Do College Credits Expire?

If you’ve been thinking about going back to college to finish your degree, you may have wondered, how long are college credits good for? Are the credits I earned years ago still worth anything? Do college credits expire?

The answers to those questions depend on a few different factors. Here’s what you need to know about when college credits expire.

Key Points

• Technically, college credits do not expire, but certain types of credits may face transfer issues if outdated.

• Credits for core courses such as English and history remain valid and generally transfer smoothly.

• STEM and graduate credits have a shorter shelf life, 10 and 7 years, respectively.

• Colleges may restrict the number of transfer credits accepted.

• New federal regulations mandate the release of transcripts for credits paid for with federal aid, effective July 2024.

When Do College Credits Expire?

Technically, college credits don’t expire. When students earn credits for taking college courses, those credits will always appear on the official transcript from the school they attended.

The question is whether another school or program will accept those credits if a student wants to transfer them. And that can be a gray area.

The good news is that older, “nontraditional learners” — undergraduate and graduate students in their mid-20s, 30s, 40s, and up — are not an unusual sight on college campuses these days. Schools that hope to attract students who are looking to complete a degree may be especially open-minded about transferring their credits.

In the fall of 2023, more than 6.2 million adults ages 25 and older were enrolled in college, accounting for almost one-third of total enrollment, according to the National Center for Education Statistics. And the number of adults going back to school and getting a bachelor’s degree or higher has been on the rise for at least a decade, the Census Bureau reports. So most college admissions offices should be prepared to answer questions about how long are college credits good for, the possibility of transferring old credits, or if some credits have a shelf life at their school.

Those policies can vary. A college doesn’t have to accept transfer credits unless it has a formal agreement with the transferring institution or there’s a state policy that requires it. A credit’s transferability also may depend on the type of course, the school it’s coming from, or how old the credit is. These deciding factors are sometimes referred to as the three R’s: relevance, reputation, and recency.

What Criteria Do Schools Consider?

How long do college credits last? Here are some things schools may look at when deciding whether to accept transfer credits:

Accreditation Is Key

Accreditation means that an independent agency assesses the quality of an institution or program on a regular basis. Accredited schools typically only take credits from other similarly accredited institutions.

General Education Credits Usually Transfer

Subjects like literature, languages, and history tend to qualify for transfer without a challenge. So if you completed those core classes while working toward your bachelor’s degree, you may not have to repeat them.

Other Classes May Have a ‘Use By’ Date

Because the information and methods taught in science, technology, engineering, and math courses can quickly evolve, credits for these classes may have a more limited shelf life — typically 10 years.

Graduate Credits May Have a Short Life Expectancy

If the coursework for your field of study in graduate school would now be considered out of date, it’s likely that some or all of your credits won’t transfer. Graduate program credits are generally denied after seven years.

There Could Be a Limit on Transfers

Many institutions set a maximum number of transfer credits they’ll accept toward a degree program. For example, the Rutgers School of Arts and Sciences won’t take more than 60 credits from two-year institutions for an undergraduate degree, and no more than 90 credits from four-year institutions. No more than 12 of the last 42 credits earned for a degree may be transfer credits.

At the University of Arizona, the maximum number of semester credits accepted from a two-year college is 64. There is no limit on the credits transferred from a four-year institution, but a transfer student must earn 30 semester credits at Arizona to earn an undergraduate degree. And credit won’t be given for grades lower than a C.

Some Transfer Credits May Count Only as Electives

If a student’s new school determines that an old class was not equivalent to the class it offers, it may require the student to repeat the coursework in order to fulfill requirements toward a major. But the new school still may consider the old class for general elective credits, which can at least reduce the overall course load required to obtain a degree.

If at First You Don’t Succeed, You Can Try Again

Many schools allow students to appeal a credit transfer decision — whether it’s an outright denial or a decision that a course will be allowed only as an elective. The time limit for an appeal may be a year, a few weeks, or just a few days, so it can pay to be prepared with the evidence necessary to make your case.

The relevant paperwork might include a class syllabus, samples of completed coursework, and a letter from the instructor that explains the coursework.

Students also may have to meet with someone at the school to talk about their qualifications, or they may be asked to take a placement exam to test their current level of knowledge in a subject.

How to Request Transcripts

Some schools allow students to view an unofficial record of their academic history online or in person through the registrar’s office. So if it’s been a while and you aren’t sure what classes you took or what your grades were, you might want to start there.

After a refresher on what and how you did at your old college, it might be time to check out how your target school or schools deal with transfer credits.

Many colleges post their transfer credit policies on their websites, so you can get an idea of what classes you may or may not have to repeat. Or you can use a website like Transferology.com, or try the “Will My Credits Transfer” feature at CollegeTransfer.net, to get more information about which credits schools across the country are likely to accept.

When you’re ready to get even more serious, you may want to see if your target school makes transfer counselors available, or if someone in the academic department you’re interested in will evaluate your record and advise you as to how many of the credits you’ve earned might be accepted toward your major.

You’ll probably need to have an official transcript sent directly to your target institution to document your grade-point average, credit hours, coursework, and any degree information or honors designations. There may be a small fee for this service, and it could take several days to process the request.

Once your target school has had time to review your transcripts, you can expect to receive a written notice or a phone call telling you how many of your credits will transfer. When you know where you stand, you can decide if you want to appeal any of the school’s transfer decisions, if you’re ready to move forward in the application process, or if you want to check out other schools.

Previously, students who still owed money to their schools could find it difficult to get their official transcripts because schools could withhold transcripts in those cases. But as of July 2024, new federal regulations require colleges to release transcripts for credits the student paid for with federal aid, such as federal loans, grants, or work-study. The only credits schools may withhold are those that the student still owes money for.

State governments may have their own laws regarding transcripts. The following 13 states ban most holds on transcripts.

• California

• Connecticut

• Colorado

• Illinois

• Indiana

• Louisiana

• Maine

• Maryland

• Minnesota

• New York

• Ohio

• Oregon

• Washington

• The District of Columbia also bans transcript holds.

In addition, certain schools may have their own policies about transcript holds. So some students might hit a road bump at the registrar’s office if they’re behind on their loans.

Recommended: Private Student Loans Guide

How Old Debt Can Affect Transferring Credits

Of course, one of the basics of student loans is repaying them. If you’re delinquent, the problems caused by unpaid student debt can go beyond trouble with transcripts.

If you’re planning to return to school and you’re behind on your student loans, you may have difficulty borrowing more money until you’ve put some money toward student loans and gotten them back on track.

The Federal Student Aid (FSA) Program offers flexible repayment plans, loan rehabilitation and loan consolidation opportunities, forgiveness programs, and more for federal borrowers hoping to get back in good standing. The Federal Student Aid office’s recommended first step (preferably before becoming delinquent or going into default) is to contact the loan servicer to discuss repayment options.

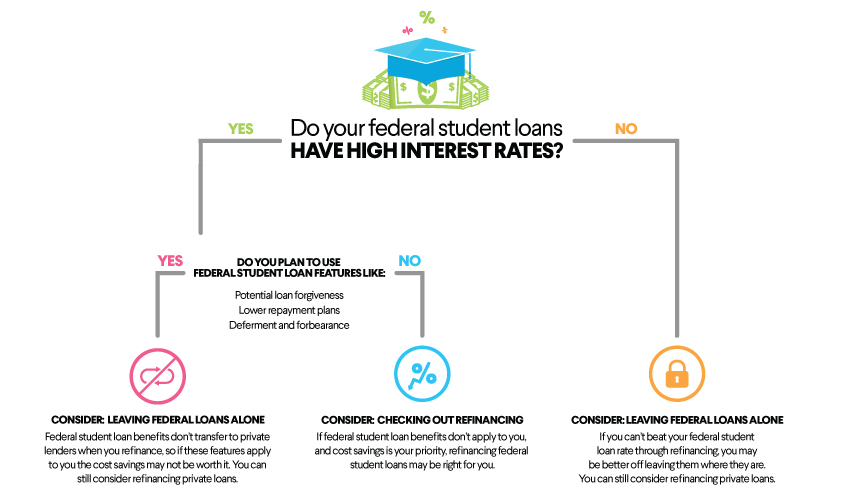

Another possible solution for those who have fallen behind on their payments can be refinancing student loans. Borrowers with federal or private student loans, or both, may be able to take out a new loan with a private lender and use it to pay off any existing student debt.

One of the advantages of refinancing student loans is that the new loan may come with a lower interest rate or lower payments than the older loans, especially if the borrower has a strong employment history and a good credit record. (Note: You may pay more interest over the life of the loan if you refinance with an extended term.) A student loan refinancing calculator can help you determine how much you might save.

Even if you’re doing just fine and staying up to date on your student loan payments, if you’re thinking about going back to school and you’ll need more money, a new loan with just one monthly payment might help make things more manageable.

However, if you have federal loans, it’s critical that you understand what you could lose by switching to a private lender — including federal benefits such as deferment, income-driven repayment plans, and public student loan forgiveness.

Recommended: How to Get Out of Student Loan Debt

Moving Forward (With a Little Help)

If you’re excited about the possibility of going back to school to finish your degree (or earn a new one), you might not have to let concerns about financing keep you from moving forward.

You can contact your current service provider with questions about payment options on your federal loans. And if you’re interested in refinancing with a private loan now, you can start by shopping for the best rates online, then drill down to what could work best for you.

With SoFi, for example, you can prequalify online for student loan refinancing in minutes, and decide which rate and loan length suits your needs.

FAQ

Are my college credits still good after 20 years?

Possibly, but it depends what kind of credits they are. Credits earned for core courses like English, history, art, and languages should still be valid after 20 years. However, credits for STEM (science, technology, engineering, and mathematics) courses typically expire in 10 years, and graduate-level courses generally expire in seven years.

Do your credits expire if you don’t finish your degree?

Technically, college credits don’t expire if you don’t finish your degree. However, you may or may not be able to transfer them to another school, depending on what type of credits they are and how long it’s been since you earned them. Credits for core courses like English and history typically remain valid over the long-term and you should be able to transfer them. But credits for STEM courses generally expire after 10 years.

Can a college withhold your transcripts if you still owe them money?

As of July 2024, thanks to new federal regulations, a college can no longer withhold your transcript for credits you paid for with federal aid, such as federal loans, grants, or work-study. The only credits schools are allowed to withhold from your transcript are those for which you still owe money.

SoFi Student Loan Refinance SoFi Loan Products

Terms and conditions apply. SoFi Refinance Student Loans are private loans. When you refinance federal loans with a SoFi loan, YOU FORFEIT YOUR ELIGIBILITY FOR ALL FEDERAL LOAN BENEFITS, including all flexible federal repayment and forgiveness options that are or may become available to federal student loan borrowers including, but not limited to: Public Service Loan Forgiveness (PSLF), Income-Based Repayment, Income-Contingent Repayment, extended repayment plans, PAYE or SAVE. Lowest rates reserved for the most creditworthy borrowers. Learn more at SoFi.com/eligibility. SoFi Refinance Student Loans are originated by SoFi Bank, N.A. Member FDIC. NMLS #696891 (www.nmlsconsumeraccess.org).

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

Third-Party Brand Mentions: No brands, products, or companies mentioned are affiliated with SoFi, nor do they endorse or sponsor this article. Third-party trademarks referenced herein are property of their respective owners.

Non affiliation: SoFi isn’t affiliated with any of the companies highlighted in this article.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Third Party Trademarks: Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOSLR-Q225-035

Read more