Breaking Barriers: New SoFi Data Reveals the Truth About Today’s Female Entrepreneurs

A new SoFi survey reveals groundbreaking news that turns many assumptions about female entrepreneurs on their heads. Women business owners are no longer content to just “stay in their lane.” Instead, they are branching out into fields previously dominated by men, such as construction, transportation and warehouse, and tech/software and AI, according to our research.

In the Summer 2025 SoFi survey of over 1,000 women business owners across the U.S., the majority of respondents reported that they had no financial help or support network when they launched their businesses. Instead, they used their own savings to get their venture off the ground and relied on their experience and know-how.

And forget investors — many female founders are getting the job done with their own money, hard work, ingenuity, and determination.

Table of Contents

- Why Business Growth Equals Personal Growth

- Bridging the Gender Gap

- Easier Than Expected

- The Challenges Women Entrepreneurs Faced When Entering Their Industry

- How Women Overcame the Biggest Challenges to Launching Their Business

- Where the Money Comes From

- Financially Fluent

- What Keeps Them Up At Night

- Reaping the Rewards

- Best Advice for Other Aspiring Women Business Owners

Key Points

• 68% funded their businesses with their own personal savings. Only 18% had a business or Small Business Administration (SBA) loan; just 3% had venture capital.

• 62% of women business owners taught themselves how to manage their business finances; 42% are very confident in their financial management skills.

• 44% say their industry’s gender makeup has motivated them to prove themselves and stand out.

• 63% of respondents say personal fulfillment comes from flexibility and control, with 42% say satisfaction derives from expanding client bases and 36% from revenue growth.

Why Business Growth Equals Personal Growth

There are over 14 million female-owned businesses in the U.S., and they generate $3.3 trillion of revenue.

Most women business owners say they are very confident in their financial management skills — and those abilities are clearly paying off. However, they do worry about the broader financial situation in the U.S. The majority of SoFi survey respondents cite “current economic uncertainty” as the biggest challenge they face right now in terms of managing their business finances.

The bottom line is that despite the unpredictability of today’s economy, women have discovered that owning a business can be deeply rewarding—and that there can be unexpected opportunities in fields that may have once seemed off-limits. In fact, 30% say that entering a new industry has been the biggest professional reward they’ve gained.

Source: Based on a SoFi survey conducted on June 12-18 of 1,000 women business owners in the U.S. ages 18 and up.

Percentages have been rounded to the nearest whole number, and some questions allowed for multiple answers, so some data may not add up to 100%.

Bridging the Gender Gap

As noted above, women are discovering opportunities in business spaces that were once men-only. Sixteen percent of SoFi respondents say their business is in an industry that’s male dominated, and 39% percent report that the industry they’re in is evenly divided between men and women. By comparison 38% say they’re in an industry that’s female dominated, and 7% don’t know the make-up of their industry.

For many women entrepreneurs, venturing into new territory has had a positive effect:

• 44% say the gender makeup of their industry has motivated them to prove themselves and stand out.

• 29% report that it allows them to distinguish themselves from the competition.

• 20% say they’ve been able to build stronger networks because of it.

• 26% of respondents say gender hasn’t had any impact at all.

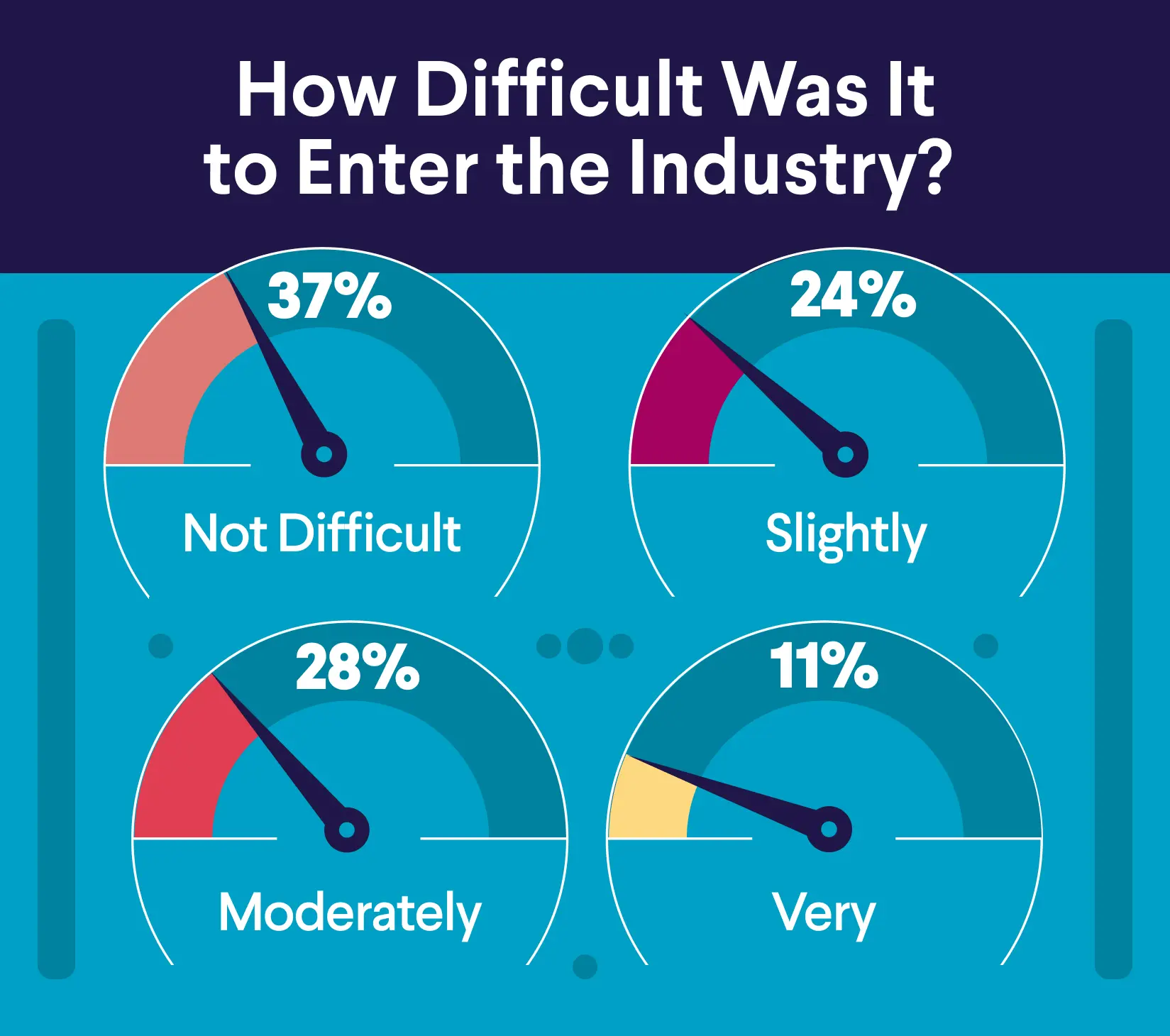

Easier Than Expected

While breaking into a male-dominated field might sound intimidating, it was actually fairly simple, SoFi’s survey found: 61% of women business owners say it was not at all difficult — or just slightly difficult — to enter their industry.

• Not at all difficult: 37%

• Slightly difficult: 24%

• Moderately difficult: 28%

• Very difficult: 8%

• Extremely difficult: 3%

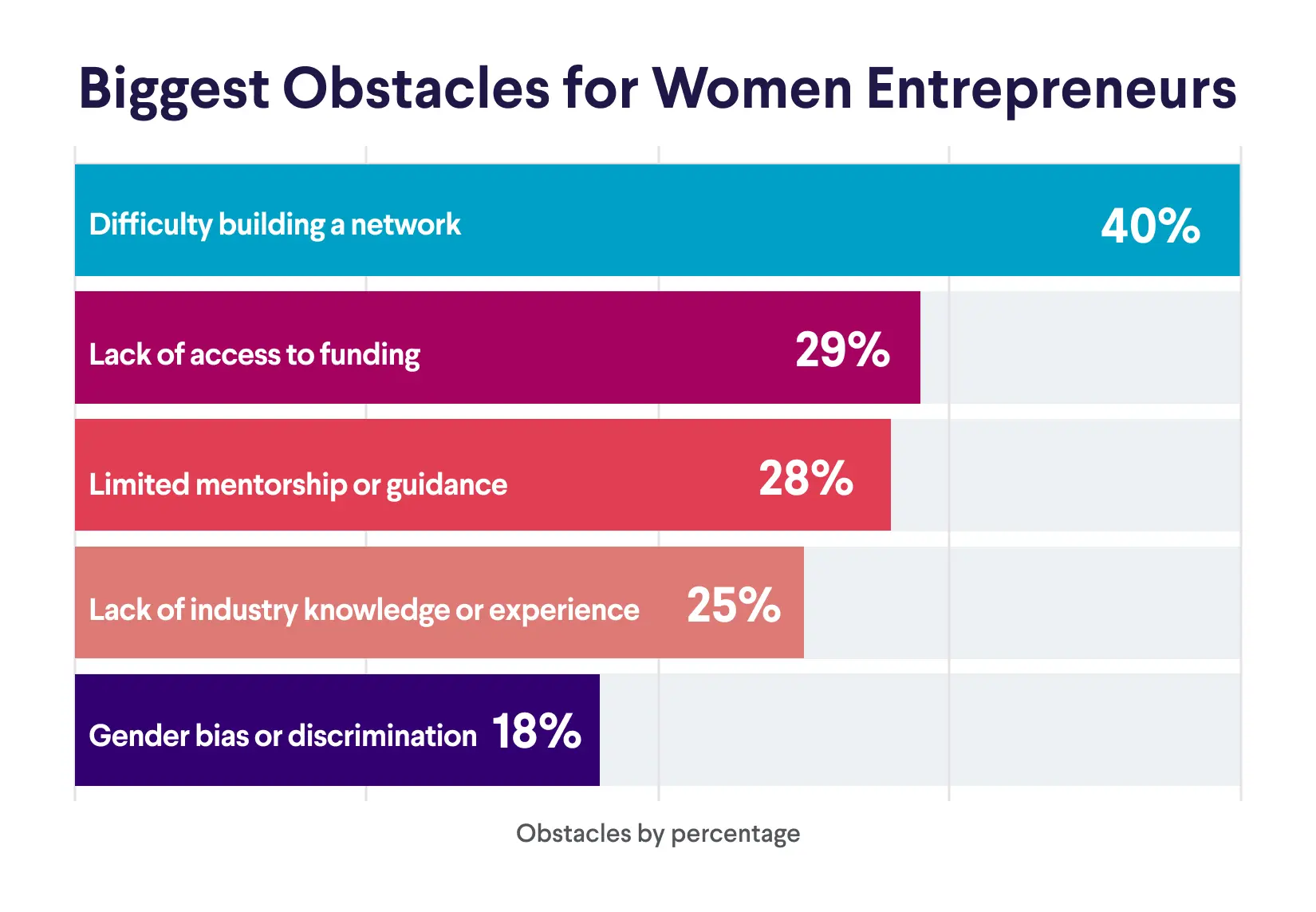

The Challenges Women Entrepreneurs Faced When Entering Their Industry

The main obstacles women business owners face had less to do with discrimination and more about building a support system, according to SoFi’s survey. Networking and finding a mentor were top challenges for 68% of respondents. Surprisingly, this was more than twice as challenging as securing funding.

• Difficulty building a network: 40%

• Lack of access to funding: 29%

• Limited mentorship or guidance: 28%

• Lack of industry knowledge or experience: 25%

• Gender bias or discrimination: 18%

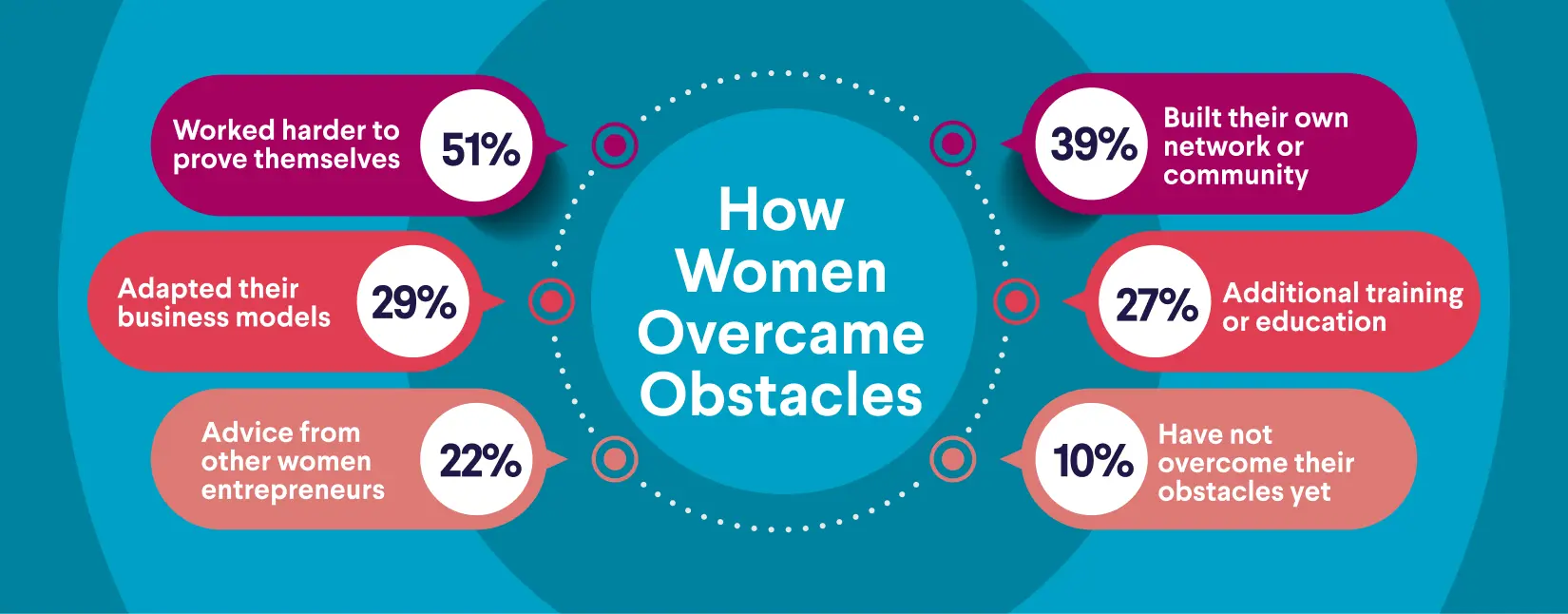

How Women Overcame the Biggest Challenges to Launching Their Business

A few roadblocks didn’t slow down these female entrepreneurs, however. In fact, many women business owners found the hurdles motivating.

• I worked harder to prove myself: 51%

• I built my own network or support community: 39%

• I adapted my business model to overcome obstacles: 29%

• I pursued additional training or education: 27%

• I sought advice or mentorship from other women entrepreneurs: 22%

• I haven’t overcome them yet: 10%

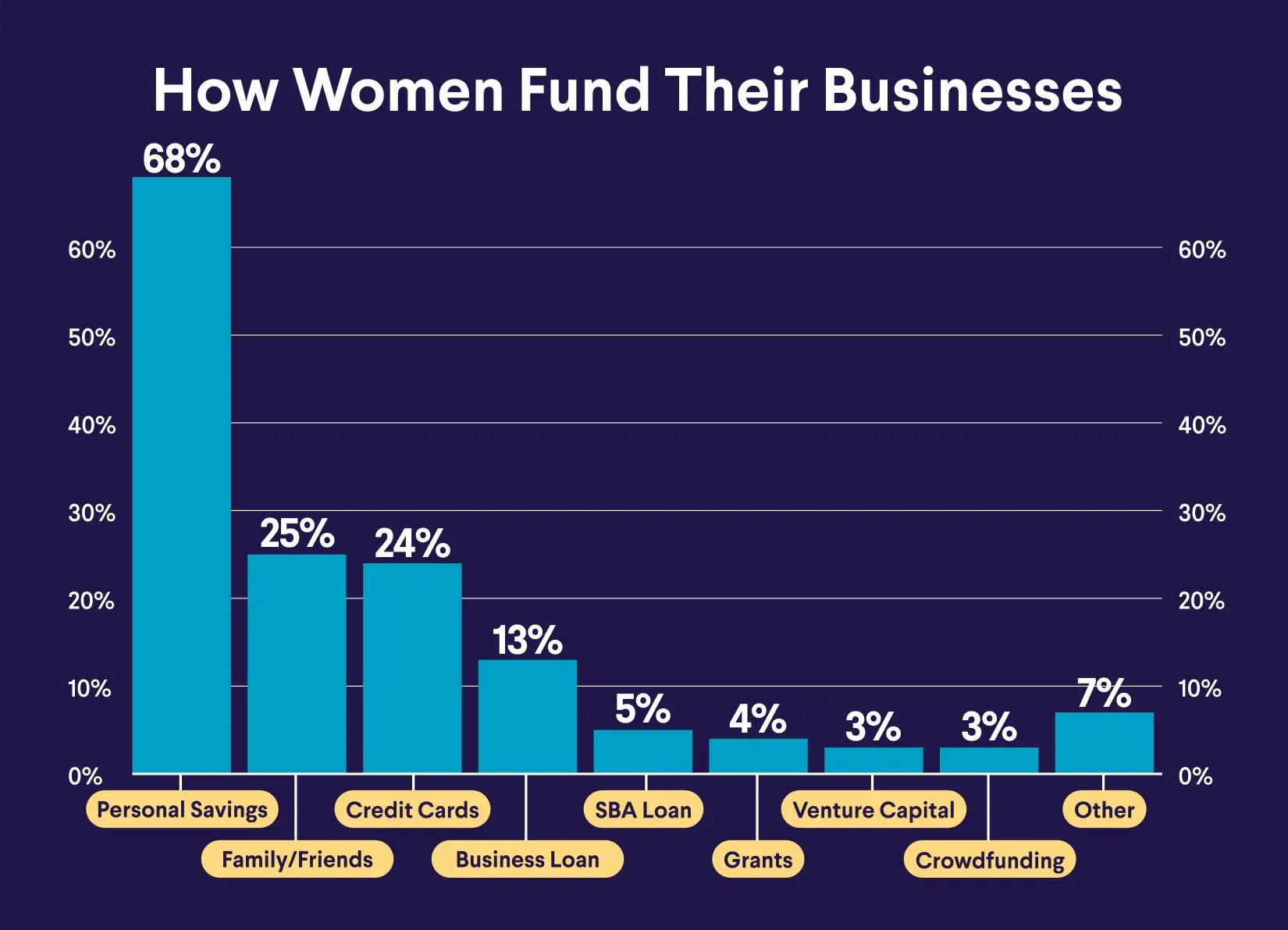

Where the Money Comes From

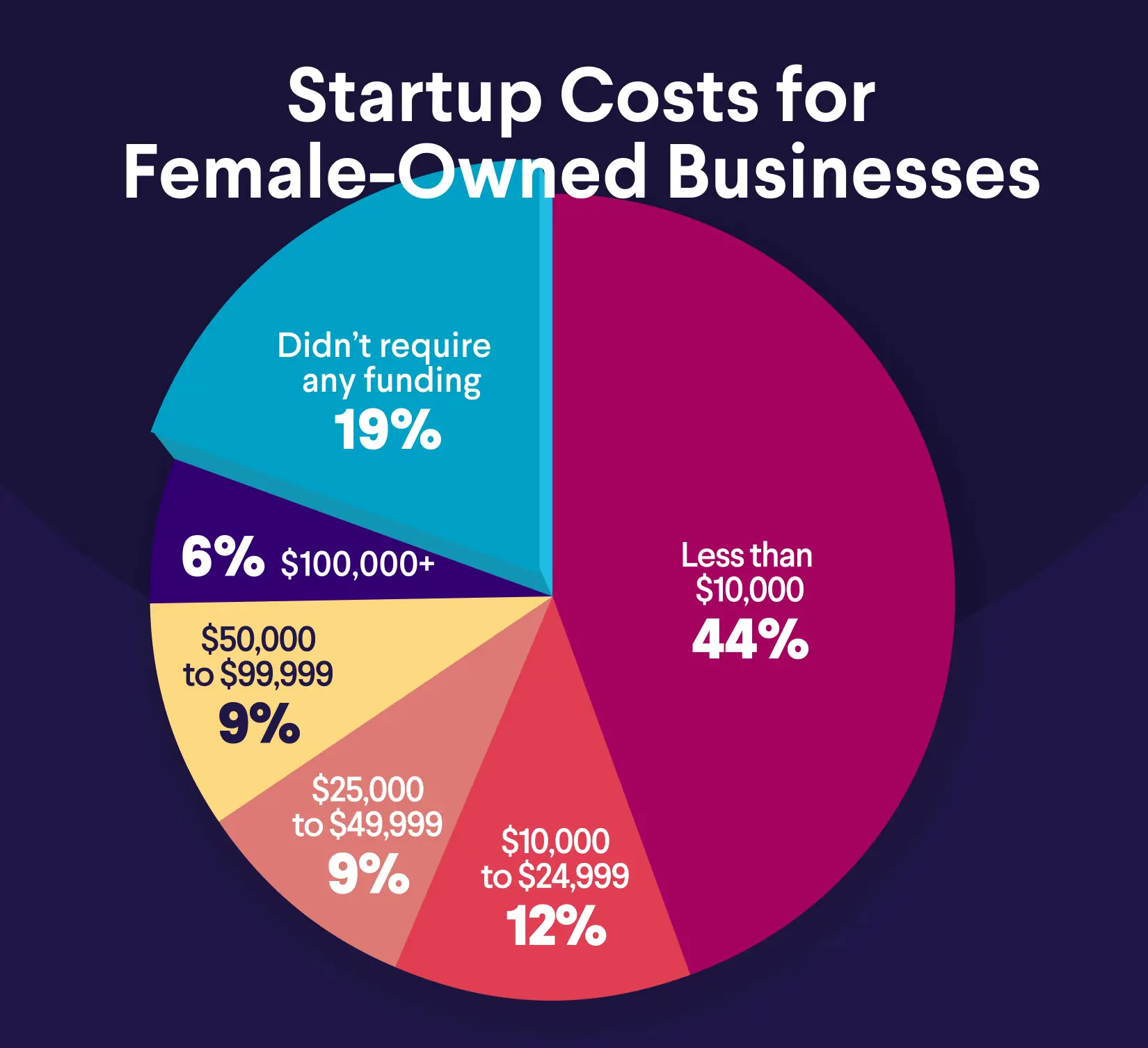

Most women business owners in the SoFi survey dug into their own savings to launch. Only 18% secured a business loan or Small Business Administration (SBA) loan. Perhaps it’s a good thing then that many of them required less than $10,000 to set up shop.

How Women Funded the Launch of Their Business

• Personal savings: 68%

• Friends or family: 25%

• Credit cards: 24%

• Business loan (bank or private): 13%

• SBA loan or assistance: 5%

• Government grants: 4%

• Venture capital or angel investors: 3%

• Crowdfunding platforms: 3%

• Other: 7%

The Initial Funding Their Business Required

• Less than $10,000: 44%

• $10,000–$24,999: 12%

• $25,000–$49,999: 9%

• $50,000–$99,999: 9%

• $100,000 or more: 6%

• My business didn’t require any initial funding: 19%

Even though they primarily had to use their own savings or credit cards to launch, 47% of women business owners say they haven’t had any funding obstacles.

Recommended: Small Business Grants: Where to Find Funding

Financially Fluent

The overwhelming majority of women business owners report that they have good money management skills — and they’re proud to use them. Only 3% outsource this task to a professional.

When asked how confident they are in managing business finances, respondents answered:

• Very confident: 42%

• Somewhat confident: 49%

• Not very confident: 7%

• Not confident at all: 2%

Most women business owners learned financial management skills on their own: 62% say they are self-taught through experience. Others had a little help, including 15% who learned from an advisor or mentor, and 12% who took classes or workshops. Eight percent of women entrepreneurs say they are still learning.

What Keeps Them Up At Night

Just like any business owner, female founders have concerns about specific financial issues. A substantial number of them are worried about the state of the U.S. economy.

Here’s what they said when asked: What are the biggest challenges related to managing your business finances?

• Current economic uncertainty: 38%

• Setting prices or fees: 32%

• Understanding taxes or compliance: 27%

• Budgeting and expense tracking: 21%

• Forecasting revenue: 20%

• Managing cash flow: 20%

• I haven’t had major financial challenges: 19%

• Access to capital or credit: 15%

Recommended: Mompreneurs: Generational Wealth and Real-Time Struggles

Reaping the Rewards

In the SoFi survey, women business owners revealed that money was less of a motivation to start their company than personal fulfillment. Thirty percent say they were inspired by the desire for flexibility and autonomy, and 27% launched to pursue a strong vision or passion. Just 23% say they started a business to generate income after a job loss or life change.

But for most respondents, the rewards have been well worth it.

Greatest Personal Rewards of Owning a Business

• Flexibility and control over my time: 63%

• Personal growth or self-confidence: 48%

• Doing meaningful or impactful work: 38%

• Financial independence or growth: 36%

• Being able to provide for my family: 34%

• Gaining respect or recognition: 28%

• Growing savings for my family: 27%

• Creating opportunities for others: 21%

Greatest Professional Rewards of Owning a Business

• Expanding my client base or market: 42%

• Achieving revenue growth: 36%

• Successfully entering a new industry: 30%

• Launching new services or products: 21%

• Hiring a strong team: 18%

• Receiving industry recognition or awards: 16%

Best Advice for Other Aspiring Women Business Owners

When asked what they would tell other women who are starting a business, the female entrepreneurs SoFi surveyed had a lot to say. Here are some of their best tips and words of wisdom:

“Try going out on a limb to achieve your dreams. You never know what you are capable of.”

“Don’t treat your business like a hobby. Keep trying and put all your efforts into it.”

“Be strong, classy, and in control. There’s nothing you can’t do if you put your mind to it.”

“Find support from other women.”

“Know the field well. I had twenty years of experience before I started my own business.”

“Learn as much as you can from someone who is in the same field or a similar one. Shadow them if you can.”

“It’s not always a direct path. Be open to changes.”

“Don’t be afraid to ask for help.”

“Save up your own money, start small and grow, and don’t give up if you have a good concept.”

“Do your homework, make sure you have good business and financial skills, evaluate risk, and don’t depend on one major customer.”

“Be tenacious, do your research, and have a two-year plan, a five-year plan, and a 10-year plan.”

“Keep learning and asking questions as you go.”

“Do your research, stay the course, and make connections everywhere you go. You never know where you will find an opportunity.”

The Takeaway

Women business owners are entering traditionally male-dominated industries in growing numbers. On the whole, they are finding the challenge motivating, according to SoFi’s 2025 survey of female entrepreneurs. Female founders have learned how to stand out from the competition, built stronger networks, and pivoted to adapt their business model to better compete.

These women business owners are confident in their financial management skills, the survey found. That may be because they’ve been doing it since the start — for many of them, funding their business was a DIY operation. They mainly relied on personal savings and credit cards to get the money they needed to launch.

Funding methods other aspiring women business owners may want to pursue include grants and loans. It can be helpful to explore all financial options when putting a business plan into action. If you’re seeking financing for your business, SoFi is here to support you. On SoFi’s marketplace, you can shop and compare financing options for your business in minutes.

If you’re seeking financing for your business, SoFi is here to support you. On SoFi’s marketplace, you can shop and compare financing options for your business in minutes.

SoFi's marketplace is owned and operated by SoFi Lending Corp.

Advertising Disclosures: The preliminary options presented on this site are from lenders and providers that pay SoFi compensation for marketing their products and services. This affects whether a product or service is presented on this site. SoFi does not include all products and services in the market. All rates, terms, and conditions vary by provider. See SoFi Lending Corp. licensing information below.

This content is provided for informational and educational purposes only and should not be construed as financial advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SOSMB-Q325-012

Read more