How Much of Your Paycheck Should Go to Savings?

Table of Contents

Financial experts typically advise people to save at least 10% to 20% of their salary, but recent GOBankingRates research reveals that 34% of Americans aren’t putting a cent of their paycheck into savings. Almost the same percentage saves less than 10% of their earnings.

Whether you are on track with your savings plans or struggling to get started, this guide can help. You’ll learn more about how much of your paycheck you should stash away and toward which goals, plus tactics for prioritizing savings.

Key Points

• Financial experts recommend saving at least between 10% and 20% of your salary, with 20% being a common figure.

• The 50/30/20 rule suggests allocating 20% of your take-home income to savings, including retirement, short-term savings, and other goals, such as debt repayment beyond the minimum due.

• The amount to save from each paycheck depends on factors like goals, current income, and living expenses.

• Saving for an emergency fund, retirement, and other goals are important savings objectives.

• Cutting spending, automating savings, and choosing the right savings account can help increase savings.

What Percentage of Your Paycheck Should You Save?

When it comes to what percentage of income to save for future expenses, financial advice can vary depending on where you look. Some experts suggest saving as little as 10% of each paycheck, while others might suggest 30% or more.

For some people who are living paycheck to paycheck, the amount may be lower still. It may be wiser to simply come up with a set amount (say, $25 to $50) to deposit into savings in your bank account.

Rules of Thumb

According to the popular 50/30/20 rule of budgeting, 50% of your take-home income should go to essentials (or needs), 30% to nonessentials (or wants), and 20% to saving for future goals (including debt repayment beyond the minimum).

The right amount for you to save from each paycheck will depend on your income, your fixed expenses, as well as your short- and long-term financial goals.

If, for instance, you are a recent grad living at home for a while and your living expenses are very low, you may be able to save a much higher percentage for the time being.

Or, if you have a sizable credit card balance, you might pump money toward paying that off. In this situation, you might minimize or even pause the amount saved while getting that debt eliminated.

Calculating Percentages From Your Paycheck

To figure out how much to save from each paycheck, you’ll need to consider a few factors. The right amount will depend on your income, your fixed expenses, as well as your short- and long-term financial goals.

• For example, if the cost of living is high in your state or local area, you may need to spend more than half of your take-home pay on living expenses, making it hard to put 20% of each paycheck into savings.

• On the other hand, if your goal is to buy a home in two years, you may need to put more than 20% percent of your paycheck into savings in order to have your down payment in that timeline. (Keep reading for tips on how to save more.)

• If you want to retire early, you may need to put more of your income toward retirement every month than the average worker.

Recommended: 50/30/20 budget calculator

Increase your savings

with a limited-time APY boost.*

4 Important Savings Goals to Work Toward

Having a few specific goals in mind can help you determine how much to save from each paycheck as well as motivate you.

Here are some common savings goals that can help you build financial wellness.

1. Emergency Fund

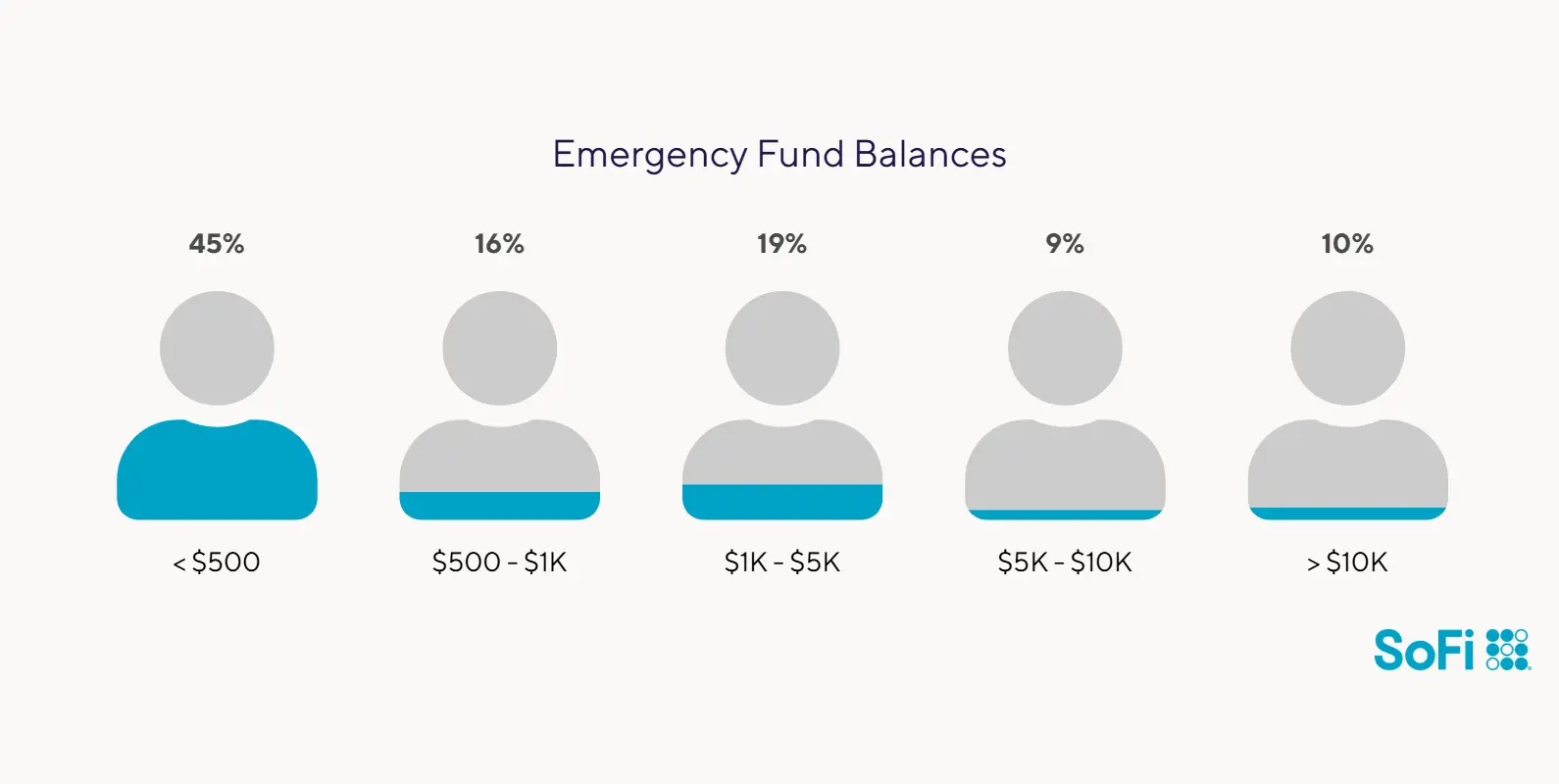

Yes, it can be hard to save money, but one of the most important priorities is to sock away money (even if just a little) regularly into an emergency fund. In SoFi’s April 2024 Banking Survey of 500 U.S. adults, 77% of respondents with a savings account said they use the account to save for emergencies.

Source: SoFi’s April 2024 Banking Survey

An emergency fund is a bundle of easily accessible cash that could help you handle a financial curveball, such as a job loss, medical emergency, or big ticket car or home repair. Ideally, an emergency fund will contain enough money to cover your living expenses for three to six months, so you don’t wind up with credit card debt.

• If you are married with an employed spouse and with no children, for example, you may only need to cover three months’ worth of expenses.

• If you have kids or you’re single, you may want to have an emergency fund that could cover more than six months’ worth of expenses.

Recommended: Emergency Fund Calculator

2. Paying Off High-Interest Debt

Another important thing you could consider doing with your savings is paying off any high-interest debt (or “bad” debt) you may have. Typically, this is credit card debt, which currently has an average rate of well over 20%.

• One debt payoff strategy is the debt snowball method. You start by paying off the debt with the smallest balance and put all your extra payments toward that until it’s paid off (while continuing to pay the minimum on your other debts).

You then put extra payments toward the debt with the next highest balance, and so on. This can give you a sense of accomplishment which can help motivate you to continue your aggressive repayment.

• Another approach is the debt avalanche method, putting all your extra payments toward the debt with the highest interest rate, while paying the minimum on the others.

When that debt is paid off, you then focus on the debt with the next-highest interest rate. This strategy can be the most cost-effective method.

3. Saving for Retirement

Another reason why saving money is important: It can secure your future by providing for your retirement. Exactly how much of your paycheck should go to retirement savings will depend on your age and when you want to retire. Some pointers:

• If your company offers a 401(k) with matching contributions, it can make sense to put aside at least as much of your paycheck as your company will match (since this is essentially free money).

• If you don’t have access to a 401(k) or want to contribute beyond that fund, you may want to open a Roth or Traditional IRA. Both types of IRAs have different tax benefits.

• When you invest in a Roth IRA, the money is taxed at the time of contribution but then in retirement, you can withdraw it tax-free. Contributions made to a traditional IRA might not be taxed at the time they are made but are taxed when they are withdrawn in retirement.

When choosing how much of your paycheck to put into retirement savings, you may want to keep in mind that the IRS sets restrictions on how much you can contribute to your retirement funds each year. IRS retirement guidelines are published and updated regularly.

4. Saving for Other Goals

After establishing plans for debt repayment, an emergency fund, and retirement savings, you may also want to consider working toward your other financial goals, like buying a house, saving for your kids’ future education, or affording a great vacation.

When you’re saving for a big purchase, you can start by determining how much money you’ll need and when you want to have the money. You can then break that dollar amount down into the amount you need to save each year and each month.

Strategies for Increasing Your Savings Rate

If you want to ramp up your savings, here are a couple of strategies that can pay off.

Automating Your Savings

Also known as paying yourself first, automating your savings involves setting up recurring payments or transfers into an account where the money won’t be spent and can earn interest. You might have a portion of your direct-deposit paycheck go straight into savings, or you could have a set amount whisked from checking into savings every pay day.

Read on for ideas about which kind of account is best for your savings.

Adjusting Your Budget

If you need to save more, take a closer look at your budget. Checking in with your budget is an important way to stay in control of your money. You may see patterns that you can address to maximize your savings. For example, did your wifi provider raise costs or have your property taxes increased year over year?

Once you size up your situation, you can take the right next steps, such as reducing costs (see below), finding a budget that works better for you, or using tech tools, such as money trackers, to manage your money more effectively.

Recommended: How to Make Money From Home

Reducing Your Costs to Save More

You can help ramp up your savings by cutting your spending. Here are some ideas:

• Review your monthly bills and see if there’s anything you can cut. You might have signed up for a couple of subscriptions and then forgotten about them, or you might see that your restaurant spending is surging lately.

• Learn how to save on food. You might try planning your meals weekly, so nothing goes to waste; joining a warehouse or wholesale club to lower your grocery bill; and using coupons and discount codes to downsize your food costs.

• Bundle up: If you get your auto and home (or renters) insurance from one provider, you may save on your premiums.

• Fight off FOMO spending (fear of missing out). Just because your friends are upgrading to a luxury car or a social media influencer is frolicking on the French Riviera, that doesn’t mean you have to too.

• Pause, for a day or a month, before making pricey impulse buys to make sure you really and truly want or need them. Try a 30-day spending rule to eliminate impulse buys. It involves waiting 30 days to make an unplanned purchase; the urge to buy may vanish in that time period.

• Pay in cash. Plastic, whether a credit or debit card, can make it easy to overspend. If you take out the cash you need for the week ahead and use only that to pay for purchases, you may be able to rein in your purchasing.

• Use budgeting tools to help stay on track. Twenty-three percent of people in SoFi’s survey use budgeting tools offered by their bank, and 20% have knowingly used AI to manage their budget or finances.

Where to Put Your Savings

Once you’ve committed to saving money, you’ll have some options about where to keep it.

High-Yield Savings Account

A high-yield savings account pays a significantly higher interest rate than a standard account. As of mid-2025, the average savings account earned 0.38% interest while some high-yield savings accounts were paying 4.00% or more.

These accounts are often found at online banks vs. traditional ones. Just be sure to read the fine print and make sure you are aware of and comfortable with any account fees or minimums that might be involved. These accounts allow for easy access to your money when needed.

Certificate of Deposit (CD)

A certificate of deposit (CD) is an account in which you commit to keeping your money at the bank for a specific term and you know what rate you will earn. Typically, there is a penalty for early withdrawal. The terms for CDs can range from a few months to several years, so you can pick what works best for you. Longer terms will often have higher interest rates.

Investment Options for Long-Term Savings

Longer-term savings goals, meaning five or 10 years or longer (such as your retirement savings) can involve investing, since you’ll likely have more time to ride out the ups and downs of the markets.

For college savings, you may want to consider opening a 529 savings plan.

Test your understanding of what you just read.

The Takeaway

Many financial experts and budgeting methods recommend putting 20% or more of your salary into savings, but that may not fit your needs. Consider your savings goals, your financial situation, and other factors to find the right figure and the right tactics to help you stash the right amount of cash. Also consider where to keep your savings: A higher rate of interest can help your money grow and work harder for you over time.

Interested in opening an online bank account? When you sign up for a SoFi Checking and Savings account with eligible direct deposit, you’ll get a competitive annual percentage yield (APY), pay zero account fees, and enjoy an array of rewards, such as access to the Allpoint Network of 55,000+ fee-free ATMs globally. Qualifying accounts can even access their paycheck up to two days early.

FAQ

Is saving 10% of my paycheck enough?

Most financial experts advise saving between 10% and 30% of your salary, with 20% being a common figure. Based on this, 10% is an adequate amount for some, but if you can ramp that up in the future, so much the better.

Is 20% of your salary enough to save?

According to the 50/30/20 budget rule, saving 20% of your salary is a good goal to have; that’s the 20 in the name of the guideline. This amount can then be divided to address different needs, such as saving for the down payment on a house, for your child’s college education, and for retirement. However, for some people, 20% won’t be enough if, say, you have a large family to support.

How much of a $1,000 paycheck should I save?

Typically, financial experts recommend saving between 10% and 30% of your paycheck, with 20% being a good figure to aim for. For $1,000, that would mean between $100 and $300, with $200 being the 20% figure. However, if you are earning a lower salary and money is tight, it would be understandable if you save less until your salary increases.

How much should you save if you don’t have a regular paycheck?

If you don’t have a regular paycheck, it can be especially important during high-earning periods to save at least 20% of your pay. Also aim for at least six to 12 months’ worth of living expenses in your emergency fund. This can be a good cushion during the off-season (if you have a seasonal business) or you lose a steady gig.

How can I save money if I live paycheck to paycheck?

If you’re living paycheck to paycheck, saving is still important. Review your fixed expenses and see what cuts you can make to free up funds for your emergency savings account and other goals. Put in the time to find a budget that works for you, and stash any money windfalls (such as a tax refund or unexpected gift of cash) into your savings. You might also sell your unwanted but still useful items to raise some cash for your savings.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

Annual percentage yield (APY) is variable and subject to change at any time. Rates are current as of 12/23/25. There is no minimum balance requirement. Fees may reduce earnings. Additional rates and information can be found at https://www.sofi.com/legal/banking-rate-sheet

Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network every 31 calendar days.

Although we do our best to recognize all Eligible Direct Deposits, a small number of employers, payroll providers, benefits providers, or government agencies do not designate payments as direct deposit. To ensure you're earning the APY for account holders with Eligible Direct Deposit, we encourage you to check your APY Details page the day after your Eligible Direct Deposit posts to your SoFi account. If your APY is not showing as the APY for account holders with Eligible Direct Deposit, contact us at 855-456-7634 with the details of your Eligible Direct Deposit. As long as SoFi Bank can validate those details, you will start earning the APY for account holders with Eligible Direct Deposit from the date you contact SoFi for the next 31 calendar days. You will also be eligible for the APY for account holders with Eligible Direct Deposit on future Eligible Direct Deposits, as long as SoFi Bank can validate them.

Deposits that are not from an employer, payroll, or benefits provider or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, Wise, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g., IRS tax refunds), do not constitute Eligible Direct Deposit activity. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. SoFi Bank shall, in its sole discretion, assess each account holder's Eligible Direct Deposit activity to determine the applicability of rates and may request additional documentation for verification of eligibility.

See additional details at https://www.sofi.com/legal/banking-rate-sheet.

*Awards or rankings from NerdWallet are not indicative of future success or results. This award and its ratings are independently determined and awarded by their respective publications.

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Bank Fee Sheet for details at sofi.com/legal/banking-fees/.

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

SOBNK-Q225-107