What Are Stock Delistings and Why Do They Occur?

Table of Contents

When a stock is delisted, that means it’s been removed from a public stock exchange. All publicly traded stocks are listed on an exchange. In the U.S., that typically means the New York Stock Exchange (NYSE) or the Nasdaq.

There are different reasons for delisting stock, it can occur voluntarily, such as when a company chooses to go private, or involuntarily, if it fails to meet the requirements of the stock exchange.

Owning a delisted stock doesn’t mean you can no longer trade it, but it does change how trades take place. If you own a delisted stock, it’s important to understand what it may mean for your portfolio.

Key Points

• Stocks can be removed from major exchanges through delisting, either voluntarily or involuntarily.

• Common reasons for delisting include failing to meet listing requirements, going private, or financial distress.

• Delisting impacts investors by making shares harder to trade and potentially losing value.

• After delisting, stocks move to over-the-counter (OTC) markets, reducing transparency and accessibility.

• Investors should assess the reason for delisting and may choose to sell shares if it signals financial issues.

How Stock Listings Work

Before diving into stock delisting, it’s helpful to know more about how stocks get listed in the first place. Stock exchanges can either be physical or digital locations in which investors buy and sell stocks and other securities. The NYSE is an example of a physical exchange, while the Nasdaq is an electronic stock exchange.

To get listed on any stock exchange, companies must meet certain requirements. For example, Nasdaq-listed companies must meet specific listing guidelines relating to:

• Pre-tax earnings

• Cash flows

• Revenue

• Total assets

• Stockholder equity

• Minimum bid price

Companies must also pay a fee to be listed on the exchange. The NYSE has its own requirements that companies must meet to be listed.

Once a stock is listed, it can be traded by investors. But being listed on an exchange doesn’t guarantee the stock will remain there permanently. Stocks get added to and removed from exchanges fairly regularly.

What Does Delisting a Stock Mean?

When a stock is delisted, either the company itself or the exchange decides to remove the stock from the exchange.

Exchange-Initiated Stock Delisting

When an exchange delists a stock, it’s typically because it no longer meets the minimum requirements for listing or the stock has failed to meet some regulatory requirement. Using Nasdaq-listed stocks as an example, a delisting can happen if a company’s pre-tax earnings, market capitalization, or minimum share price fall below the thresholds required by the exchange.

Exchanges set listing requirements to try and ensure that only high-quality companies are available to trade. Without stock listing requirements, it would be easier for financially unstable companies to find their way into the market. This could pose an investment risk to individual investors and the market as a whole.

In delisting stocks that don’t meet the basic requirements, exchanges can minimize that risk. When and if a company addresses the areas where it falls short, it can apply for relisting. Assuming it meets all the necessary requirements, it can once again trade on the exchange.

Exchanges typically give companies opportunities to rectify the situation before delisting stocks. For example, if a company is trading under the minimum bid price requirement, the exchange can send notice that this requirement isn’t being met and specify a deadline for improvement. That can help companies that experience temporary price dips only to have share prices rebound relatively quickly.

Company-Initiated Stock Delistings

A delisted stock can also reflect a decision on the part of the listed company. There are different reasons a company voluntarily delists itself. Scenarios include:

• A move from public to private ownership

• Merger with or acquisition by another company

• Bankruptcy filing

• Ceased operations

In some cases, a company may ask to be delisted as a preemptive measure if it’s aware that it’s in danger of being delisted by the exchange. For example, if the latest quarterly earnings report shows a steep decline in market capitalization below the minimum threshold, the company may move ahead with voluntary delisting.

What Happens If a Stock Is Delisted?

Once a stock has been delisted from its exchange, either voluntarily or involuntarily, it can still be traded. But trading activity now happens over-the-counter (OTC) versus through an exchange.

An over-the-counter trade is any trade that doesn’t take place on a stock exchange. Investors can trade both listed or delisted stock shares over-the-counter through alternative trading networks of market makers. The OTC Markets Group and the Financial Industry Regulation Authority (FINRA) are two groups that manage OTC trading activity.

Unless the company that issued a now-delisted stock cancels its shares for any reason, your investment doesn’t disappear. If you owned 500 shares of ABC company before it was delisted, for example, you’d still own 500 shares afterward. You could continue trading those shares, though you’d do so through an over-the-counter network.

What can change, however, is the value of those shares after the delisting. Again, this can depend on whether the exchange or the company initiated a delisting, and the reasoning behind the decision.

For example, if a stock is being delisted because the company is filing for bankruptcy its share price could plummet. That means when it’s time to sell them, you may end up doing so at a loss.

Even if a stock’s value doesn’t take a nosedive after delisting, it can still be a sign of financial trouble at the company. If you own delisted dividend-paying stocks, for instance, dividend payments may shrink or dry up altogether if the company begins making cutbacks to preserve capital or reduce expenses.

What to Do If a Stock You Own Is Delisted

If you own shares in a company that delists its stock, it’s important to consider how to manage that in your portfolio. Specifically, that means thinking about whether you want to hold on to your shares or sell them.

It helps to look at the bigger picture of why the reason for the delisting and what it might say about the company. If the company pulled its stock because a bankruptcy filing is in the works, then selling sooner rather than later might make sense to avoid a sharp drop in value.

Also, consider the ease with which you can later sell delisted stock if you decide to keep them. Some online brokerages allow you to trade over-the-counter but not all of them do. If you prefer to keep things as simple as possible when making trades, you may prefer to unload delisted stocks so you no longer have to deal with them.

Recommended: How to Open a New Brokerage Account

The Takeaway

When a stock becomes delisted, it’s removed from a stock exchange, either because it no longer met the requirements of the exchange, or because the company chose to delist for financial reasons. You can still trade a company after it’s delisted, but transactions occur over-the counter, rather than on an exchange.

Knowing about delisted stocks and companies can be helpful for investors of all types. Broadening your knowledge about the markets is almost never a bad idea.

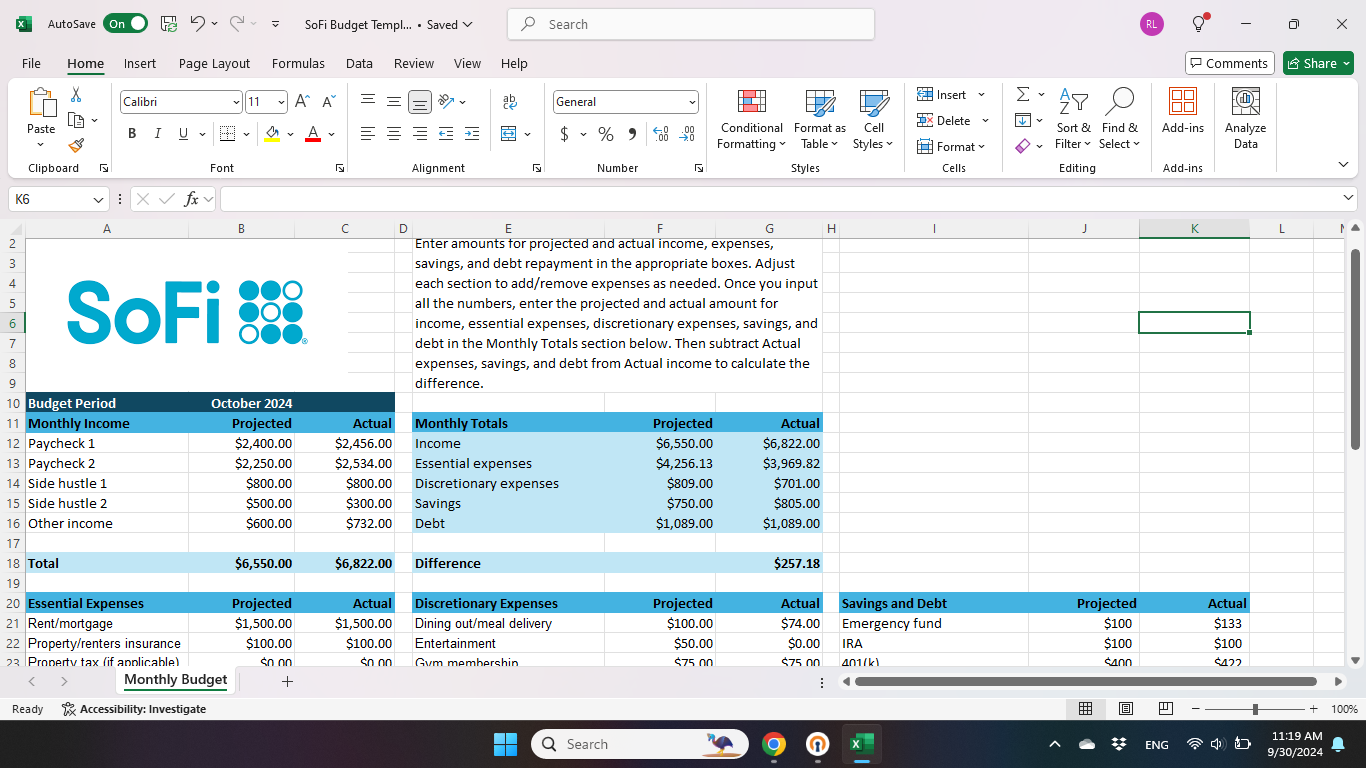

Invest in what matters most to you with SoFi Active Invest. In a self-directed account provided by SoFi Securities, you can trade stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, options, and more — all while paying $0 commission on every trade. Other fees may apply. Whether you want to trade after-hours or manage your portfolio using real-time stock insights and analyst ratings, you can invest your way in SoFi's easy-to-use mobile app.

Opening and funding an Active Invest account gives you the opportunity to get up to $1,000 in the stock of your choice.¹

FAQ

Why would a stock get delisted?

A stock can be delisted and removed from a stock exchange for a number of reasons. The delisting may be voluntary, meaning the company chooses to be delisted because it’s going private or being bought or merged with another company, or it is planning to declare bankruptcy or cease operations.

An involuntary listing, on the other hand, is when a stock exchange delists a stock because it no longer meets certain requirements by the exchange. For example, a stock could be delisted by an exchange if it no longer fulfills requirements for its share price, pre-tax earnings, or market capitalization.

Is delisting a stock good or bad?

In general, holding delisted stock is less than desirable. Once a stock is delisted from a major exchange, it becomes harder to buy and sell. In addition, the price of the shares may fall, or the delisting could be a signal that the company is in financial trouble.

What happens to my stock if a company delists?

Once a company is delisted, you still own your shares of the stock, but it becomes more difficult to buy and sell them. That’s because the stock is no longer on a major stock exchange but instead it’s on an over-the-counter (OTC) market, which is less accessible to investors and has less regulation and transparency. The value of your shares may also drop.

However, if the company delisted voluntarily because it is going private or being merged with another company, you might receive cash for your shares or shares in the purchasing company. Understanding the reason for the delisting and how it may affect your shares can be helpful.

About the author

Photo credit: iStock/wacomka

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE

For disclosures on SoFi Invest platforms visit SoFi.com/legal. For a full listing of the fees associated with Sofi Invest please view our fee schedule.

¹Probability of Member receiving $1,000 is a probability of 0.026%; If you don’t make a selection in 45 days, you’ll no longer qualify for the promo. Customer must fund their account with a minimum of $50.00 to qualify. Probability percentage is subject to decrease. See full terms and conditions.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SOIN-Q325-074

Read more