How to Save for Retirement

Between paying for your regular expenses including groceries, rent or mortgage, student loans, and bills, it can seem nearly impossible to find a few dollars left over for saving for retirement — especially when that might be decades away. However, building up a nest egg isn’t just important, it’s urgent. The sooner you start, the more financially secure you should be by the time retirement rolls around.

So, how to save for retirement? Finding a solid retirement plan to suit your needs may be easier than you think. Here are 10 ways to save for retirement to help make those golden years feel, well, golden.

This article is part of SoFi’s Retirement Planning Guide, our coverage of all the steps you need to create a successful retirement plan.

Assess Your Retirement Goals and Needs

When it comes to saving for retirement, first do an inventory of your current financial situation. This includes your income, savings, and investments, as well as your expenses and debts. That way you’ll know how much you have now.

Next, figure out what you want your retirement to look like. Are you wondering how to retire early? Do you plan to travel? Move to a different location? Pursue hobbies like tennis, golf, or biking? Go back to school? Start a business?

You may not be able to answer these questions quickly or easily, but it’s important to think about them to determine your retirement goals. Deciding what you want your lifestyle to look like is key because it will affect how much money you’ll need for retirement saving.

💡 Quick Tip: Before opening an investment account, know your investment objectives, time horizon, and risk tolerance. These fundamentals will help keep your strategy on track and with the aim of meeting your goals.

Determine How Much You’ll Need to Retire

Now the big question: How much money will it take for you to retire comfortably? You may also be wondering, when can I retire? There are several retirement savings formulas that can help you estimate the amount of your nest egg. And there are various calculators that can help generate an estimate as well.

While using a ballpark figure may not sound scientific, it’s a good exercise that can help lay the foundation for the amount you want to save. And it may inspire you to save more, or rethink your investment strategy thus far.

As an example, you can use the following basic formula to gauge the amount you might need to save, assuming your retirement expenses are similar to your present ones. Start with your current annual income, subtract your estimated annual Social Security benefits, and divide by 0.04.

Example

Let’s say your income today is $100,000, and you went on the Social Security website using your MySSA account (the digital dashboard for benefits) to find out what your monthly benefits are likely to be when you retire: $2,000 per month, or $24,000 per year.

$100,000 – $24,000 = $76,000 / 0.04 = $1.9 million

That’s the target amount of retirement savings you would need, theoretically, to cover your expenses based on current levels. Bear in mind, however, that you may not need to replace 100% of your current income, as your expenses in retirement could be lower. And you may even be contemplating working after retirement. But this is one way to start doing the math.

10 Ways to Save For Retirement

So, how to save money for retirement? Consider the following 10 options part of your retirement savings toolkit.

1. Leverage the Power of Time

Giving your money as much time to grow as you possibly can is one of the most important ways to boost retirement savings. The reason: Compounding returns.

Let’s say you invest $500 in a mutual fund in your retirement account, and in a year the fund gained 5%. Now you would have $525 (minus any investment or account fees). While there are no guarantees that the money would continue to gain 5% every year — investments can also lose money — historically, the average stock market return of the S&P 500 is about 10% per year.

That might mean 0% one year, 10% another year, 3% the year after, and so on. But over time your principal would likely continue to grow, and the earnings on that principal would also grow. That’s compound growth.

2. Create and Stick to a Budget

Another important step in saving for retirement is to create a budget and stick to it. Calculating your own monthly budget can be simple — just follow these steps.

• Gather your documents. Gather up all your bills including credit cards, loans, mortgage or rent, so that you can document every penny coming out of your pocket each month.

• List all of your income. Find your pay stubs and add up any extra cash you make on the side using your after-tax take-home pay.

• List all of your current savings. From here, you can see how far you have to go until you reach your retirement goals.

• Calculate your retirement spending. Decide how much money you need to live comfortably in retirement so that you can establish a retirement budget. If you’re unsure of what your ideal retirement number is, plug your numbers into the formula mentioned above, or use a retirement calculator to get a better idea of what your retirement budget will be.

• Adjust accordingly. Every few months take a look at your budget and make sure you’re staying on track. If a new bill comes up, an expensive life event occurs, or if you gain new income, adjust your budgets and keep saving what you can.

3. Take Advantage of Employer-Sponsored Retirement Plans

Preparing for retirement should begin the moment you start your first job — or any job that offers a company retirement plan. There are many advantages to contributing to a 401(k) program (if you work at a for-profit company) or a 403(b) plan (if you work for a nonprofit), or a 457(b) plan (if you work for the government).

In many cases, your employer can automatically deduct your contributions from your paycheck, so you don’t have to think about it. This can help you save more, effortlessly. And in some cases your employer may offer a matching contribution: e.g. up to 3% of the amount you save.

Starting a 401(k) savings program early in life can really add up in the future thanks to compound growth over time. In addition, starting earlier can help your portfolio weather changes in the market.

On the other hand, if you happen to start your retirement savings plan later in life, you can always take advantage of catch-up contributions that go beyond the 2025 annual contribution limit of $23,500 and the 2026 annual contribution limit of $24,500. Individuals 50 and older are allowed to contribute an additional $7,500 to a 401(k) in 2025 and $8,000 in 2026 to help them save a bit more before hitting retirement age. Those aged 60 to 63 may contribute an additional $11,250 in 2025 and 2026 (instead of $7,500 and $8,000, respectively) thanks to SECURE 2.0.

If you have a 403(b) retirement plan, it’s similar to a 401(k) in terms of the contribution limit and automatic deductions from your paycheck. Your employer may or may not match your contributions. However, the range of investment options you have to choose from may be more limited than those offered in a 401(k).

With a 457(b) plan, the contribution limit is similar to that of a 403(b). But employers don’t have to provide matching contributions for a 457(b) plan, and again, the investment options may be narrower than the options in a 401(k).

4. Add an Individual Retirement Account (IRA) to the Mix

Another strategy for how to save for retirement, especially if you’re one of the many freelancers or contract workers in the American workforce, is to open an IRA account.

Like a 401(k), an IRA allows you to put away money for your retirement. However, the maximum contribution you can put into your IRA caps at $7,000 ($8,000 for those 50 and older) in 2025, and $7,500 ($8,600 for those 50-plus) in 2026.

Both the traditional IRA and 401(k) offer tax-deductible contributions. Roth IRAs are another option: With a Roth IRA, your contributions are taxed, which means your withdrawals in retirement will be tax free.

You control your IRA, not a larger company, so you can decide which financial institution you want to go with, how much you want to contribute each month, how to invest your money, and if you want to go Roth or traditional.

For those who can afford to invest money in both an IRA and a 401(k), and who meet the necessary criteria, that’s also an option that can boost retirement savings.

5. Deal With Debt

Should you save for retirement or pay off debt? And, more specifically, if you’re dealing with student loans, you may be wondering, should I save for retirement or pay off student loans? That is a financial conundrum for modern times. A good solution to this problem is to do both.

Just as it can be helpful to create a budget and stick to it, it can be helpful to create a loan repayment plan as well. Add those payments to your monthly budgeting expenses and if you still have dollars left over after accounting for all your bills, start socking that away for retirement.

If your student loan debt feels out of control, as it does for many Americans, you may want to look into student loan refinancing. By refinancing your student loan, you could significantly lower your interest rate and potentially pay off your debt faster. Once the loan is paid off, you will be able to reallocate that money to save for retirement.

6. Add Income With a Side Hustle

Working a side gig in your spare time can seriously pay off in the future, especially when you consider that the average side hustle can bring in several hundred dollars a month, according to one survey.

There are several things to consider when thinking of adding an extra job to your résumé, including evaluating what you’re willing to give up in order to make time for more work. But, if you can put your skills to use — such as copy editing, photography, design, or consulting — you can think about this as less of a side hustle and more of a way to hone your client list.

A side hustle should be one way to save for retirement that you’ll enjoy doing. And it could help if you find yourself dealing with a higher cost of living and retirement at some point.

7. Consider Putting Your Money in the Market

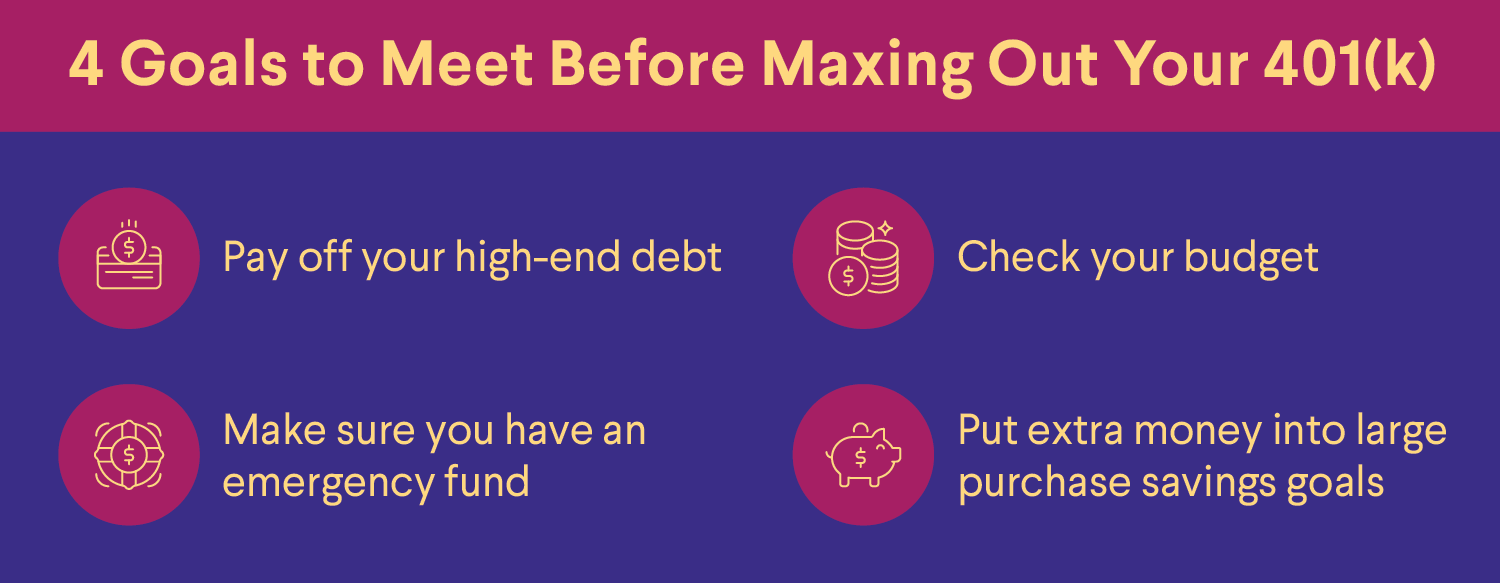

There’s no one best way to save for retirement — sometimes a multi-pronged approach can work best. If you already have a budget and an emergency savings account, and you’re maxing out your contributions to your 401(k), 403(b), 457, or IRA, then investing in the market could be another way to diversify your portfolio and potentially help build your nest egg. For instance, historically, stocks have been proven to be one of the best ways to help build wealth.

Putting your money in the market means you’ll have a variety of options to choose from. There are stocks, of course, but also mutual funds, exchange-traded funds, and even real estate investment trusts (REITs), which pool investor assets to purchase or finance a portfolio of properties.

However, investing in any of these assets, and in the market in general, comes with risk. So you’ll want to keep that in mind as you choose what to invest in. Consider what your risk tolerance is, how much you’re investing, when you’ll need the money, and how you might diversify your portfolio. Carefully weighing your priorities, needs, and comfort level, can help you make informed selections.

Once you have your asset allocation, be sure to evaluate it, and possibly rebalance it, to stay in line with your goals each year.

8. Automate Your Savings

Setting up automated savings accounts takes the thought and effort out of saving your money because it happens automatically. It could also help you hit your financial goals faster, because you don’t have to decide to save (or agonize over giving in to a spending temptation) and then do the manual work of putting the money into an account. It just happens like clockwork.

Enrolling in a 401(k), 403(b), or 457 at work is one way to automate savings for retirement. Another way to do it is to set up direct deposit for your paychecks. You could even choose to have a portion of your pay deposited into a high-interest savings account to help increase your returns.

9. Downsize and Cut Costs

To help save more and spend less, pull out that monthly budget you created. When you look at your current bills vs. income, how much is left over for retirement savings? Are there areas you can be spending less, such as getting rid of an expensive gym membership or streaming service, dialing back your takeout habit, or shopping a bit less?

This is when you need to be very honest with yourself and decide what you’re willing to give up to help you hit that target retirement number. Finding little ways to save for retirement can have a big impact down the road.

10. Take Advantage of Catch-Up Contributions

If you’re getting closer to retirement and you haven’t started saving yet, it’s not too late! In fact, the government allows catch-up contributions for those age 50 and older.

A catch-up contribution is a contribution to a retirement savings account that is made beyond the regular contribution maximum. Catch-up contributions can be made on either a pre-tax or after-tax basis.

For 2025, catch-up contributions of up to $7,500 are permitted on a 401(k), 403(b), or 457(b). Those age 60 to 63 may contribute an additional $11,250 (instead of $7,500). For 2026, catch-up contributions of up to $8,000 are permitted; those age 60 to 63 may contribute an additional $11,250 (instead of $8,000).

Under a new law that went into effect on January 1, 2026 (as part of SECURE 2.0), individuals aged 50 and older who earned more than $150,000 in FICA wages in 2025 are required to put their 401(k), 403(b), or 457(b) catch-up contributions into a Roth account. Because of the way Roth accounts work, these individuals will pay taxes on their catch-up contributions upfront, but can make eligible withdrawals tax-free in retirement.

💡 Quick Tip: Look for an online brokerage with low trading commissions as well as no account minimum. Higher fees can cut into investment returns over time.

Common Retirement Savings Mistakes to Avoid

These are some of the biggest retirement pitfalls to watch out for.

• Not having a retirement plan in place. Neglecting to make any kind of plan means you’ll likely be unprepared for retirement and won’t have enough money for your golden years.

• Failing to take advantage of employer-sponsored plans. If you haven’t enrolled in one of these plans, you’re potentially leaving free money on the table. Sign up for a 401(k), 403(b), or 457(b) to tap into employer-matching contributions, when available.

• Underestimating how much money you’ll need for retirement. Financial specialists typically advise having enough savings to last you for 25 to 30 years after you retire.

• Accumulating too much debt. Try to avoid taking on too much debt as you get closer to retirement. And work on paying down the debt you do have so you won’t be saddled with it when you retire.

• Taking Social Security too early. It’s possible to file for Social Security at age 62, but the longer you wait (up until age 70), the higher your benefit will be — approximately 32% higher, in fact.

The Takeaway

It’s never too early to start planning for retirement. And there are many ways to start saving, and set up a system so that you’re saving steadily over time. You can contribute to a retirement plan that your employer offers; you can set up your own retirement plan (e.g. an IRA); and you can choose your own investments.

The most important thing to remember is that you have more control than you think. While your retirement vision may change over time, starting to save and invest your nest egg now will give you a head start.

Ready to invest for your retirement? It’s easy to get started when you open a traditional or Roth IRA with SoFi. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here).

FAQ

What is the fastest way to save for retirement?

Take a two-pronged approach: First, invest as much as you can in your employer-sponsored retirement account like a 401(k). You’ll likely get some matching contributions from your employer, as well as tax advantages.

For 2025, the standard 401(k) contribution limit for employees is $23,500. Those age 50 to 59, or 64 or older, are able to contribute up to $31,000; those 60 to 63 are able to contribute up to $34,750.

For 2026, the standard 401(k) contribution limit for employees is $24,500. Those age 50 to 59, or 64 or older are able to contribute up to $32,500; those 60 to 63 are able to contribute up to $35,750.

Second, if you qualify, you can also set up and invest in a Roth IRA. For 2025, the Roth IRA contribution limit is $7,000 ($8,000 for those 50 and older). For 2026, the limit is $7,500 ($8,600 for those 50 and older). These limits may be further reduced based on your modified adjusted gross income (MAGI).

How much do I need to save for retirement?

To estimate how much you need to save for retirement, use this retirement savings formula: Start with your current income, subtract your estimated Social Security benefits, and divide by 0.04. That’s the approximate amount of total retirement savings you’ll need, based on your current income and expenses. You can try other calculators or formulas that might indicate that you’ll need less in retirement. It all depends.

Financial professionals typically advise having enough savings for 25 to 30 years’ worth of retirement.

How do I save for retirement without a 401(k)?

If you don’t have a 401(k), you can set up another type of tax-advantaged account for retirement, such as a traditional IRA and/or a Roth IRA. With a traditional IRA, the money grows tax free and is taxed when you withdraw it during retirement.

A Roth IRA, on the other hand, doesn’t provide a tax break up front, but the funds you withdraw after age 59 ½ are tax-free, as long as you’ve had the Roth IRA account for at least five years.

What is the average monthly income for a person who is retired?

The average monthly retirement income for a person who is retired, adjusted for inflation, is $4,381, according to a 2022 U.S. Census report.

How do taxes affect retirement income?

You will need to pay taxes on any withdrawals you make from tax-deferred investments like a 401(k) or traditional IRA. You will also have to pay federal taxes on a pension, if you have one. At the state level, some states tax pensions and some don’t. Additionally, you might have to pay tax on a portion of your Social Security benefits, depending on your overall income.

How can I supplement my income in retirement?

In addition to any retirement plans and pensions you have plus Social Security, you can supplement your retirement income with such strategies as: making investments generally considered to be safe, like investing in CDs (certificate of deposit), getting a part-time job or starting a small business, or renting out any additional property you might own, such as a vacation cabin, to make some extra money.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE SoFi Loan Products

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

Exchange Traded Funds (ETFs): Investors should carefully consider the information contained in the prospectus, which contains the Fund’s investment objectives, risks, charges, expenses, and other relevant information. You may obtain a prospectus from the Fund company’s website or by emailing customer service at [email protected]. Please read the prospectus carefully prior to investing.

Disclaimer: The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Student Loan Refinance

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SOIN-Q224-1831913

CN-Q425-3236452-31

Q126-3525874-010