The Different Types Of Home Equity Loans

Key Points

• Home equity loans allow homeowners to borrow against the equity in their homes.

• There are three main types of home equity loan options: traditional home equity loans, home equity lines of credit (HELOCs), and cash-out refinances.

• Traditional home equity loans provide a lump sum of money with a fixed interest rate and fixed monthly payments.

• HELOCs function like a credit card, allowing homeowners to borrow and repay funds as needed up to a specified limit within a set time frame.

• Home equity loans and HELOCs can be used for various purposes, such as home renovations, debt consolidation, or major expenses.

What Are the Main Types of Home Equity Financing?

When folks think of home equity loans, they typically think of either a fixed-rate home equity loan or a home equity line of credit (HELOC). There is a third way to use home equity to access cash, and that’s through a cash-out refinance.

With fixed-rate home equity loans or HELOCs, the primary benefit is that the borrower may qualify for a better interest rate using their home as collateral than by using an unsecured loan — one that is not backed by collateral. Some people with high-interest credit card debt may choose to use a lower-rate home equity loan to pay off those credit card balances, for instance.

This does not come without risks, of course. Borrowing against a home could leave it vulnerable to foreclosure if the borrower is unable to pay back the loan. A personal loan may be a better fit if the borrower doesn’t want to put their home up as collateral.

How much a homeowner can borrow is typically based on the combined loan-to-value ratio (CLTV ratio) of the first mortgage plus the home equity loan. For many lenders, this figure cannot exceed 85% CLTV. To calculate the CLTV, divide the combined value of the two loans by the appraised value of the home. In addition, utilizing a home equity loan calculator can help you understand how much you might be able to borrow using a home equity loan. It’s similar to the home affordability calculator you may have used during the homebuying process.

Of course, qualifying for a home equity loan or HELOC is typically contingent on several factors, such as the credit score and financial standing of the borrower.

Fixed-Rate Home Equity Loan

Fixed-rate loans are pretty straightforward: The lender provides one lump-sum payment to the borrower, which is to be repaid over a period of time with a set interest rate. Both the monthly payment and interest rate remain the same over the life of the loan. Fixed-rate home equity loans typically have terms that run from five to 30 years, and they must be paid back in full if the home is sold.

With a fixed-rate home equity loan, the amount of closing costs is usually similar to the costs of closing on a home mortgage. When shopping around for rates, ask about the lender’s closing costs and all other third-party costs (such as the cost of the appraisal if that will be passed on to you). These costs vary from bank to bank.

This loan type may be best for borrowers with a one-time or straightforward cash need. For example, let’s say a borrower wants to build a $20,000 garage addition and pay off a $4,000 medical bill. A $24,000 lump-sum loan would be made to the borrower, who would then simply pay back the loan with interest. This option could also make sense for borrowers who already have a mortgage with a low interest rate and may not want to refinance that loan.

Recommended: What Is a Fixed-Rate Mortgage?

Turn your home equity into cash with a HELOC from SoFi.

Access up to 90% or $500k of your home’s equity to finance almost anything.

Home Equity Line of Credit (HELOC)

A HELOC is revolving debt, which means that as the balance borrowed is paid down, it can be borrowed again during the draw period (whereas a home equity loan provides one lump sum and that’s it). As an example, let’s say a borrower is approved for a $10,000 HELOC. They first borrow $7,000 against the line of credit, leaving a balance of $3,000 that they can draw against. The borrower then pays $5,000 toward the principal, which gives them $8,000 in available credit.

HELOCs have two periods of time that borrowers need to be aware of: the draw period and the repayment period.

• The draw period is the amount of time the borrower is allowed to use, or draw, funds against the line of credit, commonly 10 years. After this amount of time, the borrower can no longer draw against the funds available.

• The repayment period is the amount of time the borrower has to repay the balance in full. The repayment period lasts for a certain number of years after the draw period ends.

So, for instance, a 30-year HELOC might have a draw period of 10 years and a repayment period of 20 years. Some buyers only pay interest during the draw period, with principal payments added during the repayment period. A HELOC interest-only calculator can help you understand what interest-only payments vs. balance repayments might look like.

A HELOC may be best for people who want the flexibility to pay as they go. For an ongoing project that will need the money portioned out over longer periods of time, a HELOC might be the best option. While home improvement projects might be the most common reason for considering a HELOC, other uses might be for wedding costs or business startup costs.

How Interest Rates Work on a HELOC

Unlike the rate on a fixed-rate loan, a HELOC’s interest rate is variable and will fluctuate with market rates, which means that rates could increase throughout the duration of the credit line. The monthly payments will vary because they’re dependent on the amount borrowed and the current interest rate.

When you take out a HELOC, you’ll start out in the draw period. Once you take out funds, you’ll be charged interest on what you’ve withdrawn. With some HELOCs, during the draw period, you’re only required to pay that interest; others charge you for both interest and principal on what you’ve withdrawn. During the repayment period, you won’t be able to withdraw money any longer, but you will need to make regular payments to repay the principal and interest on what you withdrew.

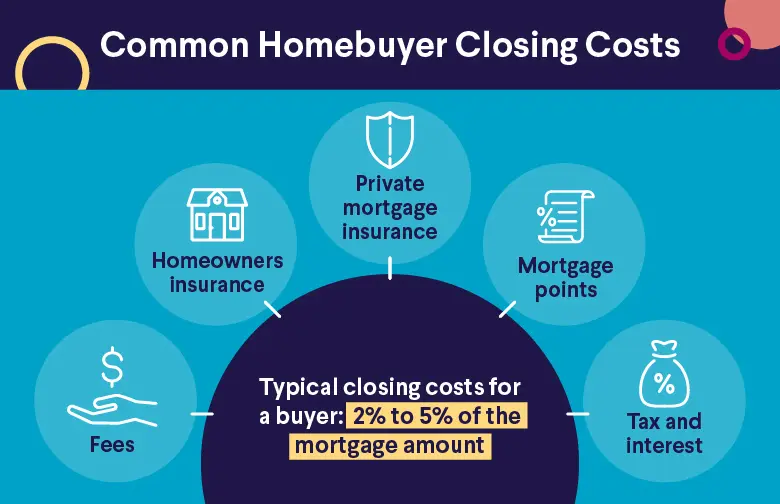

Home Equity Loan and HELOC Fees

Home equity loans and HELOCs both come with closing costs and fees, which may be anywhere from 1% to 5% of the loan amount. What those fees are and how you pay them, however, can vary by loan type. HELOCs may involve fewer closing costs than home equity loans, but often come with other ongoing costs, like an annual fee, transaction fees, and inactivity fees, as well as others that don’t pertain to home equity loans.

Generally, under federal law, fees should be disclosed by the lender. However, there are some fees that are not required to be disclosed. Borrowers certainly have the right to ask what those undisclosed fees are, though.

Fees that require disclosure include application fees, points, annual account fees, and transaction fees, to name a few. Lenders are not required to disclose fees for things like photocopying related to the loan, returned check or stop payment fees, and others. The Consumer Finance Protection Bureau provides a loan estimate explainer that will help you compare different estimates and their fees.

Home Equity Loan and HELOC Tax Deductibility

Since the passage of the One Big Beautiful BIll Act in July 2025 made permanent the mortgage deduction provisions of the Tax Cuts and Jobs Act of 2017, interest on home equity loans and HELOCs is only deductible if the funds are used to buy, build, or substantially improve the home securing the loan. What’s more, there’s a max of $750,000 on the amount of mortgage interest you can deduct ($375,000 each for spouses filing separately). Checking with a tax professional to understand how a home equity loan or HELOC might affect a certain financial situation is recommended.

Cash-Out Refinance

Mortgage refinancing is the process of paying off an existing mortgage loan with a new loan from either the current lender or a new lender. Common reasons for refinancing a mortgage include securing a lower interest rate, or either increasing or decreasing the term of the mortgage. Depending on the new loan’s interest rate and term, the borrower may be able to save money in the long term. Increasing the term of the loan may not save money on interest, even if the borrower receives a lower interest rate, but it could lower the monthly payments.

With a cash-out refinance, a borrower may be able to refinance their current mortgage for more than they currently owe and then take the difference in cash. For example, let’s say a borrower owns a home with an appraised value of $400,000 and owes $200,000 on their mortgage. They would like to make $30,000 worth of repairs to their home, so they refinance with a $230,000 mortgage, taking the difference in cash.

As with home equity loans, there typically are some costs associated with a cash-out refinance. Generally, a refinance will have higher closing costs than a home equity loan.

This loan type may be best for people who would prefer to have one consolidated loan and who need a large lump sum. But before pursuing a cash-out refi you’ll want to look at whether interest rates will work in your favor. If refinancing will result in a significantly higher interest rate than the one you have on your current loan, consider a home equity loan or HELOC instead.

When to Consider a Cash-Out Refinance

A cash-out refinance is worth looking into when you’ve built up equity in your home but feel that your mortgage terms could be better – and you need a lump sum. Let’s say you want to renovate your kitchen, and you need $40,000. You’ve had your mortgage for a few years but your credit score has improved since you got it and you could be eligible for a significantly better interest rate now. That combination of factors makes a cash-out refi worth considering. If a refinance would not make sense for you, then a cash-out refi wouldn’t, either. Instead, you might want to consider another kind of loan.

Pros and Cons of Cash-Out Refinancing

Cash-out refinances involve both advantages and drawbacks. Here are some of the most significant.

thumb_up

Pros:

• Allow you to access a lump sum of cash

• Can potentially give you a lower mortgage rate

• May let you change your mortgage terms to adjust your payments

thumb_down

Cons:

• Uses your home as collateral

• Adds another debt in addition to your mortgage

• Requires you to pay closing costs

Comparing Home Equity Financing Options

The different types of home equity loans all allow you to draw on the equity you’ve built in your home to access funds. But each type has different strengths and weaknesses, and the best type of home equity loan option for you will depend on your situation and the characteristics of the loan.

Which Type Is Right for You?

If you’re content with your mortgage – you don’t think you could get a better rate and your payments fit your budget – and you need a lump sum all at once, a home equity loan might make the most sense. To consolidate high-interest debt, buy a boat, or take a once-in-a-lifetime vacation, this might be a good option.

If your mortgage is fine and you need funds for a project that’s going to require withdrawals over time, a HELOC might be a good fit. Say you’re financing your child’s college education or starting a new business – having a line of credit to draw on when you need it could be extremely helpful.

Finally, if you’re looking for a lump sum and you feel that your mortgage isn’t a good fit, a cash-out refinance could be for you. Perhaps you could get a lower interest rate now or you’d like your term to be shorter and can afford the higher payments. In that case, a cash-out refinance could be useful.

Factors to Consider Before Choosing

As you do your home equity loan comparison and think about your options, it’s important to consider carefully what will really work best for you. Here are some questions to review.

• Will you be able to handle the additional debt in your budget?

• Do you need an upfront cash sum or access to funds over time?

• Can you realistically improve significantly on your current mortgage terms?

• Is what you stand to gain worth more than the price of your closing costs and any other fees involved?

• Are you okay with payments that vary or would you prefer knowing that your payments will stay the same?

• Are you comfortable knowing that your lender may be able to foreclose on your home if you can’t make your payments?

The Takeaway

There are three main types of home equity loans: a fixed-rate home equity loan, a home equity line of credit (HELOC), and a cash-out refinance. Just as with a first mortgage, the process will involve a bank or other creditor lending money to the borrower, using real property as collateral, and require a review of the borrower’s financial situation. Keep in mind that cash-out refinancing is effectively getting a new mortgage, whereas a fixed-rate home equity loan and a HELOC involve another loan, which is why they’re referred to as “second mortgages.”

While each can allow you to tap your home’s equity, what’s unique about a HELOC is that it offers the flexibility to draw only what you need and to pay as you go. This can make it well-suited to those who need money over a longer period of time, such as for an ongoing home improvement project.

SoFi now partners with Spring EQ to offer flexible HELOCs. Our HELOC options allow you to access up to 90% of your home’s value, or $500,000, at competitively lower rates. And the application process is quick and convenient.

FAQ

What is the downside of a home equity loan?

The primary downside of a home equity loan is that the collateral for the loan is your home, so if you found yourself in financial trouble and couldn’t make your home equity loan payment, you risk foreclosure. A second consideration is that a home equity loan provides you with a lump sum. If you are unsure about how much you need to borrow, consider a home equity line of credit (HELOC) instead.

How much does a $50,000 home equity loan cost?

The exact cost of a $50,000 home equity loan depends on the interest rate and loan term. But if you borrowed $50,000 with a 6.50% rate and a 10-year term, your monthly payment would be $568 and you would pay a total of $18,129 in interest over the life of the loan.

Can you use a home equity loan for anything?

Typically, you can use a home equity loan for just about anything you want to. Common reasons for taking out a home equity loan are to consolidate higher-interest debt, to pay for medical bills, and to fund major home repairs or upgrades. It’s important to remember that your house serves as collateral for the loan, so you want to be sure your use is worth the risk.

How do I qualify for a home equity loan?

To qualify for a home equity loan, you generally need to be a homeowner with at least 20% equity in your home. You’ll also need to have a credit score of at least 620 and a debt-to-income ratio of no more than 43%. Typically, lenders will want to see that you have a steady, reliable source of income and will be able to pay back the loan.

What is the difference between a HELOC and a cash-out refinance?

A home equity line of credit (HELOC) and a cash-out refinance are both ways of tapping your home equity to get cash, but they work differently. With a HELOC, you use your home as collateral to get a revolving line of credit, which lets you take out cash as you need it, up to a set limit, during the initial draw period (usually 10 years). During the repayment period that follows, you repay principal and interest on what you’ve borrowed. A cash-out refinance involves refinancing your mortgage for more than you currently owe and taking the difference as a cash lump sum.

²SoFi Bank, N.A. NMLS #696891 (Member FDIC), offers loans directly or we may assist you in obtaining a loan from SpringEQ, a state licensed lender, NMLS #1464945.

All loan terms, fees, and rates may vary based upon your individual financial and personal circumstances and state.You should consider and discuss with your loan officer whether a Cash Out Refinance, Home Equity Loan or a Home Equity Line of Credit is appropriate. Please note that the SoFi member discount does not apply to Home Equity Loans or Lines of Credit not originated by SoFi Bank. Terms and conditions will apply. Before you apply, please note that not all products are offered in all states, and all loans are subject to eligibility restrictions and limitations, including requirements related to loan applicant’s credit, income, property, and a minimum loan amount. Lowest rates are reserved for the most creditworthy borrowers. Products, rates, benefits, terms, and conditions are subject to change without notice. Learn more at SoFi.com/eligibility-criteria. Information current as of 06/27/24.In the event SoFi serves as broker to Spring EQ for your loan, SoFi will be paid a fee.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Checking Your Rates: To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

SOHL-Q325-022

Read more