What Is Extrinsic Value?

Editor's Note: Options are not suitable for all investors. Options involve risks, including substantial risk of loss and the possibility an investor may lose the entire amount invested in a short period of time. Please see the Characteristics and Risks of Standardized Options.

What Is Extrinsic Value?

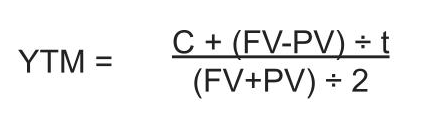

Extrinsic value is the difference between an option’s market price, known as the premium, and its intrinsic value.

Extrinsic value reflects factors beyond the underlying asset’s price that can influence the overall worth of an option. This value fluctuates based on the time to expiration and the volatility of the underlying asset.

Key Points

• Extrinsic value is the difference between an option’s market price and intrinsic value, influenced by time and volatility.

• Longer contracts and higher implied volatility increase extrinsic value.

• Interest rates and dividends affect extrinsic value differently for call and put options.

• Extrinsic value cannot be negative; it represents the portion of an option’s price that exceeds its intrinsic value.

• At-the-money options have the most extrinsic value due to sensitivity to time and volatility changes.

Understanding Intrinsic and Extrinsic Value

The intrinsic value of an option is the difference between an option’s strike price and the current price of the underlying asset, which can be calculated only when the underlying asset is in the money. An out-of-the-money option has no intrinsic value.

Remember, an option that is “in the money” would be profitable for the owner if exercised today, while an option that is “out of the money” would not.

An out-of-the-money option may present an investment opportunity for some, however, because of its potential to become in-the-money at expiration.

Extrinsic value equals the price of the option minus the intrinsic value. As an option’s expiration approaches, extrinsic value usually diminishes since there is less time for the price of the underlying asset to potentially move in a way that benefits the option holder (also known as time decay).

For example, an option that has two weeks before expiry typically has a higher extrinsic value than one that’s one week away. This does not imply it has more intrinsic value, however. It just means there is more time for it to move up or down in price.

Out-of-the-money option premiums consist entirely of extrinsic value, while in-the-money options have both intrinsic value and extrinsic value. Options that trade at-the-money might have a substantial proportion of extrinsic value if there is a long time until expiration and if volatility is high.

💡 Quick Tip: Options can be a cost-efficient way to place certain trades, because you typically purchase options contracts, not the underlying security. That said, options trading can be risky, and best done by those who are not entirely new to investing.

How Extrinsic Value Works

Simply put, the more time until expiration and the more a share price can fluctuate, the greater an option’s extrinsic value. Extrinsic value demonstrates the time that remains for potential price movement, and the uncertainty in that movement. There are a few different factors that could influence extrinsic value, and understanding them is crucial for evaluating an option’s pricing.

Factors that Affect Extrinsic Value

Two key factors affect an option’s extrinsic value: contract length and implied volatility. In general, the longer the contract, the greater the extrinsic value of an option. That’s because the more time allowed until expiration, the more a stock price might move in favor of the option’s holder. It’s possible, however, that the price moves in the opposite direction; if the holder keeps the option in the hope that the price will rebound, they may lose some or all of their investment.

The second factor that determines extrinsic value is implied volatility. Implied volatility measures the expected magnitude of how much a stock might move over a specific period. Volatility impacts an option’s extrinsic value, and its sensitivity is represented by the Greek letter vega.

Recommended: Understanding the Greeks in Options Trading

1. Length of Contract

An option contract generally has less value the closer it is to expiration. The logic is that there is less time for the underlying security to move in the direction of the option holder’s benefit. As the time to expiration shortens, the extrinsic value decreases, all else equal.

To manage this risk, many investors use the options trading strategy of buying options with varying contract lengths. As opposed to standard option contracts, a trader might choose to buy or sell weekly options, which usually feature shorter contract lengths.

On the opposite side of the spectrum, Long-Term Equity Anticipation Securities (LEAPS) sometimes have contract lengths that measure in years. Extrinsic value could be a large piece of the premium of a LEAPS option.

Some traders will also use a bull call spread, in order to reduce the impact of time decay (and the loss of extrinsic value) on their options.

Recommended: A Beginner’s Guide to Options Trading

2. Implied Volatility

Implied volatility measures how much analysts expect an asset’s price to move during a set period. In general, higher implied volatility means more expensive options, due to higher extrinsic value. That’s because there is a greater chance a stock price could significantly move in the favor of the owner by expiration (or out of favor if the markets shift in the opposite direction). High volatility gives an out-of-the-money option holder more hope that their position will go in-the-money.

So, if implied volatility rises from 20% to 50%, for example, an option holder may benefit from higher extrinsic value (all other variables held constant). On the flip side, an out-of-the-money option on a stock with extremely low implied volatility may have a lower chance of ever turning in-the-money.

3. Others Factors

There is more than just the length of the contract and implied volatility that affect the premium of an option, however.

• Time decay: The time decay, or the rate at which time decreases an option’s value, can greatly impact the premium of near-the-money options, this is known as theta. Time decay works to the benefit of the option seller, also known as the writer.

• Interest rates: Even changes in interest rates, or rho, impact an option’s value. A higher risk-free interest rate pushes up call options’ extrinsic value higher, while put options have a negative correlation to interest rates.

• Dividends: A stock’s dividend will decrease the extrinsic value of its call options while increasing the extrinsic value of its put options.

• Delta: An option’s delta is the sensitivity between an option price and its underlying security. In general, the lower an option’s delta, the less likely it is to be in-the-money, meaning it likely has higher extrinsic value. Options with higher delta are in-the-money and may have more intrinsic value.

💡 Quick Tip: All investments come with some degree of risk — and some are riskier than others. Before investing online, decide on your investment goals and how much risk you want to take.

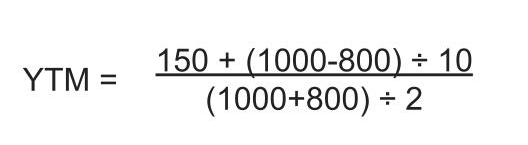

Extrinsic Value Example

Let’s say a trader bought a call option through their brokerage account on shares of XYZ stock. The premium paid is $10 and the underlying stock price is $100. The strike price is $110 with an expiration date in three months. Also assume there is a company earnings report due out in the next month.

Since the share price is below the call’s strike, the option is out-of-the-money. The option has no intrinsic value because it is out-of-the-money. Thus, the entire $10 option premium represents extrinsic value, or time value.

As expiration draws nearer, the time value declines, also known as time decay. A trader who takes the long position with a call option hopes the underlying asset appreciates by expiration.

An increase in volatility, perhaps due to the or another catalyst, might push the option’s price higher. Let’s assume the stock has risen to $120 per share following strong quarterly earnings results, and the call option trades at $11 immediately before expiration.

The call option’s intrinsic value is now $10, but the extrinsic value has declined to just $1, in this scenario, since there is little time to expiration and the earnings date volatility-driver has come and gone. In this case, the trader can sell the call for a small profit or they might choose to exercise the option.

Note that if the stock price had instead fallen below the strike price of $110, the call option would have expired worthless and the trader would have lost the premium they paid for the option.

Extrinsic vs Intrinsic Value

Extrinsic value reflects the length of the contract plus implied volatility, while intrinsic value is the difference between the price of the stock and the option’s strike when the option is in the money.

| Extrinsic Value Factors (Call Option) | Intrinsic Value Factor (Call Option) |

|---|---|

| Length of Contract | Stock Price Minus Strike Price |

| Implied Volatility |

Extrinsic Value and Options: Calls vs Puts

Both call options and put options can have extrinsic value.

Calls

Extrinsic value for call options can be high. Consider that a stock price has no upper limit, so call options have infinite potential extrinsic value. The more time until expiration and the greater the implied volatility, the more extrinsic value a call option will have.

Puts

Put options have a lower potential value since a stock price can only drop to zero. Thus, there is a limit to how much a put option can be worth, which is the difference between the strike price and zero. Out-of-the-money puts, when the stock price is above the strike, feature a premium entirely of extrinsic value.

Recommended: Understanding the Greeks in Options Trading

The Takeaway

Understanding the fundamentals of intrinsic and extrinsic value is important for options traders. Although intrinsic value is a somewhat simple calculation, extrinsic value takes a few more factors into consideration — specifically time and volatility of the underlying asset. The more time until the contract expires, and the more a share price can fluctuate, the greater an option’s extrinsic value.

SoFi’s options trading platform offers qualified investors the flexibility to pursue income generation, manage risk, and use advanced trading strategies. Investors may buy put and call options or sell covered calls and cash-secured puts to speculate on the price movements of stocks, all through a simple, intuitive interface.

With SoFi Invest® online options trading, there are no contract fees and no commissions. Plus, SoFi offers educational support — including in-app coaching resources, real-time pricing, and other tools to help you make informed decisions, based on your tolerance for risk.

FAQ

Which options have the most extrinsic value?

Which options have the most extrinsic value?

At-the-money options typically have the most extrinsic value since their price is closest to the strike price, thus being most sensitive to changes in time and volatility.

Can an option’s extrinsic value be negative?

No. Extrinsic value represents the portion of an option’s price beyond its intrinsic value, so it can never be less than zero. If an option’s market price is lower than its intrinsic value, it can only be as low as zero.

Photo credit: iStock/alvarez

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Options involve risks, including substantial risk of loss and the possibility an investor may lose the entire amount invested in a short period of time. Before an investor begins trading options they should familiarize themselves with the Characteristics and Risks of Standardized Options . Tax considerations with options transactions are unique, investors should consult with their tax advisor to understand the impact to their taxes.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

SOIN-Q324-066

Read more