How Much a $200,000 Mortgage Will Cost You

A $200,000 mortgage might cost you more than twice that amount over the course of the loan’s lifetime. That’s thanks in part to the way banks amortize, or parse out the balance of interest to principal in each payment. Of course, how much your specific $200,000 mortgage will cost is a more complicated equation, since personal financial factors like your credit score and debt level will affect your interest rate. And your interest rate, in turn, will affect your total mortgage cost.

Let’s take a deeper dive into the mortgage payment on $200K, including sample amortization tables, how much your monthly payment might cost, where to find a loan, and more.

Table of Contents

Key Points

• A $200,000 mortgage can cost more than double the principal amount over its lifetime due to interest.

• Your specific interest rate is influenced by personal financial factors like your credit score and debt-to-income (DTI) ratio and significantly impacts the total cost and monthly payment.

• Monthly payments for a $200,000 mortgage vary based on term and interest rate.

• Mortgages are amortized, meaning the majority of your early payments goes toward interest rather than the principal, which slows down the rate at which you build home equity.

• Choosing a shorter loan term, like 15 years instead of 30, results in higher monthly payments but allows you to build equity faster and save on interest.

Here’s What a $200,000 Mortgage Costs

When you take out a loan of any kind, the lending institution — often a bank — charges you for the service of giving you the money you need up front. When you repay a loan, you’re repaying both principal (the money you borrowed) and interest (the money the loan servicer is charging you).

Interest is expressed as a rate in the form of a percentage. Higher interest means you’re paying more for the loan — and lower interest, of course, means you’ll pay less. The lowest interest rates are reserved for buyers with the best financial profiles, which may include factors like robust and steady income, a good or excellent credit score, and a low level of existing debt (another factor lenders express in the form of a percentage: DTI, or your debt-to-income ratio).

With all that said, let’s say you take out a $200,000 mortgage to pay for a house that costs $275,000. In this example, you’d have made a down payment of $75,000, or just over 27%. Over the course of a 30-year mortgage term, with a fixed interest rate of 6%, you’d pay almost $232,000 in interest — along with the principal repayment, of course, bringing your total amount paid to almost $432,000. You’ll notice that figure is more than double the original $200,000 you borrowed, and this example doesn’t even include additional fees like property tax or homeowners insurance.

However, interest rates are very powerful here, and even a small decrease in interest can have a big effect on the overall loan cost. For example, imagine everything we’ve just described above remains the same, but your interest rate is 4% rather than 6%. In that scenario, your total interest would be about $143,000, representing a savings of around $90,000. (Insert shocked emoji.)

As you can see, finding the most favorable interest rates possible is really worthwhile for homebuyers. If this is your first time in the home market, a home loan help center can educate you about the buying process.

💡 Quick Tip: You deserve a more zen mortgage. Look for a mortgage lender who’s dedicated to closing your loan on time.

First-time homebuyers can

prequalify for a SoFi mortgage loan,

with as little as 3% down.

Questions? Call (888)-541-0398.

How Much Are Monthly Payments for a $200,000 Mortgage?

Maybe you’re less concerned about how much your $200,000 mortgage will cost you over the long term but are curious about the monthly payment on a $200K mortgage. Again, interest rates have a big effect on monthly mortgage payments, as does the loan’s term (how long you have to repay it). Still, we can offer a few examples.

For a 30-year $200,000 mortgage at a fixed interest rate of 7%, your monthly payments would be about $1,330 (though this figure doesn’t include property taxes or homeowners insurance, which could push your payment hundreds of dollars upward).

For a 15-year $200,000 mortgage with the same interest rate, your monthly payments would be about $1,797 (again, without additional costs included).

You can get more specific figures customized to your circumstances using a mortgage calculator or home affordability calculator online.

Where You Can Get a $200,000 Mortgage

There are ways to get a $200,000 mortgage if you’re sure you’re ready for one. Private banks, credit unions, and lenders who specialize in mortgages are all available to meet your request. You can usually do most of the application online.

One caveat: As we’ve seen above, interest rates can make a huge difference when it comes to the cost of your mortgage over time. Although market factors have a big influence on interest rates, your personal markers also matter. Getting your financial ducks in a row as possible before applying could help you save money in the long run. (So can finding an affordable place to live in the first place.) Additionally, you may want to ask for prequalification quotes from a variety of lenders to see who can give you the best deal.

Recommended: Tips to Qualify for a Mortgage

What to Consider Before Getting a $200,000 Mortgage: Amortization

Remember how we were talking about amortization above? In most cases, lenders amortize loans in such a way that, toward the beginning of the loan, the bulk of your payments are going to cover interest. (Although your fixed monthly payments never change, the proportion of how much of that amount goes toward interest versus principal can.)

To understand how this can impact your ability to build equity, we’ve included the following sample amortization schedules for two different types of mortgage loans below. As you’ll see, the remaining principal balance goes down far more slowly than the amount you pay in. For example, in the chart below, although you’d pay a total of almost $16,000 toward your mortgage, the principal only reduces by about $2,000 because nearly $14,000 of your payments go toward interest.

Amortization Schedule, 30-year, 7% Fixed

| Years Since Purchase | Beginning Balance | Monthly Payment | Total Interest Paid | Total Principal Paid | Remaining Balance |

| 1 | $200,000 | $1,330.60 | $13,935.64 | $2,031.62 | $197,968.38 |

| 3 | $195,789.89 | $1,330.60 | $13,631.29 | $2,335.97 | $193,453.93 |

| 5 | $190,949.09 | $1,330.60 | $13,281.35 | $2,685.91 | $188,263.18 |

| 10 | $175,432.38 | $1,330.60 | $12,159.65 | $3,807.61 | $171,624.77 |

| 15 | $153,435.50 | $1,330.60 | $10,933.39 | $5,033.87 | $153,435.50 |

| 20 | $129,388.32 | $1,330.60 | $8,831.12 | $7,136.14 | $122,252.17 |

| 30 | $15,377.96 | $1,330.60 | $589.30 | $15,377.96 | $0.00 |

As you can see, even 20 years into the loan’s 30-year lifespan, you’ll still be paying more toward interest than principal (though the proportion will be much closer to 50/50 than at the beginning of the term).

Next, let’s look at what happens when the home mortgage loan term is reduced to 15 years.

Amortization Schedule, 15-year, 7% Fixed

| Years Since Purchase | Beginning Balance | Monthly Payment | Total Interest Paid | Total Principal Paid | Remaining Balance |

| 1 | $200,000 | $1,797.66 | $13,752.28 | $7,819.60 | $192,180.40 |

| 3 | $183,795.53 | $1,797.66 | $12,580.86 | $8,991.02 | $174,804.51 |

| 5 | $165,163.53 | $1,797.66 | $11,233.95 | $10,337.93 | $154,825.60 |

| 7 | $143,740.35 | $1,797.66 | $9,685.27 | $11,886.61 | $131,853.74 |

| 10 | $105,440.55 | $1,797.66 | $6,916.57 | $14,655.31 | $90,785.24 |

| 12 | $75,070.50 | $1,797.66 | $4,721.12 | $16,850.76 | $58,219.74 |

| 15 | $20,775.73 | $1,797.66 | $796.15 | $20,775.73 | $0.00 |

As this chart shows, a mortgage loan with a shorter term can help you build equity more quickly: Notice how principal and interest payments are much closer to equal just five years in, or a third of the way through the loan. Keep in mind that this ability comes at the cost of a higher monthly payment, though, so it may not be possible for all — especially first-time homebuyers who may struggle to meet higher mortgage payments.

Get matched with a local

real estate agent and earn up to

$9,500‡ cash back when you close.

Pair up with a local real estate agent through HomeStory and unlock up to

$9,500 cash back at closing.‡ Average cash back received is $1,700.

💡 Quick Tip: If you refinance your mortgage and shorten your loan term, you could save a substantial amount in interest over the lifetime of the loan.

How Do I Get a $200,000 Mortgage?

Taking out a $200,000 mortgage is a fairly simple process these days. In most cases, your lender can prequalify you online or over the phone. While applying for your official approval will take a few more steps, including providing documentation like income verification and tax returns, you can still be approved in as little as a business day — and ready to take over the keys to your dream home.

To get started, reach out to the lender you’ve chosen to learn more about its process. The lender may make it simple to start your application online. Just don’t forget that interest adds up, and amortization can make it more difficult to build equity quickly. It’s worth checking in to ensure your lender doesn’t charge an early repayment penalty, and that it’s easy to pay additional principal if you’re able.

Recommended: The Cost of Living By State

The Takeaway

Because of interest, a $200,000 mortgage might cost more than $200,000 on top of the principal you borrow. It all depends on your loan term as well as your specific rate — which in turn depends on your financial standing.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

How much does a $200K mortgage cost each month?

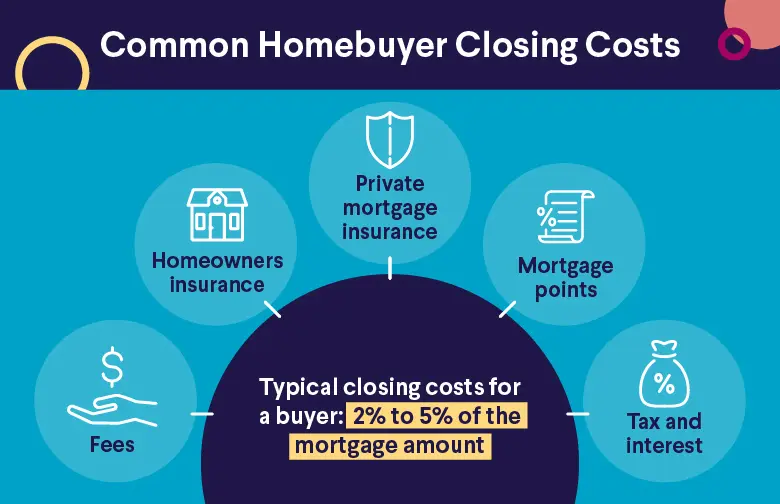

With a fixed rate of 6.25%, a 30-year $200,000 mortgage will cost about $1,231 per month before additional fees, and a 15-year $200,000 mortgage at the same rate will cost closer to $1,715. If your down payment is less than 20% you will likely have to pay for mortgage insurance as well, not to mention property taxes and insurance.

How much income is required to qualify for a $200,000 mortgage?

An income of around $65,000 is in the right ballpark to qualify for a $200,000 mortgage. Income is far from the only important factor lenders consider when qualifying you for a loan, however, and even those who make substantial income may not qualify if they have high levels of debt or other negative factors.

How much is the down payment for a $200,000 mortgage?

Down payment amounts can vary substantially. Some loans allow you to put down as little as 3.5%, which, for a $200,000 home would be $7,000. To avoid having to pay for mortgage insurance, you’d want to put down at least 20%, which is $40,000.

Can I afford a $200K house with a salary of $70K?

What you can and can’t afford is a complex calculation that depends on your lifestyle, where you live, and more. That said, a salary of $70,000 is within the feasible range to take out a $200,000 mortgage, particularly if you choose a longer loan term.

Photo credit: iStock/skynesher

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q425-181

Read more