What Is a Candlestick Chart?

What Are Candlestick Charts?

Candlesticks are price chart units that show the high, low, opening, and closing prices of a stock or security within a specified time period. Overtime, the candles create patterns that traders can use to predict price movements, trends, and reversals.

Most candlesticks consist of a body and upper and lower wicks, which are also known as shadows or tails.

Candlestick charts are commonly used, along with line charts, bar charts, and point-and-figure charts.

Understanding Candlestick Charts

Candlesticks originated in Japan, perhaps in the 19th century, as a means of tracking the prices of certain assets and commodities. When candlestick charts were introduced in the West, they originally were called Japanese candlestick charts.

The candlestick itself consists of an open area called the “real body,” which shows the range between the open and close prices, with the price movements in the specified time period shown as vertical lines or wicks (also called shadows) on either end of the body. The wicks indicate the high and the low for that period.

When the real body is filled in with black or red it means the close was lower than the open. When it’s white (blank) or green, the close was higher than the open. On most platforms, traders can alter the colors to whatever is easiest for them to read. Some candlestick charts are black and white.

Traders can set the desired time period they want to analyze; often a candlestick represents the price movements during a trading day. Candlestick patterns are formed by a series of candles within a designated interval (e.g. days or weeks).

Candlestick Charts vs Bar Charts

Like candlestick charts, bar charts show security price changes over time. Many traders think candlestick charts are easier to read; the thicker candle bodies make it easy to see the distinction between the opening and closing price and the high and low.

Bar charts are also often not color coded, making it more difficult to see price trends. However, some traders prefer the cleaner aesthetic of a bar chart.

What Do Candlestick Charts Tell Investors?

Candlestick charts are composed of candles lined up next to one another, each of which shows price movement between the specified time period. Because candles show price changes in certain time periods, traders can use charts to see trends and try to predict price changes.

Candlestick patterns can show that a negative or positive price continuation is likely, or that a price trend may reverse. Even a single candlestick can help traders decide whether to buy or sell.

Some investors use fundamental analysis of an investment to make trading decisions. But that in-depth analysis is typically not of interest to a day trader.

Day traders often use what is called technical analysis in an attempt to detect patterns in a security’s performance. Although this method is common in the financial industry, many debate the validity of these patterns and whether they can be predictive, or help investors anticipate a security’s future performance in any way.

Recommended: Understanding the Risks of Day-Trading

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

How to Read Candlestick Charts

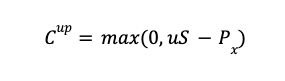

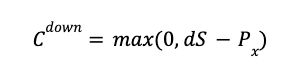

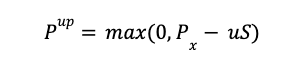

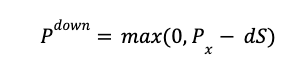

Owing to the four main components of a single candlestick — the opening price, closing price, the high and the low — candlestick charts convey a lot of information. Essentially you have five data points in each candlestick:

• The opening price (indicated by the top of the real body)

• The closing price (the bottom of the real body)

• The high (the upper wick)

• The low (the lower wick)

• Whether the day’s closing price was higher or lower than the previous close.

Components of a Candlestick

Real Body

As described above, the part of the candle between the top and bottom borders is called the candle body, or real body. This represents the opening and closing prices of the time period that the candle depicts.

The candle body is more important than the wicks or shadows, because the wicks show high and low trades, which may be significantly different from the majority of the day’s trades. A longer candle body shows a stronger price trend in either direction.

Upper Wick

The vertical line above the candle body is the upper wick or shadow. The top of the shadow the highest price the security was traded at during the set time period. A long upper shadow indicates a bearish price direction: It means traders are unsuccessfully attempting to increase prices.

Lower Wick

The line below the candle body is the lower wick. The bottom of the wick marks the lowest price of the security during the set time period. If a wick is short, it means the opening or closing price was near the high and low trades.

Range

The range is the difference between the top and bottom of the real body. If the close was lower than the open, the real body is filled in (usually black or red. If the close was higher than the open, the real body is hollow or green (or another color of the trader’s choice).

While these are the components of a traditional or standard candlestick chart, some candlestick charts have candles without a top or bottom or wicks.

💡 Quick Tip: It’s smart to invest in a range of assets so that you’re not overly reliant on any one company or market to do well. For example, by investing in different sectors you can add diversification to your portfolio, which may help mitigate some risk factors over time.

Candlestick Chart Time Frames

Traders can select the time frame that each candle represents. One commonly used time frame shows the opening price, closing price, and high and low for a single day. Each candle in the chart would show the price movement in one day.

A trader could see that a stock price declined significantly over the course of the day, which could result in a continuing decline in the coming days.

The most commonly used time frames are:

• 1-minute (M1)

• 5-minute (M5)

• 15-minute (M15)

• 30-minute (M30)

• 1-hour (H1)

• 4-hour (H4)

• Daily (D1)

• Weekly (W1)

• Monthly (M1)

Shorter time frames essentially allow traders to zoom in on the price action of the chart. For example, an H1 chart would have four times the candles of an H4 chart, so traders can look more closely at price changes.

Types of Candlesticks

Candlesticks are created by price movements throughout the specified time period. Taken as a cluster, candlesticks form patterns traders use for analysis and trend prediction.

Bearish and Bullish Candles

There are two main patterns: bearish (the security’s price is likely to decline) and bullish (the security’s price is likely to rise). These reflect the common terms for bullish and bearish market conditions.

No pattern is a guarantee of a price change or of a security’s performance. Candlestick charts are therefore used more as indicators of potential price trends.

Doji Candles

If the price closes exactly where it opened, there is no candle body. This is called a doji and is marked with a cross. A doji candlestick is rare, but when it shows up it can be a predictor of a price reversal.

Marubozu

The marubozu is essentially the opposite of the doji. It has a long candle body and no wicks or shadows. This type of candle indicates that the price didn’t trade beyond the range of the open and closing prices.

Types of Candlestick Patterns

Certain candlestick patterns can help traders make short-term predictions about price movements. Although a single candle indicates whether buying or selling action is strong, it doesn’t necessarily mean that the long-term price will continue in that direction. This is why traders look at different time periods to get a sense for longer-term trends, and to understand support and resistance levels.

There are many ways to read candlestick charts, depending on trading strategy and time frame.

At first glance, candlestick charts can appear pretty random. But there are many bullish and bearish patterns traders can identify in order to try to predict price movements. It’s important to remember that patterns are not guarantees of future price movement.

Bearish Engulfing Pattern

If there are more sellers than buyers when a chart has been trending upward, traders will see a long red candlestick after a small green one. This can indicate that prices may decline.

Bullish Engulfing Pattern

The opposite pattern will occur if the price is trending downward but then a long green candlestick appears in the chart. This may indicate that prices will continue to increase.

Bearish Evening Star

The evening star pattern is uncommon, but considered a strong indicator of future price declines when it does show up. It’s generally a three-day candlestick pattern.

• The first day is a large white or green candle, indicating a clear rise in price.

• The second day shows a smaller candle, indicating a more modest price increase.

• The third day is a long red candle that opens at a lower price than the previous day, and closes near the middle of the first candle’s range.

Morning Star

The reverse of the evening star is the morning star, a bullish indicator. The first candlestick in this pattern is long and red, the second is short and lower than the first, and the third is a long green candlestick that closes above the center of the first, indicating an upward price trend.

Bearish Harami

This is a two-candle pattern. If traders see a small red or black candle body that fits completely within the previous day’s candle body, it could indicate a price reversal. Price action continuing downward after the small candle could indicate a longer-term downward trend.

Bullish Harami

A bullish harami is a three-day pattern that may indicate a reversal of a bearish trend. If there are two black or red candles, indicating the downward trend, followed by a small white or green candle that fits completely within the body of the previous candle, that may signal a bullish turn.

Harami Cross

The harami cross can be bearish or bullish. With a bearish harami cross, there is a long candle that’s part of a downtrend and it’s followed by a doji.

With a bullish harami cross, there is a long candle that’s part of an upward trend, also followed by a doji.

In either case, the doji could signal a reversal of the trend.

Falling Three Methods

This is a bearish pattern that includes five candlesticks. Typically there is one day with a strong downward trend, followed by three small green candle bodies that stay within the boundaries of the first candle, followed by another long red candle. The falling three methods may signal an interruption of the trend, but not a full-on reversal.

Hammer

If the price significantly decreases but then makes a comeback and ultimately closes near the high, this is called a hammer. The hammer pattern has a small body and a long lower wick. It’s a bullish signal because it shows that the price was declining but then traders pushed it back up.

Hanging Man

The hanging man pattern is the opposite of the hammer. It is also referred to as an inverted hammer. This pattern looks like a square lollipop. If traders are attempting to spot the top or bottom of a market, they often use hammer and hanging man patterns as indicators.

Shooting Star

A shooting star takes shape when a security opens, the price rises significantly over the trading period, but then closes near the opening price, signaling a reversal.

To really be considered a shooting star pattern, this particular candlestick — with the short real body, long top wick, and hardly any bottom wick — must occur within an upward price trend.

Gaps

A gap is a window of time in which there are no trade transactions. Gaps in a chart can indicate support and resistance levels, which can be followed by a further bullish or bearish trend.

The Takeaway

Candlestick charts are a way of condensing price information about a security into a fairly simple diagram that looks like a candle with two wicks. The candle’s “real body” shows the range between the open and close prices. The wicks are the vertical lines at the top and bottom of the real body, indicating the high and the low for that period.

Candlesticks can be grouped together into patterns that traders can interpret as signals of price trends that are either bearish or bullish. Often it’s best to use tools like this with other types of technical indicators.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOIN20147