What Is the Monthly Cost of a $300,000 Mortgage?

For the average American, no single expense is as large as the cost of purchasing a home. Because the price is so high, a mortgage is usually necessary. And in most cases, a home purchase requires a down payment plus monthly mortgage payments.

What you’ll pay each month on a $300,000 mortgage will depend on several factors, such as the interest rate and mortgage term. These numbers will differ for everyone, so you must do some math to know your monthly cost, and it’s important to consider the total cost of a home purchase as well.

Table of Contents

Key Points

• The monthly cost of a $300,000 mortgage includes principal, interest, property taxes, and homeowners insurance.

• Factors such as interest rate, loan term, and location will determine the exact monthly cost.

• Using a mortgage calculator can help estimate the monthly cost of a $300,000 mortgage.

• It’s important to consider additional expenses like maintenance and utilities when budgeting for homeownership.

• Getting pre-approved by a lender can provide a clearer understanding of the monthly cost of a $300,000 mortgage.

Total Cost of a $300K Mortgage

There is more than one element to the total cost of a $300,000 mortgage. It can be a lot to take in, especially for first-time homebuyers. However, we can generally break the total costs of buying a home into upfront and long-term costs.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

Upfront Costs

Even in the beginning stages of your home purchase, there are some costs you will have to pay. Upfront costs of a home purchase include:

• Earnest money: Earnest money is also known as a good faith deposit. This is a sum of money you put down to show a seller you are serious about buying their home.

• Down payment: When you buy a home, you typically must pay a portion of the home price upfront, known as a down payment. While down payments can be up to 20% of the home price, they are often a much lower percentage. How much you put down upfront can impact your mortgage rate and thus your monthly costs.

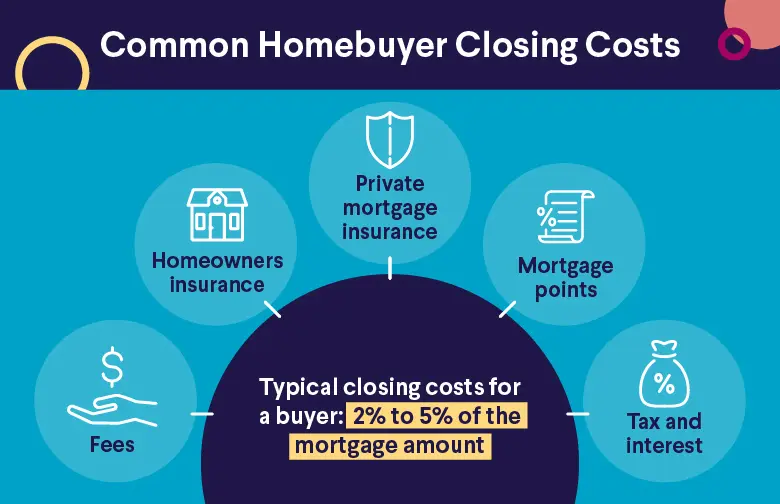

• Closing costs: Closing costs cover administrative activities involved in buying a home, such as the cost of an appraisal, lender’s fees, and a charge to record the property transfer.

Long-Term Costs

Most of the money you spend on your home will probably be long-term costs. Your monthly mortgage payment will likely be the biggest of these. The monthly payment you make against the loan you obtained to purchase the home will cover the principal plus interest. Some other long-term costs are:

• Property taxes: In most cases, you must pay taxes on your home. These can be significant, often totaling thousands of dollars annually.

• Home maintenance: Homes usually require ongoing maintenance, and these costs can be more variable than other ongoing costs.

• HOA Fees: Some homes, such as townhouses and condos, may have an ongoing homeowners association fee to cover landscaping, pools, and general maintenance.

Estimated Monthly Payments on a $300K Mortgage

The monthly payment on a $300,000 mortgage depends on your down payment, annual percentage rate (APR), and term. You must factor each into the equation to estimate your monthly mortgage payment.

For example, suppose you secure a 30-year fixed $300K mortgage at 4.5% APR. In this case, the monthly payment would be $1,520. On the other hand, if you have a 15-year fixed $300K mortgage at 4% APR, the monthly payment would be $2,219. As you can see, APR and terms can have a big impact on your monthly mortgage payment.

Monthly Payment Breakdown by APR and Term

A monthly $300K mortgage payment amount can vary widely, even if you know you will have a $300,000 loan. Use a mortgage calculator to estimate your monthly payment. Here are a few examples of how these calculations may vary depending on the APR and term:

| APR | 15-year term | 30-year term |

|---|---|---|

| 3.00% | $2,072 | $1,265 |

| 3.50% | $2,145 | $1,347 |

| 4.00% | $2,219 | $1,432 |

| 4.50% | $2,295 | $1,520 |

| 5.00% | $2,372 | $1,610 |

| 5.50% | $2,451 | $1,703 |

| 6.00% | $2,532 | $1,799 |

| 6.50% | $2,613 | $1,896 |

How Much Interest Is Accrued on a $300K Mortgage?

The amount of interest you accrue on a $300,000 home mortgage loan will, again, depend on several factors. However, the most important factors are the mortgage term and APR. When comparing two 30-year mortgages, the one with a lower APR usually accrues less interest. When comparing 15-year vs. 30-year terms with the same APR, the 15-year term will generally accrue less interest.

For instance, a 15-year mortgage with a 3.0% interest rate results in a total of $72,914 of interest over the life of the loan. Meanwhile, a 30-year mortgage with a 6.0% interest rate results in $347,515 of interest. There are also different types of mortgage loans, which can affect how much you ultimately pay.

$300K Mortgage Amortization Breakdown

As we have observed, APR and term significantly impact the interest you pay. However, the term can also affect how much you pay per month. The following table breaks down the amortization schedule of a 30-year $300,000 loan with a 5.0% APR:

| Year | Beginning balance | Interest paid | Principal paid | Ending balance |

|---|---|---|---|---|

| 1 | $300,000.00 | $14,899.49 | $4,426.03 | $295,573.90 |

| 2 | $295,573.90 | $14,673.04 | $4,652.48 | $290,921.36 |

| 3 | $290,921.36 | $14,434.99 | $4,890.53 | $286,030.78 |

| 4 | $286,030.78 | $14,184.78 | $5,140.74 | $280,890.00 |

| 5 | $280,890.00 | $13,921.77 | $5,403.75 | $275,486.20 |

| 6 | $275,486.20 | $13,645.31 | $5,680.21 | $269,805.93 |

| 7 | $269,805.93 | $13,354.71 | $5,970.81 | $263,835.05 |

| 8 | $263,835.05 | $13,049.20 | $6,276.32 | $257,558.68 |

| 9 | $257,558.68 | $12,728.10 | $6,597.42 | $250,961.21 |

| 10 | $250,961.21 | $12,390.57 | $6,934.95 | $244,026.19 |

| 11 | $244,026.19 | $12,035.76 | $7,289.76 | $236,736.37 |

| 12 | $236,736.37 | $11,662.81 | $7,662.71 | $229,073.59 |

| 13 | $229,073.59 | $11,270.75 | $8,054.77 | $221,018.76 |

| 14 | $221,018.76 | $10,858.67 | $8,466.85 | $212,551.84 |

| 15 | $212,551.84 | $10,425.47 | $8,900.05 | $203,651.73 |

| 16 | $203,651.73 | $9,970.13 | $9,355.39 | $194,296.27 |

| 17 | $194,296.27 | $9,491.48 | $9,834.04 | $184,462.17 |

| 18 | $184,462.17 | $8,988.35 | $10,337.17 | $174,124.94 |

| 19 | $174,124.94 | $8,459.47 | $10,866.05 | $163,258.84 |

| 20 | $163,258.84 | $7,903.54 | $11,421.98 | $151,836.80 |

| 21 | $151,836.80 | $7,319.16 | $12,006.36 | $139,830.40 |

| 22 | $139,830.40 | $6,704.89 | $12,620.63 | $127,209.72 |

| 23 | $127,209.72 | $6,059.21 | $13,266.31 | $113,943.34 |

| 24 | $113,943.34 | $5,380.47 | $13,945.05 | $99,998.24 |

| 25 | $99,998.24 | $4,667.01 | $14,658.51 | $85,339.67 |

| 26 | $85,339.67 | $3,917.04 | $15,408.48 | $69,931.15 |

| 27 | $69,931.15 | $3,128.72 | $16,196.80 | $53,734.29 |

| 28 | $53,734.29 | $2,300.05 | $17,025.47 | $36,708.77 |

| 29 | $36,708.77 | $1,429.00 | $17,896.52 | $18,812.20 |

| 30 | $18,812.20 | $513.37 | $18,812.15 | $0.00 |

What Is Required to Get a $300K Mortgage?

Getting a $300,000 mortgage generally requires a combination of a sufficient income and a large enough down payment. For example, if your gross annual income is $75,000 and you want to borrow $300,000 with a 30-year mortgage at 5.0%, you would probably need to make a deposit of at least $30,000 on a property.

Running the numbers in a housing affordability calculator can help you pinpoint the costs. The numbers above result in spending about 23% of your income on housing. This falls comfortably below the 30% threshold. Above that point, the Department of Housing and Urban Development (HUD) considers you “price burdened.”

Credit score can also matter when applying for a home. There’s no definite rule, as your income, down payment, and other factors will also be a part of the decision. However, you should generally have a credit score of at least 620 to apply for a conventional loan.

How Much House Can You Afford Quiz

The Takeaway

Buying a home is usually the largest expense for the average American. The monthly payment you will make on your home depends on several factors, but the most important are the APR and term. A shorter term and a lower APR will reduce how much you pay overall, though a shorter term will increase your monthly payment.

It’s important to align your purchase with factors like your annual income and down payment. Our Home Loan Help Center can be a good resource. Buying a house that you can afford will help you make your monthly payments comfortably — so you can relax and enjoy your new home.

FAQ

How much house can I afford on $70,000 a year?

How much house you can afford on a $70,000 salary depends on several factors, such as your APR, term, and down payment. With a $30,000 down payment, a mortgage rate of 5.0%, and $2,500 of monthly expenses (not including rent), you can afford a home up to $300K.

Can I afford a 300K house on a 50K salary?

You might be able to afford a $300K house on a $50K salary if you can secure a low APR and have a sizable down payment. However, you’ll want to review your monthly expenses to make sure you have room in your income to pay the mortgage.

How much is 20% down on a $300,000 house?

To put 20% down on a $300,000 house, you’ll need $60,000. People often believe you must put 20% down to qualify for a mortgage. While this might be true for some lenders, it isn’t always the case.

Photo credit: iStock/Morsa Images

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOHL0323005 Read more