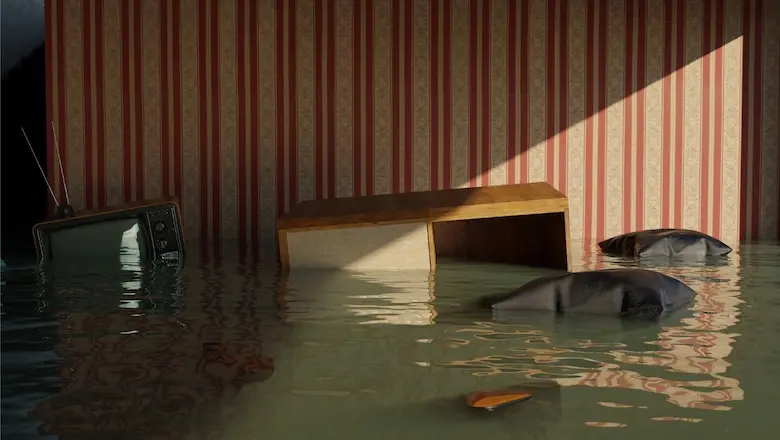

Does Renters Insurance Cover Water Leak Damage? Everything You Need to Know

If water suddenly damages your stuff — like from a frozen pipe or an accidental washing machine overflow — your renters insurance might help pay to repair or replace everything, depending on your policy limits.

But not all water damage is treated the same by insurers. Whether your policy kicks in typically depends on whether the water damage was sudden and accidental or the result of long-term neglect.

Here, we’ll break down what renters insurance usually covers when it comes to water damage, what’s often excluded, and how to protect your belongings when leaks strike.

Key Points

• Renters insurance covers water damage from sudden and accidental events, like burst pipes or storms.

• Gradual damage, negligence, and flooding or mudslides are typically excluded.

• Protect your belongings by relocating undamaged valuables or furniture away from the impacted area to prevent further damage.

• Prevent water damage by checking for leaks, ensuring appliance integrity, and avoiding unattended running water.

• Filing a claim involves stopping water flow, notifying the landlord, documenting damage, and contacting the insurance company.

Understanding Water Damage and Renters Insurance

Renters insurance is designed to protect you and your belongings from the unexpected and help you recover financially from covered events. If water damages your personal property, your policy may help pay you repair or replace it, depending on how the damage happened.

Let’s say a sprinkler malfunctions and ruins your TV or frozen pipes damage your clothes. In both cases, your insurer may cover the loss, up to your policy limits, after the renters insurance deductible is paid.

Renters insurance can also help if water damage makes your place temporarily unlivable. Most policies include loss of use coverage, which can help pay for extra living expenses, like hotel stays or meals, while your home is being repaired. So if a covered water incident forces you to live somewhere else during the repairs, your insurance may help cover the costs.

Recommended: Does Renters Insurance Cover Displacement?

Coverage for Common Water Damage Scenarios

As we mentioned, renters insurance typically covers water damage, though it depends on how the damage happened. In general, your policy might help pay for damage in situations like:

• Burst or frozen pipes: If a pipe suddenly cracks or bursts (especially in winter), your belongings might be covered — as long as you made a reasonable effort to keep your home heated.

• Water damage from putting out a fire: Whether from the building’s sprinkler system or a fire hose, your policy may help cover items that got damaged by the water.

• Storm-related water damage: Heavy rain or hail that causes leaks or water to seep in may be covered. The same may be true if a tree falls on your roof or high winds cause damage.

• Overflow or accidental leak of steam or water: If your washing machine breaks, an air conditioner leaks, or the sprinkler system goes off and soaks your furniture or electronics, your policy might help pay to replace those items.

Just remember, renters insurance usually doesn’t cover the systems or appliances that caused the damage. It only covers the damage they caused to your belongings.

Exclusions and Limitations in Water Damage Coverage

Even though your renters insurance may cover certain types of water damage, there are limits and exclusions to keep in mind.

• Personal property coverage limits: Your policy will only pay up to your insurance cap (usually between $10,000 and $100,000) for damaged items like clothes, furniture, and electronics. If, for example, a sprinkler malfunctions and ruins your wardrobe, and you only have $10,000 in coverage, that’s the maximum amount you’d get reimbursed after your deductible.

• Sub-limits for certain valuables: Insurance companies typically apply sub-limits to specific items, such as furs, jewelry, and money. For example, even with $10,000 in coverage, your insurer might only pay up to $1,000 for jewelry or watches. That means if your $2,000 watch is damaged, you’d only get half of that back.

• Additional living expenses cap: Loss of use coverage, which pays for expenses like hotel stays or meals if your rental becomes unlivable, is also capped. It’s typically either a flat amount, between $3,000 to $5,000, or a percentage of your total personal property limit.

Here are some other common policy exclusions you should know about:

• Gradual damage: If water damage occurs slowly over time, such as a leak under the sink that goes unnoticed or mold caused by poor ventilation, your policy typically won’t cover it. Remember that renters insurance doesn’t cover normal wear and tear.

• Negligence: If the damage occurs because you didn’t take reasonable steps to prevent it — such as leaving a faucet running or failing to report a leak — your insurer may deny the claim.

• Broken systems: While your policy may cover the damage caused by a broken appliance, like a leaking fridge, it typically won’t cover the cost to repair or replace the appliance itself.

• Flooding and mudslides: Standard renters insurance doesn’t cover flood or earth movement damage from things like heavy rain, rising rivers, mudslides, or storm surges. For that, you’d need a separate flood and earthquake insurance policy.

• Sewer or drain backups: Water damage from a backed-up drain or toilet usually isn’t covered unless you’ve added optional water backup coverage to your policy.

Preventing Water Leaks in Your Rental Home or Apartment

There are times when water can wreak havoc on your home. Fortunately, there are also plenty of simple ways you can help prevent water damage in your home:

• Look for leaks: Watch for dripping faucets or pipes.

• Check appliances: Make sure your washing machine and dishwasher aren’t leaking and that the hoses are in good condition.

• Prevent overflows: Don’t leave running water or appliances unattended. Also, try not to overfill tubs or sinks.

• Be smart about storage: Keep valuables off the floor and store important items in waterproof containers, especially in areas of your rental that could flood.

• Read your lease: Check your lease for any rules about water damage so you know what you’re responsible for.

Recommended: Landlord vs. Tenant Insurance Responsibility

What to Do If You Discover Water Leak Damage

If you notice signs of water damage in your rental, like puddles, water stains, or a sudden drop in water pressure, it’s important to act quickly to help prevent even more damage and protect your belongings. Here are some steps you can follow:

1. Stop the water flow (if safe to do so): If you can safely access the water source, shut off the main valve or the valve near the leaking appliance to stop more water from coming in. If you’re unsure how to do this or it seems risky, contact your landlord for assistance.

2. Contact your landlord: Let your landlord or property manager know about the water leak as soon as possible, since many leases require you to report maintenance issues promptly. The sooner they know, the faster they can send someone to inspect and fix the problem. Also, it helps protect you from being held responsible for additional damage.

3. Take clear photos and videos of the water damage: This can include snapping pictures and videos of your belongings and any areas of the home that were damaged. This can help streamline your renters’ insurance claim.

4. Contact your renters insurance company: Reach out to your insurance company to start the claims process. If your agent isn’t available right away, follow up during business hours to make sure someone is actively helping you manage the claim.

5. Protect your belongings: Relocate any undamaged valuables or furniture away from the impacted area so more of your things don’t get destroyed.

The Takeaway

Does renters insurance cover water leak damage? Maybe, but only if it results from a covered event, like a broken pipe or an unexpected appliance leak. Since coverage often comes with limits and exclusions, it’s a good idea to review your policy and ask your insurer what’s actually covered.

Keep in mind that renters insurance generally protects your belongings and may help with temporary living expenses if your place becomes unlivable. But it doesn’t cover damage to the rental unit itself. That’s typically your landlord’s responsibility. So alert them right away if you notice any issues and follow up to ensure repairs are being handled.

Looking to protect your belongings? SoFi has partnered with Lemonade to offer renters insurance. Policies are easy to understand and apply for, with instant quotes available. Prices start at just $5 per month.

FAQ

If a pipe bursts, is my damaged furniture covered?

If a pipe breaks and your furniture gets damaged, your renters insurance may cover it — as long as the broken pipe is considered a covered event under your policy. Keep in mind that the payout will depend on your coverage limits and deductible.

Does renters insurance cover damage to the apartment walls or floors?

No, renters insurance doesn’t cover the structure of the apartment, including things like walls, floors, and ceilings. Generally speaking, renters insurance only covers your personal belongings, so if a leak damages your furniture or electronics, your policy may help pay to repair or replace those items, up to your coverage limits. Your landlord is usually responsible for insurance for the structure of your apartment or unit.

Is damage from a slow, gradual leak covered?

Typically, renters insurance is meant to cover sudden, unexpected events — not damage that happens over time due to lack of maintenance. For example, if a leak slowly develops under your sink and causes damage, it’s typically not covered. On the other hand, if a storm cracks a window and water gets in, damages might be covered.

What about water damage from an overflowing toilet or washing machine?

The answer ultimately depends on the details of your policy. Damage from an overflowing washing machine is often covered, since it’s usually considered a sudden accident. But if the overflow is due to a sewer or drain backup, your policy may only help if you’ve added extra water backup coverage.

Does renters insurance pay for hotels if a leak makes my apartment unlivable?

Yes, renters insurance may help cover hotel costs if a covered water incident makes your apartment temporarily unlivable (think roof damage from a storm). This is known as loss of use coverage, and it can help pay for things like hotel stays, meals, and other extra living expenses while repairs are being made. But keep in mind, this coverage usually has a limit.

photo credit: iStock/BrilliantEye

Auto Insurance: Must have a valid driver’s license. Not available in all states.

Home and Renters Insurance: Insurance not available in all states.

Experian is a registered trademark of Experian.

SoFi Insurance Agency, LLC. (“”SoFi””) is compensated by Experian for each customer who purchases a policy through the SoFi-Experian partnership.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOPRO-Q225-047

Read more