market is moving against them.

• While premium costs are generally low, they can still add up. The cost of options premiums can eat away at an investor’s profits. For instance, while an investor may net a profit from a stock holding, if they used options to purchase the shares, they’d have to subtract the cost of the premiums when calculating the stock profit.

• Because options expire within a specific time window, there is only a short period of time for an investor’s thesis to play out. Securities like stocks don’t have expiration dates.

|

Advantages and Disadvantages of Options Trading |

|

|---|---|

| Pros | Cons |

| Additional income | Potential outsized losses |

| Hedging portfolio risk | Premiums can add up |

| Less money upfront than owning an asset outright | Limited time for trades to play out |

Test your understanding of what you just read.

The Takeaway

Options are derivative contracts on an underlying asset (an options contract for a certain stock is typically worth 100 shares). Options are complex, high-risk instruments, and investors need to understand how they work in order to reduce the risk of seeing steep losses.

When an investor buys a call option, it gives them the right but not the obligation to buy the underlying asset by or on the expiration date. When an investor buys a put option, it gives them the right but not the obligation to sell the underlying asset by or on the expiration date.

The contracts work differently for options sellers/writers.

The seller or writer of a call option has the obligation to sell the underlying asset at the agreed strike price to the options holder, if the holder chooses to exercise the option on or before its expiration. The seller of a put option has the obligation to buy the shares of the underlying asset from the put option holder at the agreed strike price.

SoFi’s options trading platform offers qualified investors the flexibility to pursue income generation, manage risk, and use advanced trading strategies. Investors may buy put and call options or sell covered calls and cash-secured puts to speculate on the price movements of stocks, all through a simple, intuitive interface.

With SoFi Invest® online options trading, there are no contract fees and no commissions. Plus, SoFi offers educational support — including in-app coaching resources, real-time pricing, and other tools to help you make informed decisions, based on your tolerance for risk.

Explore SoFi’s user-friendly options trading platform

FAQs

What is options trading and how does it work?

Options trading involves buying and selling contracts that give the holder the right — but not the obligation — to buy or sell assets at a set price by a certain date. These contracts derive their value from the underlying asset, and are often used for speculation or risk management.

Can you make $1,000 a day trading options?

It may be possible to make $1,000 in a day by trading options, but this depends on market conditions, strategy, capital, and risk tolerance. Most traders do not see consistent high-dollar returns, and losses can exceed the initial investment, meaning this form of trading may require a high risk tolerance.

Can I trade options with $100?

Some brokerages may allow you to start trading options with $100, particularly if you’re buying low-cost contracts. Account approval and margin requirements may vary, however. Options trading also carries high risk, even with a small investment.

Is options trading better than stocks?

Options trading is not inherently better or worse than trading stocks. It offers different risk-reward dynamics and may suit experienced traders seeking leverage or hedging strategies. However, options are more complex and can lead to greater losses than stocks

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Options involve risks, including substantial risk of loss and the possibility an investor may lose the entire amount invested in a short period of time. Before an investor begins trading options they should familiarize themselves with the Characteristics and Risks of Standardized Options . Tax considerations with options transactions are unique, investors should consult with their tax advisor to understand the impact to their taxes.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Utilizing a margin loan is generally considered more appropriate for experienced investors as there are additional costs and risks associated. It is possible to lose more than your initial investment when using margin. Please see SoFi.com/wealth/assets/documents/brokerage-margin-disclosure-statement.pdf for detailed disclosure information.

S&P 500 Index: The S&P 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. It is not an investment product, but a measure of U.S. equity performance. Historical performance of the S&P 500 Index does not guarantee similar results in the future. The historical return of the S&P 500 Index shown does not include the reinvestment of dividends or account for investment fees, expenses, or taxes, which would reduce actual returns.

SOIN-Q325-014

Read more