What Are the Most Common Home Repair Costs?

Thanks to high demand and inflation, the cost of home repairs has been on the rise. In 2025, the average household spent $2,041 on maintenance and $1,143 on emergency repairs, according to Angi’s State of Home Spending Report. The report also found Millennials led all generations in spending, with an average total home spend of $14,199, including the highest maintenance ($2,601) and emergency ($1,519) expenditures.

The most common home repairs include the usual suspects: electrical, plumbing, HVAC, water damage, and termite damage. Keep reading to learn more about these issues and the cost of repair or replacement, so you can pick up tips on maintaining the value of your home and be prepared for repairs when reality bites.

Table of Contents

Key Points

• Common home repairs include foundation issues, electrical problems, roof repairs, water heater replacements, water damage, plumbing, septic system repairs, HVAC issues, mold removal, and termite damage, with costs ranging from a few hundred to tens of thousands of dollars.

• The average household spending on home repairs in 2025 was $2,041 on maintenance and $1,143 on emergency repairs.

• High-cost repairs include foundation repair (up to $8,129), roof replacement (up to $13,223), and septic system replacement (up to $12,000), highlighting the need for a strong emergency fund.

• Budgeting for home repairs can be guided by rules of thumb, such as setting aside 1% of your home’s value annually, $1 per square foot of living space, or 10% of main monthly expenses.

Estimated Cost of the Most Common Home Repairs

Low-cost preventive measures — like cleaning your gutters or getting your heating and cooling systems serviced annually — can help keep common home repair costs down. But even with the best preparation, surprises (like a busted pipe or roof leak) happen, and when they do, you can be on the hook for thousands of dollars. Whether you’re a new or longtime homeowner, it’s a good idea to plan for — and budget for — home repairs.

Below is a roundup of the most common home repairs and average costs.

Foundation Repair

A number of different issues can occur with foundations, some of which are more serious (aka, costly) than others. Among the most common problems are foundation cracks, which can be caused by house settling or changes in soil pressure around the home. Cracks can lead to water damage or cause the walls in your foundation or home to bow. Foundations can also begin to sink, due to changing weather patterns, nearby tree roots, or erosion.

Since the foundation is the footprint of your home, repairs can be complicated and expensive. According to Angi, foundation repair costs can range anywhere from $2,224 to $8,129.

Average cost of foundation repair: $5,172

Electrical Issues

While there are many home repairs you can safely DIY, electrical issues and wiring are generally best left to professional electricians. Working with live wires can be dangerous and faulty electrical work can be a significant fire hazard. Some signs you may need to call an electrician include:

• Burning smell coming from an outlet

• Buzzing or sizzling noises coming from an outlet

• Flickering lights

• Outlets feel hot to the touch

• You have 2- rather than 3-prong outlets

• Circuit breaker continually trips

• Appliances spark when plugged in

Depending on the length and complexity of the job, the cost of hiring an electrician ranges between $163 and $536. Installing a new outlet can run $100 to $450, while replacing a breaker panel can cost anywhere from $519 to $2,187.

Average cost of electrical repairs: $348

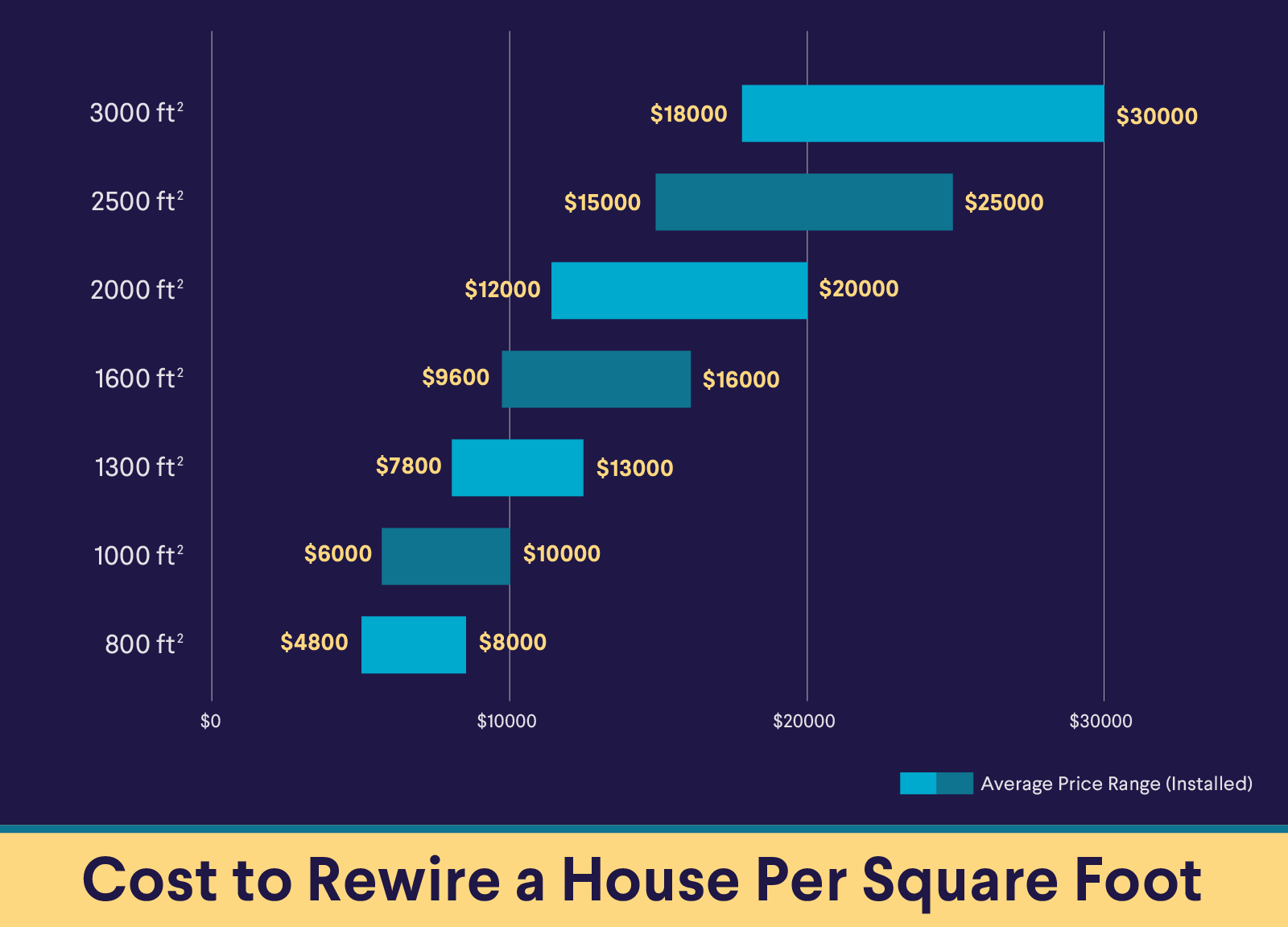

Recommended: What Is the Cost to Rewire a House?

Roof Repair

Your roof protects your home from the elements, so it’s important to keep it in top condition. If you notice any damage or signs of wear and tear, you’ll want to address them sooner rather than later. This can help prevent small problems from becoming serious and expensive. Signs that your roof may be compromised include broken, cracked, curling, or missing shingles, and any interior signs of water damage (such as dark spots or discoloration on walls or ceiling and/or mold or rotting wood in the attic).

The cost of a roof repair will depend on your home’s location, roofing material, size of your home, and the type of roof. On average, costs run between $393 and $1,939. By contrast, a full roof replacement can run between $5,870 to $13,223. Due to the significant price difference, you would generally only invest in a new roof if the damage to your existing roof is extensive or the roof is near the end of its life.

Average cost of roof repairs: $1,158

Repair or Replace a Water Heater

Due to mineral buildup and the routine breakdown of components, water heaters do not last forever. Depending on how extensive the repairs your water heater requires, you can be on the hook for a new unit entirely. And if you’ve ever taken a cold shower in the middle of winter, you know this is one repair that is essential to your quality of life.

On average, homeowners spend anywhere from $222 to $990 on water heater repairs. Your actual bill will depend on the cost of the part needed for the fix, how much your local water heater professional charges for labor, and the length of the job. Where you live and where the water heater is located in your home can also impact costs.

Average cost of water heater repairs: $606

Water Damage

Water damage is fairly common. It can result from a crack in an old pipe, a leaky roof, an unusually strong storm, or sewage backup. To prevent mold growth and further damage, it’s best to fix the issue and clear out moisture as soon as you spot it.

Water damage restoration can involve replacing wallboard, flooring, and/or ceilings, as well as ensuring that no mold spores are left behind to spread once the repairs are complete. Two important factors influencing price are the square footage affected and the type of water (i.e., whether it’s clean or has been contaminated with potentially harmful substances). The cost of water damage restoration generally ranges between $1,384 and $6,387.

Average cost to fix water damage: $3,867

Replacing Pipes

Replacing older pipes is a common home repair often needed after a home inspection. Common problems include dated construction materials with a known problem in their manufacturing, signs of corrosion, clogs, and leaks. And because pipes run behind walls and underground, repair costs often include patching up interior holes and dug-up yards.

The good news is that not all leaks, burst pipes, and signs of corrosion require replacing large amounts of plumbing. Often, a plumber can replace a small section of the pipe affected by the damage. The cost to install pipes for a repair ranges from $372 to $2,131, though it can run higher if the damaged pipes are difficult to access.

Average cost to install pipes: $1,251

Recommended: Renovation vs Remodel: What’s the Difference?

Septic System Repair

A septic tank contains and filters household wastewater. If it is damaged or not functioning properly, it’s important to deal with the problem quickly — otherwise, you could be dealing with a smelly and costly mess. Sewage backups can occur when the septic tank becomes clogged or full, there’s a problem with devices within the tank, or there’s a blockage in the home’s main drain line leading to the tank.

Depending on the type of repair, tank size, permits, and other factors, the cost of a septic tank repair runs, on average, between $628 and $3,039. A small fix like repairing a septic tank lid could cost less ($150 to $500); but if you need to replace the tank, you could be looking at a bill as high as $12,000.

Average cost to repair a septic system: $1,830

Heating or Air Conditioning Repair

Your home’s HVAC (which stands for heating, ventilation, and air conditioning) system plays a key role in keeping your home comfortable to live in. Though there are many different types of HVAC systems, they generally all work by using energy to heat or cool the air to a desired temperature. The system may also add/remove moisture and filter your home’s indoor air.

An HVAC system typically has two main components: a heater (which could be a furnace, boiler, or heat pump) and an air conditioning (AC) unit. The type of system you have and the component that’s broken will significantly influence the cost of repairs. For example, an AC system repair can run anywhere from $130 to $2,000, while a furnace repair tends to run between $132 and $503. On average, homeowners spend between $130 and $2,000 on HVAC repairs.

Average cost to fix a heating or air conditioning system: $350

Mold Removal

Mold develops inside homes as a result of moisture and can lead to health problems. Signs that you may have a mold problem include:

• Musty odor in a specific area

• Discoloration on the walls

• Peeling, cracking, or warping of floors or walls

• Leaks or water damage

• Darkening around tile grout

• Worsening of allergy symptoms

While you may be able to remove small amounts of mold yourself (provided you’re certain the mold isn’t toxic), often the best option is to hire a mold remediation professional.

The cost for mold removal will vary widely depending on where it is located in your home. Mold growth in hard-to-reach areas, like drywall or your HVAC system, generally costs more to remediate since it can require more time, materials, and labor. The size of the infestation and the type of mold that is growing also influence costs. On average, mold removal runs between $1,223 and $3,753.

Average cost of mold removal: $2,367

Termite Damage

The problem with termites is that they literally eat away at your house. They can also eat through your budget: The cost to repair termite damage can range anywhere from $1,000 to $10,000 or even more.

Generally, the longer termites chew on the wooden structure of your home, the more costly the repair will be, so it’s key to recognize — and deal with — any signs of a termite infestation early. If you catch a termite problem early, for example, you may only need to replace a few damaged boards or joists, which can run from $250 to $1,000. If the problem goes on for a while, however, you may need to replace damaged walls, framing, or floors — at a cost of $1,000 to $3,000. Worst-case scenario: Termites do enough damage to your home’s infrastructure (like beams or load-bearing walls) that it becomes structurally unsound. A major termite repair job can run you more than $37,000.

Average cost to repair termite damage: $3,000

Factors That Affect Home Repair Costs

Home repair costs can vary widely based on geographic location and other cost drivers. These are the things that might influence your bill:

Age of the Home

Not surprisingly, older homes will typically have higher repair costs. Sometimes the repair itself isn’t the driver of the increase, but rather the costs associated with postrepair restoration, such as repairing plaster walls or replacing intricate woodwork. The higher cost of buying a fixer upper can stick with you even after an initial renovation if the renovation is cosmetic and doesn’t address underlying mechanical issues such as dated wiring or plumbing.

Location and Labor Costs

The cost of living in the area where your home is located will help determine your repair costs. In higher-cost areas, labor costs also tend to be higher.

Materials and Permit Fees

Constructions materials costs have increased alongside labor costs and even outstripped them in some cases. Copper (used in wiring) and other electrical components have seen especially intense cost increases. Building permit costs vary widely by geography but high-cost areas often tend to have high permit costs. Moreover, this is one cost that is entirely out of the control of the homeowner or the contractor.

Average Cost of Home Repairs

Trying to predict — and budget for — home repairs can be challenging. However, there are several rules of thumb that can help homeowners. Being prepared for home repair costs is one of those personal finance basics you’ll want to have a handle on as a homeowner.

• The 1% Rule. One common guideline is to set aside approximately 1% of your home’s value annually for home maintenance.

• The Square Foot Rule. Another formula is to set aside $1 for every square foot of livable space.

• The 10% Rule. Put aside 10% of all your main monthly expenses.

If you don’t have enough savings to cover the cost of a necessary home repair, there are financing options, including a home equity line of credit (HELOC), a home equity loan, or a credit card (though this can be an expensive choice).

You can also use a personal loan to cover the cost of home repairs or improvements.

How to Budget for Home Repairs

One way to ensure you have cash on hand when home repair needs arise is to plan ahead and start budgeting and saving in advance.

Creating a Home Maintenance Fund

You can help ensure you’ve saved a cushion for repairs by creating a home maintenance fund.

Emergency vs. Planned Repairs

It’s one thing to create a maintenance fund and periodically do some preventive maintenance.

Home Warranty Considerations

Some homeowners choose to pay for a home warranty in order to ensure that repair costs are covered when the time comes.

Quick Tip: Check out SoFi’s home improvement loan rates to find competitive options for financing your next repair or renovation project.

The Takeaway

It’s tough to predict the cost of home repairs.

Think twice before turning to high-interest credit cards. Consider a SoFi personal loan instead. SoFi offers competitive fixed rates and same-day funding. See your rate in minutes.

FAQ

How do I estimate home repair costs?

As a general rule, experts estimate that your annual home repair costs will average either $1 per square foot or 10% of your housing costs.

What repairs are usually not covered by homeowners insurance?

Every homeowners insurance policy is slightly different.

When should I hire a professional instead of doing it myself?

Assuming you aren’t a licensed tradesperson, it’s best to hire a professional.

How much should I budget annually for home repairs?

There are several guidelines for budgeting for home repair.

What is the most expensive home repair?

The most expensive home repairs tend to be foundation repairs, full roof or septic tank replacements, or repairs due to extensive termite damage.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

Disclaimer: Many factors affect your credit scores and the interest rates you may receive. SoFi is not a Credit Repair Organization as defined under federal or state law, including the Credit Repair Organizations Act. SoFi does not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit record, credit history, or credit rating. For details, see the FTC’s website .

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOPL-Q126-008

Read more