How Much a $1 Million Mortgage Will Cost You

What is the monthly payment on a $1 million mortgage at recent interest rates? If we remove property taxes, property insurance, and mortgage insurance from the equation, you can expect to spend between $6,653 and $8,988 a month on principal and interest alone, depending on which loan term you choose. But that’s not the whole story. There’s more you’ll need to know about a $1 million mortgage payment.

Table of Contents

Key Points

• A $1,000,000 mortgage typically falls under the jumbo loan category, meaning it exceeds conventional loan limits in most areas.

• Monthly payments for a $1 million mortgage (principal and interest only) are roughly $6,653 for a 30-year term and $8,988 for a 15-year term, based on a 7.00% interest rate.

• Choosing a 15-year term over a 30-year term on a $1 million mortgage at 7.00% interest can save you over $777,000 in total interest paid over the life of the loan.

• Lenders typically require you to have a debt-to-income (DTI) ratio of 43% or less to qualify for a mortgage.

• To afford a $1 million 30-year mortgage, you would need an annual income of approximately $265,000, or about $360,000 for a 15-year term.

Cost of a $1 Million Mortgage

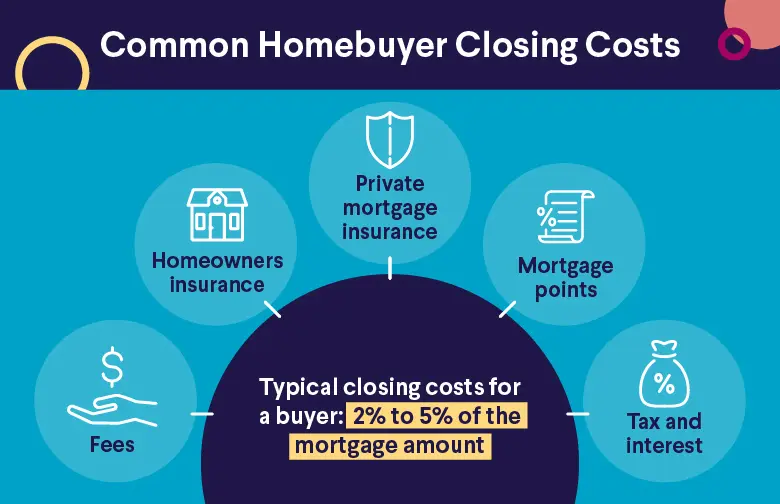

The cost of a $1 million mortgage varies depending on which home mortgage loan you choose and a few other factors, such as interest rate and property taxes. As you may know, different types of mortgage loans have different expenses, such as mortgage insurance, which can change your monthly payment.

Monthly Payments for a $1 Million Mortgage

The monthly payment on a $1 million mortgage is influenced by a variety of factors, which include:

• Interest rate

• Fixed vs. variable interest rate

• Mortgage insurance

• Property insurance

• Loan term

• Type of loan

• Property taxes

Removing all variables except a 7.00% interest rate, a $1 million mortgage payment would be between $6,653 and $8,988 per month. If you’re a first time homebuyer considering a $1 million mortgage, make sure you understand the true cost of buying and owning a home. Remember that your property taxes and some insurance costs may be dictated by your home’s location. (You may want to analyze the cost of living by state. Some of the best affordable places to live in the U.S. may surprise you.)

If these variables are new to you, a home loan help center may smooth out any confusion you may have.

Where to Get a $1 Million Mortgage

You can get a $1 million mortgage with mortgage lenders such as banks, credit unions, and online lenders. However, they’ll need to offer jumbo home loans since $1 million exceeds the conventional loan limit of $832,750 in most areas. When comparing lenders, look at both interest rates and fees. Loan origination fees, in particular, can vary greatly between lenders.

💡 Quick Tip: A major home purchase may mean a jumbo loan, but it doesn’t have to mean a jumbo down payment. Apply for a jumbo mortgage with SoFi, and you could put down as little as 10%.

What to Consider Before Applying for a $1 Million Mortgage

The monthly payment for a $1 million mortgage isn’t the only thing you should consider. Also keep in mind the total amount you’ll spend on interest for each loan term. For a 30-year loan with a 7.00% interest rate, you’ll spend $1,395,086 on interest. If you opt for a 15-year loan, you’ll spend just $617,890. This means if you can afford a 15-year loan, you’ll save $777,196.

While you’re home shopping, use a mortgage calculator to see the amount of money you’ll spend monthly and over the life of the loan. You may also want to use a home affordability calculator to incorporate your monthly debts and spending habits into the equation. While you may be able to technically afford a large monthly payment, would the expense leave room for dining out, vacations, and retirement contributions?

During the early years of your mortgage loan, more of your monthly payment typically goes toward paying off the interest on the loan, with a smaller proportion paying down the principal you owe. An amortization schedule shows how the proportions shift, and you build equity more quickly in the second half of the loan term. Here are sample schedules for 30-year and 15-year loan terms:

Amortization Schedule, 30-year, 7.00%

| Year | Beginning Balance | Monthly Payment | Total Interest Paid | Total Principal Paid | Remaining Balance |

|---|---|---|---|---|---|

| 1 | $1,000,000 | $6,653.02 | $69,678.20 | $10,158.10 | $989,841.90 |

| 2 | $989,841.90 | $6,653.02 | $68,943.87 | $10,892.43 | $978,949.47 |

| 3 | $978,949.47 | $6,653.02 | $68,156.46 | $11,679.84 | $967,269.63 |

| 4 | $967,269.63 | $6,653.02 | $67,312.12 | $12,524.18 | $954,745.45 |

| 5 | $954,745.45 | $6,653.02 | $66,406.75 | $13,429.55 | $941,315.90 |

| 6 | $941,315.90 | $6,653.02 | $65,435.92 | $14,400.38 | $926,915.52 |

| 7 | $926,915.52 | $6,653.02 | $64,394.92 | $15,441.38 | $911,474.14 |

| 8 | $911,474.14 | $6,653.02 | $63,278.66 | $16,557.64 | $894,916.50 |

| 9 | $894,916.50 | $6,653.02 | $62,081.71 | $17,754.59 | $877,161.91 |

| 10 | $877,161.91 | $6,653.02 | $60,798.23 | $19,038.07 | $858,123.83 |

| 11 | $858,123.83 | $6,653.02 | $59,421.96 | $20,414.34 | $837,709.50 |

| 12 | $837,709.50 | $6,653.02 | $57,946.21 | $21,890.09 | $815,819.40 |

| 13 | $815,819.40 | $6,653.02 | $56,363.77 | $23,472.53 | $792,346.88 |

| 14 | $792,346.88 | $6,653.02 | $54,666.94 | $25,169.36 | $767,177.52 |

| 15 | $767,177.52 | $6,653.02 | $52,847.44 | $26,988.85 | $740,188.66 |

| 16 | $740,188.66 | $6,653.02 | $50,896.42 | $28,939.88 | $711,248.78 |

| 17 | $711,248.78 | $6,653.02 | $48,804.35 | $31,031.95 | $680,216.83 |

| 18 | $680,216.83 | $6,653.02 | $46,561.05 | $33,275.25 | $646,941.58 |

| 19 | $646,941.58 | $6,653.02 | $44,155.58 | $35,680.72 | $611,260.86 |

| 20 | $611,260.86 | $6,653.02 | $41,576.22 | $38,260.08 | $573,000.78 |

| 21 | $573,000.78 | $6,653.02 | $38,810.39 | $41,025.91 | $531,974.88 |

| 22 | $531,974.88 | $6,653.02 | $35,844.63 | $43,991.67 | $487,983.20 |

| 23 | $487,983.20 | $6,653.02 | $32,664.47 | $47,171.83 | $440,811.37 |

| 24 | $440,811.37 | $6,653.02 | $29,254.41 | $50,581.89 | $390,229.48 |

| 25 | $390,229.48 | $6,653.02 | $25,597.84 | $54,238.46 | $335,991.02 |

| 26 | $335,991.02 | $6,653.02 | $21,676.94 | $58,159.36 | $277,831.66 |

| 27 | $277,831.66 | $6,653.02 | $17,472.59 | $62,363.71 | $215,467.96 |

| 28 | $215,467.96 | $6,653.02 | $12,964.32 | $66,871.98 | $148,595.97 |

| 29 | $148,595.97 | $6,653.02 | $8,130.14 | $71,706.16 | $76,889.81 |

| 30 | $76,889.81 | $6,653.02 | $2,946.49 | $76,889.81 | $0 |

Amortization Schedule, 15-year, 7.00%

| Year | Beginning Balance | Monthly Payment | Total Interest Paid | Total Principal Paid | Remaining Balance |

|---|---|---|---|---|---|

| 1 | $1,000,000 | $8,988.28 | $68,761.41 | $39,097.98 | $960,902.02 |

| 2 | $960,902.02 | $8,988.28 | $65,935.02 | $41,924.38 | $918,977.65 |

| 3 | $918,977.65 | $8,988.28 | $62,904.30 | $44,955.09 | $874,022.55 |

| 4 | $874,022.55 | $8,988.28 | $59,654.49 | $48,204.90 | $825,817.65 |

| 5 | $825,817.65 | $8,988.28 | $56,169.76 | $51,689.64 | $774,128.02 |

| 6 | $774,128.02 | $8,988.28 | $52,433.11 | $55,426.28 | $718,701.74 |

| 7 | $718,701.74 | $8,988.28 | $48,426.34 | $59,433.05 | $659,268.68 |

| 8 | $659,268.68 | $8,988.28 | $44,129.92 | $63,729.47 | $595,539.21 |

| 9 | $595,539.21 | $8,988.28 | $39,522.91 | $68,336.48 | $527,202.73 |

| 10 | $527,202.73 | $8,988.28 | $34,582.86 | $73,276.53 | $453,926.19 |

| 11 | $453,926.19 | $8,988.28 | $29,285.69 | $78,573.70 | $375,352.50 |

| 12 | $375,352.50 | $8,988.28 | $23,605.59 | $84,253.80 | $291,098.70 |

| 13 | $291,098.70 | $8,988.28 | $17,514.88 | $90,344.51 | $200,754.19 |

| 14 | $200,754.19 | $8,988.28 | $10,938.87 | $96,875.52 | $103,878.66 |

| 15 | $103,878.66 | $8,988.28 | $3,980.73 | $103,878.66 | $0 |

How to Get a $1 Million Mortgage

Anyone who has ever bought a home will tell you there are tips to qualify for a mortgage. The biggest ones include saving up for a large down payment, paying down your debts, and working on your credit score before applying for a mortgage. Paying off balances lowers your debt to income (DTI) ratio and helps you qualify for better mortgage terms. The maximum DTI is usually around 43%, but it can vary with each lender and borrower.

💡 Quick Tip: Lowering your monthly payments with a mortgage refinance from SoFi can help you find money to pay down other debt, build your rainy-day fund, or put more into your 401(k).

The Takeaway

If you need to borrow $1 million to buy a home, a 15-year mortgage will require around a $9,000 a month mortgage payment, whereas a 30-year mortgage requires around $6,650. Assuming a 7.00% interest rate, homebuyers can expect to spend between $617,890 and $1,395,086 on interest alone.

Keep in mind that property taxes, home insurance, and mortgage insurance may increase your monthly payment. If you’re in the market to buy a $1 million house, principal and interest will comprise a majority of your monthly costs.

When you’re ready to take the next step, consider what SoFi Home Loans have to offer. Jumbo loans are offered with competitive interest rates, no private mortgage insurance, and down payments as low as 10%.

SoFi Mortgage Loans: We make the home loan process smart and simple.

FAQ

How much is a $1,000,000 mortgage a month?

You can expect to spend around $6,653 a month with a 30-year mortgage term and $8,988 a month with a 15-year term. This assumes you have a 7.00% interest rate (and doesn’t take into account property taxes, mortgage insurance, and property insurance).

How much income is required for a $1,000,000 mortgage?

Housing costs should be at or below 30% of your income. If you were to choose a 30-year mortgage, this suggests that your income should be around $265,000 a year. Choose a 15-year mortgage, and your income should be around $360,000.

How much is a down payment on a $1,000,000 mortgage?

Because a $1,000,000 mortgage typically means a jumbo loan, you may need to make a down payment of at least 10%. That means your minimum down payment would be $111,112 on a home priced around $1,112,000.

Can I afford a $1,000,000 house with a $70K salary?

No, a $70,000 annual salary would not be enough to cover the cost of a mortgage on a $1,000,000 house. This salary assumes about $5,833 gross a month (before taxes and deductions), which is not enough to cover the minimum payment required of either loan term.

Photo credit: iStock/Paul Bradbury

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOHL-Q425-184

Read more