How Do You Cash Out Stocks? Guide to Selling Stocks

Table of Contents

Cashing out stocks essentially means selling them, and most investors should be able to sell their stocks without too much trouble. Buying stocks can be fairly straightforward, whether online or through a financial advisor. But, when it’s time to sell shares, some beginning investors struggle with how to turn their stocks back into cash. After all, money invested in stocks is not immediately cash.

Investors may want to sell stocks for a wide variety of reasons. They might wish to reinvest the cash into another asset with an eye toward long-term gains. Or they could choose to withdraw funds from the stock market to cover short-term, daily expenses with cash earned from the sale. So, how might investors go about cashing out stocks? And, what factors might individuals curious about how to cash out stocks bear in mind? Here’s an overview of the how and when of selling stocks.

Key Points

- Stocks can be cashed out by selling them through a broker on a stock exchange.

- Selling stocks can provide cash for major expenses or to reinvest in other assets.

- Steps to cash out stocks include determining investment goals, accessing a brokerage account, placing a sell order, waiting for the sale to be completed, and receiving the proceeds.

- Motivations for selling stocks include accessing cash for expenses, cashing out profits, preventing significant losses, day trading, and offloading low-performing stocks.

- Types of sell orders include market orders, limit orders, stop orders, and trailing sell stop orders.

Can You Cash Out Stocks?

Investors can cash out stocks by selling them on a stock exchange through a broker. Stocks are relatively liquid assets, meaning they can be converted into cash quickly, especially compared to investments like real estate or jewelry. However, until an investor sells a stock, their money stays tied up in the market.

What Happens When You Sell a Stock?

When you sell a stock for a higher price than you paid, the proceeds from the sale will include your original investment plus your gains and minus any fees. If you sold your stock at a lower price than you paid, your total return will be less than your original investment (depending on how much of an overall loss you’re taking), minus any fees. So, you can have either a positive or negative return.

How to Sell Stocks: 5 Steps

There are several steps involved in selling stocks, including the following:

1. Determine Your Investment Goals

Consider why you want to sell your stocks and whether it aligns with your overall investment goals.

2. Access Your Brokerage Account

You need to access or log in to your brokerage account to sell your stocks.

3. Place an Order to Sell your Stocks

Once you’re logged into your brokerage account, you can place a sell order (like the orders outlined below) to sell your stocks. You can choose to sell at a specific price or through a market order, which will sell the stocks at the current market price.

4. Wait for the Sale to be Completed

After placing an order to sell your stocks, you will need to wait for the sale to be completed. This can take anywhere from a few seconds to several days, depending on market conditions and the type of order you have placed.

5. Receive the Proceeds From the Sale

After the sale is completed, the proceeds from the sale will be deposited into your brokerage account or sent to you in the form of a check.

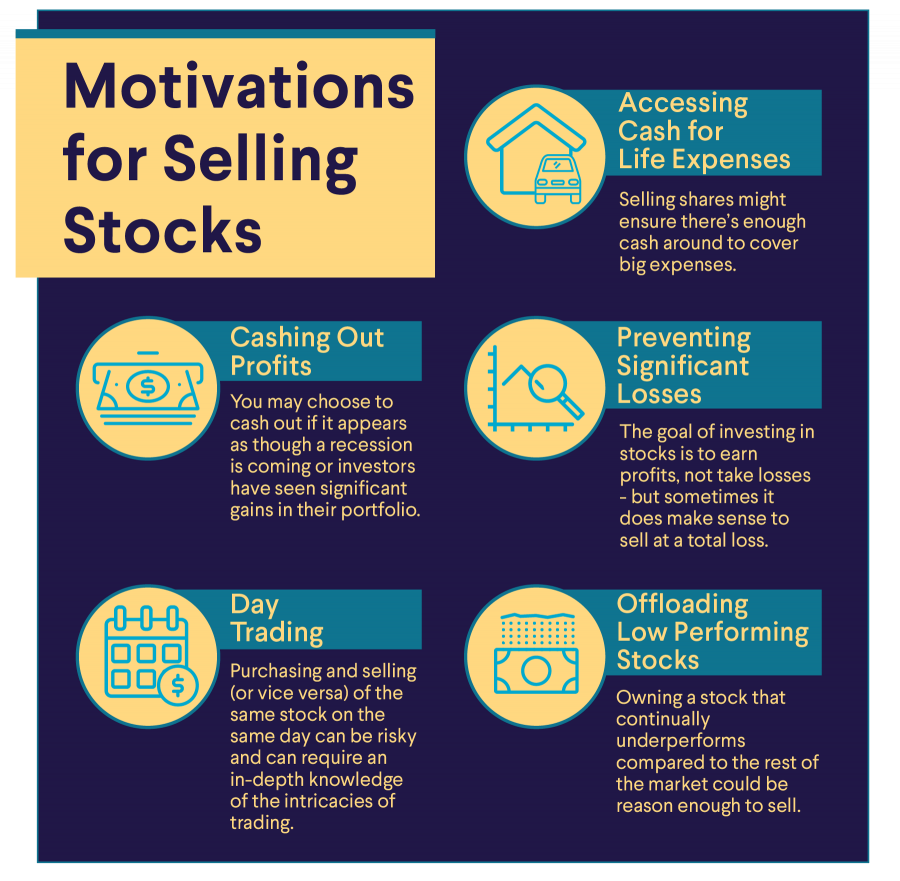

Motivations for Selling Stocks

Some investors watch their portfolios closely, selling stocks regularly to cash out profits or avoid significant losses.

However, one common reason investors decide to sell stocks is that they need the cash from the investments to pay for living expenses. While different investors might sell for various reasons, it can be helpful to understand the motivation that drives the desire to sell.

So, why might investors want to cash out stocks? Some common reasons could include the following:

Accessing Cash for Life Expenses

If investors know they’ll need cash for a major life expense, such as buying a car or home, they may choose to cash out some stocks. Selling shares might ensure there’s enough cash around to cover big expenses.

One benefit to having cash on hand instead of having money invested in stocks is that cash is not subject to the ups and downs of the stock market. However, the value of cash is impacted over time by inflation.

Some investors might also opt to move money out of stocks into potentially more secure investments, such as bonds or a money market account, until they’re ready to pay for that large expense.

Cashing Out Profits

If it appears as though a recession is coming or investors have seen significant gains in their portfolio, they might choose to cash out to lock in the profits. It’s important to understand, however, that attempting to time the stock market to avoid losses during unstable economic conditions is risky. What seems to be a trend in the market one day may or may not indicate how the markets may perform in the future.

Investors may want to ask themselves whether they’re interested in cashing out based on an emotional reaction (fear of recent market ups and downs, for instance) or a need for profits.

Preventing Significant Losses

The goal of investing in stocks is to earn profits or generate a positive return – online investing, or otherwise – is to not take losses. Still, there are some instances in which it could make sense to sell at a loss.

For example, an investor may sell specific stock holdings to prevent the likelihood of deeper losses in the future. Another scenario that might drive an investor to want to sell stocks is an industry-wide hardship, where numerous companies in one sector of the economy experience financial calamity at the same time. Industry-wide hardships may negatively impact the value of specific stock holdings.

In other instances, a company might reduce or eliminate shareholder dividends. Earning dividends may be a prime reason an investor bought the stock in the first place, so they decide to sell the stock because it’s no longer part of their investment strategy.

Day Trading

Day trading is one way of selling stocks, but it can involve significant risks. Day trades are the purchasing and selling (or vice versa) of the same stock on the same day. Here, traders are attempting to gain profit through short-term trades — typically through the use of technical or market analyses, which can require an in-depth knowledge of the intricacies of trading.

If it were possible to clearly predict future stock movements, everyone might want in on the stock market. But, stocks are volatile. Rather than guessing based on company news and technical indicators, traders who wish to make shorter term trades might choose to set a price goal. For instance, if they buy shares at $10 each, they could set a goal to sell them when they reach $18 per share.

Offloading Low Performing Stocks

Even if investors conduct thorough research on a company before buying a stock, they may later realize it wasn’t a boon for their portfolio. If a purchased stock continues to decline in value over time, investors may opt to offload the low-performing stock.

Also, some investors sell low-performing stocks at the end of the year for tax-loss harvesting, where investors sell investments at a loss to reduce their overall tax burden.

What Are the Different Types of Sell Orders?

Once an investor has decided to cash out a stock, there are several options for how to sell. Each comes with different amounts of control over the sale. Here’s an overview of the most common types of sell orders:

Market Orders

When placing a market order, an investor agrees to sell their shares at the current market price per share. The sell order will be placed immediately or when the market reopens if the order is placed after hours.

One upside of market orders is that the trade can usually be executed quickly. A downside is that the investor has no control over the selling price.

Limit Orders

With a limit order, however, an investor can set the minimum price they are willing to sell their shares for. The sell order only gets executed if and when the stock reaches that price or higher.

For example, if you want to sell a stock currently trading at $50 per share and place a sell limit order at $55, the order will only be filled if the stock price rises to $55 or above.

The upside of limit orders is that investors can control the selling price (and potentially get a higher price than the current market rate). But, one possible downside is that their order won’t go through instantly and, potentially, might never go through (if the stock doesn’t reach the selected price).

Stop Orders or Stop-Loss Orders

A stop-loss order is placed with a brokerage to automatically sell a security when it reaches a specific price, known as the stop price. The reason investors set stop orders is to prevent incurring significant losses if a stock plummets in value.

For example, if you own a stock currently trading at $50 per share and place a stop-loss order at $40, the order will be triggered, and the stock will be sold if the price falls to $40 or below.

The upside of stop orders is that they can help protect against significant losses if the stock price drops unexpectedly (but not guarantee that you’ll avoid them). However, stop-loss orders do not guarantee a specific price, and the actual sale price may differ from the stop price due to market fluctuations.

Trailing Sell Stop Orders

Investors may also choose to place a trailing sell stop order, which allows you to set a stop price for a security that adjusts automatically as the price of the security moves in your favor.

With a trailing sell stop order, you can set the initial stop price at a certain percentage or dollar amount below the market price. The stop price will then adjust automatically as the market price of the security increases so that the stop price remains a fixed percentage or dollar amount below the market price. If the market price of the security then falls and reaches the stop price, the order will be triggered, and the security will be sold.

Trailing sell stop orders may allow traders to benefit from gains when a stock’s price rises while still protecting themselves from potential losses.

Factors to Assess When Selling and Cashing Out Stocks

There are several factors that you should consider when cashing out stocks:

- Capital gains taxes: Cashing out stocks may result in capital gains, which are subject to taxes. It is important to consider the tax implications of cashing out stocks. Not all stock holdings are taxed similarly, which could impact an investor’s decision to sell or not to sell.

- Investment goals: Consider why you are cashing out stocks and whether it aligns with your overall investment goals. If you are cashing out stocks to meet a short-term financial need, selling may be necessary even if the stock price is not optimal. However, if you are cashing out stocks as part of a long-term investment strategy, it may be worth holding onto the stocks, even if they’ve declined in price, because they may still appreciate over time.

- Fees and commissions: Brokerage firms generally charge investment fees and commissions for executing trades, which can impact the overall profit or loss on the sale of your stocks. Considering these fees and commissions is important when deciding whether to cash out stocks.

Pros and Cons of Reinvesting Profits

Investors may choose to sell stocks to gain or spend cash. But, individuals may want to reinvest earnings from the stocks sold into other assets. If investors decide to reinvest their profits, they need to consider the advantages and disadvantages of doing so.

Pros

- Compound growth: Reinvesting stock profits allows you to compound your returns on your investments, which may significantly increase your overall returns over time.

- Diversification: Reinvesting stock profits can help you diversify your portfolio and reduce risk by investing in various stocks rather than holding a lot of cash.

- Hedge against inflation: Cash is subject to inflation, which makes cash savings lose value over time. Over a long-term period, cash tends to lose value, whereas the stock market tends to grow. By reinvesting rather than holding on to cash, investors may be less likely to lose money due to inflation.

Recommended: 5 Tips to Hedge Against Inflation

Cons

- Opportunity cost: Reinvesting stock profits means that you are not using the proceeds from the sale of your stocks to meet other financial goals or needs, such as paying off debt or saving for a down payment on a house.

- Taxes: Reinvesting stock profits may result in capital gains tax, which can reduce the overall returns on your investments.

- Market risk: The value of your investments can fluctuate due to market conditions, and reinvesting stock profits means you are exposed to the risks of the stock market.

Platforms for Buying and Selling Stocks

People just getting started with building a portfolio of stocks have several options. Options might include online platforms or traditional phone-in and in-person traders, including:

Online Brokerage Accounts

There are numerous online brokerage accounts and digital apps where investors can buy and sell stocks to build a portfolio. Online brokerage accounts and apps can be a convenient investment method, allowing users to sell from anywhere. Unlike many traditional brokerage firms, many trading apps don’t charge a commission on trades.

Opening a brokerage account will require identity verification and connection with a bank account for deposits and withdrawals.

Financial Advisors

Investors can also make stock trades over the phone or in person by working with a financial advisor. Sell orders placed through these individuals generally get executed within 24 hours, so it can be a slower method to cash out stocks. Before the arrival of web-driven trading, most stocks were bought and sold through traditional investment brokers or financial advisors.

Test your understanding of what you just read.

The Takeaway

Before selling any stocks, investors might opt to evaluate their short- and long-term financial goals. Then, they could devise a plan to pursue those objectives, which may lead to cashing out stock holdings. However, knowing when to sell a stock can take time and effort. Rather than trying to time the market and sell stocks to lock in immediate profits and avoid future losses, individuals may want to invest for the long term.

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

FAQ

How long does it take to cash out stocks?

The time it takes to cash out stocks can vary depending on the type of order you place and market conditions. Generally, it can take anywhere from a few seconds to several days for a sale of stocks to be completed.

Do you get money when you sell stock?

Yes, you will receive money when you sell stock, as long as its value is more than $0. The proceeds from the stock sale will be deposited into your brokerage account or sent to you in the form of a check. The amount of money you receive will depend on the price you sell the stock and any fees or commissions charged by the brokerage firm.

Can I withdraw money from stocks?

To access cash from stocks, you need to sell your holdings and use the proceeds from the sale to withdraw cash from your brokerage account.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

SOIN-Q424-031

Read more