What Is Dividend Yield?

Dividend yield concerns how much an investor realizes from their investments over the course of a year as a result of dividends. Dividends, which are payouts to investors as a share of a company’s overall profit, can help investors generate bigger returns, and some investors even formulate entire strategies around maximizing dividends.

But it’s important to have a good understanding of dividends, dividend yields, and other related concepts before going too far into the weeds.

Key Points

• Dividend yield represents the annual dividend paid to shareholders relative to the stock price, expressed as a percentage, which helps investors assess potential returns.

• Investors can calculate dividend yield by dividing the annual dividend per share by the stock’s current price, providing insight into a company’s attractiveness as an investment.

• A higher dividend yield may signal an established company, but it can also indicate slower growth or potential financial troubles, requiring careful evaluation.

• Considering the history of dividend growth and the dividend payout ratio can provide additional insights into a company’s financial health and dividend sustainability.

• Understanding the difference between dividend yield and dividend rate is essential, as dividend yield is a ratio while dividend rate is expressed in dollar amounts.

What Is Dividend Yield?

A stock’s dividend yield is how much the company annually pays out in dividends to shareholders, relative to its stock price. The dividend yield is a financial ratio (dividend/price) expressed as a percentage, and is distinct from the dividend itself.

Dividend payments are expressed as a dollar amount, and supplement the return a stock produces over the course of a year. For an investor interested in total return, learning how to calculate dividend yield for different companies can help to decide which company may be a better investment.

But bear in mind that a stock’s dividend yield will tend to fluctuate because it’s based on the stock’s price, which rises and falls. That’s why a higher dividend yield may not be a sign of better value.

How Does Dividend Yield Differ From Dividends?

It’s important to really drive home the difference between dividend yield and dividends in general.

Dividends are a portion of a company’s earnings paid to investors and expressed as a dollar amount. Dividends are typically paid out each quarter (although semi-annual and monthly payouts are common). Not all companies pay dividends.

Dividend yield, on the other hand, refers to a stock’s annual dividend payments divided by the stock’s current price, and expressed as a percentage. Dividend yield is one way of assessing a company’s earning potential.

How to Calculate Dividend Yield

Calculating the dividend yield of an investment is useful for investors who want to compare companies and the dividends they pay. For investors looking for investments to help supplement their cash flow, or even to possibly live off dividend income, a higher dividend yield on a stock would be more attractive than a lower one.

What Is the Dividend Yield Formula?

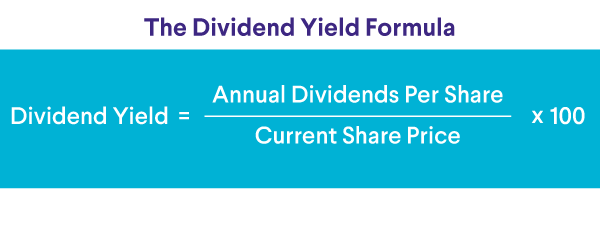

The dividend yield formula is more of a basic calculation than a formula: Dividend yield is calculated by taking the annual dividend paid per share, and dividing it by the stock’s current price:

Annual dividend / stock price = Dividend yield (%)

How to Calculate Annual Dividends

Investors can calculate the annual dividend of a given company by looking at its annual report, or its quarterly report, finding the dividend payout per quarter, and multiplying that number by four. For a stock with fluctuating dividend payments, it may make sense to take the four most recent quarterly dividends to arrive at the trailing annual dividend.

It’s important to consider how often dividends are paid out. If dividends are paid monthly vs. quarterly, you want to add up the last 12 months of dividends.

This is especially important because some companies pay uneven dividends, with the higher payouts toward the end of the year, for example. So you wouldn’t want to simply add up the last few dividend payments without checking to make sure the total represents an accurate annual dividend amount.

Example of Dividend Yield

If Company A’s stock trades at $70 today, and the company’s annual dividend is $2 per share, the dividend yield is 2.85% ($2 / $70 = 0.0285).

Compare that to Company B, which is trading at $40, also with an annual dividend of $2 per share. The dividend yield of Company B would be 5% ($2 / $40 = 0.05).

In theory, the higher yield of Company B may look more appealing. But investors can’t determine a stock’s worth by yield alone.

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

💡 Quick Tip: How to manage potential risk factors in a self-directed investment account? Doing your research and employing strategies like dollar-cost averaging and diversification may help mitigate financial risk when trading stocks.

Dividend Yield: Pros and Cons

| Pros | Cons |

|---|---|

| Can help with company valuation. | Dividend yield can indicate a more established, but slower-growing company. |

| May indicate how much income investors can expect. | Higher yield may mask deeper problems. |

| Yield doesn’t tell investors the type of dividend (ordinary vs. qualified), which can impact taxes. |

For investors, there are some advantages and disadvantages to using dividend yield as a metric that helps inform investment choices.

Pros

• From a valuation perspective, dividend yield can be a useful point of comparison. If a company’s dividend yield is substantially different from its industry peers, or from the company’s own typical levels, that can be an indicator of whether the company is trading at the right valuation.

• For many investors, the primary reason to invest in dividend stocks is for income. In that respect, dividend yield can be an important metric. But dividend yield can change as the underlying stock price changes. So when using dividend yield as a way to evaluate income, it’s important to be aware of company fundamentals that provide assurance as to company stability and consistency of the dividend payout.

Cons

• Sometimes a higher dividend yield can indicate slower growth. Companies with higher dividends are often larger, more established businesses. But that could also mean that dividend-generous companies are not growing very quickly because they’re not reinvesting their earnings.

Smaller companies with aggressive growth targets are less likely to offer dividends, but rather spend their excess capital on expansion. Thus, investors focused solely on dividend income could miss out on some faster-growing opportunities.

• A high dividend yield could indicate a troubled company. Because of how dividend yield is calculated, the yield is higher as the stock price falls, so it’s important to evaluate whether there has been a downward price trend. Often, when a company is in trouble, one of the first things it is likely to reduce or eliminate is that dividend.

• Investors need to look beyond yield to the type of dividend they might get. An investor might be getting high dividend payouts, but if they’re ordinary dividends vs. qualified dividends they’ll be taxed at a higher rate. Ordinary dividends are taxed as income; qualified dividends are taxed at the lower capital gains rate, which typically ranges from 0% to 20%. If you have tax questions about your investments, be sure to consult with a tax professional.

The Difference Between Dividend Yield and Dividend Rate

As noted earlier, a dividend is a way for a company to distribute some of its earnings among shareholders. Dividends can be paid monthly, quarterly, semi-annually, or even annually (although quarterly payouts tend to be common in the U.S.). Dividends are expressed as dollar amounts. The dividend rate is the annual amount of the company’s dividend per share.

A company that pays $1 per share, quarterly, has an annual dividend rate of $4 per share.

The difference between this straight-up dollar amount and a company’s dividend yield is that the latter is a ratio. The dividend yield is the company’s annual dividend divided by the current stock price, and expressed as a percentage.

What Is a Good Dividend Yield?

Two companies with the same high yields are not created equally. While dividend yield is an important number for investors to know when determining the annual cash flow they can expect from their investments, there are deeper indicators that investors may want to investigate to see if a dividend-paying stock will continue to pay in the future.

A History of Dividend Growth

When researching dividend stocks, one place to start is by asking if the stock has a history of dividend growth. A regularly increasing dividend is an indication of earnings growth and typically a good indicator of a company’s overall financial health.

The Dividend Aristocracy

There is a group of S&P 500 stocks called Dividend Aristocrats, which have increased the dividends they pay for at least 25 consecutive years. Every year the list changes, as companies raise and lower their dividends.

Currently, there are 65 companies that meet the basic criteria of increasing their dividend for a quarter century straight. They include big names in energy, industrial production, real estate, defense contractors, and more. For investors looking for steady dividends, this list may be a good place to start.

Dividend Payout Ratio (DPR)

Investors can calculate the dividend payout ratio by dividing the total dividends paid in a year by the company’s net income. By looking at this ratio over a period of years, investors can learn to differentiate among the dividend stocks in their portfolios.

A company with a relatively low DPR is paying dividends, while still investing heavily in the growth of its business. If a company’s DPR is rising, that’s a sign the company’s leadership likely sees more value in rewarding shareholders than in expanding. If its DPR is shrinking, it’s a sign that management sees an abundance of new opportunities abounding. In extreme cases, where a company’s DPR is 100% or higher, it’s unlikely that the company will be around for much longer.

Other Indicators of Company Health

Other factors to consider include the company’s debt load, credit rating, and the cash it keeps on hand to manage unexpected shocks. And as with every equity investment, it’s important to look at the company’s competitive position in its sector, the growth prospects of that sector as a whole, and how it fits into an investor’s overall plan. Those factors will ultimately determine the company’s ability to continue paying its dividend.

Test your understanding of what you just read.

The Takeaway

Dividend yield is a simple calculation: You divide the annual dividend paid per share by the stock’s current price. Dividend yield is expressed as a percentage, versus the dividend (or dividend rate) which is given as a dollar amount. The dividend yield formula can be a valuable tool for investors, and not just ones who are seeking cash flow from their investments.

Dividend yield can help assess a company’s valuation relative to its peers, but there are other factors to consider when researching stocks that pay out dividends. A history of dividend growth and a good dividend payout ratio (DPR), as well as the company’s debt load, cash on hand, and credit rating can help form an overall picture of a company’s health and probability of paying out higher dividends in the future.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

SOIN-Q224-1881500-V1 Read more