Housing Market FOMO: Gen Z is Feeling Left Behind

Though putting together enough money to purchase a home has always been tough for younger buyers, rising prices and higher interest rates have made it especially difficult for Gen Z (those born from the mid-to-late 1990s and the early 2010s) to get a foot in the door of the housing market.

As they wait on the sidelines for the chance to buy their first place, many are feeling “real estate FOMO” — the fear that they’re missing out on a major life milestone and opportunity to build wealth that others have managed to achieve. Let’s take a look at some of the obstacles Gen Z is facing and learn the steps that could help as you save for, and search for, a home.

What Does FOMO Mean?

FOMO, or the fear of missing out, is a term used to describe the feeling that others are doing better than you are. Maybe they’re achieving goals that you haven’t yet reached, or experiencing things that you currently don’t have the wherewithal to accomplish (financially or otherwise). FOMO is often used in the context of missing out on a social event — a concert, for example, or a party you weren’t invited to. But it also can pertain to wanting to purchase things others in your social circle have — a better car, clothes, trips, or jewelry, for example.

FOMO spending is when the fear of missing out pushes you to spend money — maybe more than you should — to keep up with your peers. (Older generations often refer to this as “keeping up with the Joneses.”) Real estate FOMO can have that effect. It might lead someone to buy a house before they’re ready, or to get a mortgage loan on a house they can’t comfortably afford. But it also can make homebuyers reluctant to pull the trigger on a purchase, if they think they’ll find a better home at a better price if they just wait a while. And for members of Gen Z, social media can exacerbate those feelings.

Get matched with a local

real estate agent and earn up to

$9,500‡ cash back when you close.

Pair up with a local real estate agent through HomeStory and unlock up to

$9,500 cash back at closing.‡ Average cash back received is $1,700.

How to Deal with FOMO in Real Estate

There are a few different things you may want to consider doing if you think FOMO is getting in the way of making smart homebuying decisions.

If You Feel You Need a Reality Check…

It never hurts to revisit your budget to see how much house you can truly afford. Using a home affordability calculator can help you set some limits. It also may be useful to talk to a financial advisor about how buying a home — or a home at a particular price — could affect your other goals. If you see a property you’re interested in purchasing, run the numbers in a mortgage calculator to get a sense of what your monthly payments would be.

If You Find Yourself Trying to “Time the Market”…

It can be tough to predict when home prices or interest rates will go down. Instead, you might want to talk to a real estate agent about the best time of year to look for housing bargains in your area. Or you could shift your search from a pricey “hot” area to a place where the cost of living is more affordable. Also, if you find a home you think you’ll stay in long-term, you may want to keep mortgage refinancing in mind as an option for lowering costs down the road.

If You’re Feeling Triggered by What Others Have…

Looking at too many listings (or home improvement shows, or friends’ house-proud social media posts) has a way of leading you away from your personal “must-haves.” When that happens, it helps to take a moment (perhaps with a social-media hiatus?) to reprioritize and get back on track.

What Are the Barriers for Gen Z Home Buyers?

Some of the obstacles Gen Z homebuyers face are the same as those would-be homeowners have encountered off and on for generations. Home prices are high. Mortgage interest rates, though nowhere near the double digits they were throughout much of the 1980s, still feel nerve-rackingly elevated. Housing inventory is low. And though inflation is cooling, gas, groceries, and other costs are still taking a toll on household budgets.

But Gen Z has some issues to contend with that other generations may not, including:

Down Payment Costs

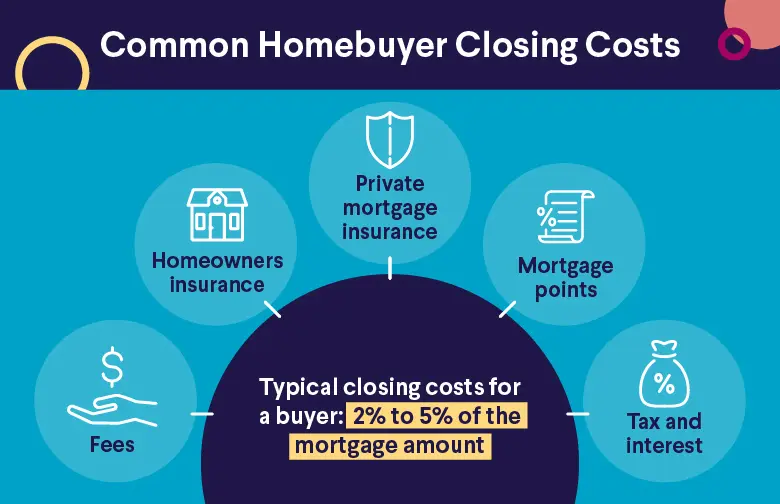

Higher-priced houses can require larger down payments, and that can make getting into the housing market increasingly difficult. First-time homebuyers typically put down less than repeat buyers — about 8% compared to 19%, according to the National Association of Realtors® 2023 Profile of Home Buyers and Sellers. That still could be a hefty chunk of change to come up with, however, considering the median home price in the U.S. is currently around $420,000.

Student Loan Debt

A college education may help Gen Z graduates earn a higher salary, but many report that student debt is slowing their progress toward certain milestones, including buying a home. Those college loans can make it even more difficult for younger buyers to save for a down payment or make higher monthly mortgage payments. You can afford a mortgage if you have student loans, but student debt can factor into your debt-to-income ratio (DTI), which may affect whether or not you qualify for a mortgage or what interest rate you’re offered.

Higher Rent Payments

Rising rental costs are another factor that may be affecting Gen Z’s ability to save for a home. According to Zillow’s monthly Observed Rent Index, the typical U.S. rent in March 2024 was $1,983, a 3.6% year-over-year increase.

Adulting = Insecurity

When you’re in a new (or new-ish) career, out on your own with bills to pay, and you’re not sure where life might take you next (a new job, a new town, a new partner, a new baby?), navigating life after college can be daunting enough without the homebuying headaches. While some in Gen Z have found a way to get into the housing market despite the barriers, others are waiting until their personal life feels more stable.

How Does Gen Z Approach Home Buying?

For some in Gen Z, buying a home may not be as significantly linked to achieving success as it was for older generations. (According to a 2023 GoDaddy survey, only 40% of Gen Z respondents chose “yes” when asked if homeownership indicated a person had achieved the American Dream, compared to 44% of millennials, 49% of Gen Xers, and 50% of boomers.) Still, it remains a goal for many, who are finding ways to make it happen — by taking on roommates, moving to a state with a lower cost of living, working a side gig to earn more money, or living with their parents after college to save money.

Where Is Gen Z Buying Homes?

As you might expect, Gen Z-ers who live in or can easily move to more affordable locations are more likely to buy homes than those in large cities where home prices are higher. According to a Redfin report, the typical home price for Gen Z buyers in 2022 was $255,000 or less — much lower than the overall median price in the U.S. that year.

Realtor.com recently listed Jacksonville, NC; Elkhart, IN; Lima, OH; Waterloo, IA; Cumberland, MD; Watertown, NY; St. Joseph, MO; Hinesville, GA; Dubuque, IA; and St. Cloud, MN, as the 10 metropolitan areas with the largest percentage of Gen Z buyers in 2022.

Recommended: Best Affordable Places to Live in the U.S.

Is It Harder for Gen Z to Buy a House?

Gen Zers aren’t facing the double-digit mortgage rates their parents and grandparents paid in the early 1980s. And they aren’t trying to buy a home during a depression or recession. Still, thanks to inflation and other factors — including an uptick in the number of affordable homes being snapped up by investment companies — this is a challenging time to become a homeowner.

According to Redfin, 30% of 25-year-olds owned their own home in 2022 — so it is doable. That homeownership rate is lower than what the baby boomers had (32%) when they were 25. But it’s actually a bit higher than the rate for millennials (28%) and Gen Xers (27%) when they were that same age.

Steps for Gen Z Home Buyers to Consider

For Gen Z, patience, flexibility, and creativity may be the keys to success in today’s tough housing market. Here are some steps to consider as you pursue homeownership:

Know Before You Go

The more you know about the homebuying process, the more confident you can feel about the decisions you make. Get to know the things you can do on the front end (like improving your credit score, lowering your DTI ratio, and researching first-time homebuyer programs and loans). And as you start your home search, consider listing your wants vs your needs, learning about the different types of mortgage loans, and going through the mortgage preapproval process.

Keep Expectations in Check

Here’s where FOMO can really get in your way: The house you can afford may not be anything close to the designer houses you see on social media and TV. But an affordable starter home can be a stepping stone to the home of your dreams. If you aren’t sure what you can manage, talk to a professional, such as your financial advisor, a real estate agent, or a mortgage professional.

Cast a Wide Net

If you can’t afford the trendiest neighborhood or a house directly on the beach, you may want to try searching in areas that are similar or nearby. If you can relocate, you could take your search even broader, looking at states that have what you want but at a lower price.

Recommended: Home Loan Help Center

The Takeaway

If high housing costs and other factors are getting in the way of your plans to buy a home, and you feel a strong sense of FOMO creeping up on you, try not to get sucked into overspending — or turned off to homeownership altogether. Staying true to your budget and your goals, and getting some assistance in finding the right home and home loan, can help you avoid feeling pressured into bad decision-making.

Looking for an affordable option for a home mortgage loan? SoFi can help: We offer low down payments (as little as 3% - 5%*) with our competitive and flexible home mortgage loans. Plus, applying is extra convenient: It's online, with access to one-on-one help.

FAQ

What does FOMO mean in real estate?

The fear of missing out (FOMO) in real estate is the worry that you aren’t where you should be when it comes to homeownership — perhaps because you haven’t yet purchased a home, or you don’t have the same level of home you see others in your peer group moving into.

What housing markets are dropping the fastest?

According to CoreLogic’s U.S. Home Price Insights report for 2024, several locations on both coasts of Florida are likely to experience price drops this year, as well as the Atlanta-Sandy Springs-Roswell area in Georgia, and the Youngstown-Warren-Boardman area in Ohio and Pennsylvania.

What is the slowest month for the housing market?

Winter is typically the slowest time of year for the housing market, while spring and summer are the busiest seasons.

Photo credit: iStock/gradyreese

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Mortgages

Terms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility-criteria for more information.

*SoFi requires Private Mortgage Insurance (PMI) for conforming home loans with a loan-to-value (LTV) ratio greater than 80%. As little as 3% down payments are for qualifying first-time homebuyers only. 5% minimum applies to other borrowers. Other loan types may require different fees or insurance (e.g., VA funding fee, FHA Mortgage Insurance Premiums, etc.). Loan requirements may vary depending on your down payment amount, and minimum down payment varies by loan type.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Qualifying for the reward requires using a real estate agent that participates in HomeStory’s broker to broker agreement to complete the real estate buy and/or sell transaction. You retain the right to negotiate buyer and or seller representation agreements. Upon successful close of the transaction, the Real Estate Agent pays a fee to HomeStory Real Estate Services. All Agents have been independently vetted by HomeStory to meet performance expectations required to participate in the program. If you are currently working with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®. A reward is not available where prohibited by state law, including Alaska, Iowa, Louisiana and Missouri. A reduced agent commission may be available for sellers in lieu of the reward in Mississippi, New Jersey, Oklahoma, and Oregon and should be discussed with the agent upon enrollment. No reward will be available for buyers in Mississippi, Oklahoma, and Oregon. A commission credit may be available for buyers in lieu of the reward in New Jersey and must be discussed with the agent upon enrollment and included in a Buyer Agency Agreement with Rebate Provision. Rewards in Kansas and Tennessee are required to be delivered by gift card.

HomeStory will issue the reward using the payment option you select and will be sent to the client enrolled in the program within 45 days of HomeStory Real Estate Services receipt of settlement statements and any other documentation reasonably required to calculate the applicable reward amount. Real estate agent fees and commissions still apply. Short sale transactions do not qualify for the reward. Depending on state regulations highlighted above, reward amount is based on sale price of the home purchased and/or sold and cannot exceed $9,500 per buy or sell transaction. Employer-sponsored relocations may preclude participation in the reward program offering. SoFi is not responsible for the reward.

SoFi Bank, N.A. (NMLS #696891) does not perform any activity that is or could be construed as unlicensed real estate activity, and SoFi is not licensed as a real estate broker. Agents of SoFi are not authorized to perform real estate activity.

If your property is currently listed with a REALTOR®, please disregard this notice. It is not our intention to solicit the offerings of other REALTORS®.

Reward is valid for 18 months from date of enrollment. After 18 months, you must re-enroll to be eligible for a reward.

SoFi loans subject to credit approval. Offer subject to change or cancellation without notice.

The trademarks, logos and names of other companies, products and services are the property of their respective owners.

SOHL-Q224-1841351-V1

Read more