What Is the Minimum Down Payment for an FHA Loan?

Saving up for a down payment is a common challenge for many prospective homebuyers. FHA loans allow qualifying borrowers to put as little as 3.5% down on a property, helping lower the barriers to homeownership for many.

With an FHA loan, borrowers may also be eligible for down payment assistance. But there are other out-of-pocket expenses to keep in mind when considering an FHA loan. Let’s take a closer look at FHA loan down payment requirements and how much money you’ll need to get to the closing table.

What Is an FHA Loan?

An FHA loan is a type of mortgage that’s issued by a lender, such as a bank or credit union, but insured by the Federal Housing Administration (FHA). The purpose of the FHA mortgage program is to make homeownership more affordable for low- to moderate-income buyers.

Since FHA loans are government-insured, they offer more flexible eligibility requirements for borrowers who might not qualify for a conventional home loan. FHA loans have lower minimum down payment and credit score requirements, making them popular with first-time homebuyers and applicants with limited savings or poor credit. Compared to conventional mortgages, FHA loan interest rates are typically lower, but will vary depending on the lender and on the borrower’s credit score and finances.

💡 Quick Tip: Buying a home shouldn’t be aggravating. SoFi’s online mortgage application is quick and simple, with dedicated Mortgage Loan Officers to guide you through the process.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

FHA Loan Income Requirements

There aren’t any minimum or maximum income requirements to qualify for an FHA loan. However, there may be income limits for borrowers receiving down payment assistance through a state or local program.

In any case, lenders will look at an applicant’s ability to manage monthly mortgage payments and ultimately repay the FHA loan. Besides savings and assets, lenders assess an applicant’s debt-to-income (DTI) ratio, which measures the percentage of monthly income that goes toward debt payments. A lower DTI ratio is typically viewed as favorable. Depending on the lender, borrowers can get an FHA loan with a DTI ratio of up to 50%. In comparison, conventional loans typically require a DTI ratio of 43% or less.

Recommended: How Much is a Down Payment?

What Is the Down Payment Required for an FHA Loan?

Down payments are calculated as a percentage of the home purchase price. Historically, lenders looked for buyers to put down one-fifth of a home’s purchase price upfront. But you no longer always need to put down 20% on a house. The minimum down payment percentage for FHA loans depends on a borrower’s credit score.

The average down payment on a house in the U.S. was 13% in 2022. But with an FHA loan, borrowers with a credit score of 580 or more may qualify for a down payment of 3.5% of the home purchase price. Those with credit scores between 500 and 579 will need to put 10% of the home price towards a down payment. For a $400,000 house, this translates to $14,000 for a 3.5% down payment and $40,000 for a 10% down payment.

💡 Quick Tip: Generally, the lower your debt-to-income ratio, the better loan terms you’ll be offered. One way to improve your ratio is to increase your income (hello, side hustle!). Another way is to consolidate your debt and lower your monthly debt payments.

What Other Cash Will I Need to Close?

Besides the down payment, the remaining amount you need to close on a house will depend mainly on the home’s purchase price. Taking out an FHA loan requires paying an upfront mortgage insurance premium (MIP) of 1.75% of the loan total. It may be possible to roll this cost into the loan, which would increase the loan principal and monthly payment amount.

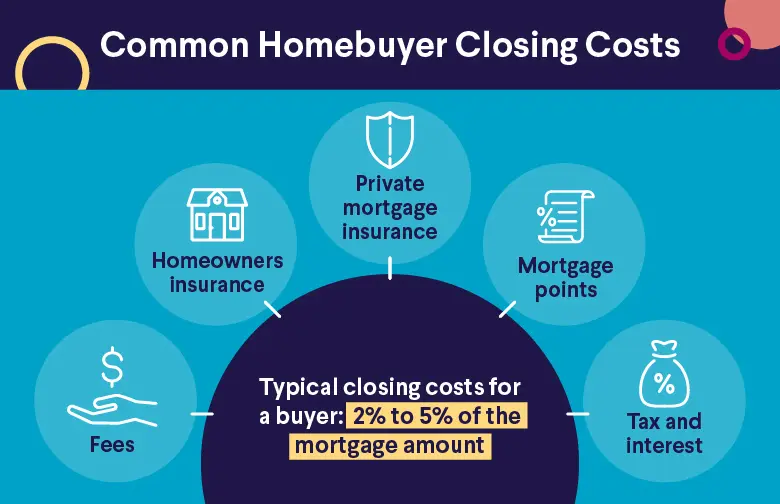

Buyers will also be on the hook for FHA loan closing costs, which typically range from 2% to 5% of the home’s purchase price. Borrowers can potentially avoid the upfront expense by rolling closing costs into an FHA loan. By financing closing costs, borrowers will pay a portion of the costs each month, plus interest. Note that financing closing costs can increase a borrower’s DTI ratio and potentially impact their ability to qualify for an FHA loan.

An alternative option to cover closing costs would be to ask for seller concessions. FHA loans allow the seller to contribute up to 6% of the home value for closing costs as a seller concession.

Recommended: What Do You Need to Buy a House?

How to Save for an FHA Loan Down Payment

Understanding how much house you can afford is a useful place to start to determine your housing budget and savings goal. Using an FHA loan mortgage calculator can help crunch the numbers to determine your down payment and monthly payment based on different loan terms. Not sure you will choose an FHA loan? Use a home affordability calculator to determine how much house you can afford.

With a savings goal in mind, calculate how much you can set aside each month after paying for debts and expenses. Consider cutting discretionary spending, such as dining out and travel, to increase monthly savings.

Buyers can also get the money they need for an FHA down payment in the form of a gift from family, friends, employer, charitable organization, or government program. Gifted funds need to be accompanied by a gift letter to show the lender that the money is going toward the down payment and doesn’t need to be repaid.

Is Down Payment Assistance Available for FHA Loans?

Borrowers who can’t afford a down payment on an FHA loan may be eligible for financial assistance. Down payment assistance can come in several forms, including grants and forgivable loans. These programs are available through local, state, and federal government programs, as well as nonprofit organizations.

Most down payment assistance programs are geared towards first-time buyers. They may include additional eligibility requirements, such as income limits and participation in homebuyer education courses. Consult a list of first-time homebuyer programs and loans to see what you might be eligible for. If it has been more than three years since you have owned a home, you may qualify for first-time homebuyer status.

Additional Cost Considerations for FHA Loans

In addition to the upfront costs of a down payment, closing costs, and MIP, there are other expenses to plan for.

The MIP includes an additional annual fee besides the 1.75% that’s required for closing. Annual payments range from 0.15% to 0.75% depending on the loan terms and loan-to-value ratio. The total annual cost is divided by 12 and spread out across the monthly payments in a given year. Note that MIP usually spans the life of the FHA loan unless a borrower refinances.

Depending on the property location, borrowers may also need to pay for flood insurance to get an FHA loan.

Pros and Cons of an FHA Loan

FHA loans are popular for their lower down payment mortgage requirements, but they’re not for everyone. Here are some advantages and drawbacks to consider when comparing home mortgage loan options.

Pros:

• Smaller down payments

• More lenient credit score requirements

• No income limits

• Can finance closing costs

Cons:

• Required to pass an inspection and appraisal

• Must be used for a primary residence.

• Loan limits of $472,030 to $1,089,300 for a single-family home, depending on the cost of living by state.

• Can require an inspection and stricter standards for the condition of the property.

The Takeaway

What is the minimum down payment for an FHA loan? Borrowers with credit scores of 580 or more can put just 3.5% down, while those with scores between 500 to 579 need to put 10% toward a down payment. The combination of lower minimum credit score and low down payment make FHA loans one attractive option for first-time homebuyers.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

What is the lowest down payment for an FHA loan?

The lowest down payment for an FHA loan is 3.5% of the loan amount. Borrowers can explore down payment assistance programs to help cover the cost.

What is the down payment for an FHA loan 2023?

The down payment for an FHA loan in 2023 ranges from 3.5% to 10% depending on the borrower’s credit score.

What will disqualify you from an FHA loan?

Borrowers could be disqualified from an FHA loan based on a high debt-to-income ratio, poor credit, or insufficient funds to pay for the down payment, closing costs, and monthly mortgage payment.

Photo credit: iStock/Edwin Tan

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

¹FHA loans are subject to unique terms and conditions established by FHA and SoFi. Ask your SoFi loan officer for details about eligibility, documentation, and other requirements. FHA loans require an Upfront Mortgage Insurance Premium (UFMIP), which may be financed or paid at closing, in addition to monthly Mortgage Insurance Premiums (MIP). Maximum loan amounts vary by county. The minimum FHA mortgage down payment is 3.5% for those who qualify financially for a primary purchase. SoFi is not affiliated with any government agency.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SOHL1023257

Read more