2025 Debt Snowball Payoff Calculation Table with Examples

Table of Contents

When you carry large amounts of debt across different credit cards and loans, it’s easy to feel snowed under. Making the minimum payment on each leaves you paying a lot in interest and doesn’t make it easy to eliminate all that debt.

One debt repayment strategy you might want to consider is the debt snowball method. The debt snowball method is a debt repayment strategy where you focus on paying off your smallest debts first while making minimum payments on the rest. Once a smaller debt is paid off, you apply that payment amount to the next smallest debt, creating momentum (“like a snowball”) until all debts are eliminated.

Let’s look at what a debt snowball strategy looks like, including how to use a debt snowball calculation table.

Key Points

• The debt snowball strategy focuses on paying off debts from the smallest balance to largest, regardless of interest rate, to build momentum and motivation.

• Continue paying minimums on all other debts while putting extra money toward the smallest one.

• Once a debt is paid off, roll that payment amount into the next smallest debt, creating a “snowball” effect.

• The debt snowball calculation table shows exactly how this method works and allows you to visualize how the debt payments are applied.

• Another method of paying off debt is the debt avalanche method, which prioritizes paying off the debts with the highest interest rates first.

Debt Terms Defined

Before we go into creating a debt reduction plan, let’s make sure you’re up to speed on certain debt terms.

Interest Rate: The interest rate is the percent of the amount you borrow that you pay to the lender in addition to the principal.

Annual Percentage Rate: This is the total yearly cost of borrowing money, including interest and fees, expressed as a percentage of the loan amount.

Minimum Payment: Loans and credit cards have a minimum amount you must pay each month on the balance, though you certainly can pay more.

Bankruptcy: If you’re unable to pay off your debts, filing bankruptcy may be a last-ditch solution to consider. Essentially, it reduces or eliminates your debts. Know that it will negatively impact your credit for many years. That’s why it’s worth it to come up with a plan for the ultimate debt payoff strategy.

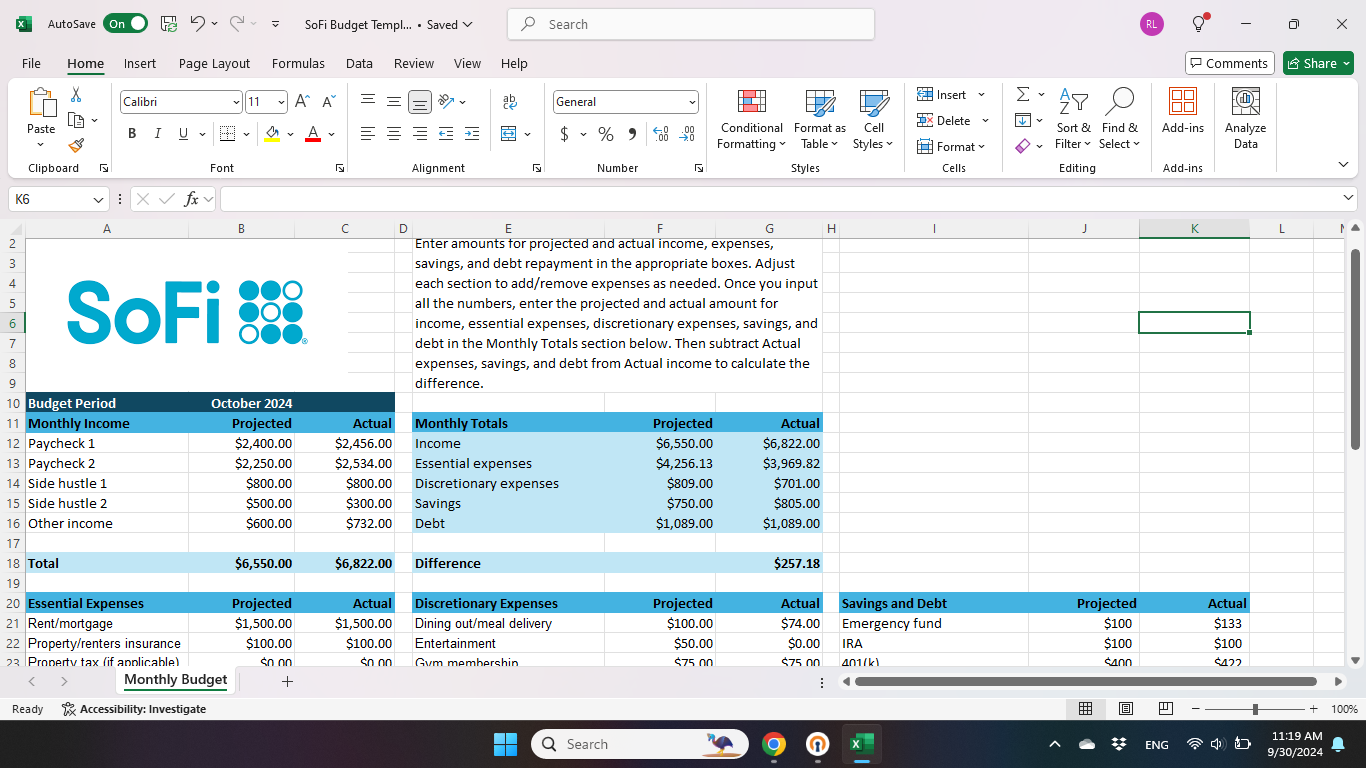

💡 Quick Tip: We love a good spreadsheet, but not everyone feels the same. An online budget planner can give you the same insight into your budgeting and spending at a glance, without the extra effort.

What Is the Debt Snowball?

Just like an actual snowball, the debt snowball method starts out small. You first tackle the smallest debt balances you have. Once those are paid off, you apply what you were paying on those to the next smallest debts. You continue to pay at least the minimum due on all your debts.

However, by focusing your attention on one debt at a time, you then free up more money to make larger payments on other debts until it’s all gone. Your snowball of debt repayment, so to speak, grows over time.

Benefits of the Snowball Method

The snowball method is one of the fastest ways to pay off debt. And over time, this method will help you have fewer payments as you pay off credit cards and loans and put more money to the remaining debt.

Drawbacks of the Snowball Method

The smallest debts you have may not be the ones with the highest interest. So while you’re paying off the little loans, the debts with higher interest continue to accumulate interest, which adds to your debt.

Check your score with SoFi

Track your credit score for free. Sign up and get $10.*

Debt Snowball vs. Debt Avalanche

If you have larger loans with higher interest, the debt snowball method may not be your best option. You might also explore another popular way to way to pay off debt: the debt avalanche method.

With the debt avalanche method, you start paying down the loans and credit cards with the highest interest first. By doing so, you reduce the amount of debt you have at those higher interest rates, which slows down the amount of interest that accumulates over time.

Just like with the snowball, you pay off one debt and then put the money you were paying on that debt toward the loan or card with the next highest interest rate until it’s all paid off.

💡 Quick Tip: Income, expenses, and life circumstances can change. Consider reviewing your budget a few times a year and making any adjustments if needed.

How Is Debt Snowball Payoff Calculated?

To use the debt snowball payoff method, you’ll need to gather information about all the debt you have. Let’s use the following example:

• Personal loan 1 balance: $3,000

◦ 12% interest

◦ Minimum payment: $100 per month

• Credit card A balance: $2,000

◦ 17% interest

◦ Minimum payment: $25 per month

• Credit card B balance: $1,000

◦ 22% interest

◦ Minimum payment: $30 per month

• Personal loan 2 balance: $750

◦ 8% interest

◦ Minimum payment: $20 per month

Even without a snowball debt payoff calculation table, you can reorder these debts so that you focus on the one with the lowest balance first:

• Personal loan 2: $750

• Credit card B: $1,000

• Credit card A: $2,000

• Personal loan 1: $3,000

Now that you’ve ordered your debts from least to greatest, you can see how once you pay off the $750 loan, that money can go toward the credit card with the $1,000 balance. Once that’s paid off, you put all that money toward paying off the $2,000 credit card balance, and then finally, to pay off the $3,000 loan.

Debt Snowball Payoff Examples

Let’s look at what the monthly payments for these reordered debts would look like if you were able to set aside $400 a month toward paying them off.

| # Payments | Personal Loan 2 ($750) | Credit Card B ($1,000) | Credit Card A ($2,000) | Personal Loan 1 ($3,000) |

|---|---|---|---|---|

| 1 | $245 | $30 | $25 | $100 |

| 2 | $245 | $30 | $25 | $100 |

| 3 | $245 | $30 | $25 | $100 |

| 4 | $25.19 | $249.81 | $25 | $100 |

| 5 | – | $275 | $25 | $100 |

| 6 | – | $275 | $25 | $100 |

| 7 | – | – | $300 | $100 |

| 8 | – | – | $300 | $100 |

| 9 | – | – | $300 | $100 |

| 10 | – | – | $300 | $100 |

| 11 | – | – | $300 | $100 |

| 12 | – | – | $300 | $100 |

| 13 | – | – | $300 | $100 |

| 14 | $260.72 | $139.28 | ||

| 15 | – | – | – | $400 |

| 16 | – | – | – | $400 |

| 17 | – | – | – | $400 |

| 18 | – | – | – | $400 |

| 19 | – | – | – | $400 |

| 20 | – | – | – | $400 |

| Total principal & interest | $7,568 | Total interest | $829 |

As the chart shows, what might have taken you years to pay off can be paid off in under two years with the debt snowball method.

One way to keep your finances on track while you’re paying off debt is to create a budget. A money tracker app can help you come up with a spending and saving plan that works for you.

Is a Debt Snowball for You?

To determine whether the debt snowball method is right for you, consider how many different debts you have as well as their interest rates. If your larger debts have higher interest rates, you might consider the avalanche method.

But if your interest rates vary, or the smaller debts have higher interest, you might benefit from paying off those lower amounts first before snowballing those payments into the larger debts.

Recommended: Tips for Paying Off Outstanding Debt

The Takeaway

If you’re trying to pay off outstanding debt, you have options. The debt snowball method has been proven effective for many people. If nothing else, it’s a way for you to focus your attention on whittling down debt and minimizing how much you pay in interest.

Take control of your finances with SoFi. With our financial insights and credit score monitoring tools, you can view all of your accounts in one convenient dashboard. From there, you can see your various balances, spending breakdowns, and credit score. Plus you can easily set up budgets and discover valuable financial insights — all at no cost.

FAQ

How long does it take to pay off debt using the snowball method?

The time it takes to pay off debt using the snowball method depends on your total debt, interest rates, and how much extra you can pay each month. Generally, people may become debt-free within a few years, as the method builds motivation by quickly eliminating smaller balances first.

What is the best way to pay off debt using the snowball method?

The debt snowball method pays off your smallest balances first, then rolls those payments up toward the larger debts until they are all paid off.

What are the 3 biggest strategies for paying down debt?

To pay down or pay off debt, you can consider the debt snowball method (which pays off the smallest balances first), the debt avalanche method (which pays off the balances with the highest interest first), or debt consolidation (which provides a new loan with a single payment and single interest rate).

Photo credit: iStock/Abu Hanifah

SoFi Relay offers users the ability to connect both SoFi accounts and external accounts using Plaid, Inc.’s service. When you use the service to connect an account, you authorize SoFi to obtain account information from any external accounts as set forth in SoFi’s Terms of Use. Based on your consent SoFi will also automatically provide some financial data received from the credit bureau for your visibility, without the need of you connecting additional accounts. SoFi assumes no responsibility for the timeliness, accuracy, deletion, non-delivery or failure to store any user data, loss of user data, communications, or personalization settings. You shall confirm the accuracy of Plaid data through sources independent of SoFi. The credit score is a VantageScore® based on TransUnion® (the “Processing Agent”) data.

This content is provided for informational and educational purposes only and should not be construed as financial advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

SORL-Q425-002

Read more