A Guide to Delta-Neutral Trading Strategies

Editor's Note: Options are not suitable for all investors. Options involve risks, including substantial risk of loss and the possibility an investor may lose the entire amount invested in a short period of time. Please see the Characteristics and Risks of Standardized Options.

Table of Contents

The typical options buyer generally seeks to profit from directional price moves in an underlying asset. However, there are some traders who aim to profit from other characteristics of options, such as volatility or time decay, by using strategies like delta-neutral positioning.

To pursue these trading strategies, investors may seek to minimize the effect of price changes and create portfolios that are more sensitive to other factors. A delta-neutral strategy does this by combining positions with offsetting deltas in order to create a net delta of zero overall.

Key Points

• Delta-neutral strategies aim to balance positive and negative deltas, achieving a net delta of zero.

• These strategies can generate profits from changes in implied volatility and time decay.

• Delta-neutral positions require regular adjustments to maintain neutrality.

• A delta-neutral straddle involves purchasing both at-the-money calls and puts.

• Delta-neutral trading minimizes exposure to short-term price fluctuations while holding longer-term positions.

What Is Delta?

Delta is one of the Option Greeks and measures how much an option will change in price, given a $1 change in the price of the underlying asset. By convention, the delta of a long position in the underlying asset is always 1, while a short position has a delta of -1.

What Does Delta Neutral Mean?

Delta neutral means that a position’s value is intended to remain stable when there are small market price changes. By holding a combination of assets and options, or combinations of various call and put options, a trader can create a portfolio with an overall delta of approximately zero.

Traders use delta-neutral strategies to reduce sensitivity to price changes while aiming to benefit from shifts in implied volatility, the time decay of options, or to hedge against existing positions.

How Does Delta Neutral Function?

A portfolio’s overall delta is determined by the sum of the deltas of its individual positions. Let’s take a closer look at delta in options and securities.

Basic Mechanics

An options trader holding shares (“going long”) benefits one-for-one from increases in the stock price. The delta for long shares is typically 1.

Investors short a stock will experience losses one-for-one as the share price rises, but they will benefit in the same amount when it falls. The delta for short shares is -1.

In the options trading world, a long call option has a delta of 0 to 1, while a long put option has a delta of –1 to 0.

Deep in-the-money long call options tend to have a delta near 1. Deep out-of-the-money long call options will have a delta near 0. At-the-money long call options typically have a delta near 0.5.

Deep in-the-money long put options typically have deltas near -1. Deep out-of-the-money long puts have deltas near 0 and at-the-money long puts have deltas near -0.5.

Delta’s values are for each individual security held and need to be adjusted based on your actual holdings. If you own 200 shares of stock, the delta for this position is 200. If you own an at-the-money call options contract, the delta for this position would be 100 x 0.5, or 50, due to options representing 100 shares of the underlying asset.

If you are writing (“going short”) options, the deltas values are reversed. If you write a call option with a delta of 0.75, then the delta for the position would be -75. Similarly, the delta for shares sold short is -1 per share.

The investor must also be aware that any delta-neutral portfolio will only retain its neutrality for a short period of time and over a narrow range of asset prices. Therefore, a portfolio must be constantly adjusted to maintain delta neutrality.

An Example of Delta-Neutral in Use

A trader might employ a delta-neutral trading strategy when they are long shares of stock but are concerned about a near-term pullback in its price. Assume the trader owns 100 shares of XYZ stock at $100 per share. A long stock position has a delta of 1. Multiplied by 100 shares, the position has a total delta of approximately 100.

The goal of a delta-neutral strategy is to use a combination of calls and puts to bring the portfolio’s net delta close to 0. One possibility is to purchase at-the-money put options that have a delta of -0.5. Two of these put option contracts (each with a delta of -0.5 a share) have a total delta of approximately -100 (-0.5 multiplied x 100 shares x 2 contracts). Recall that an options contract represents 100 shares of stock.

Here, the $100 strike acts as a temporary balance point for delta neutrality. As the underlying price moves away from $100, the delta of the portfolio will shift, and may require rebalancing to maintain neutrality. This shift happens because delta itself changes as the underlying asset changes — a second-order effect known as gamma.

Combining the deltas of 100 shares together with 2 long put option contracts with a -0.5 delta yields a delta-neutral portfolio.

Stock position delta = 100 shares x delta of 1 = 100

Long put position delta = 2 contracts x 100 shares/option x delta of -0.5 = -100

Portfolio delta = stock position delta + long put position delta

Portfolio delta = 100 + (-100) = 0 or delta neutral

The net position may offer downside risk reduction by being long put options while still having exposure to upside from the long stock position. Of course, using protective puts involves premium costs that may reduce overall returns.

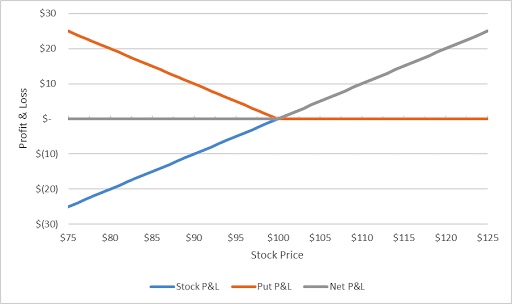

A diagram might help illustrate how delta-neutral positioning works.

Profit & Loss Diagram Using the Above Example (Not Including the Put Option Cost)

Profiting From Delta-Neutral Trading

It is possible to profit from changes other than price movements in the underlying stock. For example, an options trader can use delta-neutral strategies to seek gains from declining or rising volatility. Vega is the Options Greek that measures the sensitivity of an option’s price to changes in volatility.

Delta-neutral strategies can also be used to capture potential value from time decay or — as in the earlier example — to hedge an existing long stock position. Writing options may allow you to benefit from the effect of time decay, but there is a risk of assignment. If the underlying stock price moves significantly, the contracts could be assigned to you.

Shorting Vega

Shorting vega is a more advanced options trading strategy, used to express a bearish view on implied volatility.

You might consider shorting volatility after a period of extreme movement in the market or a single stock. The key is to short vega when implied volatility is still high and there is an expectation it may decline.

When implied volatility is high, you pay a significant premium to be long options. You may seek to capitalize on elevated premiums by selling options while still being delta neutral. The risk is that implied volatility levels continue to increase further, which can lead to losses on a short vega play. Note: delta neutrality degrades due to gamma as prices move.

Waiting for Collapse in Volatility

A short vega position relies on the implied volatility on the underlying security to drop in order to turn a profit. It might take patience for implied volatility to revert toward historical averages. To remain delta neutral, other positions might need to be added to mitigate the risk of a change in the underlying stock price.

Pros and Cons of Delta Neutral Positions

Some of the pros of crafting a delta-neutral portfolio have been highlighted, but there are potential tradeoffs and risks as well. Having to closely monitor your portfolio can be a burden, while trading costs mount as you constantly layer on or reduce hedges to keep near delta neutral.

thumb_up

Pros:

• Potential to profit from variables other than the price movement of the underlying asset

• Traders hold stock for the long run while seeking to limit the impact of near-term declines

thumb_down

Cons:

• Requires frequent trades, which may increase costs, to maintain a delta near 0

• Deltas are constantly changing, which can result in over- or under-hedging

Delta-Neutral Straddle

A delta-neutral straddle strategy uses a combination of puts and calls to keep the position’s delta near zero while having exposure to volatility changes.

For example, if XYZ stock trades at $100, and it’s at-the-money call has a delta of 0.5 and it’s at-the-money put has a delta of -0.5, a trader might buy both options to establish a neutral position and then sell them if implied volatility increases. With this delta-neutral long straddle strategy, your delta is effectively 0 but you are long volatility.

A delta-neutral short straddle is an options trade that aims to benefit from limited price movement and a decline in implied volatility. The short straddle, as the inverse of the long straddle, may be used when implied volatility is expected to decrease.

Other options trading strategies that may benefit from volatility and time decay include calendar spreads, diagonal spreads, iron butterflies, and iron condors, among others.

The Takeaway

Building and maintaining a delta-neutral portfolio can be a challenging task, but the potential to benefit from time decay and volatility shifts may make it worthwhile.

Delta-neutral trading can also help reduce exposure to short-term declines while allowing investors to hold stock for the long-term.

SoFi’s options trading platform offers qualified investors the flexibility to pursue income generation, manage risk, and use advanced trading strategies. Investors may buy put and call options or sell covered calls and cash-secured puts to speculate on the price movements of stocks, all through a simple, intuitive interface.

With SoFi Invest® online options trading, there are no contract fees and no commissions. Plus, SoFi offers educational support — including in-app coaching resources, real-time pricing, and other tools to help you make informed decisions, based on your tolerance for risk.

FAQ

How do you make money with a delta-neutral strategy?

You may profit from a delta-neutral option strategy when there are changes in a stock’s variables beyond its share price. Changes in implied volatility can present opportunities to go long or short volatility while being agnostic to the stock price’s change. You can also benefit from time decay by selling options while being delta neutral.

What is a delta-neutral strike?

A delta-neutral strike refers to the price at which a portfolio is precisely balanced. In practice, this is an approximation rather than an exact level. As the underlying asset price moves, delta may shift away from zero; it will take additional hedging trades to get back to delta neutral.

How can you calculate the value of your delta-neutral position?

To calculate your position’s delta, multiply each security’s delta by your position size. For example, one call option contract with a delta of 0.75 has a delta of 75 (0.75 x 100 options per contract). Being long 100 shares of stock with a delta of 1 has a delta of 100 (1 x 100 shares).

You combine the deltas of all positions in your portfolio to determine your overall delta. At that point, you may trade options to make your portfolio delta neutral.

Photo credit: iStock/Delmaine Donson

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Options involve risks, including substantial risk of loss and the possibility an investor may lose the entire amount invested in a short period of time. Before an investor begins trading options they should familiarize themselves with the Characteristics and Risks of Standardized Options . Tax considerations with options transactions are unique, investors should consult with their tax advisor to understand the impact to their taxes.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOIN-Q225-074

Read more