ETFs vs Index Funds: What’s the Difference?

The main difference between exchange-traded funds (ETFs) vs. index funds stems from a difference in how each type of fund is structured.

Index funds, like many mutual funds, are open-end funds with a portfolio based on a basket of securities (e.g. stocks and bonds). Fund shares are priced once at the end of the trading day, based on the fund’s net asset value (NAV).

An ETF is a type of investment fund that also includes a basket of securities, but shares of the fund are designed to be traded throughout the day on an exchange, similar to stocks.

Although index funds and most ETFs track a benchmark index and are passively managed, ETFs rely on a special creation and redemption mechanism that help make ETF shares more liquid, and the fund potentially more tax efficient.

In order to understand the differences between ETFs vs. index funds, it helps to know how each type of fund works.

Key Points

• ETFs and index funds both offer investors exposure to a basket of securities, which may provide portfolio diversification.

• ETFs can be traded throughout the day, while index mutual funds are traded at the end of the day.

• ETFs typically disclose their holdings daily, whereas index funds disclose quarterly.

• ETFs tend to have higher expense ratios than index funds, but can offer more trading flexibility.

• ETFs are generally more tax efficient than index funds.

What Are Index Funds?

Index funds are a type of mutual fund. Like other mutual funds, an index fund portfolio is a collection of stocks, bonds, or other securities that are bundled together into a pooled investment fund.

Index Funds Are Passive

Unlike most other types of mutual funds, which are actively managed by a portfolio manager, index funds are designed to mirror the holdings and the performance of an index like the S&P 500 index of U.S. large-cap stocks, or the Russell 2000 index of small-cap stocks.

Because index funds are passively managed, they tend to be lower cost than other types of mutual funds.

Not as Liquid

Investors buy shares of the fund, which gives them exposure to the basket of securities within the fund. As noted above, index mutual fund trades can only be executed once per day, which makes them less liquid than ETFs.

In addition, index funds (and mutual funds in general) have to reveal their holdings every quarter, so they tend to be less transparent than ETFs, which typically reveal their holdings once a day.

There are thousands of indexes to choose from, and it’s possible to create an investing portfolio from index funds alone.

Recommended: Portfolio Diversification: What It Is, Why It Matters

Get up to $1,000 in stock when you fund a new Active Invest account.*

Access stock trading, options, alternative investments, IRAs, and more. Get started in just a few minutes.

What Are ETFs?

Unlike index funds, ETF shares can be traded on exchanges throughout the day, just like stocks, so ETFs require a different wrapper or structure than traditional mutual funds.

How ETF Shares Are Created and Redeemed

Because an ETF itself can hold hundreds or even thousands of securities, these funds utilize a special creation and redemption mechanism that allows for intraday trading of shares. This helps to reconcile the number of ETF shares that are traded with the price of the underlying securities in the fund, thus keeping share price as close to the value of the underlying securities as possible.

As a result, ETF shares are not only more liquid than index funds from a cash standpoint, they are also more fluid from a trading standpoint. An investor can place a trade while markets are open, and get real-time pricing information with relative ease by checking financial websites or calling a broker. That’s a plus for investors and financial professionals who prefer to make trades based on market conditions.

ETF Costs

When trading ETFs, bear in mind that the average expense ratio of ETFs is 0.15%, according to the Investment Company Institute, which is historically low — but still higher than most index mutual funds, which have an average expense ratio of 0.05%.

Depending on the brokerage involved, investors may also pay commissions and a bid-ask spread, which is the difference between the ask price and the bid price of an ETF share, although this has less of an impact for buy-and-hold investors.

ETFs and Tax Efficiency

Owing to the way ETF shares are created and redeemed, ETFs may be more tax efficient than index funds. When investors sell shares of an index fund, the underlying securities in the fund must be sold, and if there is a capital gain it’s passed onto all the fund shareholders.

When an investor sells shares of an ETF, the fund doesn’t incur capital gains, owing to the mechanism for redeeming shares. But if the investor sees a profit from the sale, this would result in capital gains (which is also true when selling index fund shares), which has specific tax implications.

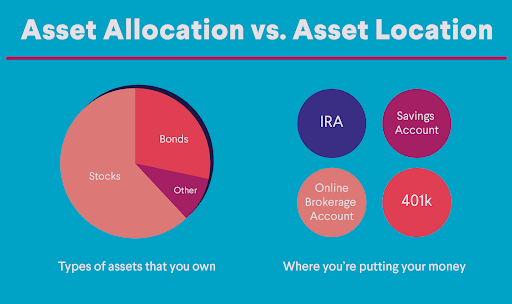

Of course, investors who hold ETFs or index funds within an IRA or other retirement account would not be subject to capital gains tax events.

When picking ETFs, however, bear in mind that the majority of ETFs are passively managed: i.e. they are index ETFs. Only about 2% of ETFs are actively managed, owing to the complexity of their structure and industry rules about transparency for these funds.

ETFs vs. Index Funds: Key Differences and Similarities

When comparing ETFs vs. index funds, there are a few similarities:

• Both types of funds include a basket of securities that can include stocks, bonds, and other securities.

• ETFs and index funds may provide some portfolio diversification.

• Index funds and most ETFs are considered passive investments because they typically mirror the constituents of a benchmark index. (By comparison, actively managed mutual funds and active ETFs have a live portfolio manager who oversees the fund, and makes trades with the goal of outperformance.)

This chart helps to summarize the similarities and differences between ETFs vs index funds.

| ETFs | Index Funds |

|---|---|

| Similarities: | |

| Portfolio consists of many securities | Portfolio consists of many securities |

| Provides diversification via exposure to different asset classes | Provides diversification via exposure to different asset classes |

| ETF expense ratios are generally low | Index fund expense ratios are generally low |

| Most ETFs are passively managed | Index funds are passively managed |

| Differences: | |

| A special creation-redemption mechanism enables intraday share trading | Shares bought and sold/redeemed via the fund itself |

| Shares trade during market hours on an exchange | Trades executed at end of day |

| Fund holdings disclosed daily | Fund holdings disclosed quarterly |

| Shares are more liquid | Shares are less liquid |

| Investors may also pay a commission on trades or other fees | Investors may pay a sales load or other fees |

| ETFs tend to be more tax efficient | Index funds may be less tax efficient |

Recommended: Learn what actively managed ETFs are and how they work.

ETF vs. Index Fund: Which Is Right for You?

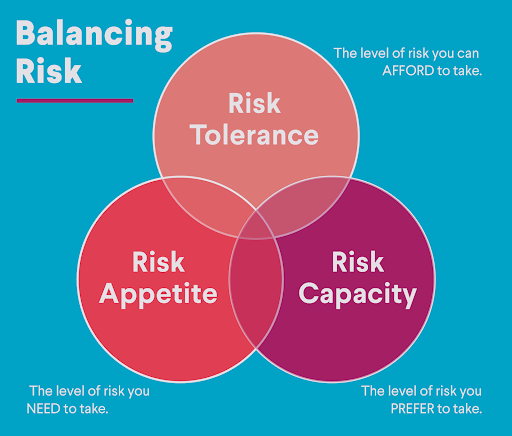

There’s no cut-and-dried answer to whether ETFs are better than index funds, but there are a number of pros and cons to consider for each type of fund.

Transparency

By law, mutual funds are required to disclose their holdings every quarter. This is a stark contrast with ETFs, which typically disclose their holdings each day.

Transparency may matter less when it comes to index funds, however, because index funds track an index, so the holdings are not in dispute. That said, many investors prefer the transparency of ETFs, whose holdings can be verified day to day.

Fund Pricing

Because a mutual fund’s net asset value (NAV) isn’t determined until markets close, it can be hard to know exactly how much shares of an index fund cost until the end of the trading day. That’s partly why mutual funds, including index funds, allow straight dollar amounts to be invested. If you buy an index fund at noon, you can buy $100 worth, for example, regardless of the price per share.

ETF shares, which trade throughout the day like stocks, are priced by the share like stocks as well. Knowing stock market basics can help you invest in ETFs, as well. If you have $100 and the ETF is $50 per share when you place the trade, you can buy two shares.

This ETF pricing structure also allows investors to use stop orders or limit orders to set the price at which they’re willing to buy or sell.

These types of orders, which are different than standard market orders, can also be executed through an online investing platform or by calling a broker.

Taxes

ETFs are generally considered more tax efficient than mutual funds, including index funds.

The way mutual funds are structured, there can be more tax implications as investors buy in and out of an index fund, and the cost of taxes is shared among different investors.

ETF shares are redeemed differently, so if there are capital gains, you would only owe them based on your ETF shares.

The Takeaway

Choosing between ETFs vs. index funds typically comes down to cost and flexibility, as well as understanding the tax implications of the two fund types. While both ETFs and index funds are low-cost, passively managed funds — two factors which can provide an upside when it comes to long-term performance — ETFs can have the upper hand when it comes to taxes.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

FAQ

Is it better to choose an ETF or an index fund?

ETFs and index funds each have their pros and cons. ETFs tend to be more tax efficient, and you can trade ETFs like stocks throughout the day. If you’re interested in a buy-and-hold strategy, an index fund may make more sense.

Are ETFs or index funds better for taxes?

In general, ETFs tend to be more tax efficient.

What are the differences between an ETF and an index fund?

While both types of funds can provide some portfolio diversification, ETFs are generally more transparent, and more tax efficient compared with index funds.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

SOIN-Q324-040

Read more